Several characters | Huan Fund Hu Yibin: Pay attention to a balanced strategy, "Dig gold on the night"

Author:China Fund News Time:2022.09.29

China Fund News

Editor's note: "Data analysis fund managers, deeply restore investment portraits." Yinghua Body Library launched a new column to say characters, and use image language to analyze the fund managers behind the data to restore the three -dimensional investment portrait for investors. Take you to explore the source of the fund's income, choose the foundation first.

With the National Day holiday, the consumer sector such as hotel catering is active. Since September, as of September 29, the hotel catering sector has risen 7.5%. Market analysts believe that the confidence of the tourism travel market has continued to boost, and the leading logic of the leading pattern of the hotel industry after the epidemic is unchanged.

Hui Yibin, manager of Huaan Fund Fund, said that the long -term improvement of the offline service industry has been improving year by year. Therefore, the long -term trend of the repair of the service industry is clear but it is difficult to achieve a short time. The service industry's competition pattern is expected to be reshaped, and the concentration of the industry is expected to increase for a long time. It will actively find and configure the opportunities of leading enterprises in industries such as transportation, tourism hotels, culture, education and entertainment.

Hu Yibin, a master's degree. He has successively served as the product manager of Hangzhou Nuclear Tonghua Shun Co., Ltd., a researcher at Changjiang Securities Co., Ltd., and researcher at Senmoro Fund Management Co., Ltd. He joined the Huaan Fund in May 2015, served as assistant to the fund investment department of the Fund Investment Department, and since November 2015 as the fund manager; the securities industry has worked for more than 10 years. He is currently the director of the Huan Fund Fund Investment Department.

Zhijun data shows that Hu Yibin's management of public offering funds has been managed for 6.85 years, and 12 funds are currently in charge of the fund, with a scale of 16.415 billion yuan. The annualized yield of 14.74%has been in management, and the CSI 300 was 1.07%in the same period, and it won the CSI 300 from a distance.

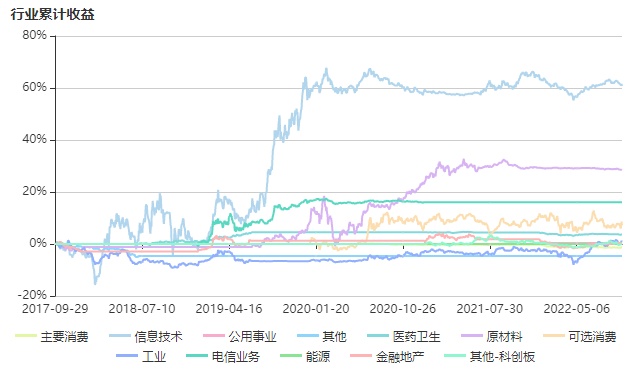

Since the employment of Hu Yibin, investment has focused on stocks. The stock industry preferences are scattered, and the top three are leisure services, electrical equipment, and transportation. The heavy position holding time is short. The industry distribution is changing.

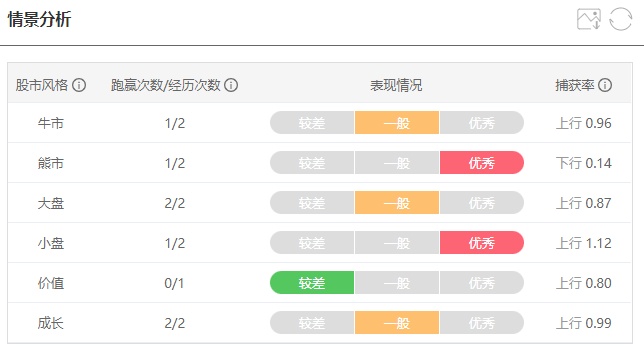

After the performance of Hu Yibin's performance in different market scenarios, it can be seen that he has performed well in the bear market and has performed well in the investment of small -cap stocks.

Hu Yibin's investment keywords are three points: growth hunters, extensive industries, and barbell strategies.

Hu Yibin is a purely growing style player, and his investment framework is also very clear. Hu Yibin will go to the track of the best risk income ratio, as well as industries in the spiral rising cycle.

Hu Yibin's industry is widely involved, focusing on balanced, avoiding betting on a single section to increase risks. In order to achieve this strategy, he will continue to expand his ability circle, keeps aggressive, and update his own investment system.

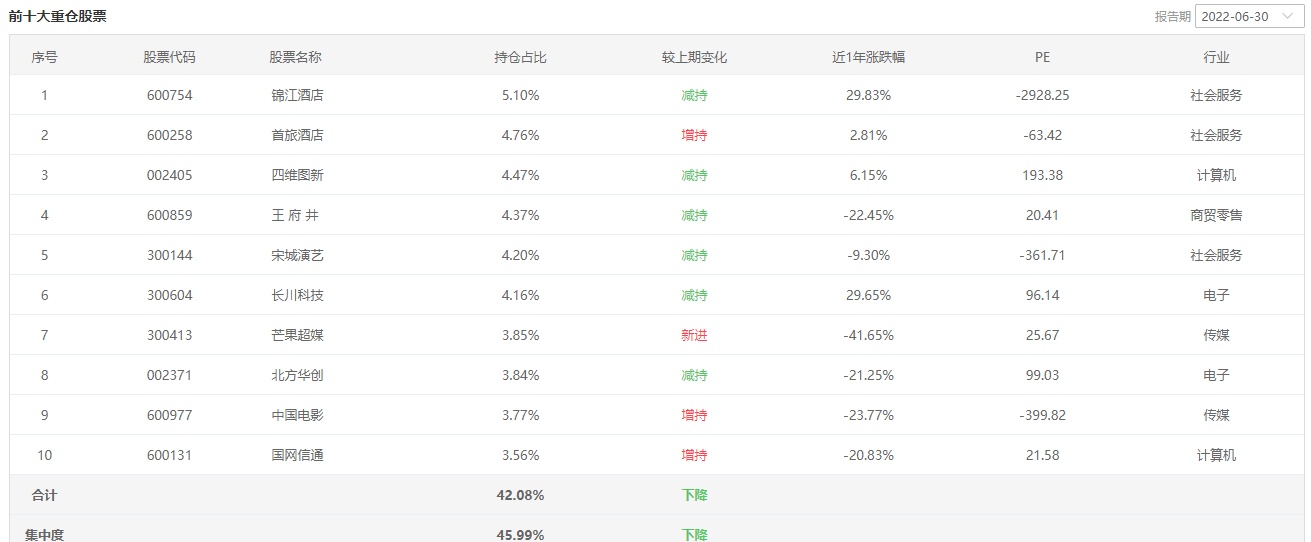

By the attribution of Hu Yibin's income, it can be found that most of the excess returns come from the stock selection effect, which is inseparable from his improving stock selection to a more important position. In addition, Hu Yibin is also good at scattered combinations and introduces barbell strategies. The role of "barbell strategy" is to neutralize the combination of short -term fluctuations. For example, Hu Yibin once configured semiconductor and offline services. On the one hand, the combination can enjoy the rising dividends of the semiconductor sector. At the same time, the offline service sector with low price -earnings ratio is hedged to high fluctuations to avoid high risks brought by the heavy positions.

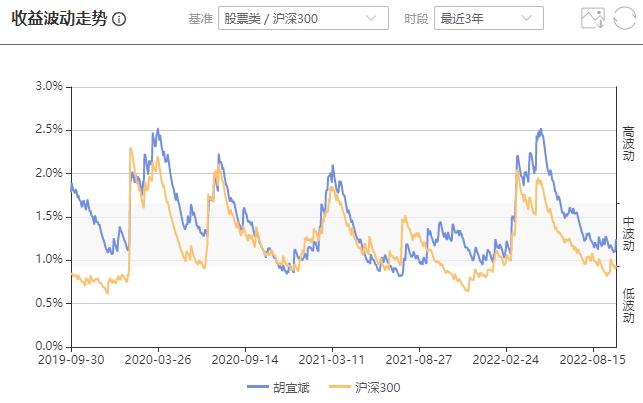

In terms of management style, Hu Yibin's investment performance is stronger, and its volatility is slightly higher than the fluctuation range of the CSI 300. Hu Yibin's income fluctuation rate floats between 0.83%-2.5%and is in the mid-to-high volatility range.

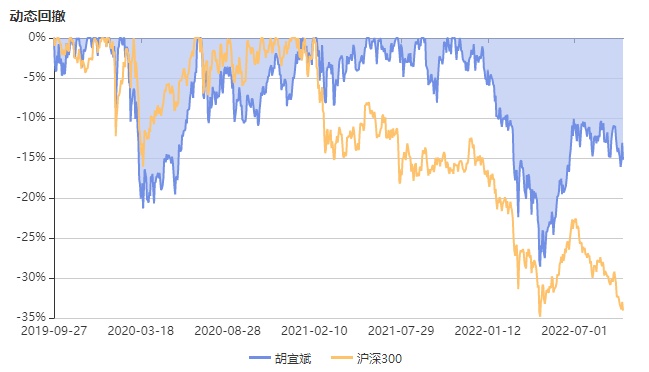

In terms of retracement control, while Hu Yibin obtains the income, he will also pay attention to the control of retracement at the same time. As of September 29, Zhijun Technology data showed that in the past three years, Hu Yibin's maximum retracement was 28.58%, while the largest retracement of CSI 300 was 34.84%in the same period.

According to data from Zhijun Brinson, Hu Yibin's representative products have obtained 62.85%of the excess returns in the past five years, and 4.78%are attributed to the industry allocation effect, and 58.07%attribute to the stock selection effect.

Specifically, the industry is widely distributed. In the past three years, the target of Hu Yibin's configuration in the electronic industry is the main force representing product performance contributions, accounting for 42.92%, followed by chemical and non -ferrous metals, contributing to excess revenue, accounting for 23.04%and 14.72%, respectively.

Taking Hu Yibin's represented product as an example, as of now, Hu Yibin's investment style of investment targets on behalf of the product is changed. His shareholding concentration is high, the holding style has grown up, and small -cap stocks have also been involved.

According to the statistics of the product on behalf of Hu Yibin's 2022, the average holding cycle of the top ten heavy stocks was 3.8 quarters. In the past three years, the fund's heavy position holding time holding a short time and holding the longest holding time is Northern Huachuang. The first two major heavy stocks are hotel stocks.

Hu Yibin has deeply invested in the secondary market investment for many years and has rich experience in cross -market investment. It is a fund manager who has grown and aggressive style. In 2018, Hu Yibin ran out of the trend, ranking first, ranking first, and was well known to the public.

In stock selection, Hu Yibin emphasized two types of companies, one can cross the macro cycle and industry cycle, leading stocks or big blue chips, and their operating ability and team ability are proved to be very good. The other is to find some dark horses with small and medium -sized market value.

Hu Yibin once said that he would dig gold on the night. Because everyone is more likely to see the light of gold during the day, it is difficult to dig out high -quality stocks with reasonable valuations at this time.

After multiple rounds of market rotation tests, Hu Yibin's investment framework has been continuously evolved and improved in practice. The industry configuration is not limited to a single industry. The "correlation" between the first few major heavy warehouse industries has also been reduced. From a number of different tracks to find Alpha, to better control fluctuations and retracement. Looking forward to the market outlook, Hu Yibin said that we need to be aware of the importance of the real economy of financial services. At present, my country is still in the period of economic structural transformation. It is believed that the future scientific and technological innovation and consumption upgrade will still become the core driving force of my country's total economic growth. A large number of investment opportunities will still be born around the fields of industrial innovation, new materials, new energy, and new consumption.

Hu Yibin said, "In terms of strategy, we have put the excavation, discovery and configuration of the hard technology innovation and the consumption upgrade of the continuous growth of residents' income within the scope of the main body of the contract."

(Note: If there is no special indication of the chart data in this article, it comes from Zhijun Technology and Wind data)

Risk reminder: The fund has risks, and investment needs to be cautious. Fund's past performance does not indicate its future performance. Fund research and analysis do not constitute investment consulting or consulting services, nor does it constitute any substantial investment suggestions or commitments to readers or investors. Please read the "Fund Contract", "Recruitment Manual" and related announcements carefully.

- END -

Sichuan August loan growth rate nationwide first

Kawaguan News reporter Lu Weitian YanAccording to the latest statistics from the Chengdu Branch of the People's Bank of China, in August, Sichuan loan growth ranked first in the country -at the end of...

Indian young entrepreneurs, after visiting Shanghai, collectively silent ...

◎ Zhigu Trend (ID: ZGTREND) | ZhenguziOn August 3, Fortune released the latest Wo...