Pickups | Securities Regulatory Commission: The scale of the stock market has increased by 238.9% over the past ten years

Author:Cover news Time:2022.06.23

Cover news reporter Teng Yan

A few days ago, the Central Propaganda Department launched the "China Ten Years of Ten Years · Series Theme Release". The column of the cover news "Picking the Year" will pay attention to the whole process, reporting to China's achievements and changes in the past decade.

On June 23, the Propaganda Department of the Central Committee of the Communist Party of China held a conference on the reform and development of the financial sector since the 18th National Congress of the Communist Party of China. The increase was 444.3%, and both markets ranked second in the world.

Li Chao said that since the 18th National Congress of the Communist Party of China, the capital market has undergone profound structural changes, the market system's inclusiveness has been greatly improved, the investment and financing functions have been significantly enhanced, and the benign market ecology has gradually formed. In the past ten years, the size of the stock market has increased by 238.9%, and the size of the bond market has increased by 444.3%. Both markets are second in the world. There are more than 200 million investors in the stock market.

▲ Li Chao, vice chairman of the China Securities Supervision and Administration Commission (picture source: Guoxin.com)

In the past ten years, the breadth of serving the real economy has expanded significantly. Vigorously improve the multi -level market system, launch new three boards and science and technology boards, and set up the Beijing Stock Exchange. The capital market has greatly enhanced the adaptability of the real economy, and the cumulative stock financing has reached 55 trillion yuan. The high -level cycle of smoothing technology, capital and the real economy, the "hard technology" industrial agglomeration effect of the science and technology innovation board was initially formed. The exchange bond market has become an important channel for non -financial corporate bond financing, and futures options cover the main areas of the national economy.

In the past ten years, important breakthroughs have been made in comprehensively deepening reforms. Focusing on deepening the structural reform of the financial supply side, comprehensively deepening the capital market reform, the basic system is more mature and set. Realize the leaping of the approval system to the registration system, steadily promote the pilot registration system, the degree of marketization, review of registration efficiency, and expected to greatly improve, and key systems such as transactions and delisting have improved systematization, and reform meets the expectations of all parties in the market.

In the past ten years, the high -quality market subject has developed a new level. The proportion of the profit of physical listed companies accounted for the profit of industrial enterprises from 23%ten years ago to nearly 50%, and the status of the national economic pillar has more consolidated. The total assets of securities and futures management agencies have increased by 5.5 times in ten years, and the scale of public fund management is currently 26 trillion yuan, an increase of 8 times in ten years, and the industry's strength has increased significantly.

In the past ten years, the international attraction and influence of the capital market have increased significantly. Coordinate openness and safety, and the system is open to open a new chapter. The industry institutional institutional stocks have been fully liberalized, and the Shanghai -Shenzhen -Shenzhen -Hong Kong Stock Connect and Shanghai -London Stock Connect are launched. A shares have been incorporated into the internationally renowned index and continued to increase the proportion. Foreign capital has maintained net inflow for many years.

In the past ten years, the capital market's legal system "four beams and eight pillars" has been basically completed. The amendments to the New Securities Law and Criminal Law (11) have been implemented, and the State Council issued the opinions of the State Council on strictly cracking down on securities illegal activities in accordance with the law. The "law enforcement deterrent power has been significantly enhanced, and the situation where the cost of market violations and regulations is too low.

In the past ten years, market toughness and anti -risk capabilities have increased significantly. Adhere to the improvement of supervision and governance through reform, improve the stability and external restraint mechanism of the market, and timely stabilize market expectations. The capital market risk is generally converged and basically controllable. In recent years, it has also undergone various international and domestic super -expected impacts. The main indexes have been steadily rising, and the healthy development trend has continued to consolidate.

- END -

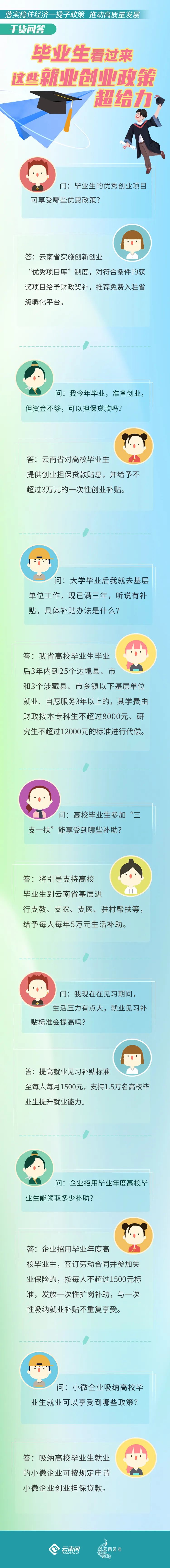

Graduates come over!These employment and entrepreneurship policies are super powerful

recentlyYunnan Province is issuedYunnan Provincial People's Government on the impl...

Jiannanchun is absent from this year's Chinese liquor T8 summit

On June 17, the Eleventh China Bai Wine T8 Summit was held in Luzhou. The summit w...