The "recession" in the United States has continued. What has happened in the past 100 years?Detailed explanation →

Author:First financial Time:2022.06.24

23.06.2022

Number of this text: 2619, the reading time is about 4 minutes older

Introduction: What are the characteristics of the economy when they have recession? What changes will appear in the market?

Author | First Finance Zhou Erin

The risk of decline in the US economy and its spillover effect have attracted global attention. Although the real decline may be the earliest to 2023, the market has opened a "recession transaction."

Recently, the accident price of commodities continued to decline. After the stock market experienced over 20%, it still rebounded weakly, the credit spreads expanded, and the consumer confidence index of the University of Michigan fell to the lowest point in the past ten years. Where will the future market go? Over 100 years of experience in recession may help you make some predictions.

Detailed explanation of 17 declines in 100 years

The Federal Reserve President Powell testified on June 22 in the Senate Banking Committee that the US economy was very strong and enough to deal with the tightening of Silver root; the rate hike measures in progress were appropriate, but each time was uncertain. Reduce the inflation rate to 2%.

Following the 75bP interest rate interest rate interest rate hike in June, this statement was obviously to reiterate the determination of the Fed's anti -inflation, and the US stock market closed down on Tuesday. CME's Fedwatch tool shows that the market is currently included in the Fed's July meeting of 75bp, which is 88.5%, and the benchmark interest rate may rise to 2.50%at that time.

Powell believes that economic recession is a "possibility", but most institutions currently believe that the risk of recession is much higher than the Federal Reserve's expected. The definition of recession is that the GDP has slowed down for two consecutive quarters, and inflation is downward. The US GDP grew negatively in the first quarter, so data in the second quarter attracted much attention.

UBS Securities EVIDENCE LAB believes that the United States may fall into a decline in 2022 or mid -2023, but the market has begun to price it. The agency sorted out 17 declines in the United States over the past 100 years, of which 10 of them were mild declines (the peak to the bottom of the GDP to the bottom of the valley was lower than 3%), and 7 times was a deep decline (GDP decreased by more than 3%). Under the depth decline, the weighted average GDP loss was 17.3%(seriously affected by the Great Depression), which lasted an average of 15 months (if the recession caused by the new crown epidemic was excluded from the sample, it was 18 months)) Essence In contrast, in the mild decline, the average GDP loss of the average time is only 2.4%, and it usually lasts 11 months.

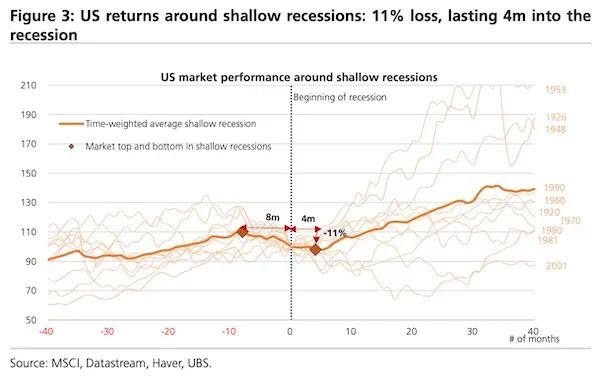

From the perspective of the market's influence, the average market decline was 34.4%before and after the depth recession. The market selling starts 3 months before the depth decline, and it will last for 12 months. The market did not sell until the depth decline started, which implied the cause of the deep recession -the economic and financial system did not prepare for the upcoming impact, which affected the balance sheet of consumers, enterprises and banks. In contrast, mild decline is often related to the central bank's interest rate hike during the high inflation period, which is usually foreseeable.

Similar to the depth decline, the market decline in the mild correlation has reached 12 months. However, the market selling caused by mild decline began earlier, that is, selling sold at the eight months before the beginning of the recession, and the end time was earlier, that is, 4 months after the beginning of the recession. Therefore, in a typical 12 -month mild recession, the market sells for about one -third of the top three, and the market has recovered in two -thirds after decline.

From the perspective of industry performance, in the United States, the return of financial stocks, industrial stocks and non -necessary consumer goods is the most sensitive to recession. If the decline shifted from mild to depth, their decline will be maximized; It will avoid, and their prospects will also be maximized. In fact, during the previous mild decline, the performance of financial and consumer stocks was slightly stronger than the broader market. In terms of recent market performance, retail giants such as Wal -Mart and Target have been sold, which is also because the rising cost pressure this year is eroding their profit margins.

So does high inflation mean that the risk of deep recession is higher? Evicnce Lab research shows that on average, before the mild decline, the inflation rate in the United States was 6.6%, while the Fed's policy interest rate was 8.1%. In contrast, before the depth decline, the average inflation rate was 2.6%, while the Fed's policy interest rate was 4.6%. "High inflation or high interest rates will not automatically lead to deep recession, but considering the form of consumers and banks' balance sheets, the risk of recession is increasing, but any decline should be mild." UBS said.

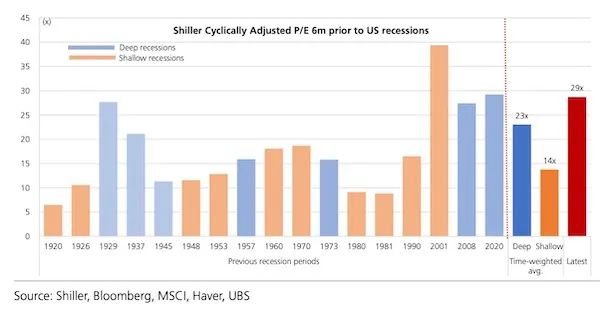

As far as the market is concerned, the factors that affect the return rate are often valuation, not the probability of economic recession. "Although it is very likely to avoid any recession, if the liquidity continues to tighten, the market may still fall sharply due to the shrinkage of valuation. Although Schiller's CAPE index is about 30%lower than the high point, it is depth and shallow.度衰退前的23倍和15倍的平均估值水平相比,目前的28.7倍仍非常高。更高的债券收益率和利差仍是比盈利衰退更大的担忧。”瑞银称,按The valuation of the S & P 500, if the BAA -level bond yield increases 100bp, the valuation may be reduced by 2.3 times.

Overseas stock markets are still under pressure

The maximum decline of the S & P 500 reached 24%, while Nasdaq was approaching 30%. After such a rapid throwing pressure, it is not uncommon to have a "bear market rebound", but it is still difficult to change the main line of the bear market. On the evening of the 21st, the three major indexes of the US stocks rose across the board. The new energy vehicle sector rose strongly, and the three major stock indexes increased by nearly 3%. "The shortness of shortness has been a bit hard recently. After the market is selling sharply, it is indeed a bit unable to sell it for the time being." Yuan Yuwei, a global macro trader, told reporters, "The valuation of the Nasdaq 100 Index has returned to about 20 times. It is more difficult to kill continuously. If the Fed is expected to be managed, including suppressing energy prices, it is difficult to continue to kill at least in the short term.

Coincidentally, Sika Moore, a senior analyst of Jiasheng Group, also told reporters that the reinsurance of institutional investment portfolio at the end of the month and season will cause funds to flow into US stocks, because the previous throwing pressure is large At the benchmark, under the "bear market rebound", the S & P 500 is expected to test the resistance range of 4000-4200. "

Most institutions believe that U.S. stocks still have the risk of further downside, which not only comes from further contraction of valuation, but also may come from the decline in profitability. UBS Asset Management (Shanghai) Asset Allocation Fund Manager Roddi told First Financial Reporter that the stock market valuation of developed markets has been adjusted sharply this year, but the market has not adjusted sharply to the profitability of developed economies. With the obvious economic decline and the rise of inflation, corporate profits will be lowered, resulting in further pressure on the stock market.

Until inflation or the central bank retreat

When will the market stop falling? The mainstream point is that either the Federal Reserve yield or wait for inflation to fall. Judging from the current stubbornness and determination of the central bank, it is difficult to appear before autumn.

"At present, the central banks have to break the expectations of inflation. Although wages are rising, it is difficult to reach the rhythm of basic daily necessities and service prices (including food and energy prices). The degree of demand is formed to cool down inflation. The Fed is expected to have a policy interest rate of 3.375%at the end of 2022 and 3.75%at the end of 2023. "Robertson, the global chief strategist of Standard Chartered, told reporters.

Looking at the world, in the main central bank, except for the Bank of Japan, major central banks are currently tightening silver roots due to inflation. However, in the face of the pinch of inflation and the risk of recession, the central banks of various countries are very careful and should be grasped.

The market currently predicts that the Bank of Canada raises 50bp in July, but it does not rule out the possibility of 75bp; the Bank of England has raised interest rates for 25BP for the fifth consecutive time, and the current benchmark interest rate is 1.25%. The central bank pointed out that the inflation rate is expected to reach 11%in October and more than 9%in the next few months. However, the central bank recently stated that GDP is expected to shrink 0.3%in the second quarter, lower than the previously expected increase of 0.1%. Because the inflation increases the negative effect on domestic household income, it is unwilling to raise interest rates sharply. Rhythm; the euro zone will announce the June CPI on July 1, or help the European Central Bank to make a July interest rate hike 25bp or 50bp decision. Once the implementation is implemented, this will be the first interest rate hike at the European Central Bank.

- END -

Published in advance!

/Social Insurance Information System of Employees of Hubei Enterprise EmployeesIt is planned to be in late June 2022Disclosure during late JulyAccess to the national and provincial overall informati

Promoting development and operation!Chengdu introduced 8 major measures for cultural and creative re

In order to thoroughly implement the Party Central Committee and the State Counci...