Federal Reserve Hard Euctity Speaking: Can withstand tighter monetary policy experts: "Interesting hikes" or exacerbated global financial market fluctuations

Author:Securities daily Time:2022.06.24

Wen | Yan Liliang Han Yu

After the Federal Reserve announced the 75 basis points last week, at 21:30 on June 22, Beijing time, the Federal Reserve Chairman Powell said at a hearing of the Congress Banking Committee that continuing to raise interest rates is appropriate. By 2%, it is believed that the US economy can withstand more tight monetary policies. At the same time, Powell also publicly acknowledged the possibility of decline in the US economy and said that the "soft landing" was extremely challenging. On the same day, Britain announced that the May Consumption Price Index (CPI) increased by 9.1%year -on -year, a new high since 1982. It is worth noting that the British Bank of Britain has raised interest rate hikes 25 basis points on June 16, the fifth rate hike since December last year. The Bank of England is expected to exceed 11%of the inflation rate in October this year, and a warning of the British economy or facing the risk of recession. European Central Bank President Lagarde also reiterated on Monday that the European Central Bank plans to raise interest rates this summer to respond to the inflation phenomenon of the euro zone. Under the trend of tightening, inflation does not decrease, the risk of economic recession has intensified the developed economies led by the United States. It is facing the most severe inflation pressure since the 1970s. Some economies of the central bank also frequently inhibit inflation through interest rate hikes in the first half of this year. According to data from the Bank of America Global Research (BOFA Global Research), some global central banks have reached 124 times this year, exceeding the number of year in 2021. In 2020, the global central bank has accumulated a total of only 6 times. Zhang Manan, deputy minister and researcher of the China International Economic Exchange Center, said in an interview with the Securities Daily that the global high inflation pressure was not short -term. The phenomenon of high inflation in Western countries is not exactly caused by short -term external factors, and has deeper structural inflation incentives. If the central bank of the affected country wants to solve the current inflation problem only through the tightening monetary policy, it is likely to be futile. Behind the frequent interest rate hikes is the risk of high inflation facing western countries. High inflation is also spreading to a wider area centered on the United States. In May, US residents' consumer price index (CPI) increased by 8.6%year -on -year, a new high since 1981. The data of the euro zone also reached 8.1%of the same period, and the inflation trend was obvious. In some countries such as Turkey, the value is as high as 73.5%, and "malignant inflation" has appeared. Fast interest rate hikes may exacerbate the risk of economic recession, and it has gradually enveloped the international financial market. Last week, the three major US stocks indexes were frustrated. The S & P 500 Index has fallen by more than 20%this year. It has entered a technical bear market. The European STOXX 600 has fallen by nearly 17%within this year. It also fell more than 10%. The volatility of international bonds and foreign exchange markets is also increasing. Zhang Monan said that if central banks from various countries cannot effectively control inflation and avoid decline, the world economy and international financial markets will suffer greater impact. Some entrepreneurs and executives led by Musk's opinions on the U.S. economic prospects are pessimistic about the economic prospects of the United States. Based on the conclusion of the 750 CEOs by the United States Research Organization "The Conference Board", more than 60 % of CEOs are expected to have a decline in the area where their company operates. When Musk participated in the 2022 Qatar Economic Forum on June 21 (local time), he also expressed concern about the decline in the US economy, and announced that Tesla plans to cut by 10% in the next 3 months to 10% The number of official employees. Goldman Sachs Economist also lowered the expectations of US economic growth in recent research reports. It is predicted that the probability of the US economy will enter a decline next year by 30%and the original expected value is 15%. And if you avoid recession in the first year, the probability of the decline in the second year is 25%. In general, Goldman Sachs economists believe that the overall probability of the US economy will reach 48%in the next two years, and the probability of this probability is 35%. In contrast to the above forecast, US Treasury Secretary Yellen has always held a more "optimistic" attitude, saying that although the level of US inflation is "high to unacceptable", "recession is not inevitable." Zhang Manan believes that in the prediction of the economic environment, the sensitivity of entrepreneurs is also worthy of our attention. According to historical experience judgments, the United States is very likely to go out of the dilemma of high inflation without experiencing "recession". The "pain index" of the US current economy (the economic pain index is a total of the unemployment rate and inflation rate) at a high value. How to avoid large -scale economic recession at the same time on the premise of effectively controlling inflation is a major challenge.

Recommended reading

234 BYD concept stocks were behind the "group pet": institutional research, stock price soaring, individual companies were questioned

In June, the financing efficiency of the stock bond market improved the role of the capital market pressing stone

Image | Site Cool Hero Bao Map.com Editor | Caushan Dan Audit | Hou Jiening Final Audit | Li Hui

- END -

Inner Mongolia introduced 40 hardcore measures to stabilize the basic economic market

The reporter learned from the policies organized by the Information Office of the Inner Mongolia Autonomous Region Government on June 21 that recently, the Inner Mongolia Autonomous Region Government

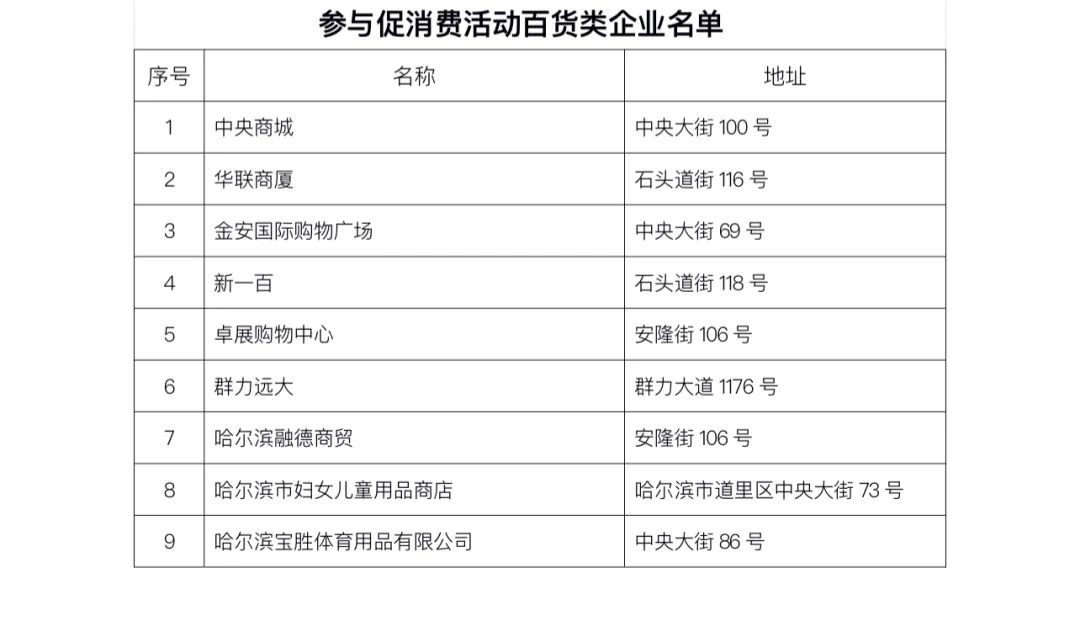

Published on the 25th!The second round of consumer subsidies are here

The reporter learned from the Daoli District of Harbin City that in order to furth...