The convertible bond market staged "Doomsday Crazy"!The Dodon convertible bonds soared over 63%of the two days and were mainly monitored by the key monitoring

Author:Daily Economic News Time:2022.06.24

Last weekend (June 17), the regulatory regulatory announced the new regulations for convertible bonds in order to prevent excessive speculation of the convertible bond market.

In addition to increasing the participation threshold, the introduction of the corresponding mechanism has also increased the restrictions on rising declines, which will also make the phenomenon of stir -frying the Yongji convertible bonds basically not exist.

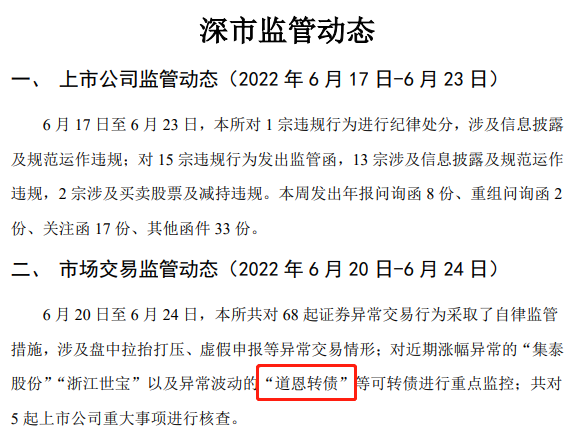

However, due to the feedback of the solicitation of opinions on July 1, 2022, on the last few trading days, the convertible bond market appeared "Doomsday Crazy". After the Daen convertible bonds soared 42.98%yesterday, it rose 20.50 again today. %, As the Dow's convertible debt soared over 63%, it was listed as a key monitoring object by the Shenzhen Stock Exchange.

The Dodon convertible bonds soared over 63%of the two days and were mainly monitored by the key monitoring

Since the beginning of this year, the hype of the secondary market convertible bonds is very popular. With the continuous growth of the convertible bond market, the internal T+0 trading mechanism of convertible bonds, with the strong market speculation atmosphere, has continued to emerge in the market. For example, the maximum increase in the first day of listing of aggregate convertible bonds exceeded 200%, and the first day of the Yongji Convertible Bonds listed on May 17, the increase of 276%on the first day of listing. According to statistics from the private equity row network, seven of the convertible bonds listed this year have increased by more than 50%on the first day of listing. Among them, Yongji Convertible Bonds and Plastic Convertible Bonds have doubled on the first day of listing, with 276.23%and 133.58%, respectively. It is also the first batch of convertible bonds to double the increase in the first day of listing.

The powerful money -making effect of the convertible bond market also attracted the entry of private equity institutions and tourism. Small plate convertible bonds are the concentration of "demon debt". Sure enough, on the first day of the new regulations of convertible bonds, the convertible bond market was slightly reduced than before, but on June 23, the convertible bond market staged a "Doomsday Carnival" drama.

Doun Convertible (128117, the price was 194 yuan, an increase of 20.5%) after opening over 10%of the day and was pulled by the fund to stop. After the stopping was opened, the convertible bond was sideways. After the opening in the afternoon, it was stopped again. Until a few minutes before closing, the convertible bond was once again increased by funds, and the closing of the closing of 42.98%was 42.98%.

Some people in the market pointed out that "the master of the previous debt told me that only the debt would be a leader. After 128117 stopped, it easily earned 20%, and it would be high tomorrow, and it was expected to be 25-30%." It is worth noting that today's Daen convertible bonds, as the travelers pointed out yesterday, opened nearly 10%again, a wave of pulling and sidewalking. At 10:48 am, at a price of 193.2 yuan, the price of 193.2 was coming. After stopping, after opening, the Doden convertible debt was pulled up again in the afternoon.

The two -day soaring over 63%is undoubtedly abnormal fluctuations, and the Daen convertible debt is therefore listed as a key monitoring object by the Shenzhen Stock Exchange. In this regard, Ma Cheng, chairman of Shenzhen Juze Investment, told reporters in the early stage that the increase in the threshold for transaction convertible bonds is that it is to protect retail investors and the embodiment of strengthening the appropriate management of investors. In recent years, convertible bonds have been continuously speculated by funds. The speculative atmosphere is strong, the stack of convertible bonds is huge, and the risk of investment convertible bonds has increased. By.

For standardized convertible bond markets, more and more private equity starts allocation

As the new rules of convertible bonds soliciting opinions for the feedback of the comments are July 1, 2022, market speculative funds are likely to continue to specify the convertible bond target on the last few trading days. On the other hand, with the market specifications, more and more private equity institutions have begun to allocate convertible bonds.

According to the China -foundation Association data, the private equity institutions have issued a total of 32 private equity products with the words "convertible bonds" since this year. Especially since May this year, there have been significant signs of the issuance of convertible bond private equity products. 7 Performators. As of the 23rd of the month since June, a total of 6 private equity products with the words "convertible bonds" were issued. Among them, Shenzhen knew that Capital had recorded on June 22 that he knew the 10th convertible bond private equity securities investment fund.

Shenzhen knows that of the 11 private equity products filed by the Fund Industry Association, 5 are 5 private equity products with the word "convertible debt"; The convertible bond selection No. 5 Private Equity Investment Fund. Among the private equity products under the private equity, there are also 5 private equity products with the word "convertible bond"; it is worth noting that Zhuhai Newda Investment is issued this year. Large households of convertible bond private equity products. On February 7 this year, the New Dada Investment Convertible Securities Investment Fund was filed, and the New Dada Investment Conduct 10 Private Equity Securities Investment Fund was filed on February 24th. The first phase of private equity investment funds.

Daily Economic News

- END -

Dahongmen area transformed the Capital Business New Area Nanzhongxian Cultural Science Park in September opened the park in September

Xinyahui International Clothing Market Transformed into an Experience Comprehensive Shopping Center Heasheng Plaza, Facheng Trading Market transformed into Fengtai District Government Service Center a

GCL Technology Leshan 100,000 tons of granular silicon project will be put into production recently

Leshan GCL. Photo source: Company PicturesOn June 21, GCL Technology (HK03800, a s...