what happened?This brokerage management and general manager were warned together

Author:China Fund News Time:2022.06.25

China Fund reporter Yan Ying

Recently, there have been repeated brokerage firms for the asset securitization business, and Tianfeng Asset Management has added another example.

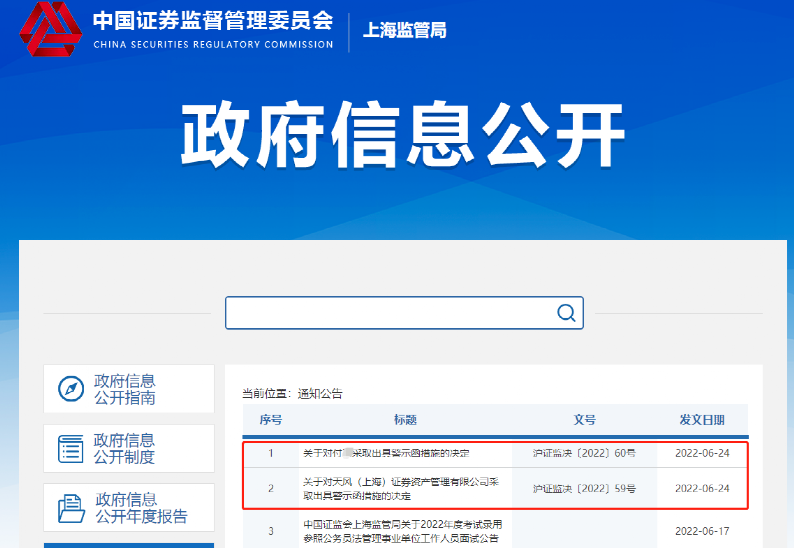

On June 24, the official website of the Shanghai Securities Regulatory Bureau showed that due to problems in the development of asset securitization, Tianfeng Asset Management was issued a warning letter. Fu Yu, the general manager of Tianfeng Asset Management, was also supervised by the warning letter due to its responsibility for management.

With the expansion of the ABS market scale and the increase in the position of the capital market, the specifications of the brokerage industry's exhibition industry have also received special attention. Recently, securities firms have been named by supervisory asset securitization business, and Galaxy Jinhui and Cinda Securities are listed.

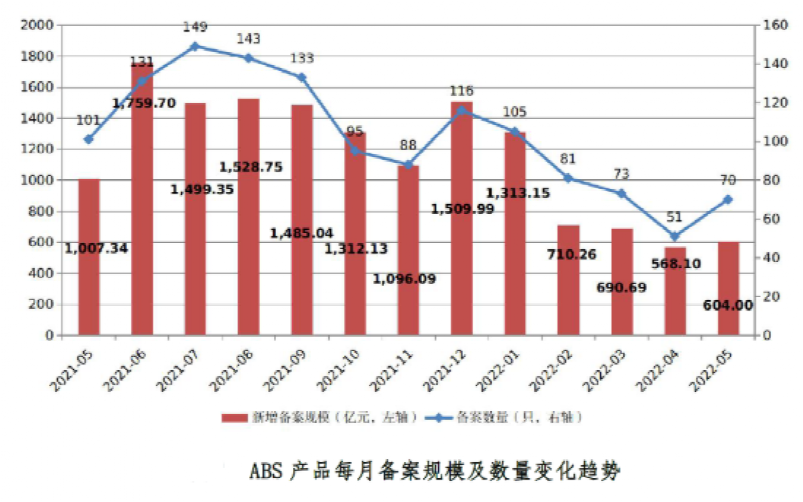

It is worth noting that ABS issuance has been tightening in the market in the near future. Compared with the same period last year, the number of issuances and scale has declined sharply in terms of issuance and scale since this year. According to the China -Foundation Association, in May 2022, 70 of the company's asset securitization products were recorded, and the total number of new filing scale was 60.400 billion yuan; the number of new filing scale increased by 6.32%month -on -month, a year -on -year decrease of 40.04%.

Company+general manager named

Specifically, this time the Shanghai Securities Regulatory Bureau found that during the development of asset securitization business, Tianfeng Asset Management mainly had two major problems:

The first is incomplete internal control. The compensation assessment and the deferred revenue have not been complete, the quality control and the head of the kernel department are mixed, the registered management of insiders has not been disclosed, and the inspection of the drafts is not strict.

The second is that the pre -risk prevention measures of integrity are not complete, and there are insufficient counseling and publicity work in customers.

Based on this, the Shanghai Securities Regulatory Bureau adopted the administrative supervision and management measures with a warning letter to the Tianfeng Asset Management, and asked Tianfeng asset management to quote as a warning, carefully find and rectify the problems, continue to improve the internal control of investment banking business, strengthen the integrity industry industry Management and submitting a written report to the CSRC.

At the same time, the Shanghai Securities Regulatory Bureau stated that, as the general manager of Tianfeng Asset Management, Fu Yu was responsible for the above -mentioned issues and decided to adopt administrative supervision and management measures with alert letter.

It is worth noting that the recent regulatory ticket issued by the securities firms has gradually increased, quoting Article 6 of the "Integrity Regulations", and the violations of the Tianfeng asset management are also related to this clause.

Article 6 of the "Integrity Industry Regulations": Securities and futures management agencies shall establish and improve the internal control system of integrity, formulate specific and effective pre -risk prevention systems, control measures and post -postkeeping mechanisms, and for the business types and links engaged in the business types and links. And related work to evaluate scientific and systematic integrity risks, identify the risk points of integrity, strengthen job balance and internal supervision mechanism and ensure that operation is effective.

The business types and links stipulated in the preceding paragraph include business contracting, undertaking, sales, trading, settlement, delivery, investment, procurement, business cooperation, personnel recruitment, and applying for administrative licenses, acceptance of regulatory law enforcement and self -discipline management.

The company's establishment is less than two years

Among the securities management subsidiaries, Tianfeng Asset Management is still a "recruit."

In March 2020, the CSRC approved Tianfeng Securities to set up asset management subsidiaries to engage in securities asset management business. Tianfeng Asset Management Registration is Shanghai. The initial registered capital was 500 million yuan, which was wholly funded by Tianfeng Securities. In August of that year, Tianfeng Asset Management was officially registered in Shanghai and officially opened in December. It has been established for less than two years since its establishment.

In terms of the person in charge, as early as in August 2020, when Tianfeng's capital management was approved, the bank "veteran" Wang Hongdong served as the vice chairman and general manager Wang Hongdong, but he stepped down after more than a year. In August 2021, the legal representative of Tianfeng Asset Management changed from Wang Hongdong to Fu Yu.

With the asset management business of Tianfeng Securities, Tianfeng Asset Management obtained 500 million yuan in capital in June 2021, and the overall business developed well in 2021. At that time, the operating income was 990 million yuan, of which, the fees and commissions net income of 933 million yuan, the investment income and fair value changes were 53 million yuan; the operating profit was 532 million yuan, and the net profit was 405 million yuan.

In terms of the scale of asset management, the total size of the asset management business at the end of 2021 was 109.034 billion yuan, of which the active management scale was 48.149 billion yuan. According to Wind information statistics, the issuance scale of Tianfeng capital management ABS in 2021 was 26.701 billion yuan, ranking 11th in the industry.

In addition, in the first quarter of 2022 disclosed by the China -Foundation Association, in the average annual list of corporate asset securitization business, Tianfeng Asset Management ranked ninth with a monthly average scale of 53.788 billion yuan.

According to reports, the Tianfeng Asset Management Asset Securities Securities Team, with the help of Tianfeng Securities, external cooperation agencies, and the team's own resources, to build a domestic first -class domestic and diversified leading advantage, the structured structure with asset securitization, the combination of investment and financing combining investment and financing, and the combination of investment and financing combining investment and financing. Financial business platform. The asset securitization business is positioned as "the capital intermediary business, based on the underwriting business, and the investment business."

Since June, Tianfeng Asset Management has issued multiple innovation ABS projects. For example, "Jiangbei Investment-Green Guarantee Lingque Intellectual Property Phase 1 Asset Support Special Plan" is the first national single exchange market specific trust structural intellectual property securitization product.

ABS tickets have successively issued one after another with the expansion of the ABS market and the increase in the position of the capital market, individual ABS products have begun to default, and credit risks hidden in the issue period and duration of the deposit period are constantly being recognized. Recently, securities firms have been regulated by the asset securitization business.

On April 18, the Shenzhen Securities Regulatory Bureau issued a decision to take a warning measures for Galaxy Jinhui. According to the Shenzhen Securities Regulatory Bureau, in the process of engaging in asset securitization business, Galaxy Jinhui had due diligence in some asset securitization business projects that depended on the issuer and third -party provided information, and insufficient verification.

On April 19, the Beijing Securities Regulatory Bureau issued a decision to take a correction of regulatory measures for Cinda Securities. It is worth noting that, in addition to the company's order to make corrections, the general manager of Cinda Securities is also asked to accept the conversation.

The Beijing Securities Regulatory Bureau pointed out that Cinda Securities has not established an effective constraint and checks and balance mechanism in the process of launching the ABS business. The ABS business development links are illegal, the risk management is absent, and the disclosure of some ABS projects is incomplete. The company's investment banking business compliance personnel are insufficient, the salary management is not complete, the internal control of the investment banking business is insufficient, the unified standards are not implemented for similar businesses, and the compliance inspection and conflict of interest are not standardized.

The increase in the warning letter means that the supervision of ABS business is continuously strengthened, and the management of intermediaries should pay special attention to diligence in the early stage of diligence and product duration.

Wind data shows that a total of 482 companies have been issued in the market this year, with a total issuance of 452.977 billion yuan; 606 in the same period last year, with a total distribution of 612.996 billion yuan. 63 credit ABS, with a total issuance of 168.329 billion yuan; 88 in the same period last year, with a total issuance of 392.178 billion yuan (calculated at the date of issuance of the issuance of the issuance).

In contrast, whether it is corporate ABS or credit ABS this year, the number and scale of issuance have fallen sharply.

A briefing of the operation of the asset securitization business in May 2022 disclosed by the China -Foundation Association showed that in May 2022, 70 of the company's asset securitization products were recorded, and the total number of new filing was 60.400 billion yuan (see Figure 1). In May, the number of new filing increased by 6.32%month -on -month, a year -on -year decrease of 40.04%.

Edit: Captain

- END -

7 new local infections in Beijing involved 5 districts including Chaoyang

Zhongxin Jingwei, June 15th. According to the Healthy Beijing public account, on the 15th, Beijing held a press conference on the prevention and control of the 366 new crown pneumonia. Liu Xiaofeng,

CEO of Hong Kong Investment Fund Guild: Investing in China's value chain, Hong Kong plays a huge role!

China Fund reporter Yao BoThe Hong Kong Investment Fund Association (Fund Associat...