Automotive wheel manufacturer Hongxin Technology breaks through the GEM: The production capacity of the project approved is 2 times the existing production capacity

Author:Daily Economic News Time:2022.06.26

Zhejiang Hongxin Technology Co., Ltd. (hereinafter referred to as Hongxin Technology) is applying for the GEM IPO of Zhejiang Hongxin Technology Co., Ltd. (hereinafter referred to as Hongxin Technology). At present, the Shenzhen Stock Exchange has issued the first round of review letter to it. According to the plan, Hongxin Technology plans to raise 748 million yuan through the launch of the list, all of which are used for "an upgrade project of 1 million high -end forged automobile aluminum alloy car wheels and research and development centers" to expand existing capacity.

"Daily Economic News" reporter noticed that in addition to the fundraising project, there are still two approved projects in Hongxin Technology. The approval scale is 600,000 annual output and 300,000 annual output. 19 million (including the production capacity of the above -mentioned approval items). In 2021, Hongxin Technology's production capacity, output, and sales of 863,500, 787,800, and 70,500, respectively, reported that the production capacity exceeded the existing production capacity by twice.

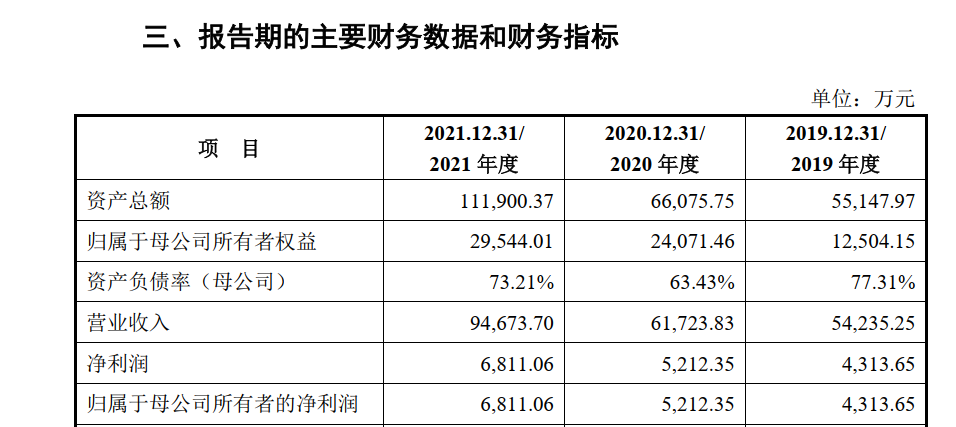

The performance has increased year by year, but the gross profit margin has declined year by year

From 2019 to 2021, Hongxin Technology's operating income was 542 million yuan, 617 million yuan, and 947 million yuan, respectively, and net profit was 43.136 million yuan, 52.1235 million yuan, and 68,100,600 yuan, respectively. The company's main products are commercial car wheels and passenger wheels. Among them, the income of commercial trains is 56.22%, 54.51%, and 55.22%, respectively. Essence

Photo source: prospectus (declaration draft) screenshot

Although the performance is growing, the gross profit margin of Hongxin Technology has declined year by year. From 2019 to 2021, the gross profit margin is 22.10%, 20.26%, and 14.57%, respectively. The reporter noticed that the decline in gross profit margin was mainly due to the decline in the gross profit margin of the first major product commercial vehicle wheels. From 2019 to 2021, its gross profit margin was 23.62%, 20.79%, and 12.64%. Essence

Hongxin Technology's email on June 20 responded to a reporter in the "Daily Economic News" reporter that in 2020 and 2021, the company's commercial vehicle gross gross margin rate decreased compared with the previous year, mainly due to the decline in the gross profit margin of the entire vehicle supporting market and the after -sales market. drive.

In 2020 and 2021, the sales unit price changes of Hongxin Technology Commercial Wheels in the supporting market of the vehicle were -9.65%and 9.47%, respectively, and the unit cost change was -5.22%and 21.26%, respectively. The unit price changes of the product sales are -8.03%and-4.94%, respectively, and the unit cost changes are -6.07%and 4.29%, respectively.

From 2019 to 2021, the Haomert Wheel Products (Suzhou) Co., Ltd. (hereinafter referred to as Hameter) is the company's largest customer, and the sales products are mainly commercial wheels. According to the prospectus (declaration draft), in 2020, the increase in domestic forged aluminum alloy wheels competitors increased, and market competition intensified. In order to adapt to market changes, the company reduced the unit price of commercial trains to Hameter.

In 2021, due to the sharp rise in the price of aluminum materials in major raw materials, Hongxin Technology and Hameter negotiated the pricing after negotiation. However, Hongxin Technology said that although the company has passed the factors of the rise in aluminum prices to downstream customers, the product price adjustment is lagging, and it cannot cover the increase in the price of aluminum stick procurement. The gross profit margin of the wheels decreased compared to the same period last year.

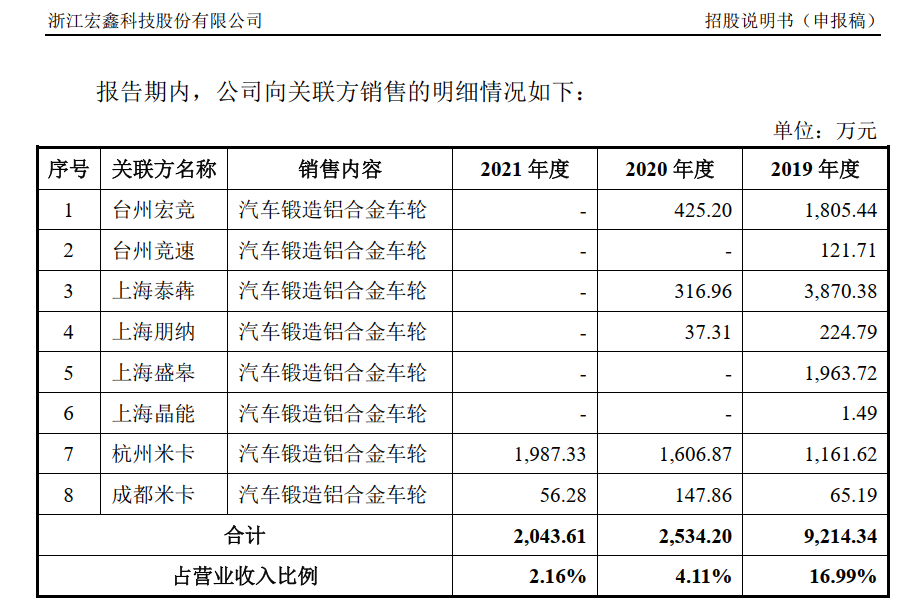

Part of the related parties before the application for canceling or renamed the name

From 2019 to 2021, Hongxin Technology has frequently conducted affiliated transactions with many affiliated parties, including related sales and affiliated procurement. Among them, in 2019, there is a relatively large related sales sales.

Photo source: prospectus (declaration draft) screenshot

The prospectus (declaration draft) shows that, due to factors such as protecting customer information and conservative companies' business secrets, Hongxin Technology conducted export declaration and sales through 4 trading companies including Shanghai Tai Benjin Export Co., Ltd. (hereinafter referred to as Shanghai Tai Ben) Car forging aluminum alloy wheels, in 2019 and 2020, the total sales amount was 60.6038 million yuan and 3.5427 million yuan, accounting for 11.17%and 0.57%of operating income, respectively. Among them, Shanghai Tai Ben and Shanghai Shengyu International Trade Co., Ltd. (hereinafter referred to as Shanghai Shengyi) are all listed on the top five customers in 2019.

These four trading companies are all related parties of Hongxin Technology. Three of the actual controller Wang Wenzhi have made significant influence. One has held shareholders and director Hong Chongen who holds more than 5%of the shareholders and director of the executive director and general manager. Four trading companies have engaged in wheel sales business and constitute interbank competition with the company.

However, from August to September 2020, two trading companies such as Shanghai Shengyi canceled the name and business scope of Shanghai Pengna; Shanghai Taiben also canceled in February 2021. Hongxin Technology replied to reporters that in 2020, in order to completely eliminate competition in the industry and reduce related transactions, the company stopped selling products to 4 companies such as Shanghai Tai Ben and resolved interbank competition.

However, is the company's associated sales of four companies such as Shanghai Tai Ben in 2019? If necessary, why is it gradually stopped after 2020? In this regard, Hongxin Technology did not make a clear reply in the email, but only stated that "the transaction price sold to the above company is determined based on the sales price of the terminal customer, and there is no interest delivery problem for related sales." In addition, Hongxin Technology also sells automobile forging aluminum alloy wheels to two companies including Taizhou Hongjing Automobile Parts Co., Ltd., which has 50%of the actual controller's daughter Wang Yian. Logging out.

At present, Hongxin Technology is still selling products to related parties Hangzhou Mika Industrial Co., Ltd. and its affiliated enterprises. The total sales amount from 2019 to 2021 is 12.268 million yuan, 17.547 million yuan, and 20.4361 million yuan, respectively. Hongxin Technology said that the above transactions accounted for a relatively low impact on the company's financial status and operating results.

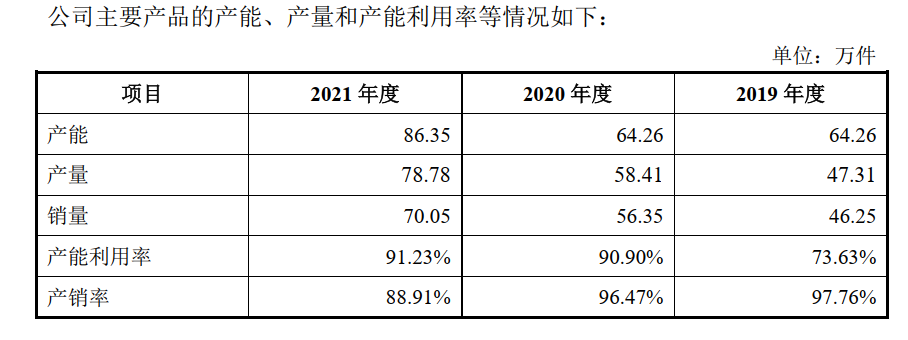

The production capacity of the project is surpassed with 2 times production capacity

According to the IPO plan, Hongxin Technology will raise 748 million yuan through this IPO. After implementing the fundraising project, it is expected to add 1 million pieces per year for new automotive forging aluminum alloy vehicles, and the construction period of production projects is 4 years.

The reporter saw in the environmental assessment document of the project that there are currently two factories in Hongxin Technology, which are the Food Park Factory and Chengjiang Factory District. "Technical Reform Project", the Food Park Factory District has approved the project "annual output of 300,000 high -precision lightweight aluminum alloy wheel technology reform projects", and both projects are displayed as "construction and unpaid production".

If it is successfully listed, in the next few years, Hongxin Technology will use the fundraising project and two approved projects to increase a total of 1.9 million pieces of production capacity.

From 2019 to 2021, Hongxin Technology's capacity capacity was 642,600, 642,600, and 863,500, respectively. The capacity utilization rates were 73.63%, 90.90%, and 91.23%, respectively. Essence The capacity utilization rate continues to increase, but the production and sales rate has declined.

Photo source: prospectus (declaration draft) screenshot

In the next few years, the new production capacity exceeds twice the capacity of 2021. Can such large production capacity be smoothly digested? Hongxin Technology replied to reporters that the company's existing production scale and production capacity have become saturated, and it is difficult to meet the company's sustainable business needs. This fundraising project is the new production capacity project of the company's existing core business, which can make full use of it to make full use of it. The existing customer resources and sales channels provide a solid guarantee for the implementation of this fundraising project and the digestion of production capacity.

In addition, Hongxin Technology said that 600,000 projects in annual output are construction projects, with an annual output of 300,000 pieces of technical reform projects, and the construction nature of two projects is different. The production and sales plan is reasonably formulated and adjusted according to the actual situation of the project and the future development strategy.

Daily Economic News

- END -

Bilibili is less profitable, and US stocks have fallen 14%. Should we see it in the future?

On the Chinese video market, Bilibili is an absolute leader in the market. With t...

Time is fixed!Construction on June 26

/The reporter learned from the Civil Aviation Hubei Regulatory Bureau that the th...