Top 10 news on the weekend affecting the market for a week

Author:Broker China Time:2022.06.26

The above audio technology comes from: Xunfei Voices

1

Heavy! The comprehensive registration system reform seminar was successfully held

According to the WeChat public account of the National Financial and Development Lab, on June 25, the National Financial and Development Lab and the Institute of Finance of the Chinese Academy of Social Sciences jointly held a seminar on a comprehensive registration system to invite relevant experts and scholars and the heads of market institutions to jointly summarize the early stage The pilot experience of stock issuance registration system reforms and suggestions for the upcoming comprehensive registration system reform.

Participants believe that the implementation of the stock issuance registration system in an all -round way is the established task of the Party Central Committee and the State Council, and must be resolutely completed without discounting; the pilot of the early registration system reform has achieved positive results, the stock market is more inclusive, the issuance and listing audit procedure is more even more Transparent, the review efficiency is significantly improved; the next step should be systematically summarized the early pilot experience, adhere to the original intention of the registration system, deal with the relationship between the market and the government, highlight the legalization of the marketization of reform, and improve the issuance review system from the perspective of investor needs. Realize the reform of the comprehensive registration system.

2

The long -term funds of A shares are coming, involving the 100 billion market! Personal pension investment fund rules are released, these products have been included, there are five highlights

On June 24, the CSRC issued the "Interim Provisions on the Management of Business Management of Public Pension Investment Public Investment Fund" (referred to as "Interim Regulations") and solicited opinions from the society.

According to the regulations, during the trial stage of the personal pension system, it is planned to include the pension target funds with a scale of not less than 50 million yuan at the end of the last four quarters. Pension target funds are fund products with low and medium fluctuations and assets containing equity assets. In the future, with the gradual push of personal pension systems. The CSRC stated that it will further expand the scope of the product, incorporate more investment styles, clear investment strategies, good long -term performance, stable operations, and other types of public funds for long -term investment in personal pensions. Related product lists are updated every quarter, dynamic adjustment and optimization, stimulating market players to participate in vitality, and better serve personal pensions for long -term value preservation and appreciation.

For details, see: "Heavy!" The long -term funds of A shares are coming, involving the 100 billion market! Personal pension investment fund rules are released, these products have been included, there are five major highlights "

3

It affects the scale of nearly trillion! A -share Hong Kong stock ETF has entered the era of "interconnection and interconnect"

On the 24th, the CSRC officially issued the "Announcement on the Integrated Arrangement of Transaction Open Fund Integration", and proposed that from the date of this announcement, the transaction -type open -end fund was officially included in the interconnection. Fund shares of stocks and trading open funds listed on the exchanges listed on the exchanges of securities companies or brokers.

At the same time, the Shanghai and Shenzhen Stock Exchange and Zhongdeng Company also issued relevant announcements. One of the most watched markets, the scope of stock ETFs in the Shanghai -Hong Kong Stock Standard is: Exchange ETF has an average of 1.5 billion yuan in the past 6 months, and its ingredient securities are mainly based on the stocks of the Shanghai and Shenzhen Stocks. The average asset size of the Said ETF has reached HK $ 1.7 billion in the past six months, and its component securities are mainly based on the stock of the Hong Kong Stock Connect. In addition, the ETF incorporated into the target must meet the requirements of 6 months of listing and its target index for one year. In principle, the ETFs marked in principle are adjusted every six months. The first -time inspection deadline of Shanghai Stock Connect ETF, Shenzhen Stock Connect ETF, and Hong Kong Stock Connect ETF was April 29, 2022.

Comments: According to the preliminary calculation of the E Fund Fund, for overseas investors, the ETF interconnection mechanism is currently expected to be included in more than 80 ETFs in the mainland market, which will exceed 600 billion yuan; for mainland investors for investors in the Mainland; The Hong Kong market is expected to be included in 6 ETFs, with a scale of 360 billion Hong Kong dollars. In the context of interconnection and interoperability becoming the main way to allocate A shares, after further enriching foreign investment varieties and improving its investment convenience, the ETF market is expected to usher in incremental funds and promote the continuous expansion of the market size of ETF.

4

Beijing encourages consumers to change new energy vehicles, and can enjoy up to 10,000 yuan subsidy! Four departments: orderly carrying out pilots such as pure electric, hydrogen fuel cells, etc.

According to the Ministry of Transportation website on June 24, the Ministry of Transport, the National Railway Administration, the China Civil Aviation Administration, and the State Post Bureau issued the implementation of the "CPC Central Committee and the State Council of the State Council of the Communist Party of China on the complete and accurate implementation of the new development concept to do a good job of carbon peak carbon neutralization work The implementation opinions of the Opinions put forward the active development of new energy and clean energy transportation. Relying on the pilot construction of a transportation country, the pilot of pure electric, hydrogen fuel cells, renewable fuel vehicles, and ships in an orderly manner. Promote the application of new energy vehicles. Explore the application of new types of power ships such as methanol, hydrogen, and ammonia to promote the application of liquefied natural gas power ships. Actively promote the application of sustainable aviation fuel.

On June 26, the Beijing Municipal Bureau of Commerce and other 7 departments issued the "Beijing Municipality on Encouraging Automobile Renewal Consumption" notice, which mentioned that the subsidy time was from 0:00 on June 1, 2022 to December 31, 2022 31, 2022 At 24:00. During the period, the type of transfer or scrap passenger car is a new energy passenger car or other passenger cars using 1-6 years, and can enjoy 8,000 yuan subsidy; transfer or scrap for 6 years (inclusive) other passenger cars, you can enjoy 1 10,000 yuan subsidy.

5

State Administration of Traditional Chinese Medicine: By 2025 All Community Service Center will set up the Traditional Chinese Medicine Museum on June 24th, the State Administration of Traditional Chinese Medicine on "Opinions on Strengthening the Work of TCM Talents in the New Era" (hereinafter referred to as "Opinions") and TCM talents A press conference was held in the relevant situation, and the reporter asked.

At the meeting, Lu Guohui, director of the Department of Personnel Education of the State Administration of Traditional Chinese Medicine, introduced that the "Opinions" focused on the major needs of the development of traditional Chinese medicine and proposed the main goal of the work of traditional Chinese medicine talents in the new era: by 2025, the talent training of talents that meet the characteristics of traditional Chinese medicine The evaluation system is basically established, the total number of talents has grown rapidly, and the institutional environment is significantly optimized. The training and creating a talent team that basically meets the needs of the development of Chinese medicine, and realize that the configuration of traditional Chinese medicine physicians at the second level or above is not lower than the total number of doctors in the institution. 60%, all community service centers and township health centers have a traditional Chinese medicine museum and a traditional Chinese medicine doctor. By 2030, the reform of the talent development system and mechanism has made significant progress, the talent echelon is more reasonable, the scale of high -level talents has increased significantly, the grass -roots talent teams are more stable, and the TCM Talent Center and innovation high areas have been gradually completed. The system is basically formed.

6

Gree has a discount of 3.5 billion discounts, super "iron powder" greatly reduced its holdings! The institution received 3 billion, and foreign capital entered

Gree, a home appliance giant with a decline in the stock price for a year and a half, is still sold at a low valuation! After the market on June 24, Gree Electric had 21 large transactions, with a total transaction of 110 million shares, a transaction value of 3.504 billion yuan, and the average transaction price was 31.79 yuan, a discount of 6.22%from the closing price. The seller is the Southern Road Sales Department of Caida Securities Beijing, and the buyers are mostly institutional seats, which takes about 3 billion yuan. The above -mentioned large transaction accounts for 1.86%of Gree's equity.

A reporter from securities firms found that only enough equity can sell only Zhuhai Gree Group, Zhengjin Company, Zhuhai Mingjun and Jinghai. That night, Gree announced that the shareholders of Jinghai Interconnected issued the "Reference to Reducing Shares", which was indeed Beijing. The last time the Beijing -hai Connect was reduced to Gree in July 2020.

Comments: Some people in the industry said that Gree has been transformed in channels in the past few years, and e -commerce sales have increased year by year, and naturally moved dealers' cheese. Jinghai Interconnection, as a Gree dealer channel alliance, has begun to reduce its holdings.

See "Gree's 3.5 billion discounts, super" iron powder "to reduce holdings! The institution received 3 billion, the foreign capital entered, and the transformation accelerated? "

7

The Seventh Kingdom Group Summit was held, and oil became the biggest highlight! U.S. stocks closed sharply, the Nasdaq and S & P increased by more than 3%

According to CCTV news reports, the Seventh -way Group Summit, which has attracted much attention from the market, was held from June 26 (today) to 28th (next Tuesday). , Economic recovery and other topics. Observer pointed out that at this meeting, everyone has paid more attention to the energy crisis. Since the emergence of the Russian -Ukraine conflict, commodities, including oil and natural gas, have risen to varying degrees, which has also driven inflation. The member states of the G7 Group hopes to find a way through this meeting. On the one hand, the energy income of the Kremlin is limited, and on the other hand, the impact of rapidly reducing the impact of Russia's oil and natural gas dependence on Russia. Essence

With the long -term inflation expectations of the University of Michigan's inflation, and the St. Louis Fed Chairman Brad emphasized that the risk of recession was "exaggerated", the three major stock indexes of the US stocks opened high on Friday, and the "annual large shuffle" of FTSE Russell Pulling a series of stocks rose, adding to the icing on the cake. As of the close, the S & P 500 index rose 3.06%; the Nasdaq index rose 3.34%; the Dow Jones Index rose 2.68%. Large -scale technology, banks, new energy vehicles, Meta and Wells Fargo rose over 7%, Tesla rose more than 4%. China stocks continued to rise on Friday, and the Nasdaq China Golden Dragon Index rose 4%, and the cumulative increase of 11%last week. Among them, Xiaopeng Automobile rose more than 7%, Weilai rose more than 4%, the ideal car rose nearly 4%, and Alibaba rose nearly 5%.

Comments: Although the US stocks received a Dayang line last week, the analysts are still in a state of pessimism for the backlord. Chris Senyek, chief strategy analyst at Wolfe research, said on Friday that the market rising in the past three days is still a bear market rebound under the deep oversold conditions. Although there may be some additional subsequent rises in the short term, the basic situation of our mid -term declines remains unchanged. The next round of decline will be promoted by risk risk and profitability.

8

The CSRC approved the IPO approval of 3 companies, and agreed to the 5 companies IPO registration

The CSRC approves the IPO approval of 3 companies. The CSRC approved Hongye Futures Co., Ltd. for the first time publicly issued no more than 100777778 new shares. The CSRC approved the first public offering of no more than 27.84337 million new shares. The CSRC approved Shanghai Baoli Food Technology Co., Ltd. for the first time publicly issued no more than 401 million new shares.

The CSRC agreed to register the two corporate science and technology board IPOs. The CSRC approved the first public offering of stock registration of Jiangsu Fava Thai Nano Technology Co., Ltd. and Haiguang Information Technology Co., Ltd. for the first time.

The China Securities Regulatory Commission agreed to register the 3 company GEM IPO. The China Securities Regulatory Commission agreed to the first public offering of stock registration of Nanjing North Road Zhi Control Technology Co., Ltd., Chongqing Zijian Electronics Co., Ltd., and Beijing Huada Jiutian Technology Co., Ltd. GEM for the first time. 9

Tip: A total of 9 new shares are purchased this week

A total of 9 new shares are issued this week. Among them, 1 on Monday: Zhongye Technology; 5 on Tuesday: Masuchu Cable, Ke Run Zhikong, Obi Zhongguang, Zhongke Environmental Protection, Yuandao Communication; 2 on Wednesday: Huifeng Diamond : Tianxin Pharmaceutical.

10

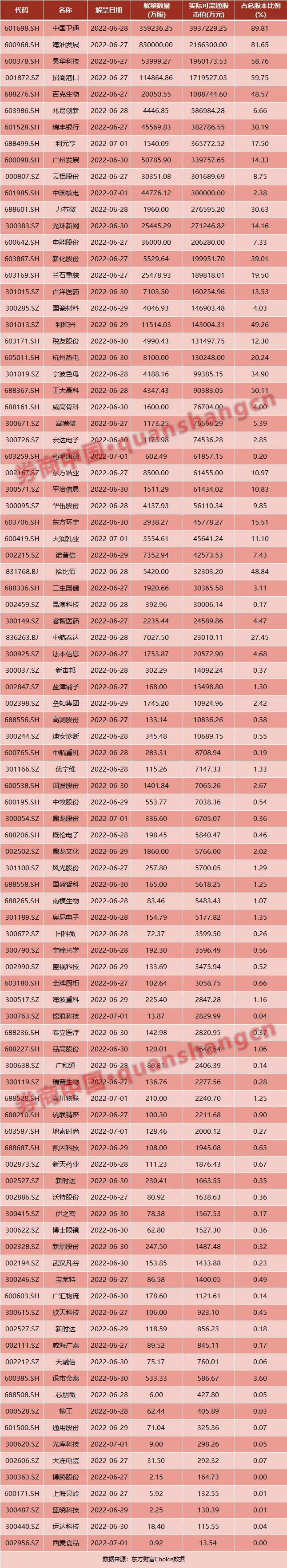

This week's 161.4 billion market value restricted shares lifted the ban, China Weitong's ban on a market value of 39.3 billion

Data show that a total of 93 companies have been lifted one after another this week (June 27th to July 1st), with a total of 17.579 billion shares of the ban. Based on the closing price on June 24, the market value of the ban was 161.463 billion yuan.

From the perspective of the market value of lifting the ban, the top three for lifting the ban are: China Weitong (39.372 billion yuan), the development of sea oil (21.663 billion yuan), and Haohua Technology (19.602 billion yuan).

From the perspective of the proportion of lifting the ban, the top three of the lifting of the ban are: China Weitong (89.81%), the development of sea oil (81.65%), and China Merchants Port (59.75%).

Responsible editor: tactics

- END -

WeChat Announcement: Campaign to clean up such accounts!

The WeChat Security Center released the WeChat Personal Account Release of Prohibi...

"Bear Market" focuses on American confidence, economist: US economist may be pushed to "hard landing"

[Global Times special reporter Zheng Ke Global Times reporter Ni Hao Yuwen] The faint light has disappeared and welcome to the bear market -A American media was full of frustration on the 13th. On