The gap in pension is 8 trillion yuan.

Author:Huashang Tao Lue Time:2022.06.26

The third pillar of the pension is riding.

Wen | Chinese Business Tao Qiluo Zhou Ruihua

In late April, the State Council issued the "Opinions on Promoting the Development of Personal Pension" (hereinafter referred to as "Opinions"). The promulgation of the "Opinions" establishes the third pillar of personal pensions in the pillar of our country's endowment security system in terms of system. It is an effective supplement to the first and second pillars to ensure the sustainable development of my country's endowment security system.

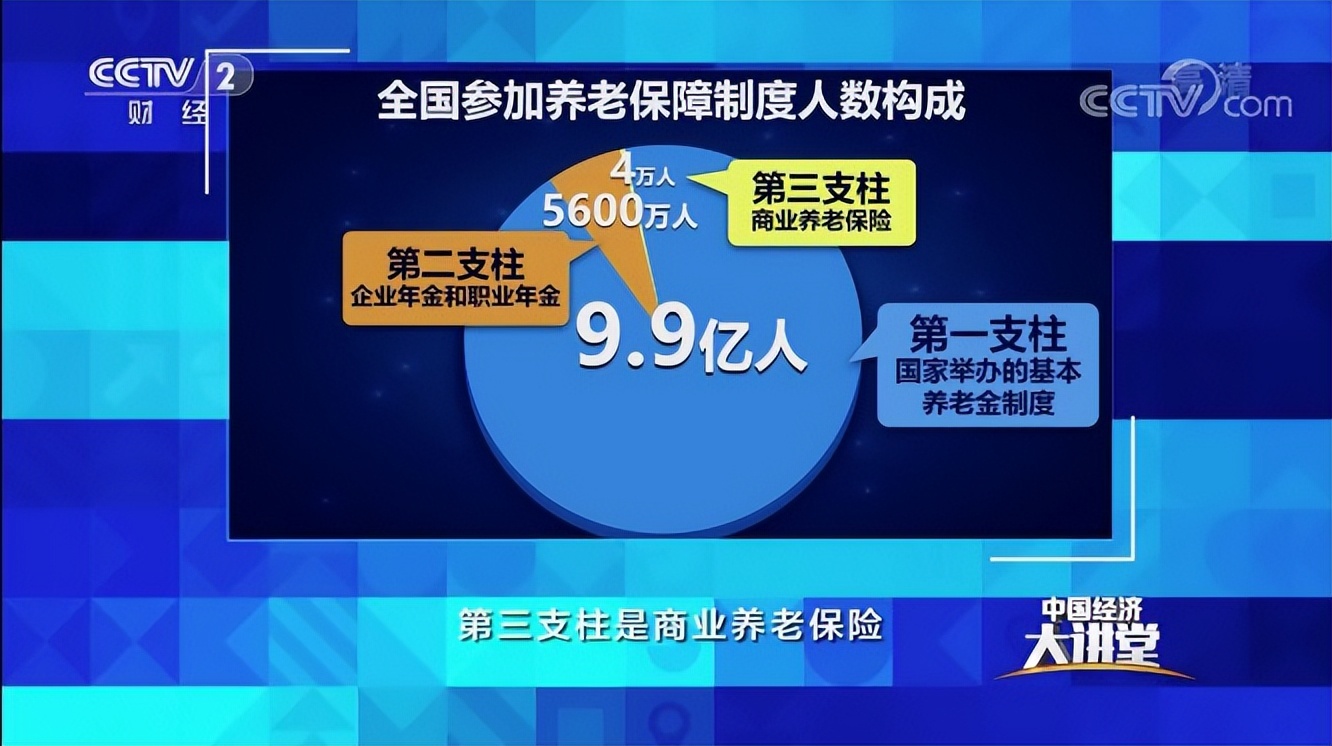

After more than 30 years of development, my country has now established an endowment security system based on basic pension insurance, supplemented by corporate annuity, and personal pensions, covering over 1 billion people.

In this context, what does the status of establishing the third pillar of personal pensions in the form of institutional form mean?

[In the future, you have to rely on personal pensions]

Earlier this year, the information published by the Ministry of Finance revealed that in 2021, the first pillar of my country's pension -basic pension, the gap reached 700 billion yuan. According to the recent Chinese pension research report released by the Insurance Industry Association, this gap will reach an amazing 8 trillion-hundred trillion-hundred trillion-hundred trillion yuan in the next ten years.

This means that the largest pillar of my country's endowment security system has been unacceptable, and the post -80s generation may become a generation of pension -free pension. The reason behind it is related to two "imbalances".

The first is the imbalance of the population structure.

According to the Statistics of the National Economic and Social Development of the National Bureau of Statistics in 2021, in 2021, the population of the country over 65 years old exceeds 200 million, accounting for 14.2%of the entire population. From a global perspective, Japan, which has the highest level of aging worldwide, has reached 27%, followed by Italy, Germany, and France, with 23%, 21.12%, and 20%, respectively. China's aging level is in the degree of aging. Global ranked tenth.

However, from the perspective of aging speed, from entering aging society to entering a deep aging society, France has used 140 years. The United States is 72 years. Copy preparation. And China has only 20 years, and the speed of aging aging is beyond the expectations of everyone, and it is not fully prepared for this.

On one side is aging acceleration, but on the other hand, young people are unwilling to have children, and their population growth will fall.

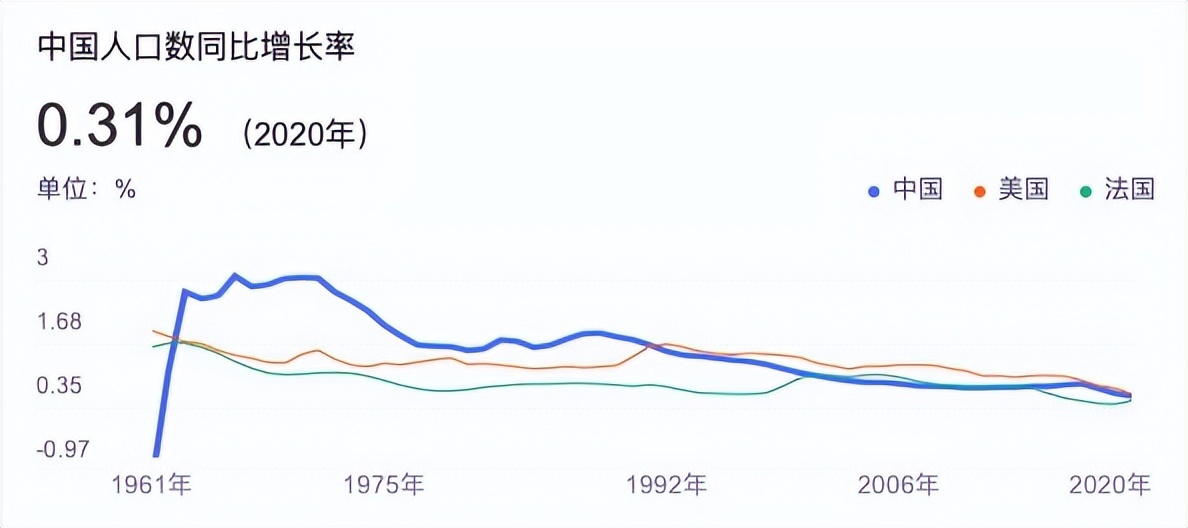

According to data from the National Bureau of Statistics, the natural growth rate of my country's population has decreased from 33.33%in 1963 to 0.34%, of which the natural growth population was 480,000 in 2021, a new low since the founding country. Some experts even predicted that in 2022, my country will have a negative population growth for the first time.

This population growth rate is higher than that of Japan, South Korea, lower than the United States, and approaching France, which is highly aging.

The population structure is unbalanced, and the speed of new population cannot keep up with the speed of aging. In the future, the pressure on the balance of the revenue and expenditure of basic pension insurance in the future is increasing. According to the UN population prediction data, my country's elderly population support ratio will support 1 elderly man from five labor in 2020 to two labor -supported for the elderly in 2050.

For labor, two people will raise an old man in the future, and the burden of pension will increase. For the elderly, the number of supporters has been reduced from 5 to 2, the pension gap is getting larger and larger, and the quality of pension life will inevitably decline.

In 2017, Bloomberg Sunset Index, which covers 178 countries around the world, ranked fifth among the most serious risk of population aging in the world.

Looking at the world, many countries that have entered an aging society also adopt the "three -pillar" pension guarantee system. Due to the more sufficient time to deal with it, a more complete pension system has been established. Basic pension pressures are not as big as my country as big as China. Essence

This involves the second "imbalance" of my country's pension security system and the imbalance of the three pillars of the pension.

Take the United States for reference. The United States has entered the aging society since the 1940s, but of the "three pillars" of the American pension system, the first pillar of the bottom of the pocket is accounting for only 7.7%of the total pension assets. The third pillars accounted for 53.3%and 39%, respectively. The first pillar accounts for a small proportion and play a role in basic pension. The elderly mainly depends on enterprises and individuals.

In contrast, according to the "Bulletin of the Development Statistics of Human Resources and Social Security in 2020", the proportion of my country's largest pillar in pension assets exceeds 60 %, which is contrast with the basic positioning of the insurance; the second pillar is the second pillar; the second pillar is 30 % of the enterprise annuity; the third pillar led by the individual is still in its infancy, and the scale is negligible. my country's pension mainly depends on the first pillar, and individuals have almost no effect in the elderly.

Looking at Western countries that earlier entering aging society, a basic development law of pensions will be found: a country must consolidate basic pensions in the early stage of population aging and achieve full coverage; after entering the moderate aging society, the basic pension is the basic pension. There will be a gap in gold, and at this time, the structure of the pension system is needed.

To apply this development law, what is urgently needed in my country is to vigorously develop personal pensions.

[Personal Pension Pioneer]

In Western countries with mature personal pensions systems, there are mature personal pension solutions, such as pension government bonds promoted by the United Kingdom, and Germany's development formula.

Although my country has not introduced the Opinions until now, it is clear that the personal pension system is clear, since 2000 my country has entered an aging society, it has been explored in the academic and business circles. In 2012, Yang Yansui, a professor at the Hospital Management Research Institute of Tsinghua University, found that the pensions of some provinces and cities were unacceptable. It predicts that the population structure is unbalanced. In the future, there will be a large gap in pensions.

In September of that year, she wrote the "Eight Issues of the Reform of China's Pension System" published in the "First Financial Daily", proposing to delay the collection of pensions, improve the structure of pension systems, and develop personal pensions. Her remarks were collectively opposed by netizens at the time, and anger netizens burst out almost all foreign calls from Tsinghua University.

At the same time with Professor Yang Yansui, in the trend of aging, the business community is also trying to innovate business models, thinking about how to combine personal wealth with pension, and let the pension "third legs" run.

For example, in 2012, the insurance product of the docking pension community launched by Taikang was an innovative exploration of organic insurance business with medical and nursing entities. In essence, this is a fundraising model of pension funds. It is not only a long -term investment of annuity. In the stage of creating wealth, preparing funds for your own elderly life, buying a guarantee, but also a check -in letter in the pension community. , Buying happy customers, their spouses and parents can give priority to the Taikang House pension community.

Ten years later, when I looked back in 2022, the pension gap reached 700 billion yuan, and Professor Yang Yansui's predictions have become a reality; "happiness has appointments" for ten years to sell 140,000 copies, and the flagship store in the pension community Taikang House · Yanyuan It has also ushered in the 7th anniversary. One bed is difficult to find. Taikang's funding business model and medical care layout have also been verified by the market.

Entering 2023, the birth of the "63 baby tide" in my country will be over 60 years old, opening the peak of retirement. This means that in the next ten years, an average of 27 million people will enter the pension model each year, which will form a huge challenge for the balance of income and expenditure of my country's endowment insurance funds.

The implementation of the "Opinions" will also run in the form of institutionalization to allow the "third leg" of the endowment guarantee system to ease the impact of "retirement tide".

The exploration of academic and business circles such as Professor Yang Yansui and Taikang not only proves the urgency and necessity of implementing the personal pension system, but also found a feasible solution for the implementation of the personal pension system through business practice. The implementation of "provides effective theoretical basis and practical reference.

——End —————

Welcome to pay attention to [Huashang Tao strategies], know the characters of the wind, and read the legend of Tao Tao.

Copyright, prohibit private reprint!

Part of the picture comes from the Internet

If it involves infringement, please contact to delete

- END -

V viewing financial report | Strong demand for lithium salt, the company's half -year net profi

Zhongxin Jingwei, June 8th. Recently, the concept of lithium lithium in salt lake has risen. On the evening of the 7th, Shengxin Lithium could disclose the semi-annual performance forecast. The compa

Leshan City Printing the "One -stop" service implementation plan for the "14th Five -

Recently, the Leshan Market Supervision Bureau issued the One -stop Service Implementation Plan for the Fourteenth Five -Year Quality Infrastructure of Leshan City , based on the summary of the p