Car consumption remain strong every 100 points through the brand 100 indexes

Author:Daily Economic News Time:2022.06.26

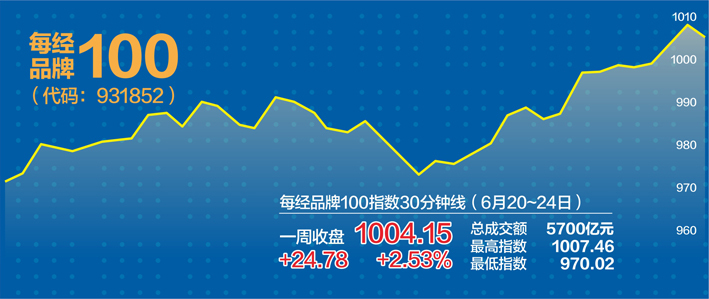

When overseas markets are stable, every 100 index of brand 100 rushes thousands of marks!

After the overseas market plummeted the previous week, last week's overseas market fluctuated and stabilized, and the overall Chinese stocks recovered and performed smoothly. New energy vehicles and large consumption of domestic markets continued to rise, driving each brand 100 index rebound. In the end, each brand, the brand goes through the brand. The 100 index rose 2.53%last week to close at 1004.15 points. In terms of individual stocks, Geely Automobile (HK00175, the stock price of HK $ 17.940, a market value of 179.8 billion) increased by more than 20%in a single week, including Changan Automobile (SZ000625, a stock price of 22.35 yuan, a market value of 170.579 billion), China Resources Land (HK01109, a stock price of 35.400 Hong Kong, a market value of 252.4 billion ) Waiting for 6 stocks weekly increased by more than 10%. Judging from the target of the tracking index, with the arrival of summer, the construction of beer brands has significantly boosted its valuation.

The index is like a thousand points like a rainbow

The Fed's tightening expectations have been strengthened. Although it still affects the global market, the market emotions were significantly gentle last week, and the overseas stock markets did not fall sharply, and the trend was relatively stable. At present, the bottom of the domestic economic growth has been rebounded. Under the support of reasonable funds, it has expanded effective investment, supports car consumption, home appliances to the countryside, and other consumer policies have frequently landed. The two major tracks remained strong. In the end, the 100 index of the brand rose 2.53%last week to close at 1004.15 points.

From the perspective of individual stocks, 60 stocks in ingredients stocks increased, and the proportion of component stocks accounted for 60 %. Geely Automobile and Changan Automobile in the new energy vehicle track accounted for the top two of the weekly increase, of which Geely Automobile rose 20.24 %, Eye -catching, Changan Automobile's weekly increase also reached 18.13%, while China Resources Land, China Life, China Resources Pharmaceutical, China Resources Beer and China Overseas Development Weekly increased by more than 10%. On the list of individual stocks, only Jianfa shares and PetroChina fell more than 5%. In addition to strong performance, component stocks also reflect the characteristics of resistance.

After a week of rebound, the price -earnings ratio of the 100 index of 100 in the brand is still significantly lower than the 12.54 times price -earnings ratio of the Shanghai Stock Exchange A shares and 21.28 times the price -earnings ratio of the Shenzhen motherboard.

A private equity manager in Shenzhen told the "Daily Economic News" reporter: "Last week we mentioned the concept of big consumption in the continuous performance last week, especially the Guizhou Moutai Weekly realized 'Sanlianyang', the stock price returned to 2,000 yuan In Daguan, liquor has once again become the focus of consumer -themed funds, but from the perspective of brand value, in addition to liquor, the beer sector is also outstanding this week. In addition to Qingdao Beer, China Resources Beer has increased by more than 10%. Later, the domestic beer brand came out, and it is also worth the attention of investors. "

The reporter noticed that there are fewer domestic beer brands in China. The leading company Qingdao Beer and Chongqing Beer have increased by nearly 5%last week. The construction shows a strong concern.

Beer industry enters the stock game

The Chinese beer industry has entered the fast track of national development since the late 1990s. Several leading companies have accelerated the merger and expansion rhythm to achieve "horse running circles". The CR5 headed by Ce Beberry reached more than 70%, and the oligopoly monopoly pattern was initially established. From 2010 to 2015, the industry price war fiercely intensified. Large beer giants compressed the cost of beer to a very low level with a scale advantage, objectively accelerating the clearing of small and medium -sized capacity in the industry, and the market share of leading enterprises has steadily increased.

Due to the fierce competition in the leading enterprise market in the past 20 years, through a large number of self -built production capacity or acquisition of local beer production capacity, it has formed a scale advantage, with a large number of low -cost beer to capture the advantages of market share. Therefore, there are a large amount of inefficient production capacity in major wine companies, which reduces the overall capacity utilization rate and profit margin of the industry.

The analysis of Southwest Securities pointed out that the problem of overcapacity in the industry in the industry has gradually solved, but there is still a phenomenon of high -end and canned production capacity. Various wine companies have put in high -end production capacity or optimized and upgraded the old capacity of the old. Elinage for high -end transformation.

At present, the concentration of the Chinese beer CR5 sales end increased to 73.6%in 2020. It has a vertical comparison of American and Japanese oligopoly companies. In 2020, the US CR5 sales share accounted for 89.4%, and the sales share of Japan's CR4 accounted for 86.2%. Therefore, there is still much room for improvement in China to facilitate the industry's leaders. With the stable market structure, the company's "horse racing land" has ushered in a new situation of significantly increased the contribution of price increase. At the same time, the price of leading wine companies has grasped the pricing voice, and the price increase frequency increases the superposition terminal conduction to ensure the profitability of the enterprise.

Beer product strength goes to brand power

From the perspective of the two major leaders in the domestic beer industry, China Resources has maintained its leadership in the leader, and after Tsingtao Beer has introduced Baiwei British Bo, Japan Asahi and Fosun Group, it has gradually followed the relationship. Essence

Look at China Resources Beer first. In addition to the well -known brand of "Snowflake", the company reshapes the creation of "domestic brand+international brand" 4+4 (high -end) product structure to form a full coverage of high -end price segments, which corresponds to the new choice of the full age group customer base. Essence

As far as domestic high -end brands are concerned, the company mainly promotes four products: "Breaking the World Super X", "Marce Green", "ingenuity" and "Facebook", of which Super X and Marce Green are targeted at 18-25, 25 ~ 30 years old respectively For young consumer groups, terminal retail prices are 8 yuan and 13 yuan, respectively, ingenuity and Facebook for young and middle -aged consumer groups in ages of 30 ~ 45, 45 ~ 55, and terminal retail prices are 15 yuan and 20 yuan, respectively. The company passes through the company. Gives product brand stories and feelings to create a product image and stimulate the consumer desire of consumer groups. As far as international brands are concerned, Xili has become China Resources Beer to create another international new product growth pole other than snowflakes. In the 2021 company's performance meeting, Xili mentioned that in 2025, it will occupy 15% of the company's sub -high -end products 4 million tons. ~ 20%market share. The Xili series launched products such as Xili, Sul, Hongjue, Tiger card. In addition, Xili Group has a wealth of product series. Compared with Parkway, the average price of Xili is higher. Malt concentration and alcohol content are higher than Parkway. The taste and raw materials are better, and the shelf life is long and has strong competitiveness.

Soochow Securities stated that the positioning of China Resources Beer Products covers people from different ages from young to middle -aged, focusing on consumer scenarios, but also corresponding to the product grade from high to low. International brands build the company that is gradually moving from product power to brand power.

Similarly, the brand value of Tsingtao Beer comes from its century -old accumulation. It has accumulated the honor in various beer rating competitions over the years, and the reputation of the masses in recent decades. The Tsingtao brand itself has a deep "moat", which constitutes the brand monopoly, and it is difficult for competitors to easily impact their brand status in the short term. By 2021, the value of the Qingdao brand was as high as 198.566 billion yuan, and the first place in the beer industry. The total value of the three major brands such as Qingdao, Laoshan, and Hans has exceeded 300 billion yuan.

From the perspective of the overall valuation of the beer industry, each of the two major ingredients of the brand 100 index China Resources Beer and Qingdao Beer, although occupying the leading position of the domestic beer brand, the price -earnings ratio is very low, both below 41 times, significantly lower than the industry average than the industry average. 70 times the price -earnings ratio, the valuation advantage is obvious.

Daily Economic News

- END -

Xu Jingping: Casting a "golden key" of the revitalization of the countryside

Poverty alleviation is not the end, but the starting point for new life and new struggle. In consolidating and expanding the results of poverty alleviation and comprehensively promoting the work of ru

alert!Gift rice noodles, free travel ... These may be routines!

Under the severe crackdown on judicial organs and the strict precautions of the people, the number of new cases of newly issued new issues in the city has decreased significantly. However, recently, s