The total amount of the History of Dubang Insurance has been executed by tens of millions, the four -year accumulation of more than 400 million, and the solvency of the solvency is under pressure.

Author:Discovery net Time:2022.06.27

On June 17, Dubang Insurance's newly executed total amount was 166,400 yuan. At the same time, the company's history was executed tens of millions of yuan, involving more than a thousand legal proceedings. In terms of operation, Dubang insurance solvency has been under pressure, with a cumulative loss of 436 million yuan in the past four years.

According to the company's investigation, on June 17, Dubang Property Insurance Co., Ltd. (hereinafter referred to as: Dubang Insurance) was listed as the executed person, with a total amount of 166,400 yuan. History recorded 156 executors, with a total execution of tens of millions of yuan; more than a thousand lawsuits involved lawsuits. At the same time, the official website of the China Banking Regulatory Commission shows that Dubang Insurance has business compliance issues and insurance consumer complaints.

It is worth noting that the recent progress of the 400 million yuan in capital increase plans on the official website. The announcement shows that the subscription amount of 116 million shares is currently not subscribed by shareholders, and the company's shareholders still have equity pledge. In addition, the Capital Insurance Report in the first quarter of the Corporation showed that the company's solvency indicator declined and applied to the regulatory authorities for three years of transition period.

In terms of performance, Dubang Insurance has continued to lose money in recent years, and it still loses 1.797 million yuan in the first quarter of this year. In response to the above situation, it was found that the interview letter to the Dubang Insurance requested the request to be explained, but as of press time, Dubang Insurance did not give a reasonable explanation.

History has been executed tens of millions, and was fined for business compliance issues

According to public information, Dubang Insurance was established on October 19, 2005 with a registered capital of 2.7 billion yuan. The main operating products include motor vehicle insurance, property loss insurance, liability insurance, short -term health insurance, etc.

According to the investigation of the enterprise, on June 17, Dubang Insurance was listed as the executed person, and the total amount of execution was 166,400 yuan. The executive court was the People's Court of Xiangzhou District, Zhuhai City, Guangdong Province. No., the case is a dispute over the property loss insurance contract with Zhuhai Mori and Construction Engineering Co., Ltd..

Furthermore, the History of Dubang Insurance was 156 executors, and the total amount of execution was 18.1346 million yuan, of which 4 were added in 2022.

(Photo source: Enterprise check)

It is understood that the executed person refers to the parties who refused to fulfill the court's decision or arbitration after the legal appeal period expires or after the final judgment. The investigation of the enterprise shows that the current capital insurance involves 6 records in this case, with a total amount of the target of 6.6062 million yuan, while the total amount has not fulfilled the total amount of 4.93 million yuan, and the proportion of not fulfilling is 74.63%.

(Photo source: Enterprise check)

As of June 23, Dubang Insurance involved over 999 legal proceedings, with 733 referee documents, with a total case of 34.7752 million yuan, accounting for 92.04%of the defendant's documents; 1207 announcement announcements.

Regarding the legal proceedings involved, industry professionals analyzed that the amount of litigation of property insurance companies or the nature and nature of its business. Although conventional claims litigation cases have no impact on the company's daily operations, it will still affect the company's performance. Therefore, insurance companies also need to pay more attention to customer service work, improve all aspects from underwriting to claims, and reduce the occurrence of litigation risks from the source.

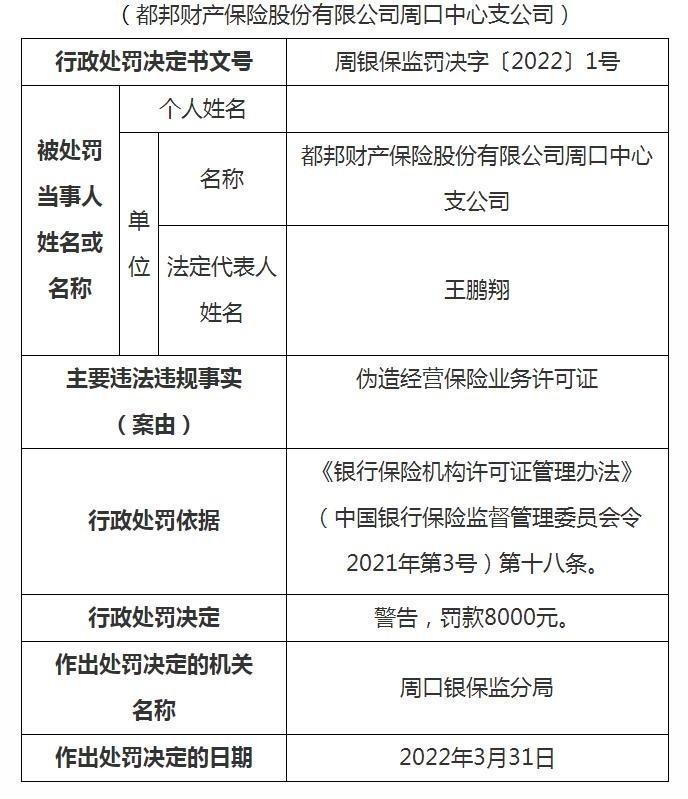

It is worth mentioning that Dubang Insurance also experienced illegal acts during the operation. According to the official website of the CBRC, on March 31 (administrative penalty time), the Dubang Insurance Weekly Central Branch was fined 8,000 yuan for illegal and illegal acts for falsifying business insurance business licenses.

It is found that according to the incomplete statistics of the administrative penalty information published by the CBRC official website, in 2021, Du Bang Insurance received a total of 19 tickets, and the cumulative penalty was not 2.96 million yuan. Essence

(Picture source: official website of the China Banking Regulatory Commission)

At the same time, the CBRC announced in the fourth quarter of 2021 insurance consumer complaints show that the total complaints of Dabang Insurance were 107, 100 million yuan premium complaints/100 million yuan, and 10,000 insurance policies complaints of 111 per 10,000.

116 million shares have not been subscribed by shareholders, with 436 million accumulation for four consecutive years

Du Bang Insurance's official website shows that there are 14 shareholders, of which the shareholders of the state owned shareholders hold 59.55%. On May 31, Dubang Insurance issued an announcement on the disclosure of information on changing the registered capital. The announcement shows that the company issued a total of 400 million shares, the unit price per share was 1.00 yuan, and the capital increase shareholders invested 400 million yuan in currency methods. After the capital increase, the registered capital of Dubang Insurance increased to 3.1 billion yuan.

Among them, 9 of the 14 shareholders of Dubang Insurance subscribed for 2839.9 million shares, and the subscription amount of 1160.1 billion shares was not subscribed by shareholders, entering the same ratio of capital increase in the next round.

(Picture source: Dubang Insurance Official Website)

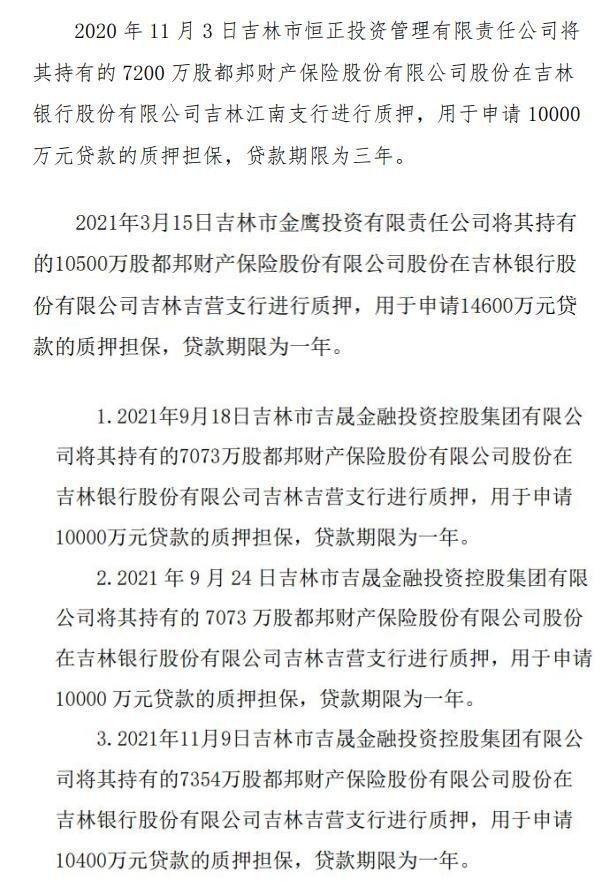

It should be mentioned that among the 9 shareholders who increased their capital, there are three shareholders holding the shares of the shareholders. On November 3, 2020, Dubang Insurance shareholders Jilin Hengzheng Investment Management Co., Ltd. pledged 72 million shares held to apply for pledge guarantee for 10,000 yuan of loans. The loan period was three years; 2021 3rd; On the 15th, Jilin Golden Eagle Investment Co., Ltd. pledged 105 million shares held to apply for pledge guarantee for 146 million yuan of loans, with a loan period of one year.

On September 18, September 24, and November 9, 2021, Jilin Jisheng Financial Investment Holding Group Co., Ltd. will use 70.73 million shares, 70.73 million shares and 73.54 million shares to apply for a pledged pledge of loans. Guarantee, the loan period is one year. (Picture source: Dubang Insurance Official Website)

Judging from the solvency report disclosed by Dibang Insurance, this capital increase or a measure for the improvement of the payment capacity. In 2021, Dubang insurance solvency adequacy ratio declined as a whole, and the core and comprehensive solvency adequacy ratio dropped from 161%in the first quarter to 124%at the end of the fourth quarter. In the first quarter of 2022, the core and comprehensive solvency adequacy ratio of Du Bang Insurance under the policy rules of the second -generation project transition period of the second -generation project was 122%.

In addition, as of the end of the first quarter, Dubang Insurance's actual capital was 736 million yuan, at the end of the previous quarter of 801 million yuan; net cash flow -17.39 million yuan, at-2.25 million yuan at the end of the previous quarter.

On March 21, 2022, the CBRC's solvency supervision department officially approved the Dubang Insurance, giving Dubang Insurance's transitional policy from 2022 to 2024.

(Picture source: Wind)

Dubang Insurance stated in the first quarter solvency report that since 2021, the company's series of influence on the decline in solvency, especially in terms of management management and investment allocation, has organized relevant meetings to study and discuss the response to business losses in response to business losses Supporting measures for the decline in solvency.

Data show that in 2016, Du Bang Insurance turned losses into profits, realizing a micro-profit of 0.06 million yuan, and insurance business revenue increased slightly to 4.020 billion yuan in the same period; in 2017, insurance business revenue was 4.212 billion yuan, and net profit was 111 million yuan; however, from 2018 to 2021 Duobang Insurance has been losing money for four consecutive years, with a loss of 436 million yuan, of which 242 million yuan was lost in 2021.

(Picture source: Wind)

The annual report found that the loss of losses in 2021 was expanded or because of the auto insurance business. The annual report shows that in 2021, the company's motor vehicle insurance realized the original insurance premium income of 2.67 billion yuan, and the underwriting profit was-4.05 billion yuan. Therefore, Dubang Insurance stated in the solvency report that in terms of strategic planning, the company has increased the development of non -auto insurance business, enhanced the weight of non -auto insurance business weights, and offsets the adverse effects of comprehensive reform of auto insurance.

(Picture source: annual report of 2021)

(Reporter Luo Xuefeng Financial Researcher Liu Lixiang)

- END -

Fill in domestic gaps in the research and development of the key technology of wheat green and deep processing in our province, making breakthrough progress in research and development

Elephant reporter Feng Jingwen/Wen TuOn July 6, the reporter learned from the Hena...

No fear of global earthquakes, and A shares have risen again, how to grasp it?The latest voice of the stock god: investing "wonderful hand" is "hand"!Just understand it ...

The above audio technology comes from: Xunfei VoicesInvest in Xiaohongshu — Issue...