"Fengkou Research Report · Company" automobile parts leader throw 17.5 billion!60,000 tons of new capacity will be released in the second half of the year!This company is the first supplier of the project, covering industry giants such as Ningde Times, with a net profit growth of 73%!

Author:Federation Time:2022.06.27

The leading part of the automobile parts throwing 17.5 billion "full -effort to hold" the new material. This company is the first supplier of the project. The new production capacity of 108,000 tons is expected to be completed by the end of 2022. Among them, 60,000 tons are planned to test by June 2022. It is expected to usher in the market increasing market increase, as well as the lithium battery equipment business covering industry giants such as Ningde Times and 100 billion Weiyi Lithium. At the same time, overseas customers have gradually advanced, and the company is sufficient in handling.

Company essence:

① CITIC Construction Investment Securities Qin Jili is optimistic about the company's confession for the company's "liquid gold" EVE glue. For tires and other projects, the project is clearly produced based on "liquid gold";

② The company's 10,000 -ton EVE glue production line has reached its production. It is expected to be completed at the end of 2022 by the 108,000 tons of EVE projects. Among them, 60,000 tons are planned to test the car in June 2022. The project is expected to achieve about 2 billion yuan after the project reaches the production income to achieve profits to achieve profits. The total amount is about 300 million yuan;

③ The company has completed the full set of equipment layouts of ingredients and mixing equipment in the lithium battery field. The downstream customers include Ningde Times, Yimei Lithium Energy, Tianpeng New Energy, etc. Overseas customer expansion is gradually advancing, and the order is sufficient;

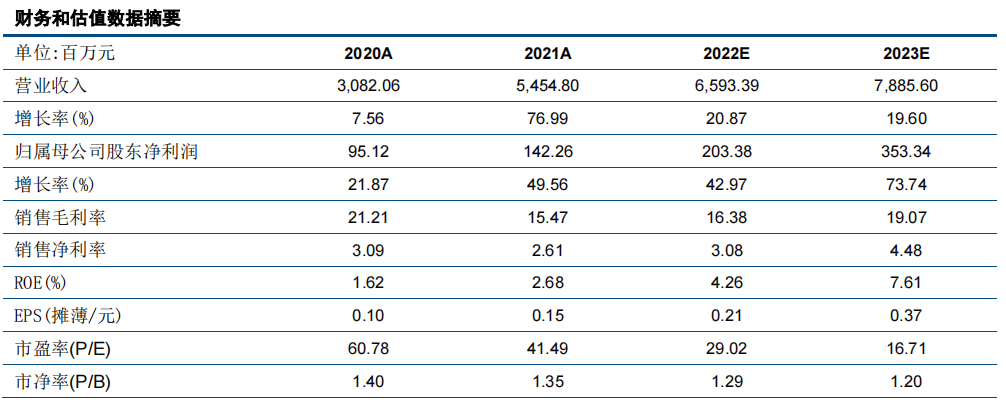

④ Qin Jili estimates that the company's net profit from the mother from 2022-2023 is 2.03/353 million yuan, respectively, an increase of 42.97%/73.74%year-on-year, and the corresponding PE is 30/17 times;

⑤ Risk reminder: market expansion is not as good as expected, raw material price fluctuations, etc.

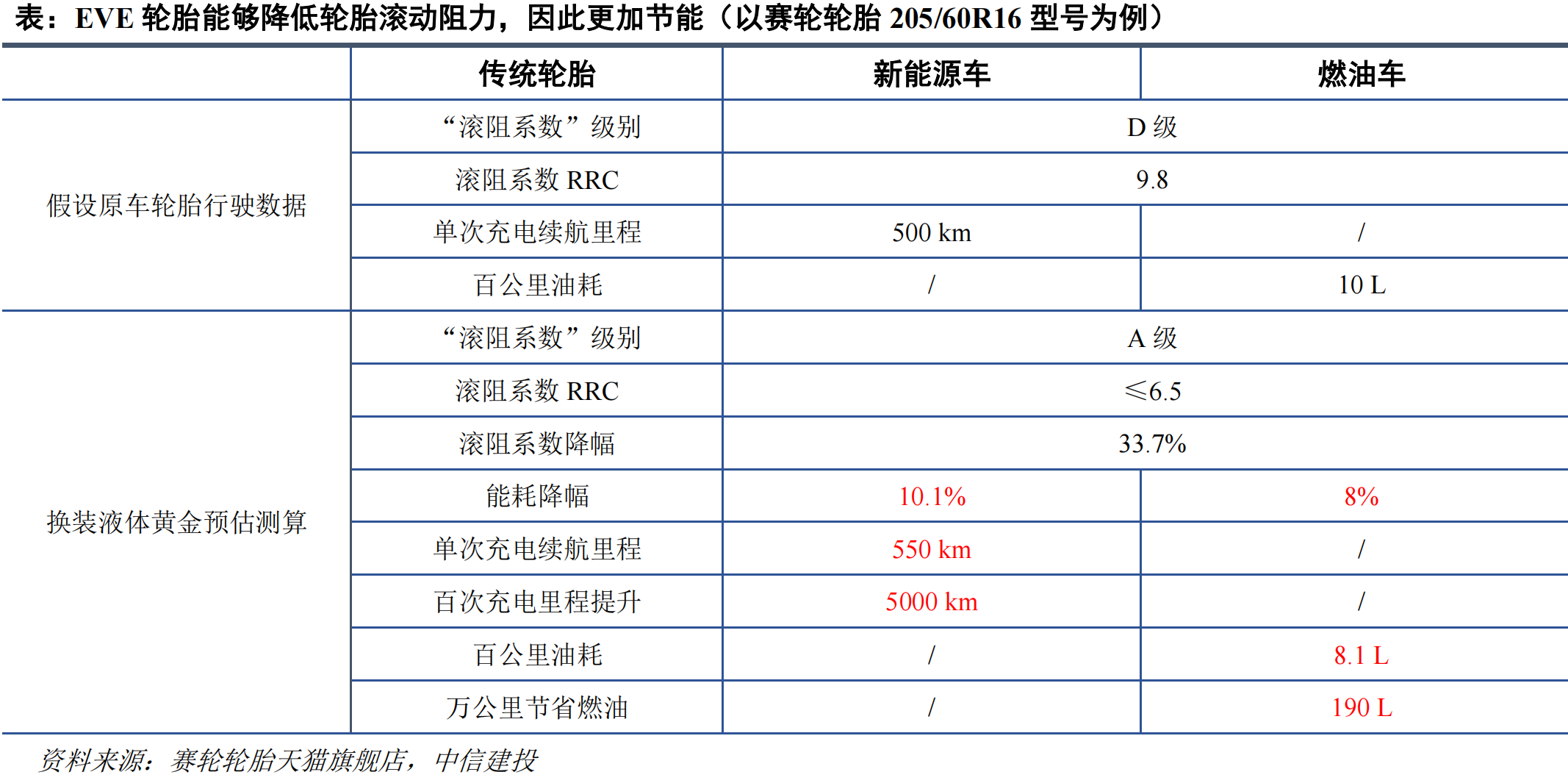

Event: The tire industry leading tires issued two major investment announcements, which fit a total of 17.483 billion yuan of annual output of 500,000 tons of functional new material projects and 30 million sets of high -performance sub -tires and 150,000 tons of non -road tire projects. Among them, the "liquid gold" materials of the functional new material project "liquid gold" materials have an annual demand of 190,000 tons and 70,000 tons in the first phase. The tire project is clear that raw materials are functional new materials based on "liquid gold". The two announcements marked that the cylinder tires will be fully shifted to "liquid gold".

CITIC Construction Investment Securities Qin Jili is optimistic about the leading soft control shares of rubber equipment (002073). The company's "liquid gold" products are currently mainly sold for racing tires. Road, giant tires, and semi -steel tires have also begun to promote, progress is smooth.

In addition, the company has completed the full set of equipment layout of ingredients and mixing equipment in the lithium battery field. The downstream customers include Ningde Times, Yimei Lithium Energy, Tianpeng New Energy, etc. , Lithium Equipment's business revenue will grow rapidly.

Qin Jili expects the company to return to the mother's net profit from 2022-2023 to 2.03/353 million yuan, respectively, an increase of 42.97%/73.74%year-on-year, and the corresponding PE is 30/17 times.

"Liquid Gold" EVE glue breaks the "impossible triangle" in the tire industry, and the company's production capacity is about to release

EVE glue is tire tire glue. It can improve the tire's anti -humidity and abrasion resistance without changing the original tire structure and pattern. It is praised by the industry as "liquid gold".

At present, the company has 10,000 tons of EVE glue production lines. In June 2020, the company's construction of 108,000 tons of EVE project was expected to be completed by the end of 2022. Among them, 60,000 tons planned to test the car in June 2022. After the project is reached, it is expected to achieve about 2 billion yuan in operating income, and the total profit will be about 300 million yuan. The company strives to form an annual output of 300,000 tons of EVE glue production capacity during the "14th Five -Year Plan" period.

In terms of demand, coupled with the expansion of this production project, after the entire tribe of the handwriting project, the wheel will have about 27 million full steel tires, 90 million semi -steel tires, and 300,000 tons of non -road tires. The amount of semi -steel tire 3KG corresponds to about 675,000 tons of liquid gold demand.

According to Qin Jili, assuming the price of the product is 20,000/ton, that is, corresponding to 13.5 billion yuan, and the market space of non -road tire consumption will be greater. At the same time, liquid gold materials do not rule out that they will be sold outside, and global tire giants such as Michelin and Guteyear have also been in contact with the company.

The tire industry is expected to bottom out and rebound, and the company's rubber equipment business continues to grow

In 2021, due to the impact of upstream raw materials and price increases in shipping, the tire industry's prosperity continued to decline. However, with the inflection point and automobile consumption and infrastructure under the policy stimulus, the tire industry is expected to bottom out.

In recent years, domestic head tire manufacturers have maintained higher capital expenditures. From 2017-2021, Linglong tires, racing tires, and Sen Kirin capital expenditure increased from 13.83, 8.55 and 440 million yuan to 48.89, 25.91 and 1.467 billion yuan, respectively. The compound growth rate is 37.12%, 31.94%, and 35.13%. In the future, with the gradual recovery of the tire industry and the investment in the project under the construction of the project, the company's rubber equipment business is expected to continue to grow. In addition Contribute income income.

- END -

In the 36 days when Beijing paused, we kept 24 stores and all employees

Although there are 9 stores closed temporarily , there are no closures in 24 sto...

Transaction is changing!Emperor Ke shares: In the past 3 trading days, 40.19%, no major information that has not been disclosed

Every time AI News, Emperor Keke (SZ 300842, closing price: 69.97 yuan) issued an ...