Nanyang Investment Group plans to issue 530 million yuan ultra -short -term integration to repay interest debt

Author:Dahe Cai Cube Time:2022.06.27

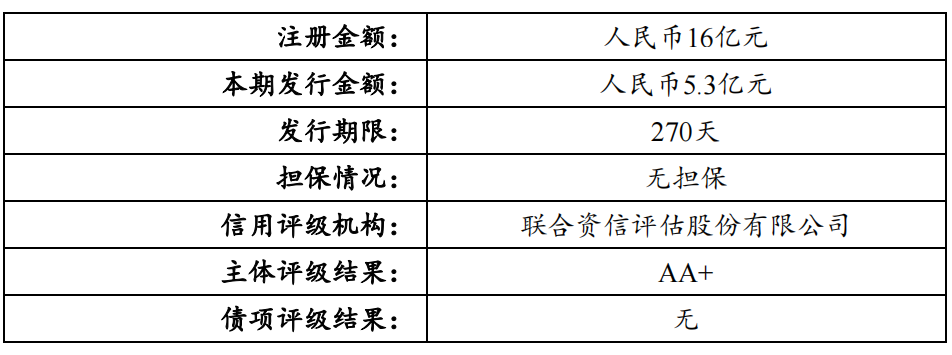

[Dahecai Cube News] On June 27, Nanyang Investment Group issued the second phase of the second phase of the 2022 ultra -short -term financing voucher issuance plan.

According to disclosure, Nanyang Investment Group issued 530 million yuan in this issue, and the period of debt financing instruments was 270 days; the lead underwriters and bookkeeper managers were the main underwriters and bookkeeping managers for the Industrial Bank, and the joint underwriters were Huaxia Bank.

The issuance date is June 28, 2022-June 29, 2022, the Sabbath is June 30, 2022, and the redemption date is March 27, 2023. After a comprehensive evaluation of the United Credit Evaluation Company, the main credit level of Nanyang Investment Group is AA+rating outlook for stability.

According to the fundraising instructions, this issue has raised a total of 530 million yuan to raise funds to repay the issuer's interest debt.

Financial data shows that the net profit of Nanyang Investment Group from 2019 to 2021 and 2022 was 64.808 million yuan, 34.248 million yuan, 44.0195 million yuan, and 773,200 yuan, respectively. The publisher's net profit fluctuates greatly, mainly due to financial expenses and subsidy income fluctuations. The issuer's current main business income rate has a low gross profit margin, which has led to the weaker profitability of the issuer's own profit. The profitability depends mainly on government subsidies.

As of the date of signing the instructions for this fundraising, in addition to the issuance of ultra -short -term financing vouchers in this period, Nanyang Investment Group's deposit debt financing balance was 4.86 billion yuan, of which the ultra -short -term financing coupon was 1.06 billion yuan, the orientation tools were 2.000 billion yuan, and the medium -term bills were 1000 billion yuan. Yuan, corporate bonds 800 million yuan.

Responsible editor: Tao Jiyan | Review: Li Zhen | Director: Wan Junwei

- END -

The second quarter performance refreshing single quarterly new high -wide exchange energy high -scoring commitment to attract attention

Guanghui Energy (600256) is expected to increase by 259.85%to 266.95%year -on -yea...

Chengmai, Hainan: Sand and earth plant "golden sweet potatoes", and poor villages transform into "100 million yuan villages"

Entering Sha Tu Village, Qiaotou Town, Chengmai County, Hainan Province, the small ocean building built by the villagers rose up, making it difficult to imagine that this was once a well -known poor v