Gaming Factory Mihayou "Stepping on Thunder" Minmetals Trust Dingxing Series?Some investors call the sales page of the same series of products have shown "Fund" products

Author:Daily Economic News Time:2022.06.27

A few days ago, the People's Court of the Chengzhong District of Xining City released the news that the court was scheduled to publicize Mihayou Technology (Shanghai) Co., Ltd. (hereinafter referred to as "Mihayou" in accordance with the law at 09:00 on July 25, 2022 in accordance with the law. ) Five Mine International Trust Co., Ltd. (hereinafter referred to as the "Minmetals Trust") business trust dispute.

Later, the news of the game factory Mihayou suspected of "stepping on the thunder" to the Minmetals Trust Dingxing series products spread widened. Some media reported that Mihayou and another game company's products were suspected to be the "King of Retail" to the Ministry of Mine Trust Dingxing Series on behalf of China Merchants Bank. The total size of the product is about 2.3 billion yuan, the threshold for buying is 1 million yuan, and the period is 18 months.

Regarding the authenticity of the news, the relevant person in charge of Mihayou replied to the reporter that "no comment"; the fault trust also "had no response."

In fact, before that, many investors have reported to each reporter that they have previously purchased the "Ministry of Mine Trust-Dingxing Series Collection Fund Trust Plan" that they have purchased earlier, and have experienced problems that cannot be redeemed.

Investor: Product introduction page inconsistent front and rear

Recently, investors from the Ministry of Field Trust Dingxing No. 3 Getting Fund Trust Program told reporters that the trust products they purchased have a redemption problem at the end of April this year. It is understood that the five-mine trust-Dingxing Series 1 and 2 expires on March 30, the 3-5 period expires on April 30, and the 6-11 period expires on May 31. 12-15 The period expires on June 18.

For agencies, many investors told reporters that they were promoted and subscribed through the Merchants Bank APP wealth management manager.

However, some investors said that the product was originally inconsistent before and after the interface (with now) when the China Merchants Bank app was launched.

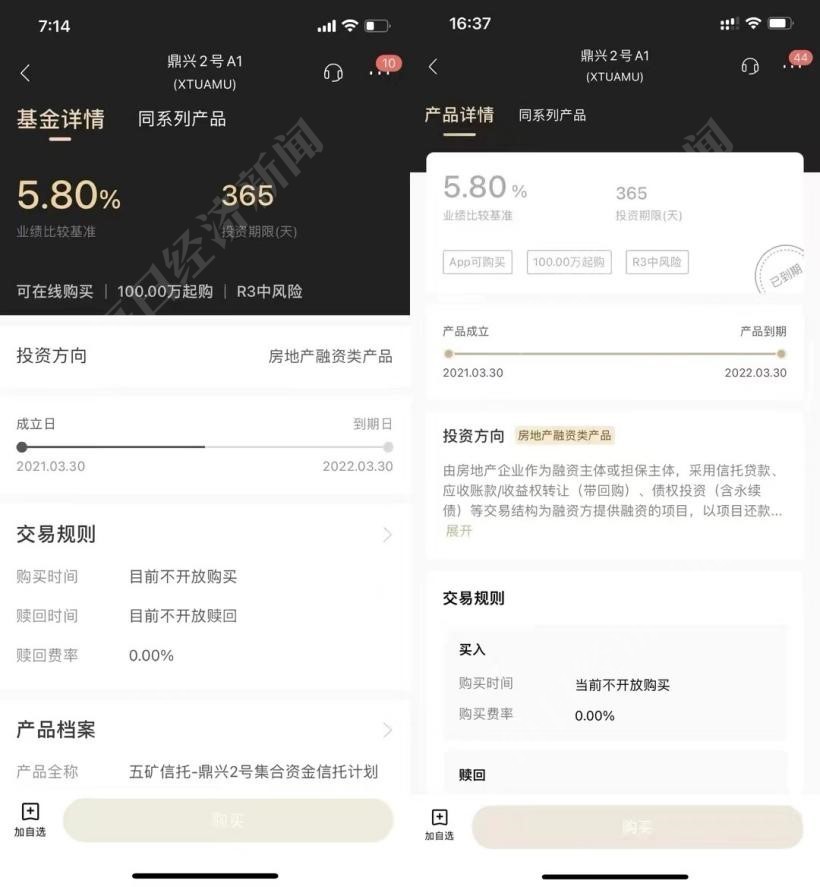

Investors said that before the purchase of this product, the upper left corner was marked as "fund details". However, from the screenshot provided by investors, the word "fund details" displayed in the original location has become "product details". In contrast, both products are "Dingxing 2 A1", with the same yield and investment period, 5.8%, the investment period of 365 days, and the risk level is R3 risk.

The picture on the left is the interface before the product expires, and the picture on the right is the interface in May this year;

Some investors also mentioned that there is no recording and video process in the process of subscribing to products online. "Financial manager sent a product code on WeChat, purchased directly on a mobile banking, and did not even sign it." An investor said.

In response to the above -mentioned issues, the reporter contacted the relevant person in charge of China Merchants Bank, but as of press time, no reply was received.

Do you need to assume legal responsibility? Meng Bo, a lawyer of Beijing Jingshi Law Firm, told each reporter that in judicial practice, the court usually listed the appropriate obligation to the financial consumers when he tried such cases to promote financial consumers. According to Article 72 of the "Minutes of the National Court of Civil and Commercial Trial Works", appropriate obligations refer to the process of marketing institutions in the process of promoting and selling high -risk -level financial products such as financial consumers and sales of trust wealth management products. Sell appropriate products to appropriate financial consumers and other obligations.

According to investors, on June 15, investors in phases 1-5 products have received 20%of the principal redemption. The trustee's Minmetals Trust recently issued a redemption plan to apply for a series of multi -period products to extend the expiration date for 18 months.

Judging from the information disclosed by the Ministry of Field Trust, Dingxing Series has disclosed a total of 15 product announcements. According to the "Minmetals Trust Trust-Dingxing 9 Collection Trust Plan" provided by investors, the scale of raising funds raised by this period of products does not exceed 163 million yuan.

The trust contract shows that the trustee of the product is the fabric trust, and the custodian is the Beijing Branch of China Merchants Bank. After the trust plan is established, the trustee will use the trust plan for the trust plan in accordance with the agreement of the "Credit Credit Transfer Contract Contract" to be transferred to Shenzhen Wushunfang Commercial Factory Co., Ltd. RMB 163 million.

Minmetals trusts last year's revenue and net profit doubled

Public information shows that the Minmetals Trust is a non -silver financial institution under the Ministry of Minerals Group. It was established on October 8, 2010. It is registered in Xining City, Qinghai Province, with a registered capital of 13.051 billion yuan.

In 2021, the five -mine trust achieved operating income of 4.597 billion yuan throughout the year, a year -on -year decrease of 10.98%, and net profit was 2.362 billion yuan, a year -on -year decrease of 15%. The annual report shows that the size of the company's trust assets was 817.405 billion yuan, an increase of 16.30%, and the number of active management assets was 716.926 billion yuan. Among them, the end of the financing period was 316.166 billion yuan, and the securities investment category was 300.357 billion yuan.

In terms of the adverse rate of inherent assets, the number of non -performing assets at the end of 2021 at the end of 2021 was 847 million yuan, and the non -performing asset rate was 3.11%.

In terms of business data, from the perspective of operating data, the report of the 2021 report showed that during the reporting period, China Merchants Bank achieved operating income of 33.1253 billion yuan, an increase of 14.04%year -on -year; the net profit attributable to the shareholders of the Bank was 119.922 billion yuan, a significant increase of 23.20 year -on -year increased by 23.200. %, A new high in recent years; the non -performing loan rate at the end of the period is 0.91%; the dial -up coverage rate is 483.87%, an increase of 46.19 percentage points from the end of 2020.

Daily Economic News

- END -

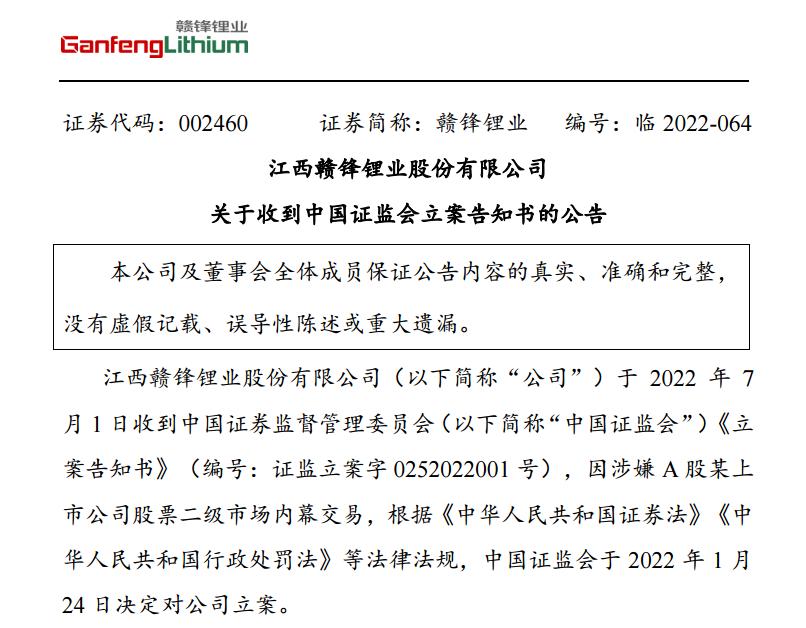

Thunder on the weekend!The two hundred billion giants were set up, suspected of the inside story of the company's company's stock!Exclusive response of the chairman →

On July 3rd, Ganfeng Lithium (SZ002460, a stock price of 15.697 yuan, and a market...

The Fed's radical rate hike disturbing the world, industry insiders: may lead to a global economic recession!

[Global Times special reporter Zheng Ke Global Times reporter Ni Hao and Wang Yi] In order to fight against the worst inflation in the United States in 40 years, the Federal Reserve Commission announc