Recently, a new trend has appeared in the fund distribution market

Author:Financial breakfast Time:2022.06.28

Recently, some fund companies have reported a hybrid fund with a closed operation period of up to 10 years, which has aroused market attention. Some media call it the longest holding fund in history. In fact, not only the fund company is reporting to hold the holding fund, but also the fund company has set up a three -year holding fund for three years.

In fact, whether it is reported on the ten -year holding fund or the issuance of the three -year holding fund, the fund company hopes to lock the investment period of investors through the measure of holding period, and guide investors from trend investment to long -term investment. So as to get better long -term returns.

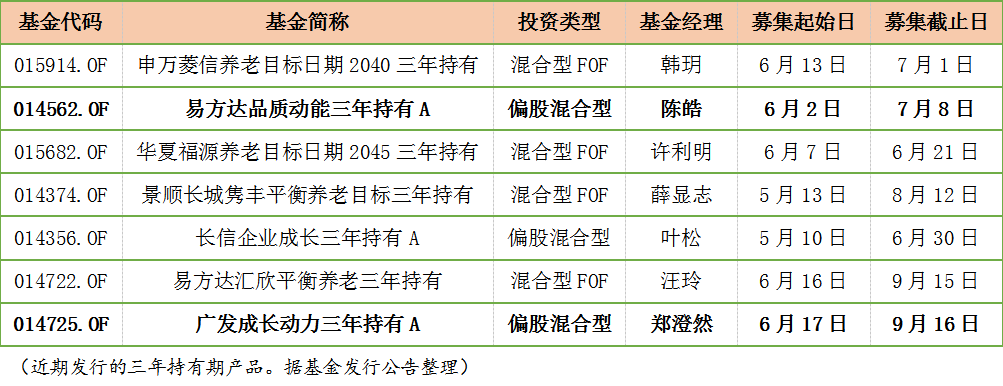

At present, the ten -year holding fund is still in the declaration stage. Then, let's take a look at which fund companies have recently deployed their three -year holding product in the counter -trend. What kind of elite soldiers did they send?

As shown in the table above, the three -year product recently released is a mixed FOF, and the other is partial stock hybrid funds. It is worth noting that the two head fund companies, Yi Fangda and Guangfa, are pushing the three -year new product of active rights.

When is it suitable for layout for three years of holding products?

As mentioned earlier, the fund company hopes to lock investors' investment periods through this measure to guide investors to turn to long -term investment to obtain better long -term returns. But why did you choose to lay out at this time? In other words, is it suitable for layout for three years of holding products? Before answering this question, let's first popularize the characteristics of the three -year holding of products and the background of emergence.

The first is "potential" -policy support and call, and the holding of the holding period has gradually become a new trend

On April 26, the CSRC issued the "Opinions on Accelerating the High -quality Development of the Public Fund Industry", and put forward the implementation of the policy of personal pension investment public funds, encouraging industry institutions to develop various types of lock -up and service investors' lives Periodic fund products and other requirements.

In this context, the fund company has begun to lay out a period of lock -up funds. Since June, the three -year holdings of equity funds and the three -year holding period FOF have been released on sales channels.

The three -year holding period means that investors can purchase funds at any time, but they need to hold three years to redeem. Through this mechanism to lock the investment period, guide investors' long -term investment, so that investors can experience the value of long -term investment, so as to obtain better long -term returns.

Especially for investors who have a low demand for funds, choosing a three -year holding fund fund will help increase the probability of obtaining positive returns. Because the three -year period is conducive to help investors avoid the risk of "chasing the rise and fall" and redeemed at critical times, but also to the effective implementation of the fund manager's medium and long -term investment strategy, thereby improving the fund holding return.

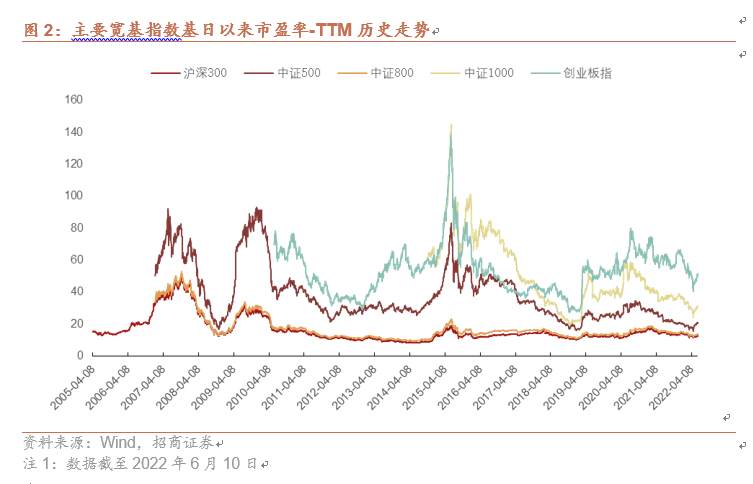

The second is "time" -the mainstream index valuation is more than 50%since the listing, and it is at a relatively low history

According to the calculation of China Merchants Securities, as of June 10, 2022, CSI 300, CSI 500, CSI 800, CSI 1000, and GEM refer to the corresponding valuation level (P / E ratio-TTM) 12.59, 20.89, 13.69, 31.31, 31.31, and 31.31, and 31.31. 51.09, all of which are more than 50%since the listing, and the valuation level is relatively low in history.

In the three historical periods with the absolute values of each index and the current valuation of each index three years ago, the investment of various types of broad -foundation indexes to obtain positive income and average benefits. It was found that although the market conditions have fluctuated since 2014, when buying the motherboard broad -foundation index at a time similar to the current index valuation level and holding it for 3 years, they can still get good benefits and the probability of obtaining positive returns. High, exceeding the full -stage winning rate.

In addition, China Merchants Securities also chose some points similar to the current market market for buying calculations. The results show that when the history of the main board is similar to the current index point, buy the motherboard wide -based index or the CSI bias fund and hold 3 In the year, the probability of obtaining positive returns was higher, and most of them were higher than the winning rate since the basic day.

Among them, when the current point of the SCR partial stock index is similar to the current points of June 9, 2015, June 17, 2015, and June 1, 2015, the winning rate of the buying index holds 3 years is 3 years. 84.4%, 84.9%, and 83.9%, with average yields of 38.8%, 39.3%, and 38.4%.

Based on the above two sets of calculation data, China Merchants Securities has two conclusions:

First, from the perspective of the similar historical valuation level, the current broad -foundation index is currently at a relatively historic low. Although the short -term market fluctuates large, the A -share market is good for a long time. There is a period of product.

Secondly, from the perspective of the similar market point, buying the CSI Prescription Fund Index at the historical point and holding it for 3 years. Essence For investors, the current exponential point or buying a three -year holding of partial stock fund products is a good time.

How to choose a fund manager of long -distance running together?

Based on the above analysis, it is now a good time for layout of three -year holding funds. So, what kind of products are worthy of attention? We believe that investors can choose from two dimensions: one is to see the proposed fund manager and product direction; the other is to see the comprehensive strength of the fund company platform.

According to these two dimensions, the Gangfa Growth Power, which is planned to be managed by Zheng Chengran for three years (Class A: 014725, Class C: 014726) is worthy of attention.

1. Fund managers prefer growth stocks, and product investment direction is in line with economic development trends. Zheng Chengran, a bachelor's degree in the Department of Microelectronics at Peking University, a dual degree in economics, and a master's degree in finance. In 2015, he joined the Guangfa Fund and successively served as a new energy industry researcher and the manufacturing team leader. In 2020, he went to investment positions and participated in the management of Guangfa Xinxiang A, Guangfa High -end manufacturing A and other products.

He is characterized by money that is good at earning cycles in the growth industry. That is, starting from the dimension of the industry, capture the upward turning point during the improvement of the supply and demand structure of the industry, and sell it in conjunction with the market valuation level at the downward phase of supply and demand. From the perspective of Guangfa Xinxiang's configuration, he has achieved good configuration effects in the growth industries such as electric equipment and new energy, electric vehicles, military industry, and electronics.

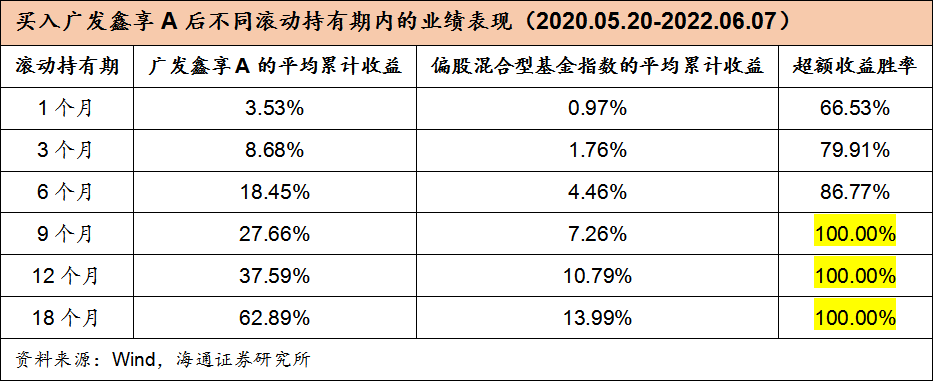

According to the research of Haitong Securities, as of June 7, 2022, Zheng Chengran's annualized income since the management of Guangfa Xinxiang A was 48.04%, and the annualized excess revenue of the relative performance benchmark was 44.51%, which was the top 5%of similar products. As a growth style product, Guangfa Xinxiang A also showed better risk control capabilities. The income retracement ratio and Sharp were ranked 13/1177 and 10/1177.

In addition, Haitong Securities estimates the performance of buying Guangfa Xinxiang A different rolling holdings. Buying Guangfa Xinxiang A holds 18 months, and the average yield of the bias hybrid fund can be won by nearly 50 percentage points. With more than 9 months, the winning rate of excess revenue reaches 100%.

2. The scale of the active rights and interests of the Guangfa Fund is high. The absolute income of its products in the past three years is 94.8%

1) From the perspective of the overall performance, according to the research of Haitong Securities, as of the end of the first quarter of 2022, the absolute revenue of the active rights and interest products under Guangfa Fund in the past three years was 94.08%, and the excess revenue (compared to the average of large companies) of about 26.04%. Homesy public fund managers are ranked first in medium.

2) From the perspective of management scale, as of the end of the first quarter of 2022, the number of active equity funds of the Guangfa Fund ranked second.

3) Judging from the three -year holding period/fixed -opening product, the two active equity funds under the two years of the Guangfa Fund have doubled their revenue.

According to Wind statistics, the Guangfa Fund has deployed a three -year lock -up period (including three -year closed and three -year holding period) from 2019 (including three -year closed and three -year holding period). At present, the active equity fund, which has been operating for three years, has the three years of Guangfa Ruiyang and the three years. The theme of Guangfa Science and Technology is flexible, and it has obtained more than doubled in three years.

In summary, the three -year holding of Guangfa Growth Power, which is planned to be managed by Zheng Chengran, is worthy of attention. If you plan to start a long -term investment, you may wish to keep in three years with the head fund company, adhere to the power of long -term investment, and witness the power of time.

Risk reminder: The market is risky, and investment needs to be cautious. The past history of the fund does not represent the future, and the performance of other funds managed by the fund manager does not constitute the guarantee of the fund's performance. The above content does not mean a prediction of market and industry trends, nor does it constitute investment actions and investment suggestions. Investors are advised to make investment decisions carefully according to their own risk tolerance.

- END -

Zhang Yunfei became the chief risk officer of the 10 -year chief risk officer of the Governor of the Jinhang Bank

The 13 -year -old Jinchang Bank (HK02558, with a stock price of HK $ 1.23, a marke...

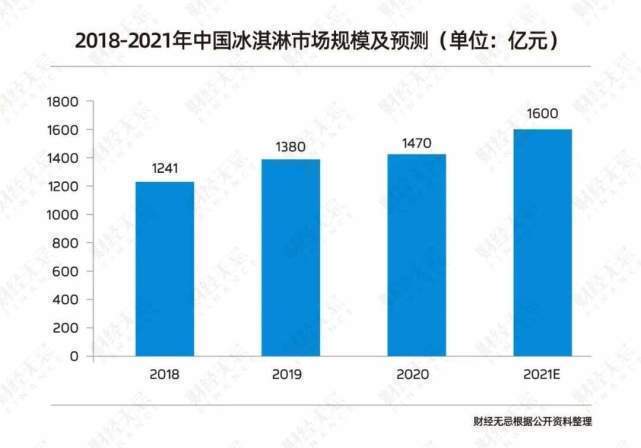

Is ice cream or "high"?

Wen | NingwenSummer is here. When buying ice cream checkout, many young people fee...