Business answer

Author:Main News in Tibet Time:2022.06.28

First, what is the Course of the Tibet Autonomous Region Government?

The Tibetan Autonomous Region Government Bond Counter business (hereinafter referred to as the "counter business") refers to the bank's opening of bond accounts for investors through business outlet counter or online banking, distribute bonds of Tibet Autonomous Region Government, conduct bond transactions, and handle bond custody and correspondingly Settlement, proxy principal and interest payment, providing inquiry and other related services. According to the "Notice of the Ministry of Finance on the Issuance of Local Government Bonds through the Market of the Commercial Bank Counter" (Treasure [2019] No. 11) "Notice of the Ministry of Finance on Further the Issuance of Local Government Bond Counter" (Zuku [2020] No. 49), bonds issued by the Tibet Autonomous Region Government can be sold within the Tibet Autonomous Region through the commercial bank counter market.

2. What is the difference between the cups of circulating bonds and savings national bonds?

Bonds such as bookkeeping government bonds and local government bonds supported by the counter business can be collectively referred to as counter circulation bonds. Compared with the savings national bonds well, the two types of bonds are mainly different: First, the circulation attributes are different. Counter -circulation bonds can be subscribed at the time of bond issuance, or they can be purchased or handled after listing or apply for pledge loans; they cannot be traded after the issuance of the Savings Treasury bonds. Investors can go to the banks that subscribe to bonds Sexual needs. Second, the price of ticket interest rates is different. Counter -circulation bonds are market pricing. The interest rates are determined through the bidding of the bidding on the day of issuance. In a few days, the bank outlets and electronic channels are obtained, the interest rate level is relatively stable, and it is generally higher than the bank deposit of the same period. The third is different distribution arrangements. Counter -circulation bond issuance arrangements are relatively flexible, and the issuance of each bond is basically covered throughout the year; the Ministry of Finance will announce the savings government bond issuance plan at the beginning of the year, and the issuance month and issuance time are relatively fixed. Fourth, the types of investors are different. Counter circulation bonds are available for individuals and small and medium -sized institutional investors to subscribe for transactions; savings government bonds only support individual purchase.

3. What is the significance of issuing the Tibetan Autonomous Region Government Bonds through the commercial bank counter?

The first is to enhance the consumption power of residents. Government bonds are on sale for individual investors, which are conducive to stability and increasing residential property income, improving the expected and environmental of residents' consumption, actively cope with epidemic conditions to promote consumption capacity and improve quality, and help form a new development pattern of large domestic cycles.

The second is to broaden the issuance channels. The issuance of the underwriting group through public bidding methods is mainly held by banks and other financial institutions. Investors have a single structure. Because bank financial institutions are generally held to expire, bond liquidity is affected to some extent. The issuance of commercial bank counters is conducive to expanding the issuance channels of Tibet Autonomous Region Government, enriching investment groups, and strengthening bond liquidity and market influence.

The third is to enrich investment varieties. In the context of the promulgation and implementation of the new asset management regulations, the issuance of Tibet Autonomous Region Government Bonds through commercial bank counters is conducive to enriching the investment varieties of individuals and small and medium -sized institutions, and better meet their low -risk investment needs.

The fourth is to enhance the public's sense of gain. Investors subscribe to the Tibetan Autonomous Region Government Bonds through the commercial bank counter market, which is conducive to the public to actively participate in the implementation of the national strategic implementation and the party committee of the autonomous region and the government's major decision -making deployment and implementation, help our district's four major issues: the development, development, ecology, and strong border. Participation and sense of gain.

4. What are the basic situations of the Tibet Autonomous Region Government's bonds issued through the commercial bank counter?

(1) Background introduction. The counter business is an important part of government bond issuance channels. It is an important measure to enrich the structure of investor and achieve sustainable development. At present, the domestic economy is facing a complicated and severe situation, and the international environment has undergone profound changes. Further comprehensively promotes the issuance of the counter business. For the "six guarantees" work, implement the "six stability" tasks, and promote the mutual promotion of the domestic large cycle as the main body and the domestic and international dual cycles. The new development pattern is of great significance.

(2) Overview of bond information. According to the arrangement of the Tibet Autonomous Region Government Bond Issuance Plan in 2022, the general bonds of the Tibet Autonomous Region Government (Phase III) in 2022 were issued on June 29. The total amount of the issuance of the issuance of the issuance does not exceed 100 million yuan, of which the face value of the issuance of the commercial bank counter plan does not exceed 50 million Yuan, the variety is a 3 -year accounting fixed interest rate interest rate bond, the bond code is "2271410", and the bond is referred to as "22 Tibet Treasury 05".

(3) Date arrangement and interest rate determination. The issuance date of the Tibet Autonomous Region Government's bonds is June 29, the distribution date is June 30, July 1 and 4, the step -up date is July 5, the listing date is July 7, and July July. On the 5th (extension of holidays, the same below), pay interest, repay the principal on July 5, 2025 and pay the last interest. The face value of the bond is 100 yuan, and the number of bonds for investors is an integer multiple of the face value of 100 yuan. The ticket interest rate will be determined to open the bidding for public bidding for the Tibet Autonomous Region Government Bonds in 2022 through June 29.

(4) Funding and project conditions. In this issue, the funds raised by general bonds are mainly used in the underground pipe network reconstruction project (rainfall separation project) in the north group of Liuwu New District.

5. How to inquire about the information disclosure document of the Tibet Autonomous Region Government Bonds issued by the Course of the Commercial Bank?

In accordance with the relevant provisions of the Ministry of Finance's "Public Measures for Local Government Bond Information (Trial)" (Caiyou [2018] No. 209) and other relevant regulations, more than 5 working days in advance will be disclosed in economic and social development indicators, fiscal revenue and expenditure, and the corresponding bonds to be issued to the corresponding bonds corresponding to general bonds corresponding to general bonds. Project overview, annual investment plan, project funding sources, potential risk assessment, evaluation opinions issued by third -party institutions. The information that the Tibet Autonomous Region Government's bonds need to be disclosed on June 22 on June 22 on the Tibet Autonomous Region People's Government and the portal portal website. chinabond.com.cn. 6. What are the advantages of investing in the Tibetan Autonomous Region Government Bonds through commercial bank counter?

(1) High credit grade. The Tibet Autonomous Region assumes major responsibilities such as safeguarding the national unity and security, protecting the interests of various ethnic groups, and the maintenance of national unity. Can maintain steady growth. After professional assessment of CITC Credit Credit Evaluation Co., Ltd., the credit rating of government bonds in our district is AAA, that is, our district has a strong ability to repay the debt, and the risk of breach of contract is extremely low.

(2) The starting point is low. The starting point of the investment is 100 yuan, and the minimum increase unit is 100 yuan face value. Compared with the low threshold of wealth management products and large -deposit trading transactions, it is suitable for inclusive financial products that individuals and small and medium investors participate in subscribing.

(3) There are many subscription channels. Counter business opening banks have more than 200 business outlets in the area. At the same time, the banks have opened electronic channels such as online banking and mobile banking to allow investors to easily subscribe and trade without leaving home.

(4) Strong realization ability. The Tibetan Autonomous Region government bonds subscribed by the commercial bank counter can be bought and sold at any time during the transaction period. The transaction funds are clearly liquidated in real time, which can meet investors' requirements for liquidity.

(5) Duty -free policy is excellent. According to the "Notice on the Income Tax Exemptation of Local Government Bond Interests" of the Ministry of Finance and the State Administration of Taxation, "Notice on Comprehensively Pushing the Value -added Tax Pilot of Business Tax Reform", and exempt from the interest income from the Tibet Autonomous Region Government Government by individuals and institutional investors Income tax, value -added tax.

(6) Great social contribution. Investors subscribe to the Tibetan Autonomous Region Government Bonds. While obtaining investment income, they contribute to the construction of their hometown and enhance the public's participation and sense of participation in the economic and social development of the Tibet Autonomous Region.

(7) The transaction review and query mechanism is complete. The central settlement company has a counter review and query telephone. After subscribing or trading bonds, investors can dial 400-666-5000 to review the holding of bonds, and repeat the nuclear mechanism to ensure the safety of the counter bonds.

7. What is the expected return on the sales of bonds in the Tibet Autonomous Region Government?

(1) Absolute income. The issuance interest rate was determined on the day of the issuance of the issuance. The issuance interest rate was not lower than the arithmetic average of the yield of ledger national debt yields before the issuance. Generally, it was generally 25 to 50 basis points from this average.

(2) Restore after tax revenue. For institutional investors, the interest income tax and value -added tax of local government bonds are exempted from corporate income tax and value -added tax. Among the low -risk bonds, the Tibet Autonomous Region government bonds have certain advantages.

8. What are the banks of the Tibet Autonomous Region Government Bond Counter? What is the distribution volume of each undertaking bank?

In this issue, there are 4 banks of the Tibet Autonomous Region Government Bond Counter, which are China Agricultural Bank of China Co., Ltd. (Consultation Hotline: 95599), China Construction Bank Co., Ltd. (Consultation Hotline: 95533), Bank of China Co., Ltd. (Consultation Hotline : 95566), Industrial and Commercial Bank of China Co., Ltd. (Consultation Hotline: 95588).

The planned sales volume of each undertaking bank will be determined by a quantitative bidding method through the counter to the Tibet Autonomous Region Government Bond Counter business on June 29.

9. How do individuals and small and medium -sized institutional investors subscribe through the market of commercial banks and trading the Tibet Autonomous Region Government Bonds?

During the distribution period (June 30th, July 1st, 4th), individuals and small and medium -sized institutional investors can subscribe for the business outlets of the banks of the banks of the banks of the banks of the Tibet Autonomous Region Government's Bond Counter business; You can also subscribe for the current bonds through electronic banking channels (including online banking and mobile banking).

After the listing (from July 7), the counter business adopts a bilateral quotation system for the market, and the banks will report to the bond to report the investor's purchase price and the investor selling the price. The center, the difference between the up and down reduction points. The counter transaction is settled in T+0. If investors need to realize, the funds can be received in real time after selling bonds.

Specific subscription and transaction channels refer to the bond sales information of each bank or view the China Bond Information Network-Business Operation-counter business-business outlet section.

10. How do individuals and small and medium -sized institutional investors inquire about the balance of the counter of the counter?

Through the subscription and transaction of commercial bank counters, there are two ways to conduct the counter-review inquiry of counter bonds: First, to check the balance of the bond account for the starting bank; the other is to dial 400-666-5000 to contact the central government bond registration and settlement company to review the custody account balance.

11. After buying bonds, how to get bond principal and interest?The Finance Department of the Tibet Autonomous Region will be paid (July 5th each year, if the holidays are postponed, the same below) or the expiration date (July 5, 2025) will be paid for interest or the principal to the bondThe registered custody and settlement agency designated the account, and the bond registration custody settlement agency immediately scheduled the bank after receiving the above money. The bank will be transferred to the investor funds account on the bond paid date or the expiration date.

12. What are the risks of buying local debt at the counter?

The local debt at the counter is strong, and it can be bought and sold after listing.If the bond holding expires, it can be paid at a face value of 100 yuan and obtains the interest of the ticket; the bond price will change with the market during the duration. When the price is higher than the face valueDiscount phenomenon of facial value.It is recommended that investors rationally look at the rise and fall of circulating bond prices after purchasing bonds.

Source: China Tibet News Network

- END -

Development Zone · Tieshan District urges the wave of "digital wisdom manufacturing"

On the assembly line, the machine automatic feeding and disappointment, the machine arm waving dressing ... In the production workshop of Dongbei compressor company, multiple processes realize unmanne

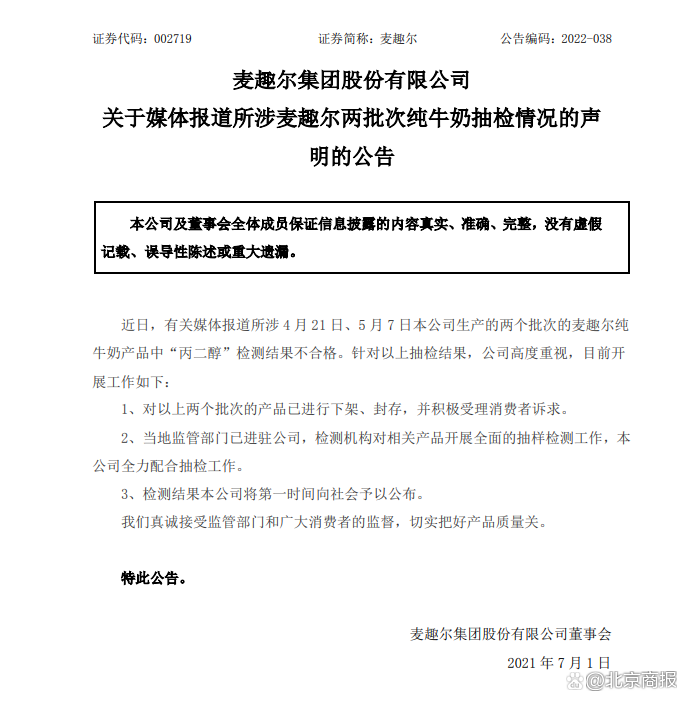

Meloel: Two batch products that are not qualified have been removed and sealed, and the regulatory authorities have entered the company

On June 30th, Mc 0 announced that recently, the relevant media reports involved in...