deal!The ETF transaction began on July 4th under the interconnection.

Author:Dahe Cai Cube Time:2022.06.28

According to the news of the China Securities Regulatory Commission on June 28, the China Securities Regulatory Commission and the Hong Kong Securities Regulatory Commission decided to approve the exchanges of the two places to formally include qualified trading open funds (exchanges trading funds, uniformly referred to as "ETF") into the Mainland and Hong Kong stock market transactions. Interconnection mechanism (referred to as "interconnection"). ETF transactions under the interconnection will begin on July 4, 2022.

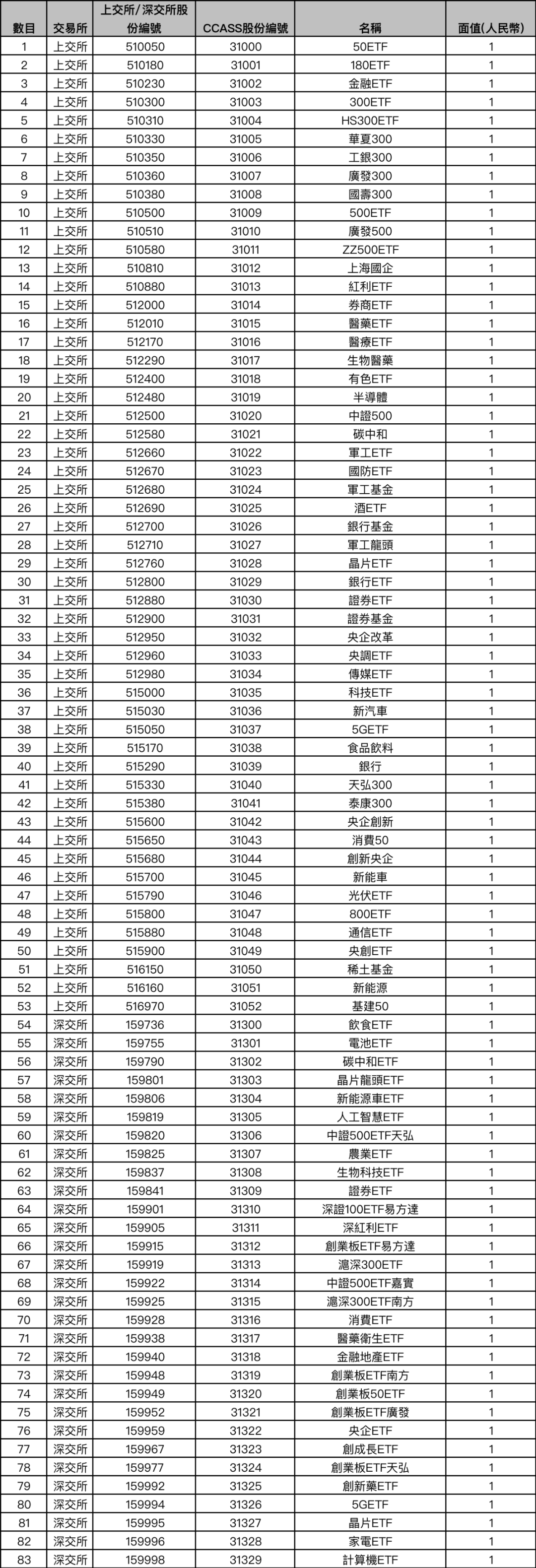

On the evening of the same day, the first batch of ETF list was released. Among them, there are 53 ETFs of Shanghai Stock Connect, 30 Shenzhen Stock Connect ETFs, and 4 Hong Kong Stock Connect ETFs.

Continue optimizing and improving the interconnection mechanism

According to the announcement of the China Securities Regulatory Commission and the Hong Kong Securities Regulatory Commission, since the China Securities Regulatory Commission and the Hong Kong Securities Regulatory Commission issued a joint announcement on May 27 this year, the two places regulatory agencies cooperated in the preparation of ETF into the preparation of interconnection. At present, related business rules, operating plans, and supervision arrangements have been determined, and the technical system is ready.

The China Securities Regulatory Commission and the Hong Kong Securities Regulatory Commission have reached a consensus on cross -border supervision cooperation and investor education cooperation involved in ETF incorporations. The two parties will continue to do well in ETF income into interconnected investor education and investment knowledge dissemination, strengthen law enforcement cooperation cooperation , Crack down on various cross -border violations of laws and regulations, deal with major or emergencies in a timely and properly, safeguard the normal operation of interconnection, and protect investors' legitimate rights and interests.

The exchanges of the two places, securities trading service companies and registration and settlement agencies shall perform various duties of interconnection in accordance with the law, and organize the market for the market to carry out ETFs into related businesses in an orderly manner. Securities companies (or brokers) shall abide by relevant regulatory regulations and business rules, strengthen internal control, prevent and control risks, do a good job of investor education and services, and effectively safeguard the legitimate rights and interests of investors. Investors should fully understand the differences in market laws and regulations, business rules and practical operations of the two places, carefully evaluate and control risks, and rationally carry out interconnected investment related investment.

In recent years, the CSRC has promoted the interconnection of the Mainland and the Hong Kong financial market and financial infrastructure in an orderly manner. On November 17, 2014 and December 5, 2016, the Shanghai -Hong Kong Stock Connect and Shenzhen -Hong Kong Connect mechanism were launched. Risk -controllable cross -border investment new model. Since the opening of the Shanghai -Shenzhen -Hong Kong Stock Connect, the overall operation is smooth and orderly. If different voting rights architecture companies, listing biotechnology companies, and science and technology board companies have been included in the bidding, the mainland capital market is open to the public, and the common development of markets in the two places. In addition, the CSRC has made an institutional improvement in optimizing the suspension mechanism, reforming the transaction mechanism, and improving the management method of the upper limit of the shareholding, and has achieved positive results. As of the end of May this year, the total net inflow of Shanghai and Shenzhen Stock Connect funds was approximately 1633.4 billion yuan, and the total net inflow of Hong Kong Stock Connect funds was about 2009.8 billion yuan.

The CSRC stated that the next step will continue to optimize and improve the interconnection mechanism, further expand the targets of interconnected transactions, effectively strengthen cross -border regulatory cooperation, support Hong Kong's international financial center status, and promote the mutual benefit and win -win and common development of markets in the two places.

Clarify the relevant arrangements of business implementation rules

In the early stage, the Shanghai -Shenzhen Exchange has released relevant business rules, which clarifies matters such as ETF income and adjustment mechanisms, trading arrangements. At the same time, in order to ensure that the market is ready, the Shanghai Stock Exchange has organized market participants to further do a good job of preparations for business startup, carry out multiple transaction system customs clearance tests with member agencies, and urge members to strengthen internal control and risk prevention. At present, the preparations such as the business and technology of ETFs into the interconnection mechanism have been basically completed.

The Shenzhen Stock Exchange cooperates closely with relevant parties, organizes market participants to prepare for various preparations, jointly conduct multiple technical system testing with member agencies, urge members to strengthen business risk prevention, and conscientiously do investor education services. At present, preparations for business, technology and markets are basically ready.

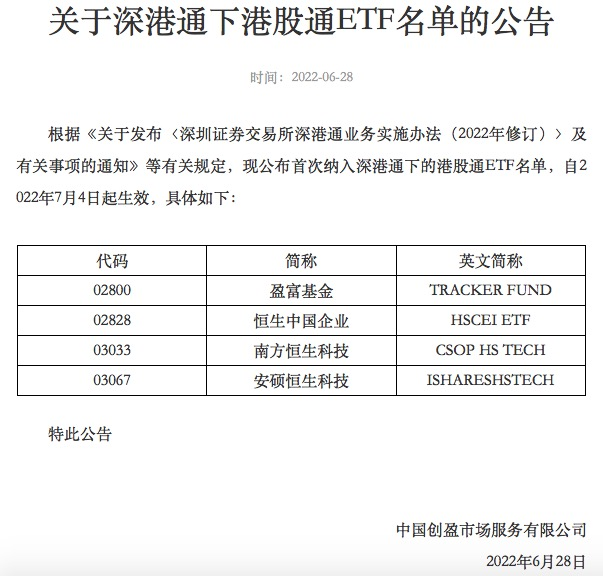

On the 28th, the Shanghai and Shenzhen Stock Exchange announced the list of Hong Kong Stock Connect ETFs that meet the conditions, a total of 4.

Source: Shanghai and Shenzhen Exchange

The Hong Kong Stock Exchange announced the initial list of the northbound ETF. Among them, the Shanghai Stock Connect ETF53, and a total of 30 ETFs in Shenzhen Stock Connect. The Shanghai Stock Connect ETF covers core broad -foundation products such as 50ETF, 180ETF, 300ETF, as well as representative industries such as biomedicine, semiconductors, and new energy. Shenzhen Stock Connect ETF covers core broad -foundation products such as GEM ETF, CSI 300ETF, as well as representative industry products such as biotechnology ETF, chip ETF, carbon neutral and ETF.

The Shanghai Stock Exchange stated that in the next step, under the unified deployment of the China Securities Regulatory Commission, it will continue to actively do a good job of forming ETFs before the formal integration mechanism of the interconnection mechanism to ensure the successful opening of the mechanism and landing smoothly.

The Shenzhen Stock Exchange stated that the next step will be deployed in accordance with the unified deployment of the China Securities Regulatory Commission, and the preparations before opening with all parties will be continued to ensure that the ETF is included in the interconnection and landing smoothly, and the cooperative development of the capital market between the two places will be better promoted. The Hong Kong and Macau Greater Bay Area achieves high -quality development.

Responsible editor: Tao Jiyan | Review: Li Zhen | Director: Wan Junwei

- END -

This Henan native donated 900 million to West Lake University and donated 1 billion to his alma mater

Text | China Science News reporter Wen Cai FeiOn July 6, on the occasion of the 120...

The relationship between Audi semiconductor and the controlling shareholder is unable to skim the power semiconductor gross profit margin or relies on the affiliates to increase

Golden Syllabus northern capital center Yan Yuan/Author Bai Qiwan Yue Yingwei/Risk...