It will be implemented from July 1st!The interpretation of the "Printing Tax Law of the People's Republic of China"

Author:Changjiang Daily Time:2022.06.30

Interpretation of the "Announcement of the State Administration of Taxation on the Implementation of the" Announcement on the Implementation of the People's Republic of China Stamp Tax Law "

In order to implement the "Printed Tax Law of the People's Republic of China" (hereinafter referred to as the stamp duty law), further standardize the management of stamp tax collection, strengthen the stamp tax tax service, promote the reform of the tax system "decentralized service", and follow the "I handle the taxpayer to the taxpayer to handle the taxpayer. Related arrangements for practical and private tax spring breeze ", the State Administration of Taxation issued the" Announcement of the State Administration of Taxation on the Implementation of the "Relevant Matters of the People's Republic of China Seal Tax Law" (hereinafter referred to as the "Announcement"). The interpretation is as follows:

First, why is the "Announcement"?

On June 10, 2021, the stamp tax law was approved by the 29th meeting of the Standing Committee of the 13th National People's Congress and will be implemented from July 1, 2022. In order to ensure the smooth implementation of the stamp duty law, standardize the management of stamp duty, and optimize the stamp tax tax service, the State Administration of Taxation will issue the "Announcement". At the same time, in order to implement the "Opinions on Further Deepening the Reform of Taxation and Management" issued by the China Affairs Office and the State Council, deepen the reform of "decentralization of service" in the taxation field, the "Announcement" also clarifies the method of optimizing the preferential land value -added tax matters to further reduce tax taxes The tax burden.

2. What is the main content of the "Announcement"?

The "Announcement" has two parts of 8 parts, which clearly clarify the following management and tax service matters: First, to clarify the relevant matters related to stamp tax collection management and taxation services, including the requirements of the stamp duty shall be declared. The principle determined by the deadline, the agent of overseas units or individuals withdraws the stamp duty and its own declaration of paying the stamp duty, enjoy the preferential policies of the stamp duty, and optimize the requirements of the stamp duty tax service; Procedures for procedures for preferential preferential matters for land value -added tax.

3. How to fill in the "Parking Tax Source Details" for declaration?

The taxpayer shall fill in the "Passing Tax Source Details" in accordance with the status of the stamp duty taxable contract, the transfer of property rights transfer, and the business account book. The number of contracts is large and belongs to the same tax purpose. You can consolidate and fill in the "Standard Details of the Printing Tax Tax".

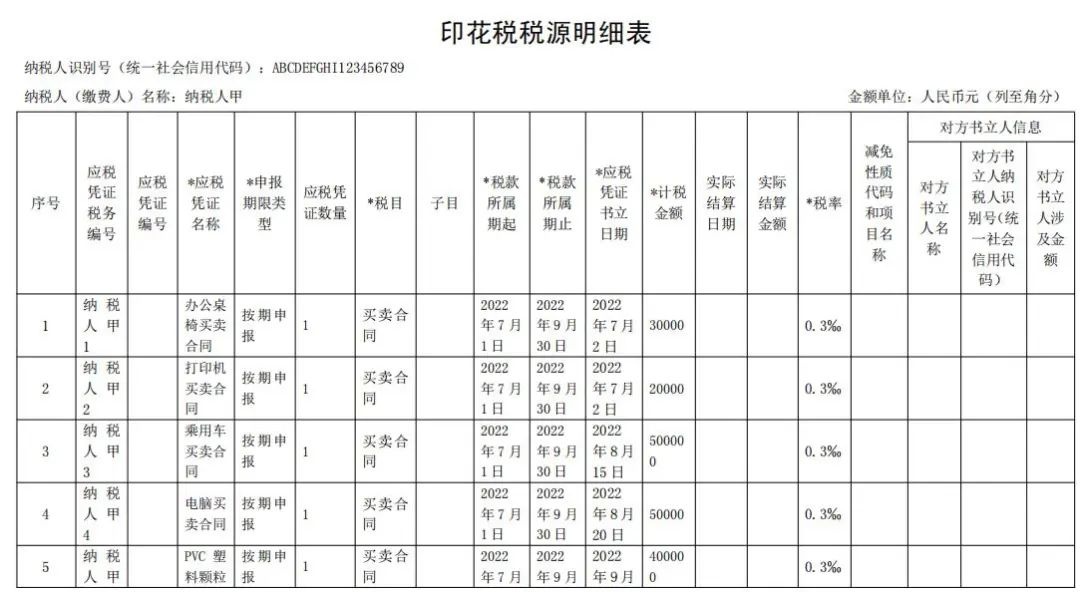

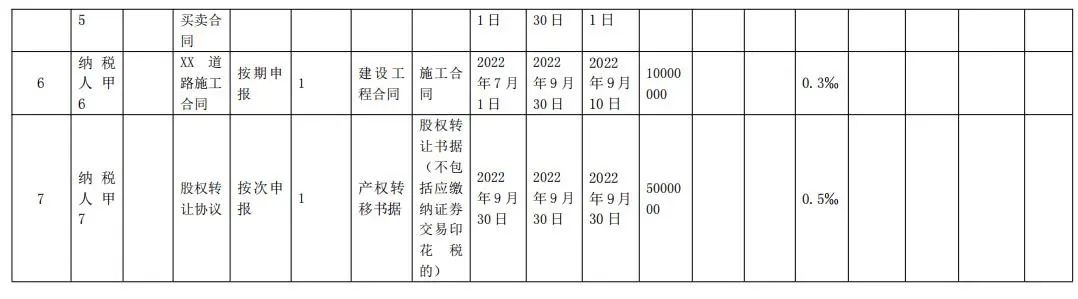

Example 1: Taxpayer A declares the stamp duty quarterly. In the third quarter of 2022, there were 5 sales contracts. 1 copy, a total of 10 million yuan (excluding the VAT (not included in the VAT (not included in the VAT (not included in the VAT tax, which is included in the list of VAT, which is not included in the VAT tax, which is included in the VAT tax), and the price of the property rights transfer is based on a total of 5 million. Yuan. When the taxpayer shall fill in the taxable contract and the property rights transfer of the book, fill in the "Standard Details of the Stamp Tax Tax Source", and in October 2022, the tax declaration period will be comprehensively declared for property behavior tax. The specifics are as follows:

Taxpayer A in October 2022 The tax declaration period should be paid to the stamp duty:

1 million yuan × 0.3 ‰+1 million yuan × 0.3 ‰+5 million yuan × 0.5 ‰ = 5800 yuan

Example 2: The taxpayer B declares the stamp duty quarterly. In the third quarter of 2022, 1 million yuan of property insurance contracts was written, and the insurance premiums listed in the contract (excluding the VAT listed) total were 10 million yuan. The taxpayer should fill in the "Passing Tax Source Details" when the taxable contract is issued by the book, and in October 2022, the tax declaration period is made to conduct a comprehensive declaration of property behavior tax. The specifics are as follows:

Taxpayer B shall pay stamp duty:

10 million yuan × 1 ‰ = 1 million yuan

4. Taxable contracts and property right transfer books are not listed according to the amount. If the amount is determined in the subsequent actual settlement, how can the taxpayer declare the stamp duty?

During economic activities, the amount of taxpayers' books and property rights transfer books have not been listed, and the situation that requires subsequent actual settlement to determine the amount is more common. Taxpayers should pay taxable contracts and property rights transfer books. According to the application of taxable contracts and property rights transfer, the book is established. After the actual settlement period, the next tax declaration period will be calculated and the stamp duty is calculated based on the actual settlement amount.

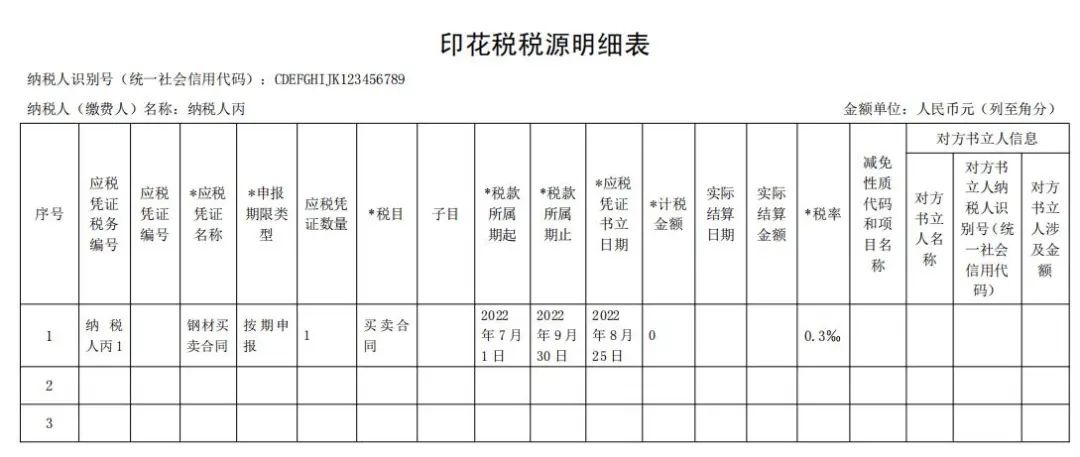

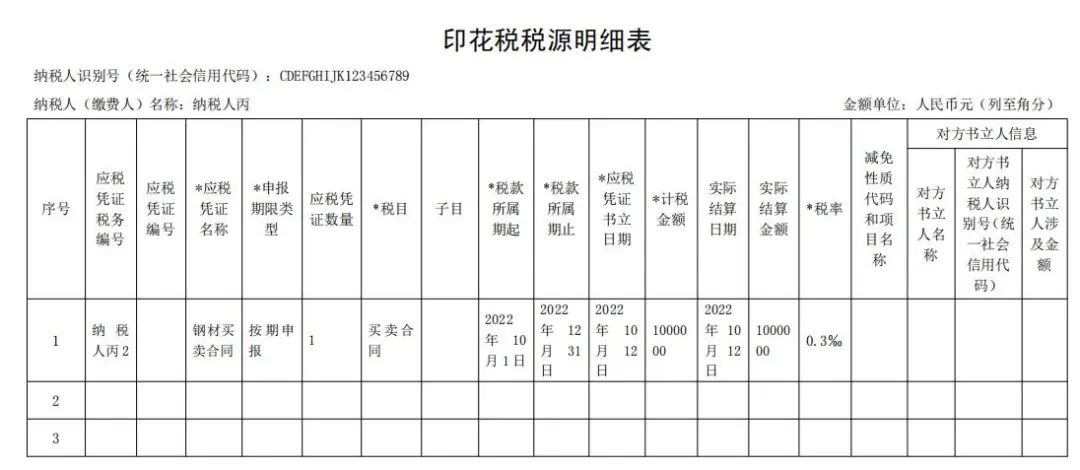

Example 3: The taxpayer C declares the stamp duty quarterly. On August 25, 2022, one of the steel trading contracts for the scholarship, the contract states the number of steels for the steel, and agreed that when the steel is delivered to the steel According to settlement, on October 12, 2022, the price of steel was settled at a contract of 1 million yuan, and the price of the steel price was 3 million yuan on March 7, 2023. The taxpayer should fill in the "Passing Tax Source Details" when the taxable contract and actual settlement of the book and the actual settlement, and the tax declaration period in October 2022, January 2023, and April 2023 will be comprehensively declared for property behavior tax. details as follows:

The taxpayer C in October 2022 The tax declaration period should be paid to the stamp duty:

0 yuan × 0.3 ‰ = 0 yuan

Taxpayer C's January 2023 tax declaration period should be paid for stamp duty:

100000 yuan × 0.3 ‰ = 300 yuan

Taxpayer C in April 2023 The tax declaration period should be paid to the stamp duty:

30,000 yuan × 0.3 ‰ = 900 yuan

5. How is the specific tax period of stamp duty stipulated?

The stamp duty is yes, year -on -year, or underwriting. The taxable contract and property right transfer letter can be paid quarterly or on a quarterly or in accordance with the sub -application. Sure. Considering the convenience of foreign units and individuals to pay the stamp duty, the stamp duty of the taxable voucher for overseas units or individuals can be paid quarterly, year -on -year or in accordance with the application. The specific tax period shall be determined by the provinces, autonomous regions, municipalities, and planned municipal tax bureaus.

6. How can overseas units or individuals pay stamp duty?

If the taxpayer is an overseas unit or individual, if there is an agent in the country, the domestic agent is a deduction obligation. Domestic agents of overseas units or individuals shall withdraw stamp duty in accordance with regulations and report to the competent tax authority.

If the taxpayer is an overseas unit or individual, if there is no agent in the country, the taxpayer shall declare the stamp duty by himself. In order to facilitate taxpayers, according to the different objects of taxable vouchers, overseas units or individuals can deliver assets, domestic service providers, or the location of the receiving party (residential place), and the taxable voucher. If the tax authority is applied for payment; if the transfer of real estate rights is involved, the tax authority of the real estate is located.

Seven, taxpayers enjoy stamp duty discounts, how to handle it?

The taxpayer enjoys the preferential method of stamp duty, consistent with the current regulations, and implements "self -discipline, declaration and enjoyment, and preparation for relevant information" to ensure that taxpayers enjoy timely stamp duty policy dividends. At the same time, the "Announcement" clarifies the taxpayer's legal liability for the authenticity, integrity and legality of the preferential information of stamp duty.

8. What new regulations do the "Announcement" make in optimizing the preferential method of land value -added tax?

After the implementation of the "Announcement", the process of preferential land value -added tax was further optimized, and the filing discount items were changed to implement taxpayers "self -discipline, declaration and enjoyment, and relevant information retention." When the taxpayer handles the original filing -category discount matters, the relevant information such as the copy of the data of the non -moving property rights, the real estate transfer contract (agreement), the deduction of the relevant materials of the project amount (such as the evaluation report, the invoice), etc. The taxpayer only needs to fill in the report on the corresponding tax and exemption bar to enjoy the relevant discounts.

At the same time, the "Announcement" clearly assumes legal responsibility for the taxpayer's authenticity, integrity and legitimacy of the reserved information.

9. When will the "Announcement" be implemented from?

The "Announcement" will be implemented from July 1, 2022.

(Source: State Administration of Taxation)

【Edit: Shang Pei】

For more exciting content, please download the "Da Wuhan" client in the major application markets.

- END -

[Central Media see Gansu] Gansu Kangle: Highland Xiacai "Fragrant Fragrance" Xiamen

After the beginning of summer, the temperature rose, and the plateau summer -growi...

[Learn and implement the spirit of the 14th Provincial Party Congress] Multiple measures and promote reforms and enters the openness (2)

Edit Gao Yun