Restricted and lifted the ban on the day of the business soup, the market value of the Soup Soup Evaporation of 80 billion Hong Kong dollars is voluntarily extended the long -term value of the company for the half -year for sale.

Author:Daily Economic News Time:2022.06.30

On June 30, the "AI No. 1" Shangtang Technology Welcome Sales and Limited Sales Day.

After the opening of the Hong Kong stock market, the stock price of Shangtang (HK0020) dived, and the stock price once explored to HK $ 2.91, down more than 40%, and the market value evaporated at HK $ 80 billion.

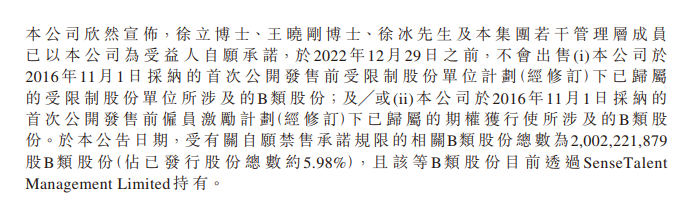

This morning, Shangtang Technology issued an announcement on the Hong Kong Stock Exchange that "in order to express the confidence of the company's long -term value and prospects," the company executives Xu Li, Wang Xiaogang, Xu Bing, and some members of the company voluntarily promised that they were voluntarily promised. Prior to December 29th, the total number of companies with a total of 2.02 billion shares (about 5.98%of the total issued shares) will not be sold.

Picture source: Shangtang Announcement

Regarding the stock lifting period, Shang Tang responded that "we also issued an announcement executives to postpone the lifting of the ban this morning, and also expressed confidence in the company's long -term value and prospects". Regarding the opening of the stock price today, Shang Tang said: "We don't comment on the stock price (performance)."

The stock price of the ban on the date of lifting the stock price is under pressure, and the long -term confidence in the voluntary sale of desires

At the opening of the market today, Shangtang's stock price dived, down more than 40%, and fell below the issue price. On the news, on June 30, Shang Tang welcomed the restrictions on the lifting period.

According to the additional prospectus announced before the listing of Shangtang, the cornerstone investors agreed to be within any time during the listing date (that is, the ban period), and will not directly or indirectly sell them according to the relevant cornerstone investment. Any sale shares purchased by the agreement. That is, all 100%of the shares are locked for 6 months after listing. The above -mentioned prospectus shows that the cornerstone investors of Shangtang account for nearly 70%of the company's total share capital.

On the morning of June 30, Shangtang announced in the Hong Kong Stock Exchange that "in order to express the confidence of the company's long -term value and prospects," the company executives Xu Li, Wang Xiaogang, Xu Bing and the company's management members voluntarily promised, and the company voluntarily promised. Before December 29, 2022, the total number of companies with a total number of companies with a total of 2.02 billion shares (accounting for about 5.98%of the total issued shares).

However, in terms of comparison, the total amount of voluntary banning is much lower than the number of lifting. This is the first period of lifting the ban after the listing of Shangtang. Restrictions on the short -term fluctuations brought by the stock price have long been common. As of press time, Shangtang has fallen 46.77%to HK $ 3.13/share, a new low since listing. The latest market value is HK $ 104.9 billion, which has evaporated more than 80 billion Hong Kong dollars from the previous day.

For today's stock price fluctuations, Shang Tang said: "We don't comment on the stock price (performance)." Shang Tang emphasized its long -term value. On the morning of the 30th, the company said to the reporter of "Daily Economic News" through WeChat: "We also issued an announcement of an announcement of the execution of the executives this morning. confidence."

In addition, on June 20, Shangtang Technology also issued an announcement of the "Adopting the Plan for Restricted Share Unit for 2022", announcing that the board of directors had decided to adopt the 2022 restricted share unit plan, the purpose is to recognize the contributions made by participants; encouragement and and. Reserve these people to serve the group's continuous operation and development; provide additional incentives to the other to achieve performance goals; attract appropriate personnel for the further development of the group; and motivate participants to win the maximum value for the company.

The first aura on the head, "Bleeding" is to be broken

On December 30, 2021, after a wave of twists and turns, Shang Tang finally landed on Hong Kong stocks as "AI's first share".

On December 10th, on the eve of Shangtang's listing, the Overseas Asset Management Office of the Ministry of Finance included Shangtang on the list of US capital investment. Three days later, Shangtang Technology announced the postponing IPO and issued a statement saying that "strong opposition to the US sanctions decision and related allegations" and "scientific and technological development should not be affected by geopolitics."

By December 20, Shang Tang only announced the restart of the IPO in the Hong Kong Stock Exchange, and replaced all the cornerstone investors into Chinese capital. Five investors including Xuhui Capital, Guotai Junan Securities Investment, Hong Kong Science and Technology Park Venture Capital Fund, Hima and Taizhou Cultural Tourism have replaced four foreign investors including Pleiad Fund, WT, Focustar Capital and Focustar Fund and Hel Ved.

After Shangtang landed in Hong Kong stocks, the stock price had risen all the way, with a maximum increase of more than 40%, and the market value once exceeded the 300 billion Hong Kong dollar mark. According to IDC's latest "2021H2 China Artificial Intelligence Market" report, in the second half of 2021, among China's artificial intelligence computer vision application market share, Shangtang Technology's market share remained first, from 18.4%of the market in the second half of 2020 in 2020 The share appreciated to 22.2%. In addition, in February this year, Shang Tang was included in the Hang Seng Technology Index and the Hang Seng Comprehensive Index.

However, at the performance level, since 2018, despite the rapid growth of revenue, Shang Tang has not yet achieved profit.

According to the financial report, from 2018 to 2021, the revenue of Shangtang continued to expand, from 1.853 billion yuan to 4.7 billion yuan, and the revenue growth has always remained in two digits, but the loss is gradually expanding. The loss of 459 million yuan expanded to the operating loss of 3.32 billion yuan in 2021.

This is not related to R & D investment. Shangtang Technology stated in the 2021 financial report that one of the main reasons for losses was the company's R & D investment. In 2021, Shangtang's research and development expenditure was 3.06 billion yuan, accounting for 65.1%of the income ratio.

The high R & D investment has not yet brought high profit returns. "Bleeding" is still an important issue that Shang Tang urgently needs to crack. It is true dragon or fake python. Investors are waiting for the answer sheet of Shang Tang.(Cover picture source: Daily Economic News Jin Horizontal Photo)

Daily Economic News

- END -

Agricultural Issuance Chongqing Branch and Chongqing Municipal Transportation Bureau jointly promote the high -quality development of rural road networks

Agricultural Issuance Chongqing Branch and Chongqing Municipal Transportation Bureau jointly promote the high -quality development of rural road networksRecently, the Chongqing Branch and Chongqing Mu

Flerat: Anfu Glass is priced at the highest price of 3.38 billion yuan to win the mining right of quartz rock ore

On July 6, Capital State learned that Flelet (601865.SH)/Flelet Glass (06865.HK) announced that yesterday's meeting passed the Proposal on the Participating in the Anti -Mining Rights and agreed to...