Why did the national "Gold Lord" repeat in Zhejiang?

Author:Zhejiang Daily Time:2022.06.30

Zhejiang News Client reporter Chen Jiaying Xia Dan Mei Lingling

On June 30, the construction of the investment signing of the lithium battery project in Zhejiang Times and the starting ceremony of the annual output of 100,000 tons of ternary orthopedic materials was held in Luzhou.

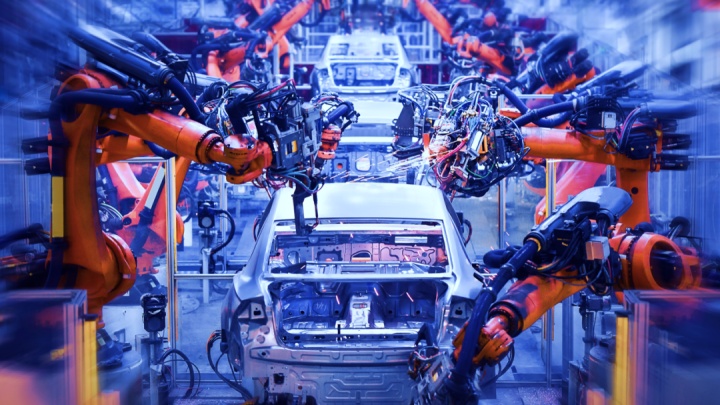

The Zhejiang Times Lithium Corporation project is a key manufacturing project in Zhejiang Province, with a planned total investment of 32.5 billion yuan. The contracting project is the first phase of the project, with a total investment of 16.5 billion yuan. It is planned to build an annual output of 150,000 tons of high -nickel -type power batteries for a ternary orthopedic linked annual output of 200,000 tons of front drives. It is expected to be completed and put into operation in 2024.

Yong Jinjun observed that in addition to Zhejiang Industrial Fund, this financing has also attracted three national funds such as the national manufacturing transformation and upgrading fund, the National Green Development Fund and the comprehensive reform test (Hangzhou) Fund, of which the largest contribution is the largest amount The national manufacturing transformation and upgrading fund (hereinafter referred to as the "manufacturing fund") has an investment of 990 million yuan.

How does the national "Gold Lord" choose high -quality projects? What are the moves in Zhejiang recently? Yong Jinjun revealed for you ——

01

Why is the 100 billion fund falling in Zhejiang

Public information shows that the manufacturing fund was established in November 2019 and has a registered capital of over 100 billion yuan. It is a national fund that shoulders national strategic will and help manufacture transformation and upgrading.

Unlike other national funds focusing on one industry, manufacturing funds cover almost the entire manufacturing industry chain, and the investment scope and methods are diversified. State -owned enterprises have mixed reforms, and they can invest in private enterprises.

According to the relevant personnel of Zhejiang Times Lithium Electric Materials Co., Ltd., this manufacturing fund is involved in investment, mainly to value Zhejiang's perfect industrial chain ecology and cooperation opportunities with Zhejiang Lithium Electric Materials Leading Enterprises.

At the same time, the lithium battery positive material, as the upstream core parts, has the characteristics of prominent foundation, strategic, pilot, and other characteristics. The manufacturing fund hopes to invest in the construction capacity of the ternary positive pole material and the production capacity of the front -drive body to further strengthen the autonomous autonomous lithium battery industry chain. Control, consolidate China's advantage in the global lithium battery industry chain.

Yong Jinjun learned that this is not the first time that the manufacturing fund has invested in Zhejiang. For how to choose high -quality projects, they have a unique set of measurement standards.

For example, Zhejiang Richam Precision Machine Tool Co., Ltd., which was previously invested by the manufacturing fund. The daily hair is the head in the segmented field, and the selection of excellent selection is one of the most important investment strategies of such funds. Secondly, whether enterprises meet equity investment conditions and how their willingness to financing is also an important consideration.

According to relevant persons, the manufacturing funds mainly conduct strategic investment around the areas of new materials, new -generation information technology, power equipment, high -end CNC machine tools, robots, and new energy industry chains. At the same time, the hard power company that can solve the neck and shortcomings in the segment is also the target of the manufacturing fund.

What are the benefits of being able to obtain funds in the 100 billion -level fund?

It is understood that the most important projects are the most important projects of the investor's industrial background. Because these national funds often have many large upstream and downstream companies in the industry, upstream and downstream collaboration can be performed after investing to help companies quickly open up " Ren Du Er pulse ".

In order to attract more national funds, Zhejiang has established a multi -level linkage through the "National Fund+Regional Fund+Marketing Fund" to build a fund group covering the province and many fields.

At present, there are more than 100 financial control cooperation investment institutions in Zhejiang Province, with a total of 97 funds participating in, and guided to leverage 350 billion yuan in various types of capital and 1270 enterprises in the province.

02

Mysterious national "gold master"

With the heating of the focus of manufacturing in recent years, the mysterious national "gold master" behind the large project has become increasingly the focus of attention.

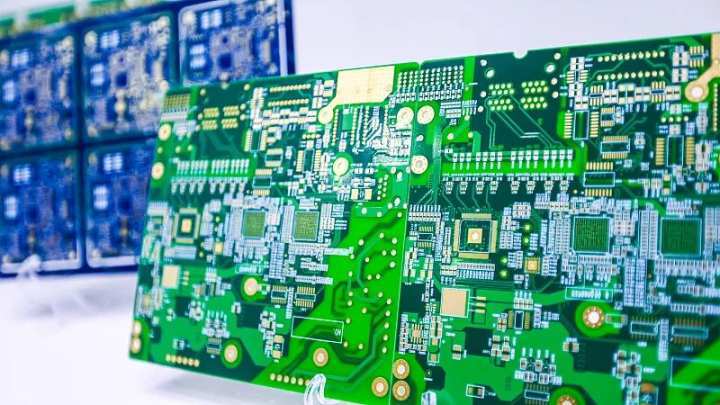

For example, the National Integrated Circuit Industry Investment Fund Co., Ltd. (referred to as the "Integrated Circuit Fund") is the first national fund and is called the "big fund".

It was established under the guidance of the Ministry of Industry and Information Technology and the Ministry of Finance in September 2014 to support the Chinese local chip industry. Since then, the "Big Fund Phase II" was also established in October 2019, with a registered capital of 204.15 billion yuan.

In addition, the number of national funds funded by the Ministry of Finance currently involved in the Ministry of Finance is not a small number, mainly including integrated circuit funds and second phases, advanced manufacturing funds and second phases, manufacturing transformation and upgrading funds, green development funds, etc. As well as amplifying social capital, they have played a significant role.

When searching for public information, Yong Jinjun also found that in recent years, these mysterious national funds have repeatedly appeared in Zhejiang.

Earlier this year, Zhejiang Cossi, located in Haining, received the capital increase of the "Big Fund Phase II". Some media said that this is the first time that the "big fund" has deployed semiconductor parts companies to fill the gaps in the field of domestic semiconductor core components and help improve the semiconductor industry chain.

Coincidentally, it is also in the field of integrated circuits. The Changdian Shaoxing project has also been favored by the "big fund". It has established a joint venture company in Shaoxing to establish an advanced integrated circuit packaging production base with a registered capital of RMB 5 billion.

- END -

The rural revitalization policy dividend frequently comes out to crack the rural financial development difficult and pain points

Joint effort to solve the difficult point of the development of rural financial developmentThe rural rejuvenation policies have frequently emerged, and rural financial reform and development ushered i

The facilitation of trade foreign exchange revenue and expenditure pilot business is shortened to 5 minutes in a single business in Xinjiang

Pomegranate/Xinjiang Daily (Reporter Wang Yongfei reported) The reporter learned from the People's Bank of China Urumqi Center Sub -branch: On June 30, under the guidance of the Xinjiang Branch of the...