Bei Road Zhi Control Customer Customer Customer Credit or Worse Patent Inventor appears to be related parties and customers

Author:Jin Ziyan Time:2022.06.30

"Golden Syllabus" Southern Capital Center Regular/Author Wuyue Yixi/Risk Control

On December 12, 2021, the State Council issued the "Fourteen Five -Year Plan" Digital Economic Development Plan ", proposing to promote the digital upgrades of energy production, transportation, storage, sales, and use of various links, and implement coal mines, oil and gas fields, oil and gas pipeline networks, etc. Digital construction and transformation of fields, equipment and process flows. With the help of policy, Nanjing North Road Zhikong Technology Co., Ltd. (hereinafter referred to as "North Road Zhikong") can win the "one place" in the wave of digital transformation in this energy field, which remains to be tested.

This time, Henan Energy and Chemical Group Co., Ltd. (hereinafter referred to as "Henan Energy"), a subsidiary of Henan Energy and Chemical Industry Group Co., Ltd. (hereinafter referred to as "Henan Energy"), a large number of accounts receivables of Bei Road Zhikong. Model risk. On the other hand, watching the background of the cooperation with customer Henan Energy, from 2008 to 2010, Beilu Zhikong and its patents in the same control of the company and the customer of Henan Energy under the same control appeared. The inventor of Wen Si ". In February 2011, the above -mentioned "Wei Weisi" appeared again in the patent list developed by North Road Zhikong and the customer's cooperation with customers Henan Energy.

1. The credit status of the customer subsidiary of accounts receivable is "deteriorated", and the proportion of credit losses may not be sufficient

The quality of the customer affects the development of the enterprise. During the reporting period, the subsidiary of Beilu Zhikong's receivables of the accounts receivable.

1.1 Due to debt defaults, Beilu Zhi Control corresponding accounts for accounts receivables will be prepared for bad accounts

According to the prospectus of the signing date of Bei Road Zhikong (hereinafter referred to as the "Prospectus") on March 22, 2022, from 2019-2021, Henan Energy is the largest and first, first and first first and first account receivables of Beilu Zhi control receivables, respectively. Large and second largest customers, at the end of the accounts receivable period, the balance of the end of the accounts receivable was 219.29 million yuan, 31.456 million yuan, and 313,628,800 yuan, accounting for 14.09%, 16.4%, and 11.2%of the balance of the current accounts receivable period, respectively.

According to the signing date of November 22, 2021, the "reply to the first public offering of shares of Nanjing North Road Zhikong Technology Co., Ltd. and the review and inquiry letter of the application document on the GEM (hereinafter referred to as" "hereinafter referred to as" " In the first round of inquiry "), Beilu Zhi Control conducted a single assessment of the credit risk of receivable of the subsidiaries of Henan Energy's subsidiary Yongcheng Coal Power Holdings Group Co., Ltd. (hereinafter referred to as" Yongmei Holdings "). In order to raise bad debts in a single plan, in November 2020, Yongmei Holding the third phase of the third phase of 1 billion short -term financing vouchers in the third phase of 2020 cannot pay the principal and interest in full, constitute debt defaults.

In other words, during the reporting period, Yongmei Holdings, a subsidiary of Henan Energy for accounts receivable, defaulted with the subsidiary of Henan Energy.

It should be pointed out that from 2020 to 2021, Beilu Zhikong will refer to the expected credit loss of Yongmei Holdings and its affiliates with the risk of recycling risks, which correspond to differential principles and determine the basis Essence

1.2 For the four main entities related to Yongmei Holdings, 30%of the credit loss basis is "improved"

According to the second round of inquiries, at the end of 2020, Beilu Zhi Control analyzed the accounts receivable of Yongmei Holdings and its subsidiaries one by one, and filed an expected credit loss on the single item of recycling risks.

Among them, Guizhou Yongkumi Technology Development Co., Ltd. (hereinafter referred to as "Guizhou Yongmei"), the relevant subject of Bei Road Zhi Holdings (hereinafter referred to as "Guizhou Yongmei"), Sanmenxia Longwangzhuang Coal Industry Co., Ltd. (hereinafter referred to as "Sanmenxia Coal Industry"), Henan Yong) China Energy Co., Ltd. (hereinafter referred to as "Yonghua Energy") and Yonggui Energy Development Co., Ltd. Shinada Coal Mine (hereinafter referred to as "Yonggui Xintian"), four subjects were calculated to calculate the expected credit loss in a 30%ratio order.

In 2020, the determination of 30%of the credit losses of the four main entities such as Yongmei, Guizhou, was based on the basis of "the parent company bond default, the accounts receivable were not overdue or a small amount of overdue, and the debt capacity was paid." In 2021, the determination of 30%of the credit loss of the four main items of the 4 main entities in Guizhou Yongmei was "improved and the proportion of the previous year was maintained."

In addition, Luoyang Longmen Coal Industry Co., Ltd. (hereinafter referred to as the "Luoyang Coal Industry"), the relevant entity of the Bei Road Zhi Holdings (hereinafter referred to as the "Luoyang Coal Industry"), the Yonggui Energy Development Co., Ltd. Xixiu Branch, Guizhou Yongrun Magnesium Co., Ltd. The 4 main entities of Energy Co., Ltd. Gu Han Shan Mine will calculate the expected credit losses at 100%ratio.

In contrast, in 2020, the determination of 100%credit losses such as Luoyang Coal Industry, including Luoyang Coal Industry, is based on the basis of "the parent company bond default, the accounts receivable are overdue, the property is preserved or forced to execute the execution The debt repayment capacity is relatively weak. " In 2021, the determination of 100%credit losses such as Luoyang Coal Industry, including Luoyang Coal Industry, was based on the basis of "maintaining the proportion of the previous year".

However, among the four related entities of Yongmei Holdings, which filed 30%of credit losses in Bei Road, the three companies of Yonghua Energy, Sanmenxia Coal Industry, and Yonggui Xintian were also unable to withstand the scrutiny.

1.3 At the end of 2020, the balance of account receivables in the three subjects in the aforementioned main body was 6.065 million yuan. According to the second round of inquiry, at the end of 2020, Bei Road Zhikong to Yonghua Energy, Sanmenxia Coal Industry, Yonggui Xintian's of Yonghua, and Yonggui Xintian. The balance of accounts receivable was 2.178 million yuan, 2.1917 million yuan, and 1.6951 million yuan, respectively. At the same time, the amount within one year of Yonggui Xintian was 406,100 yuan, and the amount of over 1 year was 138,200 yuan, and the total amount of overdue was 544,300 yuan.

After research by the Southern Capital Center of "Jin Xieyan", even if the overdue amount of Yonggui Xintian was eliminated, the total value of the accounts receivable of the three enterprises to the three companies was 6.065 million yuan. Bei Road Zhikong's accounts receivable or deposit on the three companies.

1.4 The Sanmenxia Coal Industry of Yongmei Holding Subsidies was executed, and the legal representative was restricted to high consumption

According to the referee document network on May 28, 2021, (2020) Lu 0211 Document No. 6239, the Huangdao District Court of Qingdao City, Shandong Province (hereinafter referred to as "Patson," Patson ") Hei Qingdao Zhonggatar frequency frequency motor Co., Ltd., Ningxia Di Heavy Equipment Technology Co., Ltd., and the executed person Henan Longyu International Trade Co., Ltd., Sanmenxia Coal Industry, Laichi County Chengshi Coal Selection Co., Ltd., Henan Xingluo Power Equipment The case of the notes of the payment request of the Co., Ltd. (2019) Lu 0211 Minchu No. 7645 Civil Judgment has had legal effect. Because the executive person of the Sanmenxia Coal Industry did not fulfill its obligations, the application executive Patson applied, Qingdao, Shandong Province, Shandong Province The Huangdao District Court of Huangdao filed a case on October 13, 2020.

In this case, the applied executive Patson requested a total of 2 million yuan in the amount of bills and related interest, insurance costs of 0.53 million yuan, and case acceptance fee and premium fee of 16,600 yuan. According to several query feedback results, the Huangdao District Court of Qingdao City, Shandong Province, frozen and deducted the deposit of the executive bank of Sanmenxia Coal Industry and other executives, and executed 1.4861 million yuan. Essence The Huangdao District Court of Qingdao City, Shandong Province included the legal representative of the Three Gate Gorge Coal Industry and other executive persons in the list of high consumption lists.

It should be pointed out that it is not an example of the enforcement of Yongmei Holdings subsidiaries.

1.5 Yonghua Energy, another subsidiary of Yongmei Holdings, was forced to implement

According to the referee document network on June 1, 2021 (2021), Henan 01 Document No. 18, on January 6, 2021, because of the Henan Province Yanshi City Court (2020) Yu 0381 Minchu 4641 Civil Mediation Civil Mediation Course has already been In the event of legal effect, the executed person Yonghua Energy did not fulfill its legal obligations, and the Zhengzhou Intermediate Court of Henan Province was enforced according to law and has been implemented.

The problem is far from over.

1.6 The main body of Yonggui Holdings controlled by Yonggui Xintian was seized, freezing bank deposits or other equivalent property

According to Document No. 0903, released by the referee document network (2020) on September 29, 2020, Document No. 3995, Minchu No. 3995, 2020, on August 24, 2020, Jiangsu Zhonglian Electric Co., Ltd. (hereinafter referred to as "Zhonglian Electric") to Yancheng, Jiangsu Province, Jiangsu Province The People's Court of Yantu District of the Municipal Yantu District applied for property preservation, and requested the respondent Yonggui Xintian, Yonggui Energy Development Co., Ltd., and Yongmei Group Co., Ltd. to seize and freeze the property with a value of 1.1 million yuan. Essence

The People's Court of Yandu District, Yancheng, Jiangsu Province, ruled that the bank deposit of the respondent of the respondents such as Yonggui Shinada, which was seized and frozen, or other equivalent property.

It is not difficult to find that the Sanmenxia Coal Industry of Yongmei Holdings was executed, and its legal representative was restricted to high consumption; Yonghua Energy was forcibly executed by the court for failing to fulfill its legal obligations; Frozen property for property preservation. The three subsidiaries of Yongmei Holdings have different degrees of debt risk.

On this basis, from 2020 to 2021, the operating conditions of the three companies of Sanmenxia Coal Industry, Yonghua Energy, and Yonggui Xintian, Beilu Zhikong. Is it rational? Should the North Road Zhikong take the above three companies in accordance with the basis of "property preservation or enforcement", and take 100%credit loss measures in a single measure? Is the management system of the receivables receivable of Bei Road Intelligent Control? Unexpectedly.

2. I have cooperated with customers to develop patents, and the patent inventor "walking a horse lamp" style appeared in related parties and customers

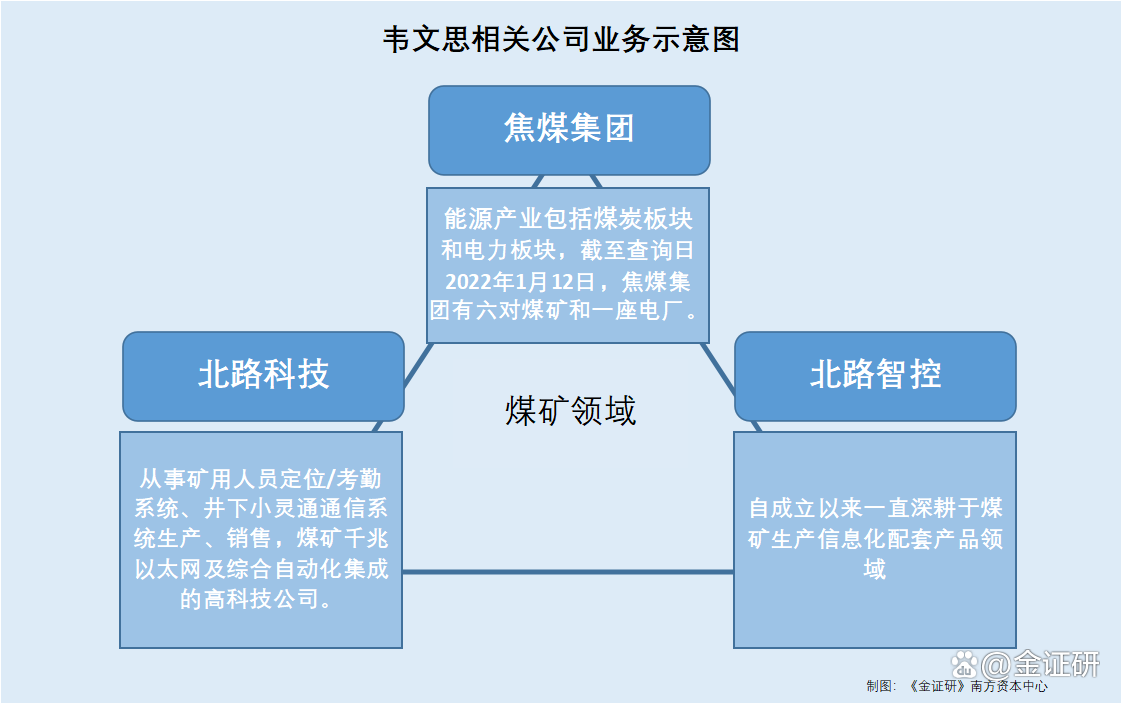

Looking at the cooperation history of Zhisong Control and Henan Energy, from 2008 to 2010, Nanjing North Road Technology Co., Ltd. (hereinafter referred to as "Bei Road Technology"), Bei Road Zhikong and Henan Energy Subsidon Coke Group appeared. "Same name" patent inventor.

2.1 2019-2021, Henan Energy is a big customer of the Customer Customer Customer Customer Customer Customer Customer Customer

As mentioned above, from 2019 to 2021, Henan Energy is the largest, largest, and second largest customers of Beijing Road Intelligence Controls, respectively. Yuan, 313.628 million yuan.

In addition, according to the prospectus, from 2019 to 2020, the corresponding sales amount of Beilu Zhi Control to Henan Energy Sales Smart Mining System was 27.5935 million yuan and 119.89 million yuan, respectively, the second largest and third largest customers, respectively. It is intriguing that Beilu Zhikong "surprised" the same person in the patent inventor of Henan Energy and its control enterprise.

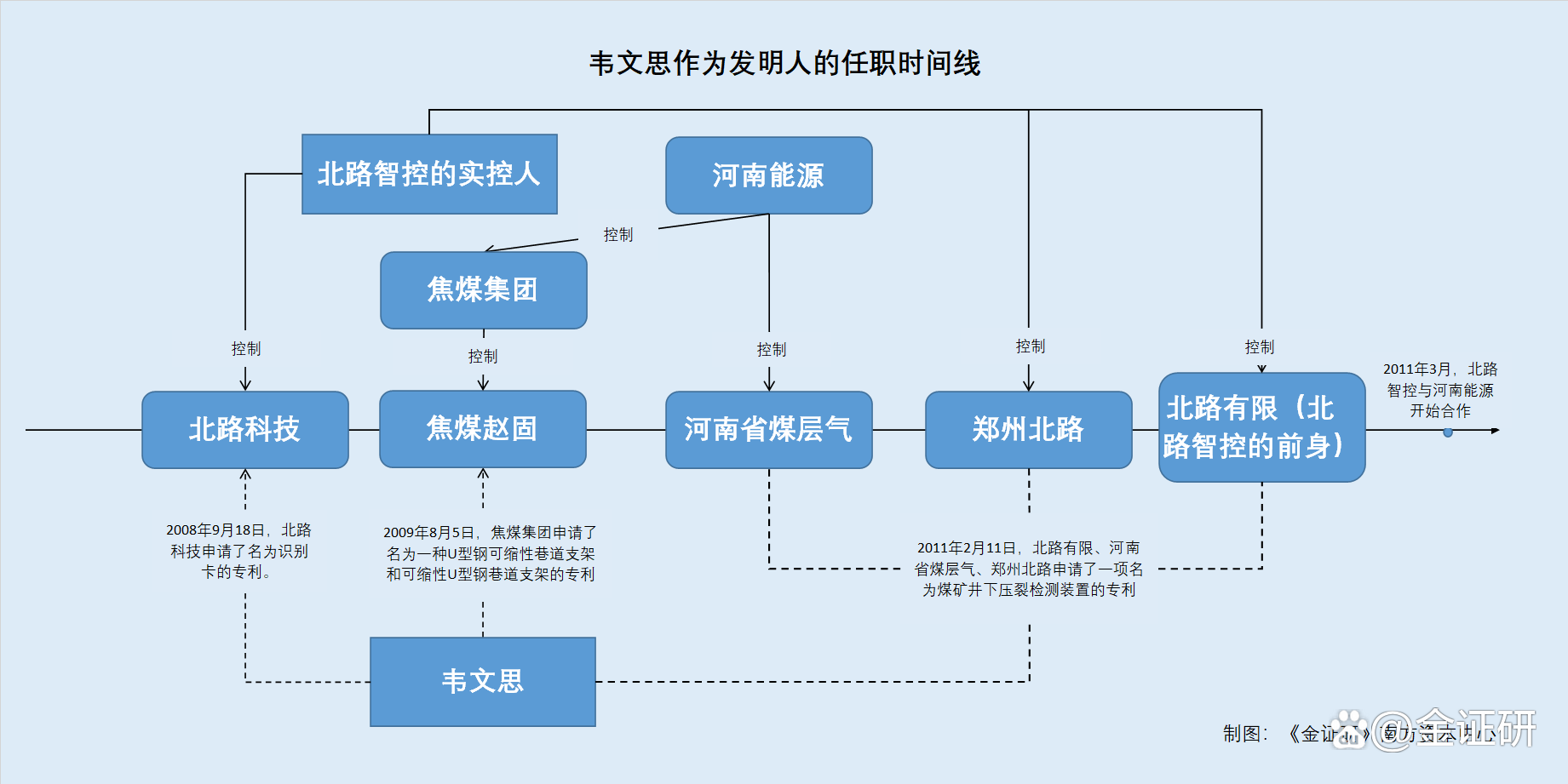

2.2 In 2008, the inventor of a patent applied by North Road Science and Technology included Wei Wensi

As mentioned earlier, the Southern Capital Center of "Golden Securities" in the "North Road Zhikong Softener Soferal and Soferality Unique Director of History and Unique Directors participated in the R & D" Unrepaired "released on June 29, 2022 pointed out that 2007- In 2016, Bei Road Technology and Beilu Zhikong may be under the same control.

During the period, Bei Road Technology and Beilu Zhikong had a "same name" patent inventor.

According to the State Intellectual Property Office, on September 18, 2008, Bei Road Technology applied for a design patent called the "identification card", the inventor was victory and Wei Wensi. As of May 31, 2022, the status of the patent case was to end its failure to end the annual fee.

It is strange that Wei Wensi is also one of the patent inventors of the affiliated enterprises under Henan.

2.3 In 2009, Wei Wensi "appeared" "List of Patent inventor of Zhao Gu Zhao Gu, a subsidiary of Henan Energy

According to the official website of Henan Energy, on December 5, 2008, on the basis of Yongmei Group, Jiaozuo Coal (Group) Co., Ltd. (hereinafter referred to as "Coking Coal Group"), Crane Coal Group, Central Plains Dahua, Henan Gas Group, reorganized reorganization. The Henan Coaling Group was established. On September 12, 2013, Henan Coaling Group and Yigu Group strategically reorganized to form Henan Energy.

According to the official website of Coking Coal Group, "Coking Coal Group" and "Coking Coke Company" refer to coking coal groups.

According to the data and public information of the Market Supervision and Administration Bureau, the Coking Coal Group was established on March 7, 2000. Henan Energy holds 100%of the equity of Coking Coal Group. ) It is the actual controller of the coke coal group. As of May 31, 2022, the coking coal group had no shareholder change record.

According to the State Intellectual Property Office, on August 5, 2009, Zhao Gu (Xinxiang) Energy Co., Ltd. (hereinafter referred to as "Jiao Coal Zhao Gu") applied for a "U -shaped steel lane canal lane lane The practical new patent of the bracket is Bai Yunlai, Jia Anli, Tian Yajun, Fu Yujun, Niu Zongtao, Qiao Yuhui, Yue Yongjun, Zuo Qingquan, Wei Wensi, Guo Xiaodian. As of May 31, 2022, the status of the patent case was to end its failure to end the annual fee.

On August 5, 2009, Zhao Gu, a coking coal, applied for a practical new patent called "shrinkable U -shaped steel lane stent". The inventor was Bai Yunlai, Jia Anli, Tian Yajun, Fu Yujun, Niu Zongtao, Qiao Yuhui, Yue Yongjun, Yue Yongjun , Zuo Qingquan, Wei Wensi, Guo Xiaodian. As of May 31, 2022, the status of the patent case was to end its failure to end the annual fee.

It should be noted that in 2009, coking coal group held 70%of the equity of Zhao Gu. Therefore, in 2009, the holding subsidiary of the coking coal Zhao Gu was the coking coal group.

It is worth mentioning that a patent applied by Beilu Zhikong also has a patent inventor named Wei Wensi.

2.4 In 2010, Wei Wensi "shaken" and became one of the patent inventors of Bei Road Zhikong

According to the information of the State Intellectual Property Office, on January 28, 2010, Beilu Zhi Control applied for a practical new patent called "a tetraonal testing device based on wireless fidelity". Hu Yanjun, Wang Satisfaction, Jiang Xihui, Wei Wensi, Duan Wenbin, Li Kaige. As of May 31, 2022, the patent case status was endless.

It can be seen that in the three years from 2008 to 2010, Wei Weisi participated in the patent invention of Bei Road Technology, Jiao Coal Zhao Gu, and North Road Zhikong.

The problem is still continuing. Bei Road Zhikong and Henan Energy Enterprises or have cooperated with R & D, while the two parties in cooperation with the next month have carried out business cooperation at the same time.

2.5 In February 2011, Bei Road Zhikong and Henan Energy Company Henan Provincial Coal Sea Gas Cooperation and R & D, the next month began business cooperation

According to the official website of Henan Energy, Henan Provincial Coal Sea Gas Development and Utilization Co., Ltd. (hereinafter referred to as "Henan Provincial Coal Sea Gas") is a subsidiary of Henan Energy.

According to the data and public information of the Market Supervision and Administration Bureau, Henan Provincial Coal Sea Gas was established on January 12, 2007. The Henan SASAC holds 28.31%of Henan Province's coal seam gas equity, which is the actual controller of the coalbed methane in Henan Province. As of May 31, 2022, Henan Province's coalbed methane had no shareholders' change record.

According to the information of the State Intellectual Property Office, on February 11, 2011, North Road Zhikong, Henan Provincial Coal Sea Gas, Zhengzhou North Road Automation System Co., Ltd. (hereinafter referred to as "Zhengzhou North Road") applied for a "Under the coal mine well The patent of the fracture detection device is Jin Yong, Duan Wenbin, Zhang Jie, Lian Zhenzhong, Wei Wensi, Ji Min, Li Bin, Xue Hongjie, Li Penghui, Sun Mingyin, Geng Yi, Wang Dong, Liu Zhiyang, Xu Chao, Xu Chao, Xu Chao, Xu Chao, Xu Chao, Xu Chao, Xu Chao, Xu Chao, Xu Chao, Feng Baoke. As of May 31, 2022, the patent case status was effective for retreat.

The "coincidence" is that the following month when the "coal mine fracture detection device" was applied for the patent "coal mines" cooperation with the coalbed methane in North Road, Beilu Zhikong began to cooperate with Henan Energy. According to the first round of inquiries, since March 2011, North Road Zhikong has begun cooperation with Henan Energy.

It should be pointed out that Wei Wensi, who participated in the invention of Bei Road Technology, Bei Road Zhikong, and Jiao Coal Zhao Gu, may be the same person.

2.6 Bei Road Technology, Beilu Zhi Control and Coking Coal Group all operate the coal mine business. The above Wei Wensi may be the same person

According to the Internet ARCHIVE's interception on May 12, 2008, North Road Institute of Science and Technology is a mining personnel positioning/attendance system, the Xiaolingtong communication system of the underground high tech company.

According to the official website of Coking Coal Group, the energy industry of coking coal group includes the coal sector and the power sector. As of May 31, 2022, the Coking Coal Group has six pairs of coal mines and a power plant.

According to the prospectus, Beilu Zhikong has been deeply cultivated in the field of coal mine production informatization supporting products since its establishment.

It is not difficult to see that the operations of Bei Road Technology, Coking Coal Group, and Beilu Zhikong are all related to coal mines. There is a connection between technology. The above Wei Wendi may be the same person.

Based on this, from 2008 to 2010, Beilu Technology, which was under the same control as Bei Road Zhikong, Zhao Gu, and Beilu Zhikong, a subordinate company of Henan Energy, and a patent inventor named Wei Wensi. In addition, on the second month of the joint application of patents for the joint application of Patent of Henan Provincial Coal Seal Gas of Henan Province on the North Road Zhikong, Zhengzhou North Road, and Henan Energy Enterprise, Bei Road Zhikong began to cooperate with Henan Energy. It is worth mentioning that in the patent developed above, it also includes Wei Wensi. Is the above -mentioned cooperation between Wei Wensi with Bei Road Zhikong and customer Henan Energy? Doubt to be solved.

Born at the end of the hug. Can Beilu Zhikong undergone the test under the "visit light" of the capital market?

- END -

Hainan Free Trade Port's "zero tariffs" imported car tax cuts exceed 10 million (with concise question and answer with policy)

According to the introduction of Haikou Customs on June 23, from Hainan Free Trade Port Transportation and Yacht Zero Tariffs policy list to June 22 this year, Haikou Customs, Haikou Customs, superv

Civilized practice blooms everywhere, "Volunteer Red" is dressed as the city of Lianghongshan University

Jimu Journalist Ye WenboCorrespondent Yu Wei Ma Haibo Xiao ManIntern Deng XinxinCh...