Help the company's confidence and strong confidence to bear responsibility to promote development

Author:China Agricultural Credit News Time:2022.07.01

Help the company's confidence and strong confidence to bear responsibility to promote development

Hao Lixia

In recent years, under the scientific leadership of the Sichuan Rural Commercial Bank under the scientific leadership of the Provincial Party Committee and Mianyang Office, it closely follows the development planning and economic work deployment of the county party committee and county government, firm confidence, and meets difficulties. The market positioning of serving small and micro, serving local economic development "is not shaken. By increasing credit support, the implementation of extension of repayment of principal and interest," reduction of expenses "and other methods, we will focus on giving full play to the" maintenance market entity, guaranteeing employment, and insurance guarantee The role of people's livelihood, comprehensively implement measures to help enterprises, and promote the steady development of the county economy. As of the end of May, the balance of various loans from the bank was 13.113 billion yuan, a net increase of 11.67 billion yuan from the beginning of the year, and a growth rate of 9.77%.

Strengthen the organizational research and find the path of "blood supply"

Three Rural Commercial Bank held a special meeting of the Central Committee of the Party Committee (Expansion), the Affairs Council, and the help of the enterprise, and learned to communicate and implement the spirit of the Central Committee, the Provincial Party Committee, the Supervisory Authority and the Provincial Party Committee of the Party Committee on the help of the enterprise. Decision and deployment, unified ideological actions, and firmly establish a consciousness of "economy is the body, finance is blood, the two symbiosis and prosperity", set up special classes to strengthen the organization and leadership of supporting market entities against epidemic rescue; Fully arranged key industries and key customer groups affected by the epidemic, and figured out the number of key industries and the number of customer subjects through field visits, telephone return visits, etc., and timely grasp the affected situation, the degree of recovery, the current status of market entities and the difficulties of market entities. , Clarify the scope of rescue, establish a key assistance customer account, formulate special service solutions, "one household and one policy" accurately assist. As of the end of May, 128 small and medium -sized enterprises have been connected to the end of May 13,000 households, a loan of 1.172 billion yuan was issued.

Establish a sound system and improve the "hematopoietic" mechanism

Formulate the "Ten Measures for Financial Assisting Enterprises to benefit the people's bailout" and "Apise Card for the Survant for the Enterprise", shoot the special video of the "reduction of fee reductions", use WeChat public account, video number, circle of friends, and major visits to enhance the bailout bailout Policies know aspects and coverage; further implement the non -performing loan tolerance and due diligence exemption requirements of small and micro enterprises, improve and improve the diligence management methods of loan -related personnel, and build a long -term mechanism for loan loans and loans. Establish a rapid approval of green channels in key areas, industries and people to ensure timely loan approval and launch; accelerate the establishment of a full process risk control management system, formulate a list of standardized service processes and loan information lists on the basis of compliance, and settle related loans on schedule. , Enhance the financial service capabilities of small and micro enterprises, complete the improvement of customer experience and loan quality; improve the assessment and valuation mechanism, grasp the performance cost matching, and guide the entire bank to do their best to do a good job of loan.

Increase the credit of credit and strengthen the "blood transfusion" channel

"The credit funds of the three Rural Commercial Bank are really a time in time. The development of the park not only has government policy support, but also has funds." Hong Zhenhua, the person in charge of the park, mentioned that the park's development confidence was full. Located in the Western Food Packaging Industrial Park in Luxi Town, Sanxi County, under the witness of relevant departments of government departments and food, packaging, small and medium -sized enterprises at all levels of the city and county, the three Rural Commercial Bank signed the "" "Bank Enterprise Comprehensive Strategic Cooperation Agreement", a comprehensive credit of 500 million yuan in the park, and providing "a package" comprehensive financial services. In order to help the company's rescue work, the three Rural Commercial Bank strengthened support for weak links and key areas, increased the support of key projects and key enterprises, and focused on the field of people's livelihood, seriously affected by the epidemic, and significant impact on employment. Industry enterprises are tilting, strengthened product combing and innovation, accurately connected the needs of different customer bases, strengthened the two online and offline publicity of "Shu Xin E · Loan" and "Shuxin E · Small Agricultural Loan", enhanced remote customers The credit surface, at the same time, pay a good job of returning visits of the stock customers, accurately publicize the rate of loan credit rate, and provide strong product support for financial support for market entities, and fully meet the daily consumer financial needs of residents. As of the end of May, online intelligent loan credit credit credit 2.76 Thousands of households, the amount of 2.327 billion yuan, 13,700 households with a letter, and a balance of 911 million yuan; strengthened the use of fintech technology, further promoted the work of "visiting thousands of visits" and "whole village credit" work, do a good job of collecting farmers' economic information collection and financial demand docking. To make full use of the advantages of digital and remote services, the bank issued a lending of the first village collective economic organization in the county, and established a cooperative relationship with the county's 383 rural collective economic organizations in the county. From January to May, the bank invested 10.853 billion yuan in various loans to the county, and the balance of loans increased by 1.167 billion yuan at the beginning of the year, an increase of 9.77%. The balance was 6.894 billion yuan, accounting for 52.57%, and a total of 5.621 billion yuan in agricultural loans, with a loan balance of 10.633 billion yuan, accounting for 83.97%.

Do practical reduction of fees and make benefits, build a "blood supplement" platform

"The construction cycle of waste incineration power generation projects is long, and the impact of the epidemic is long. The problem of tight capital chain. "The person in charge of the three renewable energy Co., Ltd. talked about the development of the enterprise. In order to further implement a measure of the Party Central Committee's stability of the economy, the bank combines the needs of market entities to revise "10 measures for loan interest rates", and add 2 interest rate preferential measures for enterprises that have a greater impact on the epidemic and keep employment. Implement accurate interest rate cuts. From January to May, the average weighted interest rate of new credit was reduced by 64 BP compared with 2021. Among them, the average interest rate of inclusive small and micro-enterprise loans decreased by 75BP compared with 2021. At the same time, the policy of currency, taxation, and rewards for the agricultural credit institution will be transformed into interest rate pricing advantages, rationalizing the profit from the real economy, effectively reducing the burden on enterprises, and improving development vitality; Increase risk resolution measures such as credit loans and medium- and long-term loans, and relieve the repayment pressure caused by the epidemic period. From January to May, a total of 307 Inclusive micro-loan was extended and the amount was 209 million yuan. 3210 credit loans and 420.77 million yuan; continuing to reduce the transfer fee of market entities such as small and micro enterprises, individual industrial and commercial households, etc., and exempt account management fees to reduce the operating costs of the market entity, and the implementation of the policy of benefiting enterprises and the people is implemented. As of the end of May, a total of 11603 small and micro enterprises and individual industrial and commercial households have been reached to profit reduction. The cumulative fee reduction scale is 740,000 yuan. Three Rural Commercial Bank will continue to be based on the new stage of development, implement new development concepts, build a new development pattern, and implement the decision -making and deployment of the Party Central Committee, the State Council and the Provincial Party Committee, and the Provincial Government, strengthen responsibility, strengthen development confidence, further further develop confidence in development, further further development Increase credit investment, improve the level of financial services, and make new contributions to the high -quality development of the county economy, and welcome the 20th National Congress of the Communist Party of China with excellent results.

- END -

China Gold News Agency held a new office area opening ceremony

On the morning of July 1st, China Gold News Agency held a new office area opening ...

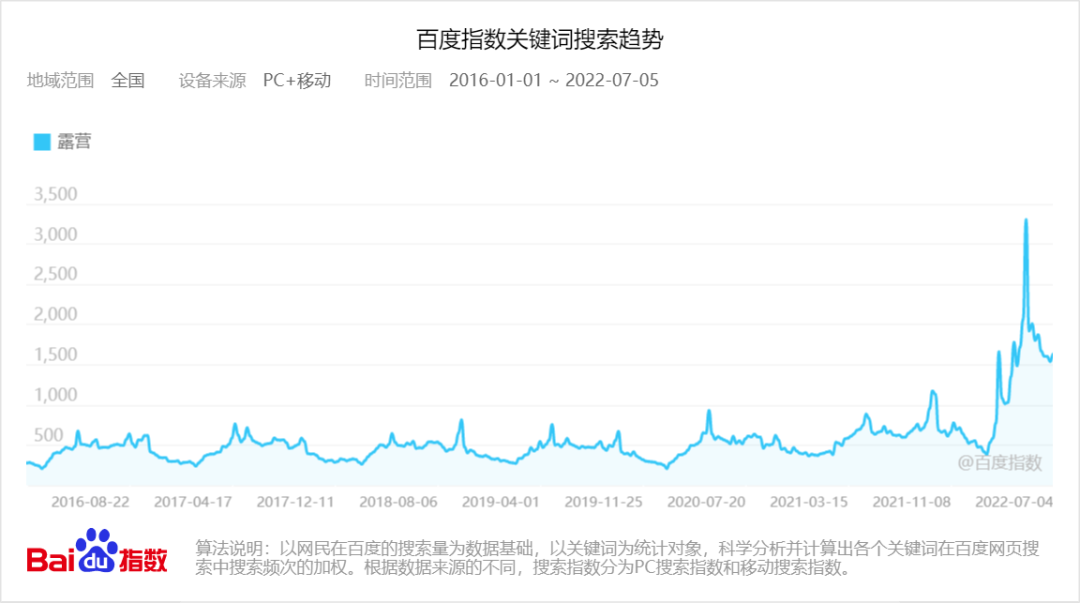

Camping fire to 618, the head brand is stable, niche brands rely on subdivided breakouts

In 2022, camping is undoubtedly one of the most outsiders lifestyles. Due to the p...