Public funds "High School Entrance Examination" unveiling: championship is 57%, "Semiconductor One Brother" Cai Songsong ranked second

Author:Red Star News Time:2022.07.01

With the end of the last trading day in June, the semi -annual performance of public funds was also released.

In the first half of this year, under the rise of energy prices in Russia and Ukraine, the Federal Reserve was expected to tighten a series of superimposed factors such as currency and epidemic conditions, and the A -share market came out of the "V" type reversal. In the first half of this year, the Shanghai Composite Index rose 1.1%, and the Shenzhen Stock Exchange Index rose 1.57%. After the first quarter of energy prices, the large -scale division of the second quarter, and the top 20 public offer funds also reshuffled again.

Public fund -raising funds that won the "high school entrance examination" championship, due to the main investment of crude oil -related varieties, earned 57.36%in the first half of this year; the runner -up fund made 52.41%in the first half of the year due to heavy warehouse coal and real estate. However, it is worth noting that investors have noticed that with the recent announcement of many countries that have increased crude oil production, the price of Brent crude oil has fallen to $ 108.9/barrel.

The 10 funds at the bottom of the public offering of the "high school entrance examination" have lost more than 30%this year. The loss of the overseas high -income bond funds of Cathay Pacific China Enterprise has reached 40.36%this year, and the gap between the public funds and one end of the public fund is close to 100%. In addition, Cai Songsong, a "semiconductor brother", also ushered in the dark moment.

Energy funds still make great money

"Dark Horse" Fund won two or three places

Geopathic conflicts have led to surge in global energy commodity prices. After the commodity and energy prices rushed in the first quarter, the trend of the second quarter was differentiated. After a brief return of crude oil prices, the price of Brent crude oil climbed again at 125.3 US dollars/barrel high in June. Essence The main contracts such as coking coal, vegetable meal, palm oil and other main contracts have insufficient stress since April, and the product performance has been differentiated. In addition, A shares have begun to fight back in late April, making it difficult for the goods energy to repeat the "unified rivers and lakes" in the first quarter.

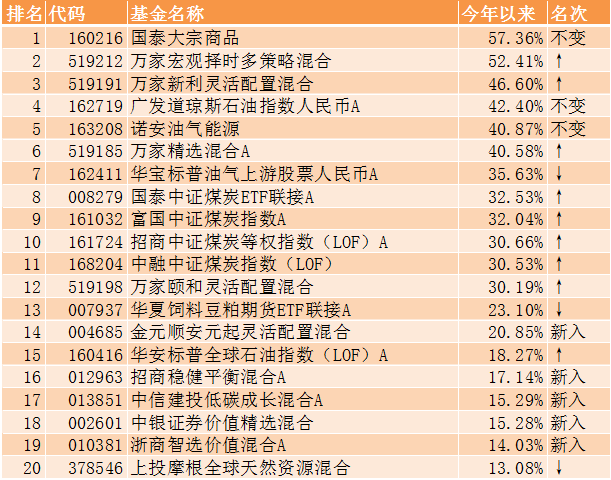

Based on the data of the Tiantian Fund, as of June 30, the reporter's closing of the fund C share was removed on June 30. The reporter found that the gap between 20 performance in the first half of the public fund was huge, with a maximum of 57.36%, while the 20th place was only 13.08%.

▲ In the first half of the year's fund performance TOP20

In the first half of this year, the "Chinese Entrance Examination" champion was obtained by the Cathay Pacific Commodity QDII Fund, with a great achievement of 57.36%. The fund -related investment varieties related to this fund, which have increased by 40.40%in Brent crude oil prices in the first half of this year. Cathay Pacific Commodity QDII Fund also won the first place in the list in the first quarter of this year.

The funds of the two heavy warehouse coal mining industry entered the list with the "dark horse". Wanjia macro -selection multi -strategy hybrid funds and Wanjia Xinli were flexible, respectively, with 52.41%and 46.60%of the results, and won the runner -up and third runner -up. The fund managers of these two funds are Huanghai. He entered the Wanjia Fund since April 2015. He has only one year and 281 days as a fund manager. The total scale of 4 funds under the name is only 1.29 billion yuan.

Both fund holding industries are highly high, with about 46%of the mining industry, and 35%distributed in the real estate industry. In the first half of this year, the A -share coal sector rose by 31.38%, of which coal mining rose 43.32%, and housing construction increased by 13.63%.

It is worth noting that investors pay attention to the performance list of public fund performance. It is only a reference for historical performance. Whether funds can continue good performance in the future need to be judged in combination with more information.

▲ TOP10 of public fund performance in the past 3 months

The reporter sorted out the performance rankings of public funds in the past three months. The recent rise in funds are mainly concentrated in the new energy vehicle sector. Many index funds have performed well. Rat 37.93%.

The countdown TOP10 is the worst loss of 40%

"Semiconductor Brother" Cai Songsong ushered in a dark moment

Public funds in the first half of the year are the countdown to TOP10, and the losses have exceeded 30%.

Last year, the Fund Manager Yuba Nian managed the Penghua Global Short -Term Treasury (QDII) Fund. Due to the heavy positions, the real estate overseas debt caused the net value of the fund to fall by 48.97%, which was close to the "chopping". This year, there are also fund managers and Yubian, and they have also stepped on the "deep pit" of overseas debt. Cathay Fund Manager Wu Xiangjun's Cathay Pacific China Enterprise Overseas High Investigation Bonds (QDII) lost 40.36%.

▲ In the first half of the year's countdown performance TOP10

The Fund's 4th quarterly report showed that the top 5 bonds held by Chinese companies' overseas high -yield bonds (QDII) were the US dollar bonds issued by Times China Holdings, Xuhui Holdings, Country Garden, and Lu Jin infrastructure. Fund manager Wu Xiangjun also mentioned that since the fourth quarter, the Chinese -funded US dollar debt -like fault has fallen, and the real estate debt in the high -yield debt sector dragged down seriously.

Since last year, the stock market adjustment, many top -flow fund managers were "folded into the sand", and Zhang Kun's Yifangda Asian Selection Stock Fund ranked 7th in 2021 to lose 30.63%. "Cai Songsong, a brother of semiconductor, also ushered in a dark moment. The Norian Innovation Drives Mixed A Fund, which plunged 36.86%in the first half of the year.

Cai Songsong's experience was quite "cross -border". At the age of 15, he entered the Chinese University of Science and Technology's youth class. After receiving a doctorate degree, he entered the design of the Chinese Academy of Sciences chip design. Later, he moved to a brokerage researcher. In 2019, he served as a fund manager.Later, he concentrated its position in semiconductors. Thanks to the science and technology market, Noon's growth and hybrid performance soared to 200%. In 2021, a sentence, "Don't make money, call me President Cai, lose money and call a dog."EssenceIt is worth noting that in the recently announced Cai Songsong Fund's positions, all the top ten heavy stocks have "changed blood" and no longer have semiconductors. Instead, they are distributed in computer software and media industries.Red Star News reporter Lu Bo

Edit Yu Dongmei

- END -

Look!Stellar airport played "flash"

Jimu News reporter Shi QianCorrespondent Huang Sheng Song QianOpening with a melod...

Shenzhen Stock Exchange Kohongtong Platform focuses on low -carbon sustainable development

The Shenzhen Stock Exchange's V-Next platform is a professional equity investment ...