Foreign institutional investors participated in the first batch of trading of the Shenzhen Stock Exchange's debt market to complete the "head soup" of BOC Hong Kong Hong Kong BOC Macau

Author:Securities daily Time:2022.07.01

Our reporter Xing Meng Xue Meng Reporter Guo Jichuan

On June 30, the "Implementation Rules for the Implementation of the Shenzhen Stock Exchange China Securities Registration and Settlement Co., Ltd.'s overseas institutional investor bond transactions and registration settlement business" (hereinafter referred to as the "Implementation Rules") was officially implemented. On the same day, Bank of China (Hong Kong) Co., Ltd. (hereinafter referred to as "BOC Hong Kong") and Bank of China Macau Branch (hereinafter referred to as "BOC Macau") successfully completed the first batch of transactions.

The "Implementation Detailed Rules" detailed the provisions of foreign institutional investors' account opening, transaction, settlement, and information reporting. The Shenzhen Stock Exchange and China Settlement and Member Agency, Custodian Institutions and other parties have steadily and orderly promoting the implementation of the business.

After the release of the "Implementation Rules", foreign investors quickly expanded their investment channels and actively participated in it. BOC Hong Kong and BOC Macau holding the inter -bank filing documents to apply for a legal securities account to China Settlement Application, and reached bond transactions with the opponent Fang Oriental Securities and CITIC Securities through the brokerage model.

BOC Hong Kong and BOC Macau stated that the aforementioned mechanism allows foreign institutional investors to be recorded by banks directly to open accounts on the exchange market, without having to apply for access again, effectively reducing the cost of participating in the exchange of the exchange of the exchange. The bond market is convenient and quickly investing in interest rate bonds and high -quality corporate bonds, which is of positive significance for the financial market and domestic and foreign financial markets.

As a trading opponent, CITIC Securities and Oriental Securities stated that most of the foreign institutional investors who have recorded them are mature institutional investors such as large banks, insurance, and sovereignty institutions to attract the above institutions to enter the market. The diversified construction also improves the liquidity of the exchange bond market, and optimizes the market price discovery function and the asset pricing capacity of participating institutions.

"The recent exchanges' bond markets are good for frequent circulation, including free bonds (excluding convertible corporate bonds) and asset -supported securities flow fees, transaction fees, broadening overseas institutions to participate in the exchange bond market channels, etc. Increase the enthusiasm of exchanges bond investors, expand market entities, and increase market activity, which is conducive to better use of the capital market function. "Deng Haiqing, chief economist of AVIC Fund, told the Securities Daily reporter Openness will help improve the efficiency of China's bond market and absorb more overseas capital inflows.

Bai Wenxi, chief economist of IPG China, told reporters that expanding the channels for overseas institutions to participate in the exchange of exchange bond markets. For the long -term development of the domestic bond market, in addition to bringing new funds and new investors, they also It can increase the degree of openness and internationalization of the domestic capital market and the bond market, and help promote the sustainable and healthy development of the domestic multi -level capital market.

The chief economist of CITIC Securities has further stated that overseas institutions bring more international vision that can improve the internationalization level of my country's capital market in all aspects of talent, trading habits, and infrastructure.

In recent years, with the rapid development of the exchange bond market, varieties have continued to be rich and distinctive, and the attractiveness to overseas investors has gradually increased. In the early stage, more than a hundred overseas institutional investors participated in the Shenzhen Stock Exchange's bond market through QFII/RQFII, and invested the target to cover various varieties such as government bonds, corporate bonds, and convertible corporate bonds.

The relevant person in charge of the Shenzhen Communications Office stated that the next step will continue to deploy in accordance with the unified deployment of the China Securities Regulatory Commission, actively promote the establishment and improve the mechanism arrangement of overseas institutional investors to participate in the exchange of the exchange bond market, guide diversified investors to continue to participate in the Shenzhen Stock Exchange's bond market, and continuously attract attraction Overseas medium and long -term funds enter the market, improve the two -way opening level of the exchange in the exchange of the exchange, and further give full play to the role of the bond market to serve the real economy and the "dual zone" construction strategic function.

- END -

The top ten projects in Chengdu happy and beautiful life will implement 363 projects this year, with a total investment of 783.8 billion!These projects started this month

On the morning of June 15th, the ten major projects in Chengdu's happy and beautif...

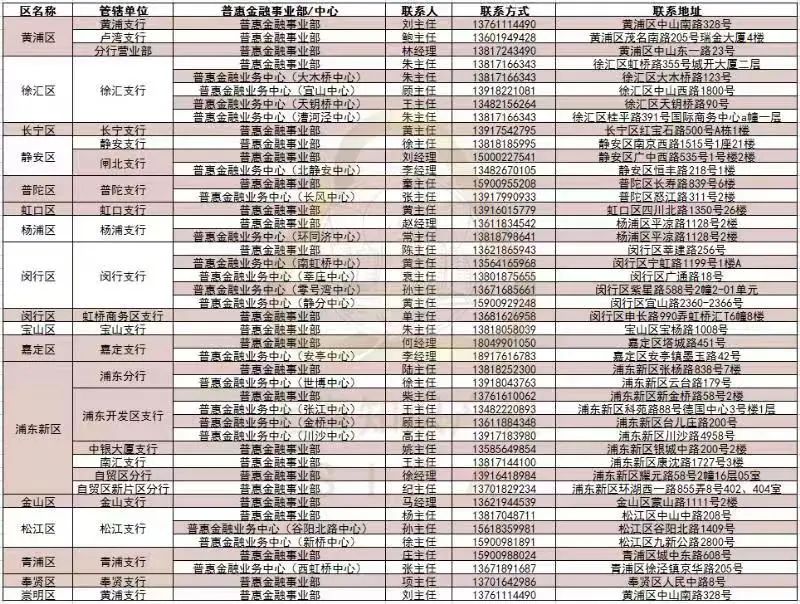

Shanghai starts the trademark pledge to help the city's restaurants such as catering, cultural tourism, and other key industries for bailout "Zhihui Bank" special activities

The Municipal Intellectual Property Office and the Bank of China Shanghai Branch c...