"The Printing Tax Law of the People's Republic of China" will be implemented on July 1st.

Author:Cover news Time:2022.07.01

Xu Yuang Liu Yanting Cover Journalist Liu Xuqiang

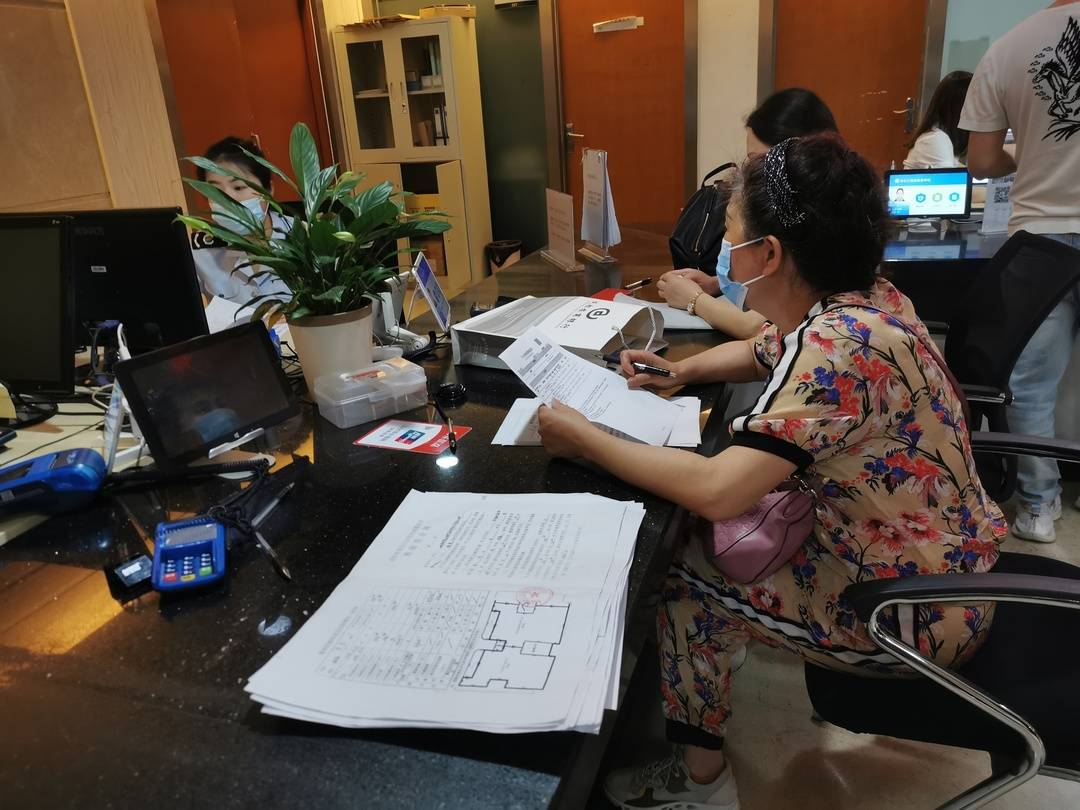

In the early morning of July 1, when Chengdu citizen Liang Wenxiu came to the tax window of the Government Service Hall to handle the real estate transaction business, he found that he only needed to pay deed tax and no stamp duty. The staff at the tax window explained to her that from July 1, the stamp duty was levied on rights and licenses. "Although the money is not much, I feel the country's real tax reduction measures." Liang Wenxiu said with a smile.

运 Changyun Flying Horse Freight Industry Co., Ltd. is a company specializing in cargo transportation. In 2021, the company signed a total of about 60 million transportation contracts and paid about 30,000 yuan in stamp duty. Zheng Yanping, the person in charge of the financial leaders today, learned that with the implementation of the "Printed Tax Law of the People's Republic of China" (referred to as the "Printing Tax Law"), the stamp tax rate of cargo transportation contracts dropped from 5 in 10,000 to three -ten thousandths. According to data calculation in the same period last year, the policy in the second half of the year can bring about 6400 yuan in tax incentives to the enterprise.

Chengdu citizens apply for tax payment business at the real estate trading window

It is reported that from July 1st, the "Stamp Tax Law" was officially implemented. The reporter learned from the Sichuan Provincial Taxation Bureau that this new law has landed in Sichuan today.

What are the changes in the newly introduced "Stamp Tax Law" compared with the "Interim Regulations", and what are the aspects of taxpayers need to focus on? Zhao Shan, deputy director of the Sichuan Provincial Taxation Bureau's Property and Behavior Tax Office, introduced that on the basis of maintaining the current taxation framework, the "Printing Tax Law" has changed the scope of taxation, tax rates, and taxation basis. The subject is reduced.

Specifically, the "Printing Tax Law" reduces the stamp tax rate of five taxable vouchers: contract, construction engineering contract, transport contract, trademark right, copyright, patent rights, and proper technical use right transfer document. The stamp tax rate has been reduced from five percent of the original to three thousandths, and the stamp tax rate of the business account book has been reduced from five percent of the original to 2.5th.

It is worth noting that the "Printing Duty Law" clearly stipulates that the six types of vouchers do not levy stamp duty: except for the records of the capital book, other business account books do not levy stamp duty; The contract does not levy stamp duty; the interbank borrowing contract does not levy stamp duty;

The reporter found that the "Stamp Tax Law" deleted the "other account books", "rights, license licenses" taxis listed in the "Interim Regulations" and the provisions of "other credentials determined by the Ministry of Finance". The previous provisions were 5 yuan for each stamp duty permit for rights and permits.

In addition, the "Printing Tax Law" also canceled the number of tails and directly calculated tax taxes according to the actual actual amount.

- END -

Perfect World 2022 Half -year performance reversed: net profit increased by more than three times year -on -year

Last night, the A -share media leader Perfect World (002624.SZ) disclosed the semi...

Steady economic promotion development | Hunan Chenzhou: Financial "living water" stimulates the stability of the economy

Luzhou Daily All Media Reporter Tang SisiA few days ago, Luzhou City issued the 1+7 policy system to solve the actual difficulties and problems in the economic operation of Luzhou. What are the mone