A number of private equity "assault shares" of Xiaoying Technology IPO, the price difference of more than 100 yuan at the same period of the shareholding price

Author:Public Securities News Time:2022.07.01

Last year, the CSRC issued the "Application of Regulatory Rules for Supervision Rules -Regarding the Disclosure of Shareholders' Information Disclosure for the First Listed Enterprise" to strengthen the supervision of shareholders who intend to listed. Hangzhou Xiaoying Innovation Technology Co., Ltd. (hereinafter referred to as "Xiaoying Technology"), which is planned to be listed on the GEM, has 14 private equity fund shareholders or private equity fund managers shareholders, among which there are private equity of "assault" before IPO.

A reporter from the Public Securities News Daily Mirror Financial Studio noticed that among the shareholders introduced by Xiaoying Technology, investors hold the shareholders of the founder's shareholders. At the same time, the shares of the shares are different. Private equity shareholders will increase their capital and establish and record.

Multiple private equity IPOs

The listing standard for the selection of Xiaoying Technology in this IPO is Article 2.1.2 (2) of the Listing Rules of the GEM Stocks, that is, "the estimated market value will not be less than RMB 1 billion, and the net profit in the past year is positive and operated. The income is not less than RMB 100 million. "

In the prospectus, Xiaoying Technology said: "The company's financing valuation in 2020 is more than 1 billion yuan. According to the comparison company valuation of the company in the same industry, the company's preliminary financing valuation and the current operating situation, the company's estimated market value is not lower than lower than that 1 billion yuan. "In terms of performance, in 2021, Xiaoying Technology achieved operating income of 384.9055 million yuan and net profit of 820.0186 million yuan, which was based on the net profit attributable to shareholders of the parent company (based on deducting the low before and after the low -end increasing profit and loss). 742.823 million yuan.

Looking back at the growth of Xiaoying Technology, the valuation of only 100,000 yuan at the beginning of the company's predecessor, and the overall valuation before the IPO reached 2 billion yuan. The Department of Xiaoying Technology was established by Hangzhou Qiwei Technology Co., Ltd. (hereinafter referred to as "Qiwei Limited"). When it was established in June 2012, the registered capital was only 100,000 yuan. Since then Shareholders, the company's overall valuation of the company's overall valuation before 2020 has reached 2 billion yuan.

There are 33 natural persons or enterprises in this sponsor, of which 14 of the shareholders of private equity fund or private equity investment fund manager, including Chengdu Wuyue, Qingdao Jiqu, Suzhou Wuyue, Dachen Chuangtong, Cai Zhizheng, Zhejiang Chuangchuang, Zhejiang Chuangchuang Thinking, Chengdu Tianfu, Junrun Henghui, Jun Run Kezhi, etc.

The reporter noticed that among the above -mentioned private equity introduced by Xiaoying Technology, the establishment time of Qingdao Jiqu and Cai and Wisdom is close to the limited time of capital increase. Qingdao Jiqu also has the situation of increasing capital and establishing and filing.

The prospectus shows that on July 220, 2020, the Funweai Co., Ltd. made a resolution and agreed that Qiwei Co., Ltd. added a registered capital of 761989.13 yuan. The inquiry of the Securities Investment Fund Industry Association found that the establishment of Qingdao Jiqu was on July 3, 2020, and the filing time was July 9, 2020 (see Figure 1).

Figure 1: Qingdao Jiqu Investment Management Center (Limited Partnership) was established and filing time

There is a similar situation in another shareholder's wealth and wisdom. The prospectus shows that on September 29, 2020, the Funwei Limited Shareholders' Association made a resolution. Among them, Dachen Chuangjing transferred 12906.32 yuan (corresponding to 0.35%of the equity) to Cai and Wisdom. 10,000 yuan. On October 13, 2020, Qiwei Co., Ltd. completed the industrial and commercial registration of this equity transfer, and the Hangzhou West Lake District Market Supervision and Administration Bureau issued the "Business License". The Shenzhen Caizhizhi Win Private Equity Investment Enterprise (Limited Partnership) was filed on December 24, 2020 (see Figure 2).

Figure 2: Shenzhen Caizhizhi Win Private Equity Investment Enterprise (Limited Partnership) filing time

Qingdao Jiqu still has the situation that the registered place is not in the same jurisdiction. The wealth and wisdom has a low disclosure account opening rate of investors, and the manager reports that the information is inconsistent with the industrial and commercial registration information. Why did Qingdao Jiqu establish and filed after the capital increase? Why did the wealth and wisdom and wins increase the capital, and the fixed filed? Is the two private equity funds be established for investment in Xiaoying Technology?

Investor holding the "approach" founder

Qingdao Jiqu also consistent with Zhao Weiguo, Chengdu Wuyue, and Suzhou Wuyue. The proportion of holding a small shadow technology shares is very close to the founder, chairman and general manager of Xiaoying Technology.

As of the date of signing the prospectus, Han Sheng, Xiong Yongchun and Chen Chengfeng directly held Xiaoying Technology's shares of 27.98%, 6.57%, and 6.57%, respectively, with a total shareholding ratio of 41.12%, which was the company's controlling shareholder and actual controller. And Zhao Weiguo, Chengdu Wuyue, Qingdao Jiqu, and Suzhou Wuyue constitutional acting, holding 0.70%, 19.46%, 3.92%, and 0.93%of Xiaoying Technology, respectively, respectively, with a total shareholding ratio of 25.01%.

From the perspective of affiliates, the implementation of the executive partnership of the Wuyue and Suzhou Wuyue of Chengdu is Ningbo Xurui Enterprise Management Consulting Partnership (Limited Partnership). Yu Weiguo, Zhao Weiguo holds 50%of the equity of Ningbo Wuyueyu Investment Co., Ltd. and serves as its executive director and manager; 50%of the equity of Management Co., Ltd. and serving as its executive director and general manager. At the same time, Zhao Weiguo as a limited partner holds a 15.6%property share of Qingdao Jiqu; Qingdao Jiqu and Suzhou Wuyue's private equity fund managers are the investment management of the Wuyue world of Suzhou Co., Ltd., Zhao Weiguo holds 50%of Suzhou Wuyue Tianxia Investment Management Co., Ltd. and serves as its executive director and general manager; the private equity fund manager of Chengdu Wuyue is Beijing Wuyue World Investment Consulting Co., Ltd. 50%of the company's equity and as their executive directors and managers. It is found that the Chengdu Wuyue was established on May 14, 2013, and the executive partners have been changed several times since 2020. In November 2020, it was changed from Beijing Wuyue Tianxia Investment Consulting Co., Ltd. to Ningbo En Five Investment Management Co., Ltd. It was changed to the newly established Ningbo Xurui Enterprise Management Consultation Partnership (Limited Partnership).

During the same period, the price difference is more than 100 yuan

In addition to the above -mentioned shareholders, Xiaoying Technology introduced a number of shareholders within the year before the declaration, and it is even more important to have the same but the price of the same shareholding time.

Xiaoying Technology first disclosed the declaration draft in September 2021. According to the "Administrative Guidelines for Regulatory Rules in February of 2021 -Regarding the Disclosure of Shareholders' Information Disclosure for Application for the First Listed Enterprise", it will be confirmed to be pushed within 6 months from 6 months before IPO declaration. As a result, Xiaoying Technology's equity transfer in October 2020 obviously belongs to "assault shares."

In October 2020, Xiaoying Technology carried out seventh equity transfer. Qiong transferred the limited equity held by Jun Run Kezhi, Jun Run Henghui, and Wang Yu.

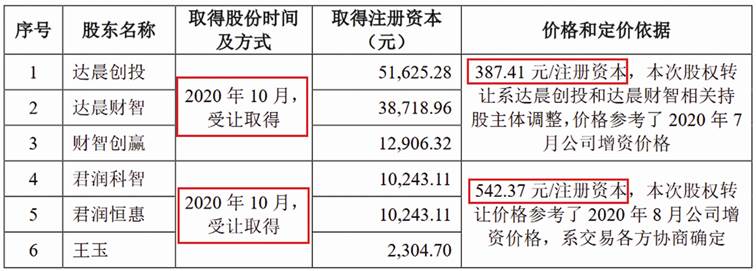

The transaction time is the same, but the transaction price is very different. From the perspective of the transaction price, Dachen Venture Capital, Dachen's wealth and wisdom and wealth and wins won the shares of 387.41 yuan/registered capital, while Jun Run Kezhi, Jun Run Henghui and Wang Yu received 542.37 yuan/registered capital. Let the shares (see Figure 3).

Figure 3: The new shareholder status of the year before Xiaoying Technology declaration

Dachen Venture Capital is the largest shareholder of Dachen Cai Zhi, with a capital contribution of 35%. Junrun Henghui's executive affairs partner and private equity fund manager are Ningbo Junrun Entrepreneurship Investment Management Co., Ltd.. Kezhi's executive affairs partner and private equity fund manager are Ningbo Junrun Kewuki Innovation Investment Management Partnership (Limited Partnership). And serve as his executive partner.

For different prices in the same period, Xiaoying Technology is interpreted as the valuation of the transaction reference: "According to the development of the issuer's business and the growth of performance, the overall valuation of the transfer of the old stocks of Funwei is 2 billion yuan, but Yinchen Chuangchuangchuang Chuangchuang Chuangchuang Chuangchuang Chuangchuangchuang Chuangchuo Based on the needs of adjusting the owner of the shareholding, the scene was transferred to Dachen Venture Capital, Dachen's wealth, and wealth and wisdom. The overall valuation of Uighurs is 1.4 billion yuan; at the same time, Xiong Yongchun, Chen Chengfeng, and Liu Qiongji need to sell some interesting equity of Funwei in personal funds, and they have negotiated with Jun Run Kezhi, Jun Run Henghui, Wang Yu, and Jun. Run Kezhi, Jun Run Henghui, and Wang Yu have supported Xiong Yongchun, Chen Chengfeng, and Liu Qiong, which is a limited equity held by the aforementioned old stock transfer.

While introducing multiple shareholders, Xiaoying Technology also signed a gambling agreement. From 2013 to 2020, Chengdu Wuyue, Qingdao Junfu, Suzhou Wuyue, Zhao Weiguo, Dachen Chuangong, Dachen Venture Capital, Dachen Cai Zhi, Cai Zhi Chuang Win, Junrun Henghui, Junrun Kezhi and other total 27 When investing or transferring the equity of Xiaoying Technology, the famous shareholders agreed with Xiaoying Technology on the terms of gambling. The rights of special shareholders on the terms of the gambling clause include liquidation priority, the right to allocate the priority distribution, the right to withdraw, the right to obtain information, the right to subscribe for the priority, the right to transfer, and the right to sell, and the right to repurchase. Among them, Xiaoying Technology is agreed to repurchase the right to repurchase the right to repurchase such as the failure of listing and issuance in Chengdu Essence

In the prospectus, Xiaoying Technology prompts the risk of gambling agreement: "According to the supplementary agreement signed by all parties, the relevant provisions have been terminated, and the gambling clauses will no longer have effective. Through, the above -mentioned shareholders may require the company to sign a gambling agreement, and may require the conditions and specific arrangements to trigger the company's repurchase obligations in the agreement. If the company's repurchase obligations are triggered, the company's liabilities may increase and reduce net assets. "It should be pointed out that Xiaoying Technology's asset -liability ratio is higher. Xiaoying Technology's asset -liability ratio at the end of 2018 and at the end of 2019 was much higher than comparable companies. The prospectus showed that from the end of each issue of 2018 to 2021, the company's asset -liability ratio was 108.97%, 144.41%, 67.15%, and 46.36%.

So, what is the purpose of adding six new shareholders within the year before the application of Xiaoying Technology IPO? Is it the main reason for the rapid decline in the liability ratio of external investment? Is there a adverse effect on the gambling agreement on the company? In the month, the valuation has changed significantly? For this reason, the reporter of the "Public Securities News" Mingjing Financial Studio previously sent a letter to Xiaoying Technology, and as of the time, no reply was received.

Reporter Cheng Shu

- END -

Capital adequacy ratio has decreased, and multi -shareholders' equity is pledged or frozen!How should Changsha Bank break through?

Xinhua Lian, the seventh largest shareholder of Changsha Bank, has all frozen 210 ...

This "official" is not big, but it is very important for Zhejiang to introduce the plan to promote the establishment

Zhejiang News Client reporter Huang HongRelated web screenshotRecently, the Zhejia...