Victory 12 billion yuan!Multiple companies are against the trend of this type of fund

Author:China Fund News Time:2022.07.03

China Fund reporter Lu Huijing

In June of this year, the Fed's target range of the interest rate federal fund interest rate rose from 0.75%-1.00%to 1.50%-1.75%, and the "violence" raised 75 basis points, the largest raising rate of interest rate hikes since November 1994. This is also the third rate hike for the Federal Reserve this year.

The Fed's continuous interest rate hikes, superimposed on Russia and Ukraine's conflict, led to soaring commodity prices. The US stock market continued to adjust. As of July 3, the S & P 500 and the Nasdaq 100 Index fell 19.74%and 29.01%during the year, opening a technical bear market.

Faced with the continuous adjustment of the US stock market, the number of funds companies with 100ETFs in the Paye Pay Index have gradually increased. At the same time, the number of NATFs that have been listed on the market have increased significantly, with a maximum increase of more than 800%within the year.

When talking about US stock investment opportunities, there are still many differences in industry insiders. Some opinions believe that if the inflation trend is eased, the economic trend is better, or it is conducive to the stabilization of US stocks; there are also opinions that the tightening of policy and economic recession is still the largest pressure on the market, and US stocks may face the risk of further adjustment.

Fund Company's retrograde layout Naiga ETF

The products on the venue attacked the trend of more than 12 billion yuan

Despite the continuous adjustment of U.S. stocks since the beginning of the year, it officially ended the 13 -year slow cow market for the financial crisis in March 2009. However, in recent times, the number of funds companies that reported to the US stock index on the trend have quietly increased.

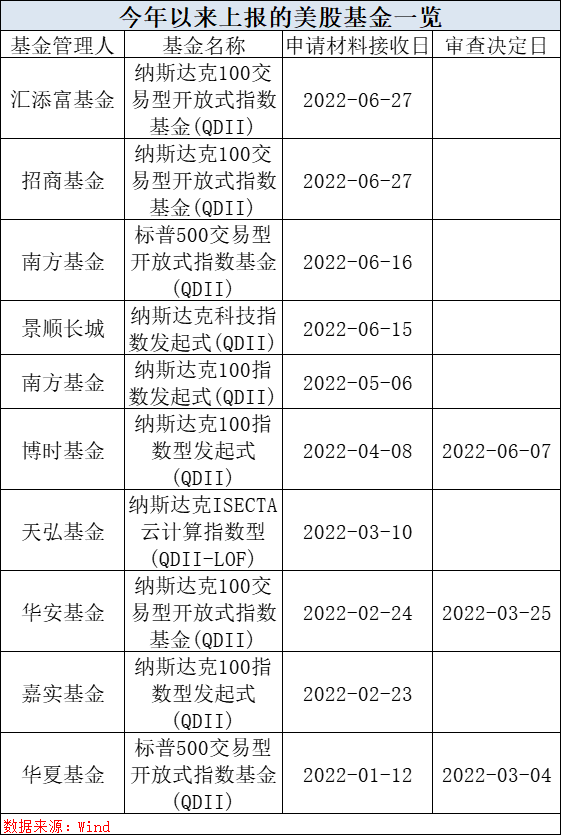

According to the website of the Securities and Futures Commission, on June 27, Huitianfu and China Merchants Fund reported to Nasdaq 100ETF. In mid -June this year, the south and Jingshun Great Wall also reported the S & P 500ETF and Nasdaq respectively. The technology index initiated fund.

According to Wind data statistics, in addition to the above -mentioned fund companies, since this year, funds including Castrol, Hua'an, Boshi, and Southern have reported to Nasdaq 100ETF or Nasdaq 100 Index Fund. Tianhong Fund also also A fund product named Nasdaq ISECTA Cloud Computing Index was reported, and some funds were already approved.

In the view of Liu Jie, the GFNa Index 100ETF and the manager of the connection fund, the layout of the NATF ETF of many fund companies has brought some investment opportunities and market investment demand for many fund companies since this year. "As of the end of May, the NAS Index 100 index has fallen by more than 25%since 2022. In recent months, the Federal Reserve’ s interest rate hikes and shrinkage have led to a low market sentiment. It covers many US stocks and even global technology giants. Therefore, in combination with the current market conditions, the investment opportunities and investment value of the Nasda Index 100 Index 100 have received continuous attention from the market. "

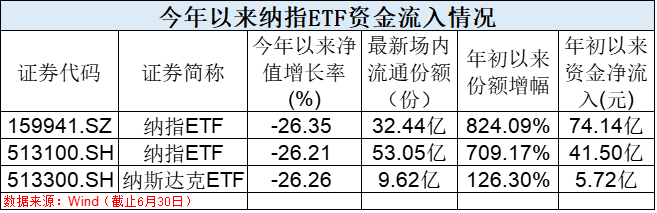

In addition to the fund company's adversity layout, the funds on the venue are also trying to use the NATF ETF that has been listed on the market. According to Wind data, as of June 30, the GFNa Index ETF, Cata Index ETF, and Huaxia Nasdaq ETF were 3.2044 billion, 5.305 billion, and 962 million copies, respectively, an increase of 824.09%and 709.17%compared to the end of last year, respectively. , 126.30%. Based on the average transaction price, the funds inflows from 7.414 billion yuan, 4.150 billion yuan, and 572 million yuan since the beginning of the year, and the total inflow of funds exceeds 12 billion yuan. Since then, the inflow of funds has exceeded 8.3 billion yuan in the inflow of three NATF ETFs.

An industry insider said that for a long time, the stock ETF has the characteristics of "more and more buying and buying". The ETF scale and the target index show a negative correlation in the short term. On the contrary, when the index fell rapidly, ETF was prone to net purchase.

Liu Jie believes that the recent NATF ETF "adversely attracts gold" is because of this year's US stocks, especially the Nasdae rebound, which is relatively rare in history. The market funds are very concerned about the short -term global technology giants covered by the Na index 100 100. Investment opportunities and long -term allocation value.

From a short -term perspective, every time the short -term policy is superimposed, there are some opportunities to rebound games. For example, after the Federal Reserve raised hikes in March 25bp, the boots landed, and the market formed a short -term continuous rebound; the market situation from April to June was roughly the same. Before and after the interest rate hike policy, the market fluctuated, and the air overwhelmed. Or the back.

From the perspective of long -term investment, high -tech companies represented by Na Shi 100 are still an important reference indicator of the US economy. Although the performance of some companies in 2022 is not expected, the Bloomberg client data shows that the Nasda Index 100 is in the NASCO 100 in it. In 2022 and 2023, the ROE forecast data remains a high level. Therefore, under the trend of existing interest rate hike expectations with the market, in the future in the future, in the case of fully adjusting the market, the leadership of US stock technology leaders is probably probably probably probably. It is still determined by the fundamental situation to determine its secondary market performance.

Inflation expectations will still affect the US stock market

There are still differences in investors

What are the conditions for the US stock market that has been adjusted for half a year? Standing at the moment, what is the investment opportunity for the US stock market? Many people in the industry also put forward their own opinions.

Cathay Fund said that the US stock market has been adjusted sharply since this year. From the perspective of driving factor, the adjustment of US stocks in this round of US stocks is mainly to kill sharply. Inflation and the Federal Reserve's interest rate hikes are important reasons for this US stock market. At present, high inflation in the United States has reduced service needs, leading to a comprehensive contraction of factory orders and production, and American corporate activities have slowed significantly in June. Recently, the prices of commodities have also fallen significantly. If the economic growth rate is faster than the Federal Reserve in the fourth quarter, the inflation may fall fell quickly. Weaken, you can pay attention to the layout of the S & P 500ETF and Naiger ETF.

Liu Jie said that there are many excellent companies in US stocks, especially pharmaceutical and technology companies, which reflect the effect of science and technology companies. Under normal circumstances, these companies have a strong competitive advantage in the global emerging opportunities. From the Internet revolution to the biotechnology revolution, from daily electronic consumption to the continuous iteration of global computers, the development and progress of human society is high. Technology companies are closely related.

The fluctuations caused by the short -term market sentiment due to the rate hikes and interest rate hikes may have a certain departure with the current overall performance of the technology leading company, so it has also spawned some short -term investment opportunities; in addition, the concerns about the decline in the US economy also given the market further interest rate hike band When it comes to pressure, interest rate hikes and inflation require the Federal Reserve for continuous balance, which has also spawned some short -term investment opportunities.

For the future, the prices of inflation, especially oil prices, etc. will affect the policy of the Federal Reserve's interest rate hikes and the rate of interest rate hikes. If the price of oil is stable in the future, the inflation trend eases or improves significantly, the trade tariffs are reasonable, and the economic trends will bring more benefits to the fundamentals of technology companies, which will be more conducive to the stabilization rebound of US stocks.

However, there are currently some institutions with a cautious attitude towards the US stock market. CITIC Securities believes that considering factors such as inflation, supply chain, logistics, and strong US dollars, U.S. stock performances will continue the trend of staged repair since the beginning of the year. Finally, in the process of continuing to tighten financial conditions, it is difficult to see institutions and retail funds continue to flow into the US stock market. Therefore, before the formation of the Fed's monetary policy steering, U.S. stocks are expected to usher in a continuous rebound.

Boshi Fund also reminded that the US manufacturing PMI decreased from 57 last month to 52.4, a new low since 23 months, and the market's concerns about economic growth have further intensified. Looking back, the Federal Reserve may still raise interest rates at 75 and 50 basis points in the interest rate interest rate meeting in July and September. Fed Chairman Powell reiterated its firm commitment to curbing inflation at the latest Congress hearing. Policy tightening and economic recession are still the largest pressure on the market, and US stocks may face the risk of further adjustment.

Edit: Captain

- END -

Reluing and cultivating excellent agglomeration -Jiangsu accelerates the cultivation and expansion of "specialized new" enterprises

Xinhua News Agency, Nanjing, June 18th.Xinhua News Agency reporter Chen GangTo cop...

The city's only!Selected into the strong town of the national agricultural industry, Langqi's "secret" is ...

Recently, the Ministry of Agriculture and Rural Affairs announced the establishmen...