IPO observation 丨 Volon food is planned to be listed, it is not enough to rely on "daily nuts"

Author:Red Star News Time:2022.07.03

The nut food industry may welcome another listed company.

The Red Star Capital Bureau noticed that recently, the SFC website disclosed the prospectus of Qingdao Wolong Food Co., Ltd. (hereinafter referred to as "Walron Food"). Volon Food is intended to be listed on the main board of the Shanghai Stock Exchange, raising 700 million yuan, and the sponsor is CITIC Securities.

Volon Food claims to be the first to launch "daily nuts" products in China, but the rhythm of set foot in the capital market is long overdue. Its competitors (300783.SZ), Liangpin Shop (603719.SH), etc. have long been listed.

The Red Star Capital Bureau noticed that the current revenue of Walron Food is still "daily nuts", accounting for more than 70 %. However, its advantageous positions are constantly shrinking, and the market share is declining and surpassed by opponents. From the perspective of products, marketing, channels, etc., the road to breaking Walron Food is still difficult. Whether listing can help Walon's food over the difficulty still needs to be observed.

Data Chart According to visual China

The success or failure is due to "daily nuts"

Founded in 2016, Volon Food is a casual food producer with nuts related to nuts. The prospectus stated that the company took the lead in launching "daily nuts" products in China.

Daily nuts are actually a small packaging and mixed nuts composed of 6-8 kinds of nuts and dried fruits. Once launched, it quickly set off a wave of mixed nuts in the nut industry. Data show that the penetration rate of Tmall's daily nuts consumers in Tmall Nuts rose from 17%in 2017 to 47%in 2019.

In 2019 and before, the market share of Volon Food in the mixed nut industry ranks first in the industry. In this context, Volon Food naturally made a lot of money. According to the data, the revenue of Walron Food in 2017 has passed the 1 billion mark, and the mixed nuts are Volon's revenue pillar.

However, the "daily nuts" have also trapped the "daily nuts" that laid a piece of Walon food.

The prospectus shows that from 2019 to 2021 (reporting period), Volo Food's operating income was 1.165 billion yuan, 889 million yuan, and 1.108 billion yuan, respectively, and net profit attributable to mothers was 131 million yuan, 88.924 million yuan, and 13 billion yuan. Essence In 2020, Volon Foods had a serious decline in income due to the affected income, a year -on -year decrease of 23.69%, and net profit attributable to the mother had a sharp decrease of more than 30%.

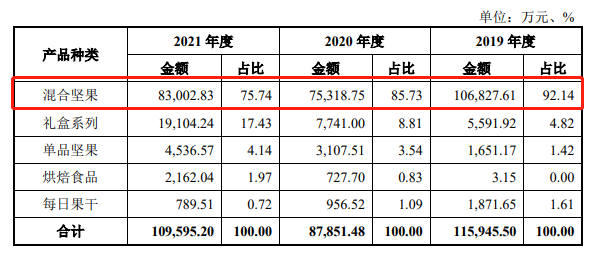

From the product point of view, the Volon structure is relatively single. During the reporting period, the income of hybrid nut products accounted for 92.14%, 85.73%, and 75.74%of the main business revenue, respectively, showing a decline year by year, but the proportion was still high.

What's more optimistic is that the advantages of Volon food are constantly shrinking. Faced with the dimension of dimensions such as three squirrels, Volon lost the leading position of the mixed nut market.

After the rise of the mixed nuts, three squirrels, good product shops, and Qiaqiang casual food brands have also launched daily nut products. According to media reports, there are only more than 300 brands of "daily nuts" on the Jingdong platform.

Data from the Foresight Industry Research Institute showed that from 2019 to 2021, the average market share of Volon Food in the mixed nut industry market fell to 9.3%. In 2021, Volon's market share in the mixed nut market was only 7.2%, ranking third.

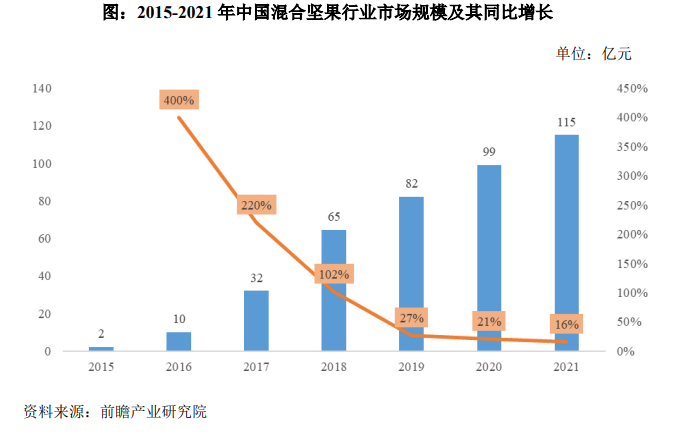

From the perspective of the industry's environment, the growth of the mixed nut industry is not reunited. According to the survey of the Foresight Industry Research Institute, in 2021, the market size of my country's hybrid nut industry was about 11.5 billion yuan, an increase of 16%year -on -year. This growth rate was the lowest year since 2015.

The road to break the situation is difficult

In the industry, the giant is serving, how to break the situation of Volon food has become the focus of market attention.

In terms of products, Volon tries to change the characteristics of a single structure. The prospectus shows that in recent years, Volon has expanded new product categories such as single -product nuts, nuts gift boxes, and strong nuts. However, Volon's products are currently concentrated in nuts, and compared with head companies, they do not have advantages in terms of category richness and brand awareness.

Moreover, Volon Food does not seem to focus on R & D. During the reporting period, its costs in R & D were 376,300 yuan, 1.5761 million yuan, and 1.885 million yuan, respectively, accounting for less than 0.2%of operating income. The R & D department of Volon Food was even established in early 2019.

If the product is not enough, then marketing will come together. In fact, it is not uncommon for marketing costs for the leisure food industry to be higher than R & D.

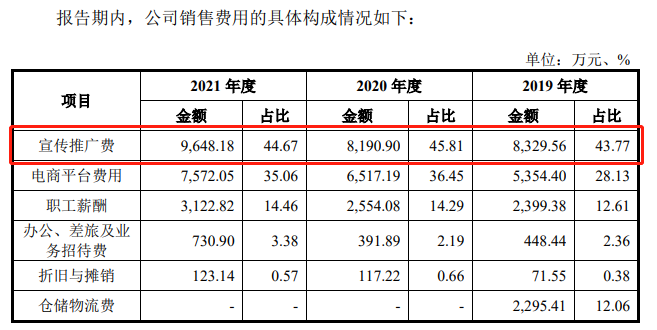

From 2019 to 2021, the promotion fee of Volon Food was 83.2956 million yuan, 81.909 million yuan, and 96.4818 million yuan, accounting for more than 40%of the sales costs, accounting for 7.15%, 9.21%, and 8.71 of total operating income, respectively. %, Far higher than R & D investment.

In 2021, Volon Food put forward a new goal- "Captain Captain in Nuts". At the marketing level, Volon Food has also continuously increased the volume of the spread of Volon food brands by creating a brand IP image "Little Long Ren", trying star cooperation, film and television drama implantation, and head -of -headed goods.

However, the promotion fee has been smashed, and it seems that the company's performance is still limited. The company's revenue in 2021 has not returned to the level of 2019.

In addition, channels are also one of the factors that restrict the development of Flong Food. In recent years, whether it is three squirrels with online advantages, or many stores with many stores, it is undergoing all -channel strategic layout. Volon Food still depends on the offline channels of dealers. During the reporting period, its distribution model revenue accounted for 78.14%, 62.94%, and 60.87%of the main business income, respectively, and declined year by year, but the proportion was still high.

Walron's offline channels are mainly concentrated in commercial supermarkets, convenience stores, wholesale markets, etc., and retailers are also promoting their own nuts, which will further squeeze the market of Volon food. For example, Wal -Mart launched Huiyi's "daily nuts", and Hema also launched "daily nuts".

Walron Food obviously also perceived the challenges he faced. This IPO, it is planned to raise 700 million yuan, which is used to produce intelligent transformation and intelligent warehousing and logistics center construction project (310 million yuan), brand image and omni -channel sales network construction project (210 million yuan) and supplementary mobile funds. (180 million yuan).

Wallon said that on the one hand, the omni -channel sales network construction project will improve the company's online sales capabilities, product information dissemination, and new product promotion speed through online marketing channels such as experts, store live broadcasts, crowd operations, and traffic release. In terms of, the company will put it in East China, South China, Huaxi, North China and other regional offices through offline MINI stores to directly display the company's full category products to customers.

Whether Whether Whether the Foods can break through the barriers will be successful, the Red Star Capital Bureau will continue to pay attention.

Red Star reporter Yu Yao Yu Dongmei

Edit Yang Cheng

- END -

Guangdong: High -quality enterprise trade foreign exchange revenue and expenditure facilitation pilot "four sides dilatation"

21st Century Business Herald reporter Jia Junhui Guangzhou reportA few days ago, the 21st Century Business Herald reporters learned from the Guangdong Provincial Branch of the Foreign Exchange Bureau.

Animation interpretation of the "1+20" policy ④ | Six policy measures for stable investment

JPEG Webkit-Playsinline (The effect of horizontal screen viewing is better)Hebei...