Increase tax reduction and fees, focus on focusing on the province's "50" in the prov

Author:Heilongjiang Daily Time:2022.06.13

Recently, Heilongjiang Province ’s“ Implementation Plan for Implementing the State Council ’s solid and stable Economic Parement Policy and Measures” was officially introduced, including 50 measures in 8 aspects. On the 10th, Wei Zhe, a member of the Party Committee and Chief Accountant of the Provincial Taxation Bureau, said in an interview with reporters that this year our province's five -value -added tax refund, social security reduction, reduction of "two taxes", rents and exemptions, and inclusive micro -loan Including policy support, so that policy dividends reach the most needed enterprises and the masses as soon as possible.

Five policies increase

More intensity more discounts

"Increasing" and "expanding" is a high -frequency word that has appeared many times in the tax policy. In this regard, Wei Zhe introduced it to reporters in detail.

The first is to further increase the implementation of the VAT tax refund policy. On the basis of earlier implementation of the country's promulgation policy, 7 industries including wholesale retail, accommodation catering, and other 7 industries have been included in the full monthly refund incremental tax tax, and the scope of the existing reserved tax deduction policy at one time.

The second is to expand the implementation of social security slow payment policies. The basic endowment insurance, work injury insurance, and unemployment insurance premiums of enterprise employees have expanded from the original 5 specialty industries to the 17 industries that have difficulty in manufacturing.

The third is to expand the scope of application of the "two taxes" (that is, the real estate tax, urban land use tax) policies. For high -risk areas in the epidemic, the "two taxes" policies that are avoided in the service sector in difficult industries in the service sector are extended to all small VAT taxpayers and individual industrial and commercial households.

The fourth is to increase the policy of rents and exemption. Give full play to the role of tax leverage, and rent real estate and land to small -scale taxpayers, individual industrial and commercial households for small -scale VAT taxes, and for each monthly rent for rent, "two taxes" for 3 months for rent -free real estate and land. The previous difficulty industries were exempted from the "two taxes" for 1 month for a month.

Fifth, increase support for inclusive micro -loan.

Expand the scope of tax refund scope

Focus on key industries

In this year's implementation of a new combined tax support policy, the large -scale VAT retain tax refund policy is the highlight. In this province's package of policies and measures, the implementation of further increased value -added tax tax refund policy is in No. 1 One, it can be seen that the importance of this policy is full of expectations. In this regard, Wei Zhe said that the newly issued tax refund expansion policy scope, focusing on key industries, focusing on supporting "wholesale and retail industry", "agriculture, forestry, animal husbandry, fisheries", "accommodation and catering", "residential services, repair and repair, and Other service industries "" education "," sanitation and social work "and" culture, sports and entertainment industry ", many of them are impacted by the epidemic, the most need to relieve difficulties, and the most eager for policy support.

The tax refund of these industries is compared with the past, one is to expand the scope. From the original only refund the incremental tax on April 1, 2019, it can expand to the continued refund increase, and it can also refund all the existing tax taxes at one time. The second is to increase the proportion. The proportion of refunds for incremental tax refund increased from 60%to 100%. The third is to reduce the threshold. The refund conditions for incremental retention tax refund are incremental from the original six consecutive months and no less than 500,000 yuan in the sixth month. You can apply for a monthly application as long as there is an increment.

Arrange according to policy ladder

Removal tax refund direct enjoyment

The tax refund policy is good, and the policy is strong. Applying as soon as possible to obtain policy dividends as soon as possible should be expected by the taxpayer. In this regard, Wei Zhe said that according to the policy arrangements of the policy, the existing tax refund of medium -sized enterprises in 6 industries including small and micro enterprises and manufacturing in the early stage has been basically completed. In June, the tax authorities will focus on the existing tax refund of large enterprises in 6 industries. For the newly added wholesale and retail industry, including 7 major industries such as the wholesale and retail industry, it can apply to the competent tax authority to apply for refund to the incremental tax deductible from the tax declaration period in July, and apply for a refund to the reserved tax on the one at a time.

The taxpayer only needs to log in to the Electronic Taxation Bureau of Heilongjiang Province. After completing the normal tax declaration, the online report is submitted to submit the "refund (deduction) tax application form". After the submission, the in charge of the tax authority will conduct review as soon as possible according to the process. After the review is approved, the tax revenue will be refunded and sent to the same treasury department at the same level. According to the three -party coordination mechanism established by the tax and finance and the treasury department, the two departments will fully guarantee the inheritance of tax refund funds and timely processing Without special circumstances, after the tax revenue is refunded, the tax refund can basically reach the corporate account on the same day.

Expansion "Silver Tax Interaction" enterprise

Cracking "small and micro" financing problems

Affected by the epidemic, there are many small and medium -sized enterprises in urgent financing support, and in the 50 policies and measures to stabilize the economy, it is clearly stated that it is necessary to optimize the "silver tax interaction" SME credit review and risk control model The number of enterprises in the scope. Wei Zhe said that "silver tax interaction" is a financing activity carried out by the tax and China Banking Supervisory Department for integrity and micro enterprises. The specific method is to push the enterprise's tax credit in accordance with laws and corporate authorization in accordance with laws and compliance and enterprise authorization. To banks, banks use tax information to optimize credit models to provide tax credit loans for small and micro enterprises for trustworthiness.

Source: Heilongjiang Daily

- END -

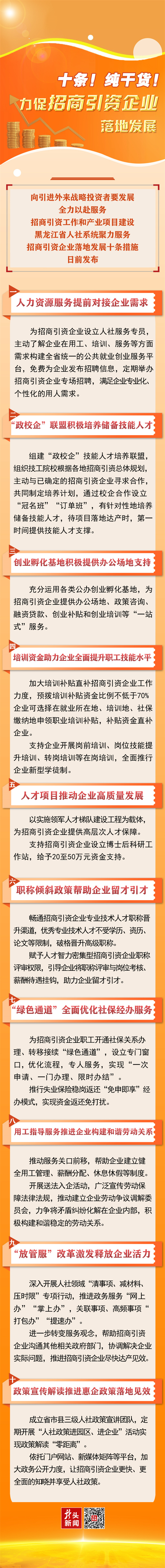

Ten!Pure dry goods!Promote the implementation of investment enterprises to develop enterprises

Source: Last News

Tede, the second A -share listed company in Licang District, Qingdao, landed on the Bei Stock Exchange

On the morning of June 20, the listing ceremony of Qingdao TEDE Automobile Bearing...