Dong Zhongyun, etc.: In the second half of the year, the science and technology board is still expected to lead the market

Author:Zhongxin Jingwei Time:2022.07.04

Zhongxin Jingwei July 4th. Question: In the second half of the year, the science and technology board is still expected to lead the market

Author Dong Zhongyun China Asset Manager Forum Director

Macro Strategy Researcher at Wang Rudan AVIC Securities Research Institute

Since rebounding in May, the investment style has returned to the technological growth sector with high profit growth. As of mid -June, the 50 -led market of science and technology innovation was increased by 11.97%from early May to June 14th, which greatly won the Shanghai and Shenzhen 300, the GEM index and the Shanghai Stock Exchange Index. Because the science and technology board in 2022 has many similarities in the market environment and rising support in 2013, we analyze the market environment and rising momentum of the recently rising period of science and technology innovation 50 and 2013. In July, the wave of lifting of the ban on the ban on the trend of China Science and Technology Board is expected to perform smoothly, and the next stage can continue to obtain excess returns.

Macroeconomic has risen stable, and the focus of scientific and technological innovation policy support

At present, the domestic economy has shifted from downlink to a stable and rebound. Overseas demand has weakened exports, and real estate has not recovered.

In terms of exports, on the one hand, among China's main export destinations, the United States has begun to shrink liquidity, and the European Union will start raising interest rates in the second half of the year. As overseas enters a tightening cycle, the overall demand for exports in my country will weaken. On the other hand, the universal re -production and re -production of global developing countries is also squeezing in China's exports. Under the influence of weakening demand and replacement of overseas supply chain, the high base of exports last year will be superimposed. China's exports will be difficult to reach the growth rate of the past two years, and the second half of the year may continue to weaken.

In terms of investment, real estate investment is still in the downward channel. From January to May, the cumulative real estate investment year -on -year growth rate, new real estate construction, construction and completion area have been built year -on -year. New lows. In the second week of June, the land transaction area and land transaction premium rate of 100 large and medium -sized cities were still significantly lower than the same period last year. However, under the continuous efforts of the steady growth policy, the recent sales end of the real estate market have begun to recover. High -frequency data shows that the decline in real estate sales has slowed down year -on -year.

Although the speed of economic recovery is slow. But the path of recovery is very clear. This is very similar to the economic background before the start of the GEM bull market in 2013. In 2012, exports and investing in the "two carriages" were stunned, and the market emotions were shrouded in the haze of weakened economic growth. In terms of exports, 2012 is the eleventh year of China's joining the WTO, and the exports that have continued for many years have entered a bottleneck period. In terms of real estate, in 2013, China's real estate market entered a adjustment period. Due to the high housing prices and the gradually emerging real estate market bubbles, the Chinese government has begun to rectify the real estate market to promote reasonable return of housing prices. In the context of the "New State Eight Articles" and "New State Five Articles", the deposit reserve ratio and deposit and loan interest rate continued to increase, it was difficult for real estate to become the growth of economic growth. The downturn in the real estate market has led to a decrease in demand for steel, furniture and other related industries, and lowering the growth of overall GDP. Under the anxiety of the financial market for hard landing, it has fallen from 2012.

In 2013, in the context of weakening the economy, a series of policies were supported by a series of policies, and the relevant sectors enjoyed a strong rebound in policy dividends. In the context of the Shanghai Stock Exchange Index in 2013, the Shanghai Stock Exchange Index rose 100.73%from the beginning of the year to the end of the year, and continued to go steadily in the bull market in 2014-2015.

The economic transformation and upgrading of China in 2022 is also imminent. Under the challenge of rising unilateralism and protectionism, deepening supply -side reforms and self -reliance of technology is the focus of policy support. When the economic fundamentals are still weak and the "steady growth" policy has not yet been fulfilled, the science and technology innovation -related sectors have performed well since April in a good policy environment, and the overall running to the Shanghai Stock Exchange Index.

Figure 1: Since the rebound in April 2022, the trend of each stock market (unit:%) data source: Wind, Corresponding

Domestic liquidity loose and good growth rebound

Similar to the GEM positioning growth and innovation enterprise, supporting traditional industries and new technologies, new industries, new formats, and new models in deep integration. Scientific and technological innovation enterprises, both have strong growth attributes, and have changed obviously on risk -free interest rates.

In 2022 and 2013, they both tightened the expected game of overseas liquidity, but in 2022, domestic liquidity is better than in 2013. At present, the overnight borrowing rate is far lower than the same period in 2013, which facilitates the rebound of growth stocks.

Profit growth is the core motivation to support the steady rise of the stock price

In the context of stabilizing economic stability, market sentiment still fluctuates, and the upward industrial cycle drives profit growth is the core driving force to support the steady increase of stock prices.

In 2013, benefited from the strategic emerging industry development dividends and the Chinese market is in a new round of cutting-edge technology industry chain. The Internet industry is booming in 2012-2015, 4G relay 3G network penetration rate has continued to increase, and the network is becoming more convenient to promote the Internet The content side also ushered in an explosive growth, and the booming development of the media industry chain contributed a higher profit growth rate to the GEM index. Driven by the high profitability of the industry, the GEM index trends up.

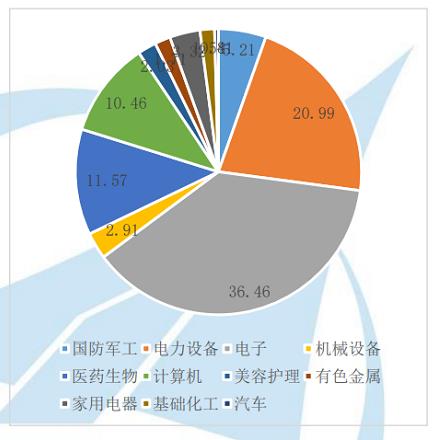

At present, the economy is in the stage of recovery after the epidemic, and the industry's industry has a high industry prosperity in the science and technology innovation board. It is expected that the performance is expected to continue to fulfill the support of the stock price. The Science and Technology 50 Index consists of 50 securities with large market value and good liquidity in the science and technology board. As of June 2022, the theme industry of science and technology boards was electronics, electric equipment, pharmaceutical creatures, computers, machinery and equipment. Among them, the proportion of electrons is as high as 36.46%, and the power equipment is 20.99%. Observing the current distribution of science and technology boards, the distribution of the two -level industry of Science and Technology Board, it can be found that the electronics are mainly semiconductors (88.3%). Photovoltaic equipment in power equipment accounts for relatively high, 62.19%of the overall power equipment. Figure 2: From 2022 to the present, the proportion of the 50th application of science and technology innovation in the industry (unit:%) Data Source: Wind, the AVIC Securities Research Institute organized

Combing the rise of science and technology 50, we found that from April 25, 2022 to June 29, 2022, the rebound of science and technology 50 was mainly contributed by electric equipment and electronic. The contribution point of the power and equipment in the first place reached 126.75 points, far exceeding other industries. In China's manufacturing industry is gradually moving towards the stage of high value -added, high -tech content, and high quality, the prosperity of new energy photovoltaic and electronic semiconductor and other technology manufacturing related industries has continued to increase, and the high -speed growth of industry profitability has become a solid support for rising stock prices.

Since July 2021, the contribution of the profit of the semiconductor industry to the stock price has begun to exceed the degree of valuation contribution. Since then, the valuation has weakened, but the profit growth rate has remained high. And from December 31, 2021, the contribution of profitability to the stock price surpassed the valuation contribution and became the core pillar of stock price rising.

In the future, with the continued expansion of the needs of automobiles, industrial control, and high -performance operations, the semiconductor parts will still maintain high prosperity; in terms of new energy, the Russian -Ukraine conflict has strengthened the importance of the country's emphasis on alternative energy and demand growth. It is expected that it is expected that it is expected In the context of high inflation, Europe and the United States can bring better prices and cash flow to the Chinese photovoltaic industry chain.

The tide of lifting the ban is coming, the overall trend of the science and technology board may be relatively stable

In July 2022, the Science and Technology Board will usher in the highest scale of lifting the ban in the past three years.

Similar to the release of the GEM in 2013, the third year of the opening of the science and technology board in 2022, and the peak of lifting the ban in July. The types of shares of the science and technology board are mainly divided into general shares, first -issued institutions, the original shareholders, the original shareholders restricted shares, and the starting strategic allocation shares.

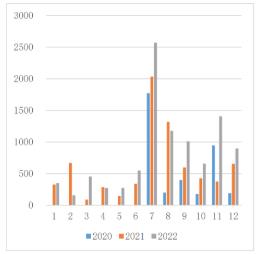

Among them, the general shares of the first issuance are the shares obtained by investors through online purchase during the issuance stage of the new shares, and there is no lock -up period and can be circulated on the first day of listing. %Outlet Object account account lock -up period is 6 months, and the rest is not locked; the general shares and first -issued institutions that are lifted on the first day of listing are eliminated. It was 257.013 billion yuan, which was larger than 203.521 billion yuan in 2021 and 177.14 billion yuan in 2020.

Figure 3: Since 2020, the scale of the science and technology board has been lifted each month (excluding the first issuance of the first general shares and the first -issuance institution, the unit: 100 million yuan) Data Source: Wind

However, referring to the experience of the third year of GEM's opening of the ban on the ban on the ban on the ban, we believe that the market is more rational for lifting the trend of lifting. Therefore, the impact of this ban on the market may be small. In the drive of profit, the science and technology board is expected to continue to stabilize and strengthen.

Science and Technology 50 valuation is in the bottom range of history

Since the rebound in April 2022, the valuation of the 50 science and technology innovation 50 is in the historical bottom range, and it has a high configuration cost -effective. It is expected to continue to rise with the performance of the interim report. April 22, 2022, the 50 -valuation of science and technology innovation was 0%since 2020. Since then, it has gradually risen but it is still below 20%of the points. The valuation is at a low historic area. Looking back on the events of the GEM finger in 2013, the valuation is also at the historical bottom range of 20%of the division point since the opening board.

Figure 4: Science and Technology Innovation 50 Valuation Sub -Point (Unit:%)

In the future, due to the relatively high industry new energy photovoltaic and electronic semiconductor industry, the high prosperity of the industry with a higher prosperity of the industry, and the overall situation of the disease disturbances is less affected, the performance of the interim report is strong, and the development of the science and innovation under the drive of strong profitability is stronger. 50 valuation is expected to continue to increase.

Overall, the macro PMI returned to the expansion range announced on June 30, the impact of the epidemic on the economy has further weakened, and the production, logistics and service industries have resumed in the context of the continuous optimization of epidemic control policies and the gradual implementation of the "steady growth" policy. Essence This provides a solid foundation for the long -term uplink of A shares. In the process of the market's confidence in the improvement of the real economy, the consumption and technology manufacturing industries are favorable.

Looking back, after the epidemic is calm, the consumption scenario of residents will be further repaired. Optional consumption, tourism and catering sectors are expected to usher in retreat; in addition, in the context of seeking traditional petrochemical energy replacement worldwide, wind power, photovoltaic, new energy and other technology manufacturingThe long -term growth space of the type of industry has increased, and the recent policy supports the strong demand for the background of Russia and Ukraine's conflict, which is expected to promote the profit growth of corresponding enterprises.(Zhongxin Jingwei APP) This article was selected by the Zhongxin Jingwei Research Institute. Due to the selected works, the new Jingwei copyright generated by the selected work, without written authorization, no unit or individual may reprint, extract or use it in other ways.The views involved in the selected content only represent the original author and do not represent the view of the Sino -Singapore Jingwei.

Editor in charge: Wang Lei

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

"Ice Cream Assassin" was won!

SummerIt's the season to eat ice cream againBut in recent years, many friends have...

A -share closing | The Shanghai Index rose 0.68% of the coal sector rose throughout the day

On June 8th, the three major index fluctuated in the afternoon.As of the close, ...