The former richest man in Qinghai was sentenced to three years in prison for illegal mining, and the latest value exceeded 24 billion

Author:Radar finance Time:2022.07.04

Radar Finance | Zhang Kaijing Edited | Deep Sea

Five years ago, the eleven Golden Week, a helicopter airborne was airborne on Binhe Road, Shiyang Town, Anyue County, Ziyang City, Sichuan. This is Xiao Yongming's plane. Some netizens speculated that Xiao Yongming was to go home for the holiday because he had returned to his hometown many times before.

It was Xiao Yongming's most beautiful era. In 2016, Tibet Holdings was listed on the backdoor. Xiao Yongming's net worth increased. At one time, he appeared on the 64th nationwide of the Hurun Rich List with a net worth of 26.5 billion yuan and jumped to the richest man in Qinghai.

Time moved to the world. On the evening of June 30, Zange Holdings announced the "Criminal Judgment" issued by Xiao Yongming, the People's Court of Xining City. Because of the crime of illegal mining, Xiao Yongming was sentenced to three years in prison, four years in probation, and fined 2 million yuan. At the same time, Shanghai Hongzhu Materials Co., Ltd., which was retired from Xiao Yongming, who was detained in the case, was 294 million yuan in illegal income, and was also confiscated in accordance with the law and paid the state treasury.

It is worth mentioning that, thanks to Tibet Mining in 2021, the concept of "Salt Lake Lithium" concept is popular, and the Xiao family still has considerable wealth in the hands of the Xiao family. As of July 4, the company's market value was 57.94 billion yuan. As a actual controller, Xiao Yongming held 42.15%of listed companies. Based on this, Xiao Yongming's worth was 24.422 billion yuan.

Illegal mining 16 years ago

Xiao Yongming's illegal mining goes back to the acquisition together 16 years ago.

In 2006, Xiao Yongming acquired 100%equity of Shanghai Hongzhu Materials Co., Ltd. (hereinafter referred to as "Hongzhu Materials"), and it became the shareholder of the participating shareholders of Qinghai Coking Coal Industry (Group) Co., Ltd. (hereinafter referred to as "Qinghai Coking Coal"). Essence

According to the company's investigation, Qinghai Coking Coal was established in 2004, with a registered capital of 60 million yuan, and Hongzhu Materials subscribed for 24 million yuan, holding 40%of the shares.

However, in 2011, Hongzhu supplies transferred all the equity of Qinghai coking coal to Zhenpeng Yixiao (Shanghai) Industrial Development Co., Ltd.

In the announcement of the Tibet Mining Industry, Xiao Yongming actively retired from Honghai coking coal acquisition from Qinghai coking coal after arriving at the case of 294 million yuan. Based on this, Xiao Yongming's illegal mining may occur between 2006 and 2011.

It is worth mentioning that in 2011, Qinghai Coking Coal has had a record of environmental protection punishment, and the punishment unit is the Qinghai Ecological Environment Department.

According to the penalty decision, the Erjingtian project in the coal field Jiangcang Mining Area of Jiao California in Qinghai did not submit to the environmental protection department without authorization and put into production without authorization. Therefore, it was fined 100,000 yuan and ordered the project to suspend production.

Radar Finance combed and found that behind the illegal mining of coke coke in Qinghai, there were mining rights disputes over the land of Muli coal field for more than ten years.

According to the data, Muli Coal Field is located at the junction of Tianjun County, Tibetan Tibetan Autonomous Prefecture and Haibei Tibetan Autonomous Prefecture of Haixi Mongolia, Qinghai. This area is the resource gathering area of the Qilian Mountain Rich Coal Belt, and it is also the only coking coal resource enrichment area in Qinghai.

Mu Li was originally taken from Tibetan, which means burning stones. The coke coke under the plateau frozen soil is a high -quality raw material for steelmaking. The coal field is composed of two exploration areas of Jiangcang and Julu more mining areas and arcs and Gongma, with resource reserves of 3.54 billion tons.

In 2003, in the context of the development of the western region, Qinghai began to attract investment and conduct open -air mining of Murli coal fields. Qinghai Coking Coal is one of the key enterprises for attracting investment. In addition, coal companies such as Qinghai Qinghua, Qinghai Okai, and Qinghai Jiangcang Energy have also settled in Muri and Jiangcang regions.

However, according to the relevant departments of Qinghai Province, these companies have begun brutal mining behavior without the mining right.

A person in charge of the Law Enforcement Corps of the Qinghai Provincial Department of Land and Resources revealed that as of May 2005, the law enforcement team measured the coal mining area with a satellite positioning system, and the amount of coal amount illegally excavated was close to 3 million tons.

According to Wang Jianbin, deputy director of the former Qinghai Provincial Department of Land and Resources, coal resources mining enterprises can only be used for coal resources after the evaluation of environmental impacts, but companies developing coal development in Murli and Jiangcang, None of the "six certificates of six certificates", and their mining behavior is still illegal.

In early 2010, a report entitled "The Source of Qinghai Lake Source Curlers was stolen for 8 years, and the surrounding grassland desertification" revealed the scene of the savage mining of the enterprise: " Zhanshan covered a large piece of grassland. Looking from the distance, the black smoke rolled over the coal mining area and covered the sky. "

After the report was valued by senior management, the Ministry of Land, Environmental Protection, and Qinghai Provincial Government immediately supervised Muli Coal Field. On March 22 of that year, the Qinghai Provincial Department of Ecological Environment was inspected on the spot that the No. 1 well project of Qinghai Jiaojiao River Warehouse Mining Area has unauthorizedly approved the approval method to open -air mining, and the open -air mining abandoned and abandoned is not standardized. In issues such as failure to carry out engineering environmental supervision, undergoing surface water underground water environmental monitoring, and not being approved by the environmental protection department for trial production.

According to this, the Qinghai Provincial Department of Ecological Environment ordered Qinghai Coking Coal to immediately stop the production of wells No. 1, and conduct an environmental comprehensive improvement and the construction of well mining systems in accordance with the project environmental assessment approval. Trial production shall not be put into trial production before approval.

In the same year, Qinghai Provincial State -owned Assets Investment Management Co., Ltd. also invested in the establishment of Qinghai Muli Coal Industry Development Group Co., Ltd., which was approved by the National Development and Reform Commission to clarify the "one mining area and one development subject". The development group is the only development subject within the overall planning area of Muri Mining Area. At this point, the largest coal mining area in Qinghai Province, Muli Coalfield Mining Area, has entered a new stage of unified planning, unified development and unified management. When did he hold Xiao Yongming's responsibility for more than ten years?

Xiao Yongming was sentenced to the arrest of the "invisible richest man" Ma Shaowei in Qinghai.

Ma Shaowei is the general manager of Qinghai Xingqing Industry and Trade Engineering Group Co., Ltd. (hereinafter referred to as "Xingqing Group"). According to economic reference reports, Xingqing Group was involved in Yijing Tin Coal Mine in Gongxian Mining Area in 2005, and coal mining began in the second half of 2006. In the 14 years from 2006 to 2020, Xingqing Group illegally mining of more than 25 million tons of coal mining from Murli coal field, profitable by about 15 billion yuan.

It is worth noting that during this period, the phenomenon of Murli coal fields caused by illegal mining and excessive development to destroy the ecological environment many times. The Central Environmental Protection Supervision Team has also launched environmental protection inspections many times, but these measures have been managed to avoid.

"At the open -air mining site of Xingqing Company, looking at it, the giant depression field formed by the" opening of the borer's belly '"winding field, winding for 5 kilometers from the southeast to the northwest, forming a width of about 1 kilometer, up to 300 meters deep to 300 meters to from to 300 meters to from to 300 meters to from to 300 meters to from to 300 meters. The 500 -meter gully is like a huge wound split on the plateau wetlands. "

It is worth mentioning that Ma Shaowei's father had built Madidenko, who had built the local high -rise buildings in the local high -rise building in Xining. The two generations of the Ma family were in the Qinghai business community and accumulated rich connections.

In this context, in August 2020, Ma Shaowei was adopted criminal compulsory measures by the public security organs in accordance with the law. Essence

Among them, Xiao Yongming, and a founding shareholder of Qinghai Coking Coal, who was arrested before, was the actual controller behind Shanghai East China Electric Group, and was also the gossip Zheng Rongde when the macro -building transfer was transferred.

However, according to Guo Lei, the person in charge of the Qinghai Coking Coal Original Office, the main coal mining time of Qinghai coking coal was from 2004 to 2014. Before 2012, although the company only had the right to explore and did not have mining rights, it was also supervised by local governments in explosives, production, transportation and other links of mining. Entering the third batch of key industrial projects in Qinghai Province.

The joint investigation team composed of the National Commission for Discipline Inspection and other departments believes that from the beginning, the main leaders of the Mili Mining Area have not included the issue of ecological restoration into consideration. "(Proposed by Wen Guodong) It is necessary to build Haixi Prefecture to build 100 billion yuan in coal development and coal chemical industry clusters to become industrial towns on the Qinghai -Tibet Plateau. These concepts and practices are obviously separated from the direction of the rectification and protection of Mili mining areas. ","

He was sentenced to imprisonment and repeatedly became the executor of the dishonesty

At the same time as the "old bottom" was opened, Xiao Yongming's main business also encountered a crisis.

Before becoming the "Potassium King", what Xiao Yongming did was a hotel business. After trying the cross -border sweetness, after the listing of Tibigan Holdings, he planned to make it as the law, and he entered the copper mine, and the subject he was watching was the dragon copper industry.

Public information shows that the dragon copper industry is a private holding company introduced by the Tibet Autonomous Region in 2006, which is mainly engaged in the exploration, development, processing and sales of copper multi -metal mine resources. The company's dragon -derived copper multi -metal mineral copper resources reached 10 million tons, which is currently the largest copper mine that has been proven in China.

However, unlike the previous acquisition of potassium fertilizers, the complexity of the dragon copper industry itself has made Xiao Yongming's acquisition a gambling.

First of all, with rich copper mine resources, the dragon copper industry is very valuable, and only the acquisition itself requires a lot of money. Second, the dragon copper industry is not operating well. 155 million yuan, by the end of June 2018, the asset -liability ratio has climbed to 80.93%; in the end, the minerals of the dragon copper industry are high and the terrain is complicated, so it is also known as one of the most difficult mines. The latter project also requires huge amount of funds to invest in construction.

To this end, Xiao Yongming not only repeatedly passed bank loans and equity pledge financing as copper ore blood transfusion, but also triggered a series of financial bathing behaviors of Tibet Holdings "disassembling the east wall".

In 2019, the CSRC announced that Tibet Mining was suspected of having virtual operating income and operating profit, accounts receivable and prepaid accounts, and did not disclose its controlling shareholder Zange Group and its non -operability occupation of Tibet. 3 illegal facts of mining funds. Tibet Mining was fined 600,000 yuan, and Xiao Yongming was also prohibited by market ban.

In the end, Xiao Yongming had to relieve the debt pressure and had to conquer the dragon copper industry, and the latter was included in Zijin mining in 2020.

To make matters worse, after the failure, Xiao Yongming is already in debt today, and the Tiber Group behind it is in the crisis of liquidity.

The financial report shows that as of the first quarter of 2022, Xiao Yongming and Tibet Group, with their unanimous actors Yonghong Industrial, were all pledged by the cumulative 49.25%of the listed companies. According to the investigation of the enterprise, Xiao Yongming from 2017-2021 was issued a total of 19 limit orders, and now there are still 5 unliked; at present, Tibet Group has been frozen Tibet Group's cumulative equity worth 779 million yuan was frozen; in 2021, Tibet Group was also applied for bankruptcy and reorganization, but the court ruled that it would not accept it.

Under the top of debt, the Tibet Group tried to return the funds of Tiber Mining shares held by reducing holdings and auction. At the same time, some shares of the group were forced auction.

Radar Finance searched Tibet Holdings (formerly Tibet Mining) in Ali Auction, and received 35 results. Among them, 81 million shares auctioned on October 22, 2021 have been auctioned by Sun Shah Hongyun, a subsidiary of Jiangsu Shagang Group, the largest private steel company in China; 56 million shares auctioned on November 15 have been shot; December 13 The auction of 196 million shares has been applied for a suspension auction, and 26 million shares have not obtained the right to dispose of the disposal; 57 million shares auctioned on December 24 have reached a settlement agreement on December 24, without the need to auction.

In addition, 20 million shares of Tibet Mining held by Xiao Yongming on December 13 were also auctioned and eventually applied for a suspension.

In February 2022, Tibet Group and Yonghong Industrial also had a cumulative 10.84%equity of listed companies to Xiahongyong; in May, Tibet Group continued to reduce its holdings by 3%.

In this context, as of the first quarter of this year, Tibet Group, Yonghong Industrial and Xiao Yongming had a total proportion of the listed companies that had fallen to 49.25%; as of the third quarter of last year, the ratio was still 73.37%.

Judging from the current situation, Tibet Mining is still in the hands of the Xiao family. At present, Xiao Yongming's eldest son Xiao Ning is the chairman of the listed company, and the second son Xiao Yao is the vice chairman; Xiao Miao Miao, the daughter of Xiao Yongming, also serves as as many as 9 companies.

However, compared with many years ago, the Xiao family's anti -risk ability has been greatly weakened. In the future, if you want to keep this wealth, the Xiao family will face many challenges.

- END -

More than a hundred experts and entrepreneurs investigated and investigated the original Yang's prefabricated vegetable industry

On June 24th, the 2022 China (Yuanyang) pre -production industry conference was gr...

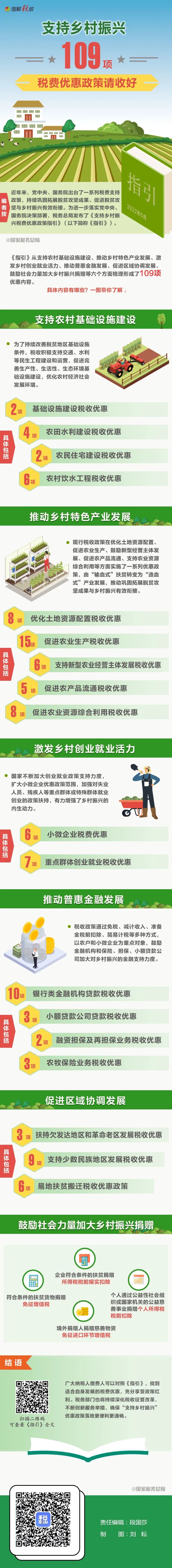

109 preferential taxes and fees support rural revitalization!One picture to understand the specific content

Support Volkswagen Entrepreneurship and Innovation, please collect these 120 prefe...