Establishing a long -term mechanism for small and micro -financial services requires research and solving five aspects.

Author:Dong Ximiao Time:2022.07.05

Small and micro enterprises have an indispensable role in my country's economic and social development. In the past four years, the government work report has repeatedly mentioned small and micro enterprises, of which 16 times were mentioned in 2021, and each in 2019, 2020, and 2022 each withdrawn 12 times. A few days ago, the People's Bank of China issued the "Notice on Promoting the Establishment of Financial Services Small and Micro -Enterprises Dare to Loans for Loaning Energy Loaning and Loaning Mechanism". The recent report released by the Audit Office shows that some banks include the increasing increasing increase in loans of small and micro enterprises in some banks, inadequate investment, and inadequate management. Therefore, in accordance with the principles of marketization and the rule of law, it is important and urgent to accelerate the establishment of a long -term mechanism for small and micro financial services.

From the British in 1931, it proposed the "McMilun gap" to China ’s efforts to solve the financing problem of small and micro enterprises in recent years. Small and micro financial services have attracted much attention as a global and long -term issue. The author believes that the establishment of a long -term mechanism for small and micro -financial services to effectively improve the quality and efficiency of small and micro financial services, which requires research and solving five problems.

First, the issue of conceptual ideas. It is difficult for financing and expensive financing to be discussed together. In fact, financing difficulties and expensive financing are two issues. The author believes that first of all, it is necessary to crack the problem of financing difficulties, and the problem of expensive financing is mainly resolved by the market. Theoretically, if the problem of financing difficulties is really solved, the problem of expensive financing can naturally be relieved. Generally speaking, if the supply is very sufficient, the price will naturally decline. At present, it is meaningful to emphasize the solution of the problem of expensive financing, but the focus is still on cracking financing difficulties and accelerating the relief of financing difficulties, thereby promoting the gradual decline in financing costs. At the same time, we must focus on solving the "first kilometer" problem of small and micro enterprises' financing, that is, small and micro enterprises that have never obtained financing services from regular financial institutions to obtain the first financing from regular financial institutions. If the "first kilometer" problem is resolved, it will help promote the increase in credit and decline in financing costs. Therefore, it should pay more attention to the supply of small and micro financial services, instead of being too entangled with a single loan interest rate and service price.

Second, the issue of supply and demand entity. From the perspective of the supplier, in recent years, government work reports have made clear requirements for the growth of large banks inclusive small and micro loans. In addition, it should also pay attention to small and medium -sized financial institutions such as small and medium -sized banks, consumer finance companies, and give full play to their positive role. In particular, private banks and consumer finance companies mainly based on the Internet model have flexible institutional mechanisms and innovative products and services. They are both capable and willing to further expand their services to small and micro enterprises. Enterprise policy restrictions. From the perspective of demand subjects, services such as individual industrial and commercial households and new citizens should be strengthened. Individual industrial and commercial households are "small and micro -micro". Financial services of individual industrial and commercial households are shortcomings in the shortcomings of small and micro financial services. Targeted measures should be taken to optimize and improve. In March, the Banking Regulatory Commission and the central bank jointly issued documents to strengthen financial services to new citizens. It should further deepen the comprehensive research on the needs of individual industrial and commercial households and new citizens, and on this basis, more accurately develops and matches customized products and services.

Third, the issue of the ecosystem. It is necessary to clarify the different positioning of large and medium -sized financial institutions, give play to the positive role of small loan companies and financing guarantee companies, and develop an ecological system and service network with a clear and clear division of labor with the spirit of tolerance. Non -market -oriented over -sinking of large banks has indeed brought some problems, mainly for the "tip phenomenon" and "extrusion effects" of small and medium banks. Large banks should be encouraged to focus on solving the "first kilometer" problem of small and micro enterprises, that is, increasing the proportion of "first loan households". Regulatory departments shall significantly increase the evaluation weight of the "first loan" as an assessment of the "first loan households" as assessment. In the survey, it was found that agricultural insurance helps reduce the risk of small and micro enterprises and farmers in counties, and help alleviate its financing problems. The supply -side reform of agricultural insurance should be promoted, agricultural insurance varieties are innovative, the development of income insurance should be vigorously promoted, and the level of insurance protection is improved. In addition, intermediary agencies can also be introduced to help small and micro enterprises improve their management and digital capabilities, such as helping small and micro enterprises regulate financial statements.

Fourth, the issue of science and technology empowerment. Xiaowei Finance is based on online services and supplemented by offline services, which is the general trend. It is necessary to accelerate the application of fintech, vigorously promote the digitalization, mass, and standardization of financial products, continuously reduce operating costs, and improve the sustainability of inclusive small and micro financial services. For small and medium -sized banks, it is limited by restrictions on funds, technology, and talents. By strengthening cooperation, it is necessary to study sharing technology systems and software development. Financial management departments and industry associations can promote small and medium -sized banks to jointly build and jointly develop and share technology platforms. Such as building a public platform for the cloud computing industry to reduce the cost of scientific and technological research and development of small and medium -sized banks. You can also encourage the capable small and medium -sized banks to launch the establishment of science and technology research and development alliances in a market -oriented manner. In the new round of rural credit cooperatives, many provincial joint agencies (joint banks) are preparing to set up science and technology subsidiaries. However, most of the core systems of rural commercial banks and agricultural credit cooperatives are still in the Provincial Party of China. The construction system of the provincial party's party agency often emphasizes the unity of the system. In the next step, it is necessary to improve the openness of the platform and strive to meet the diverse needs of the agricultural and commercial banks and the agricultural credit cooperatives.

Fifth, the issue of model innovation. From the perspective of global perspectives, small and micro financial services include the model exploration of Yusus's founding Grame bank, as well as technological innovations of small WeChat credit companies (IPC) small WeChat credit companies (IPC). The micro "Taizhou model" also has the head geese effect of large banks "benefiting you", as well as positive supplements of small and micro finance. The "Five -Person Group" of Gramez Bank and the "three -product and three tables" of Taizhou model focuses on solving the problem of trust, that is, through the relationship chain, acquaintance circle in the region, master the business of small and micro enterprises, and the owner of the small and micro enterprises Then judge its ability to repay and repay. However, the trust relationship between acquaintances is generally limited to a certain area, and the comprehensive cost of financial institutions is relatively high. With the help of digital technology, the design of digital small micro -credit products that matches their production and operations for different levels of small and micro enterprises with different levels of small and micro enterprises have a stronger replication and promotion significance through online operation. Of course, we must also grasp the principles of moderate to avoid multi -credit, over -credit, and prevent the risk of "co -debt". Small and medium -sized banks are the vital army to serve small and micro enterprises. It is necessary to further support the steady development of small and medium -sized banks, and take measures to support small and medium banks to better serve small and micro enterprises. In particular, the capital supplementary channels of small and medium -sized banks should be further enriched. For example, the threshold can be reduced, and small and medium -sized banks that support small and medium -sized banks are particularly listed to issue preferred shares and sustainable debt to supplement capital. In addition, the disposal of non -performing assets for small and medium -sized banks should be accelerated to expand the channels and means of non -performing assets. Many small and medium -sized banks have a heavy historical burden, affecting their ability to serve small and micro enterprises. The financial management department shall implement the due diligence of small and micro financial services, the error tolerance correction and correction of fault tolerance, and take practical measures to dispel concerns that the banks are afraid of badness and punishment. For banks, the principle of due diligence, fault tolerance and correction should be passed to grass -roots branches and customer managers. As long as there is no obvious moral risk, small and micro enterprises generally do not strictly punish customer managers and branches. If you do not implement due diligence, fault tolerance and error correction mechanism, it may be difficult to change the situation of not loaning or unwilling to loan.

For the central and local governments, it is important to continue to strengthen the construction of financial infrastructure, and actively optimize the small and micro financial service ecosystem by improving the credit system and guarantee system construction of small and micro enterprises. In particular, local governments should speed up the integration of various types of credit information and government data, build a regional big data platform and credit reporting platform, and empower financial institutions.

- END -

Zhangye Jingkai District: Implement the spirit of the Provincial Party Congress to promote the construction of the project "Accelerating Run"

Ganzhou Rong Media (Reporter Chen Zhiwei Cheng Xuelei) At present, in the golden p...

Discene!

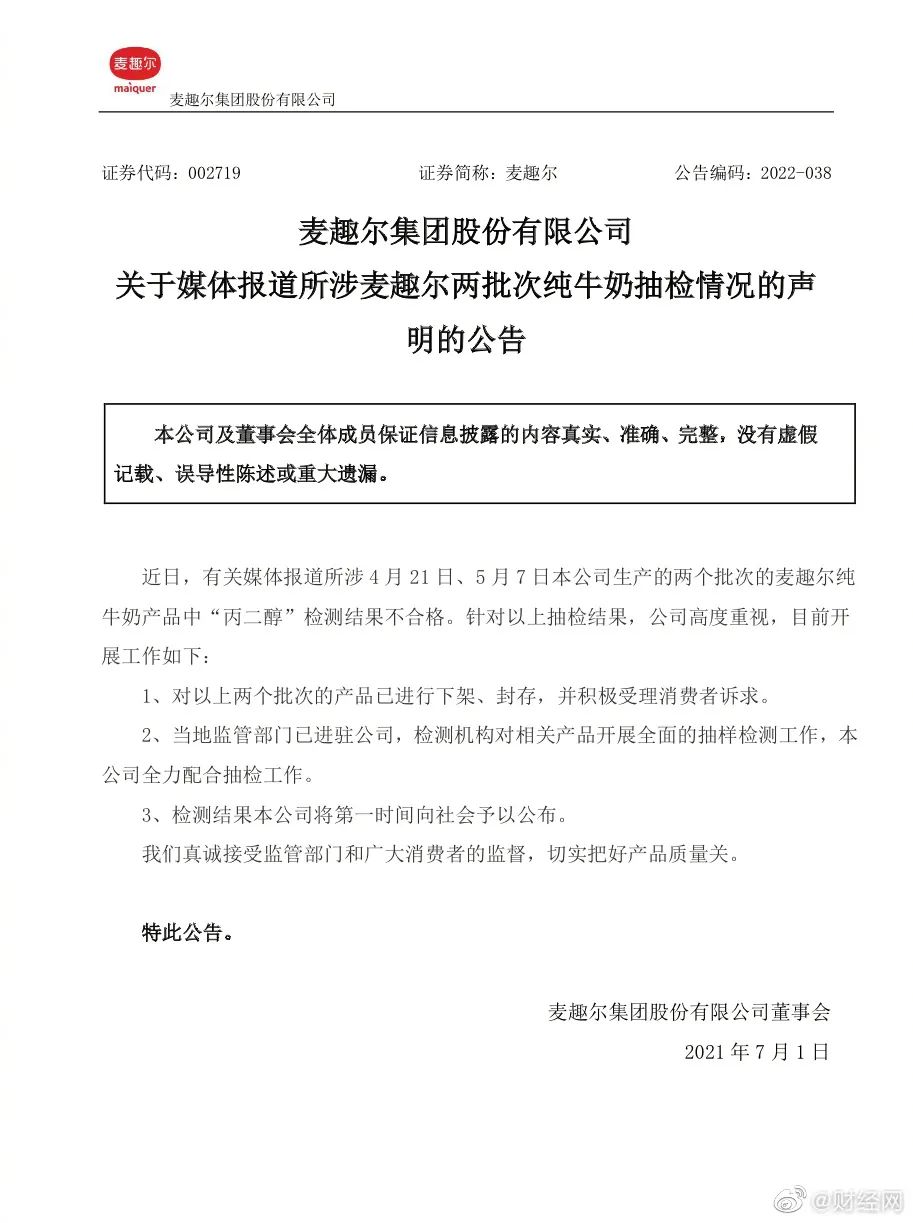

In response to the two batches of reports of unqualified pure milk sampling inspec...