The IPO of the Lilida North Stock

Author:Capital state Time:2022.07.05

Picture source: Bei Stock Exchange website

Lyda's main business is the research and development, production and sales of IoT modules and IoT system solutions, as well as IC value -added distribution business.

Financial data shows that from 2019 to 2021, Lerida achieved operating income of 1.256 billion yuan, 1.3077 billion yuan, and 2.206 billion yuan, respectively, and realized net profit attributable to the owner of the parent company 7117 million yuan, 512.776 million yuan, and 181 million yuan. Essence

Picture source: company prospectus

The net amount of the company's raised funds is intended to be used for the expansion of the third phase of the IoT module production project, the research and development center construction project, and supplementary funds after the issuance of the issuance costs. A total of 299 million yuan was invested in raising funds.

Picture source: company prospectus

At the IPO of the Beijing Stock Exchange, Lilida admits the following risks:

(1) Risks of international trade disputes

In recent years, the international trade environment has become increasingly complicated, and international trade friction disputes have intensified. Some countries have provoked trade disputes with China, conducting trade sanctions and unilateral restrictions on Chinese enterprises. Caused a serious negative effect. If the relevant countries will increase the restrictions on China's semiconductor industry in the future and further expand the field of trade sanctions, the company may face the risk of being unable to import chips from relevant countries and regions or to sell products to some customers, so as to draw the company’s production and operation belt Come and adversely affect.

(2) The risk of concentration of suppliers

During the reporting period, the company's purchase amount for the top five suppliers accounted for 49.36%, 51.45%, and 51.52%of the total procurement amount, respectively, and the purchasing concentration was high. They were 23.01%, 33.02%, and 36.34%, respectively. The company's upstream suppliers are mainly well -known internationally or domestic original chips. These chip originals are mainly funded and technical dense enterprises. They enter the high barriers and have a small number. They have the design and production capacity of advanced IC products. Therefore, the original chip of the company has a high concentration characteristics.

Although the company has established a good cooperative relationship with the original supplier of the upstream major chip, if the original upstream chip was used in the future due to major changes in the equity structure, management adjustment or operating conditions The upstream customer channel changes and other reasons, which leads to the termination of the upstream chip original factory with the company's authorized agency agreement or business cooperation, will adversely affect the company's operating performance.

(3) The risk of product agency authorization is canceled or unable to renew the contract

The original authorization of the chip is the cornerstone of the steady development of the company's IC value -added distribution business. At present, the company has obtained the authorized qualifications of international or domestic or domestic or domestic well -known chips such as ST The factory has established a good business cooperation relationship.

However, if the original factory's own business adjustment, or the further intensification of international trade frictions, or the company's service support capabilities cannot meet the requirements of the original factory, or the company and the original factory controversial or disputes, the company is in the original chip factory The cancellation of the qualifications of the authorization and cannot continue to obtain the new product line authorization or the existing product line authorization is canceled, which will have a significant adverse effect on the company's business operations.

(4) Market supply and demand risk

Beginning in 2020, due to the rapid development of 5G communications, the Internet of Things and other industries, the market's demand for chips has shown a rapid growth trend. At the same time, the upstream chip manufacturers are affected by factors such as the new crown epidemic. One of the main businesses is the IC value -added distribution business. Benefiting from the popularity of the chip market, the company's 2021 income and profit scale have increased high.

In the future, if the demand for chips will decline in the downstream market, the capacity of upstream chip manufacturers will be restored or increased, the tension between supply and demand of the chip market will be alleviated, which will have a significant impact on the company's IC value -added distribution business income and profits.

(5) Return policy risk

The issuer's IC value -added distribution business and some major original transactions adopt the supplier return model. In this model, the issuer first prices at the original price meter (that is, the nominal purchase price. The price is generally higher than the issuer's direction. The price of the customer's sales) purchased from the original factory. After the product sales were sold, the issuer applied to the original factory to apply for a return on the cost according to the cost price determined in advance. After passing through the CreditNote (deductible payment credentials) to the issuer. During the reporting period, the amount of suppliers received by the company was equivalent to RMB 305.8265 million, RMB 418.971 million, and 503.7517 million yuan, respectively.

The calculation of the supplier's payment involves a large number of customers and materials models. The issuer exists that the customer declares information is inaccurate when the customer declares the payment is reported to the supplier. According to the original distribution policy, the original factory will inspect the distribution activities and return declarations of authorized distributors from time to time. Risks such as receiving the payment, the recovery of the return, the supplier's fine, the cancellation of the agency right, and the inability to renew the agency right may have a significant adverse effect on the company's operating performance. (6) Risk of decline in gross profit margin

During the reporting period, the company's comprehensive gross profit margin was 21.28%, 18.20%, and 22.59%, respectively. The comprehensive gross profit margin was affected by factors such as changes in product structure, sales price, and cost of raw materials. If the price of direct raw materials will rise in the future or the company cannot continue to improve technology innovation capabilities and maintains a certain leading advantage, or competitors will weaken the company's product's competitive advantage by improving product technology content and reducing sales prices, the company has the risk of decline in product gross profit margin.

- END -

Heze Xia Gan production has once again realized the "three increases"

On June 20, the reporter learned from the Heze Agricultural and Rural Bureau that this year's summer grain harvest in our city has been basically completed.The three increases.As the province's food...

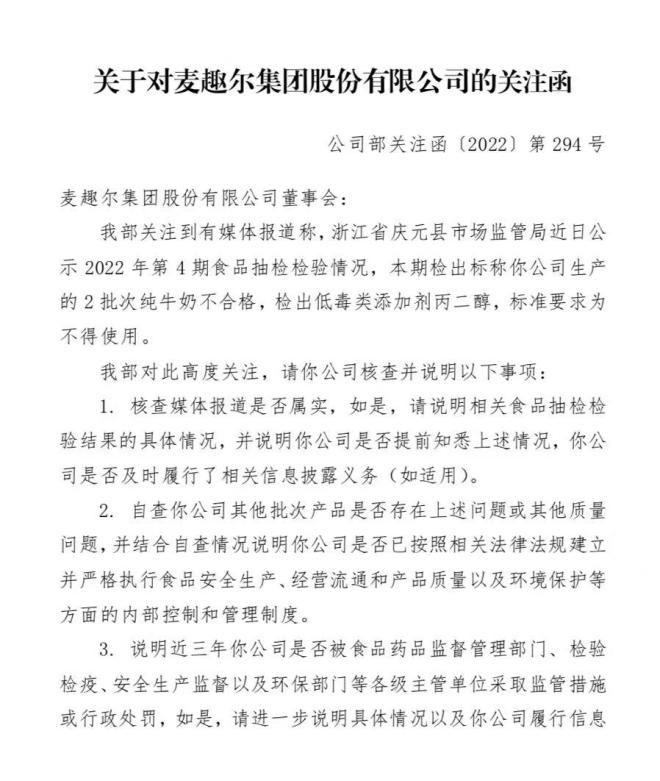

Maiquer in the storm of "Poisonous Milk": "High -end Dream" is broken or suffered a crisis of trust?

Future Net, Beijing, July 2 (Reporter Ling Meng) A food spot check report made the...