Super LP invested, Chengdu gave birth to 5 billion new funds

Author:Investment community Time:2022.06.13

The National SME Development Fund falls into Chengdu.

Investment industry-decoding LP learned from Chengdu Jiaozi Financial Holding Group that as a national SME Development Fund, the National SME Development Fund (Chengdu) Jiaozi Venture Investment Partnership completed the industrial and commercial registration, officially established in Chengdu High-tech Zone, and management institutions. Management agencies It is the well -known local venture capital -Oriental Fugai.

The fund is the first landing fund established since the new policy of the Sichuan Provincial Industry this year, and it is also the first fund in Sichuan Province and the largest fund in Sichuan Province and the largest fund in Sichuan Province. It is reported that the subsidiaries signed the scale of 5 billion yuan, mainly investing in small and medium -sized enterprises in semiconductor, new energy, new materials, information technology, medical and health and other fields.

Of course, this is just a ray of microcosm of Chengdu Chuangjun.

National Mother Fund

For the first time in Sichuan, the scale is 5 billion

This time is Chengdu, Sichuan.

The National SME Development Fund (Chengdu) Jiaozi Entrepreneurship Investment Partnership, the main LP includes the National SME Development Fund, Chengdu Jiaozi Financial Holding Group, Chengdu Wenjiang District's major industrialized project investment fund, Chengdu High Investment Group, Shenzhen Dongfang Fuhai Co., Ltd. Company, open source securities, Shanxi Securities, etc.

Among them, the National SME Development Fund is a national super LP. In June 2020, in order to implement the "Guiding Opinions on Promoting the Healthy Development of SMEs" and the State Council decision -making and deployment, under the leadership of the Ministry of Industry and Information Technology and the Ministry of Finance, the central government directly contributed to the central government and jointly jointly contributed by many national and central enterprises, insurance institutions, and funds. The subsidiaries and other national SME Development Fund Co., Ltd. were launched in Shanghai, which officially invested in operations with the parent fund entity. It supports the development of SMEs through investment subsidiaries and direct investment. The registered capital reached 35.75 billion yuan.

Up to now, the establishment of the first batch of national SME Development Fund and the second batch of sub -funds has been completed; starting this year, the third batch of sub -funds have begun signing work. On May 25 this year, the third batch of National SME Development Fund Co., Ltd. completed the third batch of newly set up two new sub -funds signing work.

According to the data, the SME Development Fund (Chengdu) Jiaozi Entrepreneurship Investment Partnership (limited partnership), registered place: Chengdu, Sichuan, the management institution is Shenzhen Dongfang Fuhai Entrepreneurship Investment Management Co., Ltd., with a scale of 5 billion yuan, mainly investing in semiconductors, semiconductor, semiconductor, semiconductor, SMEs in the fields of new energy, new materials, information technology, medical and health.

Dongfang Fuhai is a domestic head venture capital institution. It is committed to investing in target companies with growth and listing potential. At present, the cumulative management of the institution has a total of about 25 billion yuan, 52 in the management fund, investing in more than 500 projects, and the investment field Including information technology, energy conservation and environmental protection, health care, new materials, etc.

Why does it fall in Chengdu? As early as August 2021, the official website of the National SME Development Fund Co., Ltd. issued the third batch of sub -fund management organization selection announcements, and specifically emphasized the third batch of sub -fund management agencies "priority support (sub -fund) registered and established in the central and western regions" This statement changes may mean the development of the venture capital industry in the central and western regions.

According to the relevant person in charge of the fund, around the industry's "building a strong chain" operation, the sub -fund will focus on the commanding heights of future technology and industrial development, actively play the role of "investment promotion and wisdom" and capital amplification, and promote the resolution of Sichuan Province and Chengdu "specialized specialty The medium- and long -term equity financing issues of Small and SMEs, better serve the innovation and development of Sichuan and Chengdu SMEs in Sichuan Province.

Why does VC pour into Chengdu?

Coincidentally, VC/PE frequently went to Chengdu to check in in recent years.

As the Sichuan provincial capital, Chengdu has a history of more than 3,000 years. It is the birthplace of the ancient Shu civilization and one of the top ten ancient capitals in China. Because of the unique geographical location and superior natural environment, the climate is moist throughout the year and has " The reputation of the country of Tianfu. In recent years, Chengdu has attracted a large number of young people to settle with a leisurely and comfortable life atmosphere.

For VC/PE, this dynamic city is also attractive.

Chengdu has successively established a number of parent funds to use capital investment to introduce a group of industrial chain clusters, which has played a very strong role in the development of the local regional economy and industry. In 2021, Chengdu established a number of parent funds and frequently funded the establishment of sub -funds. It was very lively —

In September 2021, Chengdu High -tech Zone United Qualcomm Capital Group, Sichuan Radio and Television Media Group, etc., set up a new industrial fund with a scale of 10 billion, of which the scale of the parent fund was 5 billion yuan. The fund is specially invested in major industrialization projects in high -tech zones, including investment directions such as M & A special sub -funds, special sub -funds of the medical and health industry, special sub -fund of education, cultural and creative industry, and electronic information industry special sub -funds.

In December of the same year, Chengdu's major industrialization project investment fund ("heavy production fund") and the national scientific and technological achievements transformation and guidance funds joined the batch of participants' investment (Guangdong) scientific and technological achievements to the entrepreneurial investment fund partnership (limited partnership) and completed the first capital capital contribution Essence Among them, the heavy production fund is a parent fund formed by the fiscal funds of the two levels of Chengdu District and the establishment of state -owned enterprise funds, with a scale of 40 billion yuan, focusing on supporting the key projects of major support, strategic projects and industrial chain of advanced manufacturing in Chengdu.

In order to further attract VC/PE, Chengdu High -tech Zone held a conference to optimize the business environment in February this year to release an industrial fund establishment plan. The meeting pointed out that in 2022, the Chengdu High -tech Zone will accelerate the establishment of industrial funds, and will arrange for the investment of not less than 18 billion yuan to guide social capital participation. Industry, 20%invested in the biomedical industry, 20%invested in new economic industries, and 20%invested in other industries including modern service industries and future industries. In particular, it will focus on hardcore technology and advanced manufacturing projects. In addition, Chengdu has also built the first fund town of the Midwest, Tianfu International Fund Town. Data show that this fund town located in Tianfu New District, Chengdu has successfully introduced IDG Capital, CICC Capital, Bohai Huamei, China Risk Investment, Plum Capital, Gao Rong Capital, Yuansheng Venture Capital, Chengdu Development Fund, Guojin Building There are 650 related institutions such as the letter fund, Chengdu Ziguang Industrial Fund, and Jiaosi Industry Fund. The total size of social funds has reached 550 billion yuan, and the scale of the fund has reached 160 billion yuan, becoming the largest fund industrial park in western China.

More than that, head institutions such as Tencent, Sequoia, Gao Yan, Shunwei, and Dongfang Fuhai have successively settled in Chengdu. Chen Wei, chairman of Dongfang Fuhai, said that the Chengdu government's investment in the market -oriented fund LP can not participate in the fund's usual management and operation, and the requirements for the proportion of return are also very flexible, and respect for the market.

Chengdu has a good industrial foundation, and is the city with the most Fortune 500 companies in the western region. In addition, Chengdu also has a lot of advantageous industries, such as biomedicine, electronic information, and entertainment industries. Many excellent companies have been born. Among them, there are no lack of science and innovation board listed companies. A partner of a VC institution in Shanghai bluntly stated that there are more and more startup companies that have fallen into Chengdu, and there are more than a dozen companies in our hands.

"Chengdu, a city that doesn't want to leave when you come." Investors and entrepreneurs like tide are practicing the slogan with action.

- END -

Investigation and instruction of the Ministry of Agriculture and Rural Ministry of the Ministry of A

On the morning of June 9th, Wang Ping, deputy director of the Ministry of Agricult...

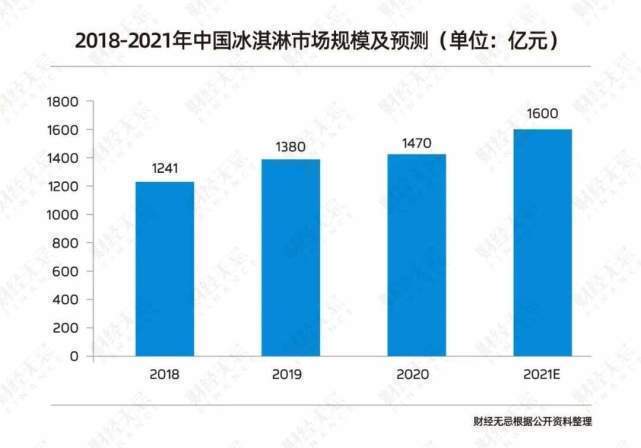

Is ice cream or "high"?

Wen | NingwenSummer is here. When buying ice cream checkout, many young people fee...