The improvement of the financing environment of housing enterprises is expected to increase the scale of credit bond financing in the second half of the year

Author:Securities daily Time:2022.07.06

6Jul

Wen | Wu Xiaolu

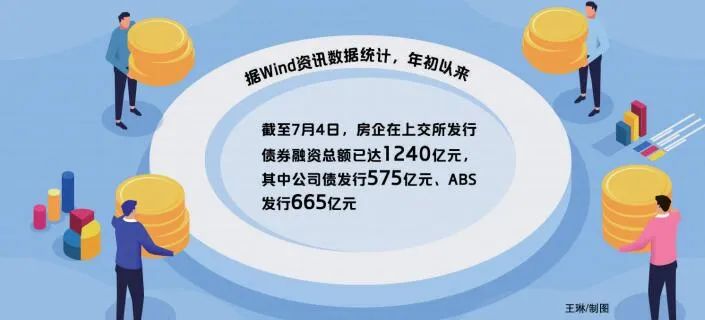

Since the beginning of this year, the financing environment of the real estate industry has continuously improved. According to the statistics of Wind information, since the beginning of the year, as of July 4, the total amount of bond financing issued by housing companies has reached 124 billion yuan, of which corporate bonds issued 57.5 billion yuan and ABS issued 66.5 billion yuan. According to industry insiders, as a whole, as the bailout policy continues to be introduced, the joint force of "increasing trust, risk prevention, and stable growth" has formed, and individual cities' housing markets have begun to recover. Housing companies have gradually eased. The financing environment has been valid. Improving, it is expected that the real estate market will continue to stabilize in the second half of the year, and the scale of credit bond financing is expected to increase. Support the improvement of the liquidity of real estate industry in real estate companies, the improvement of the financing environment of real estate enterprises has continued to improve since this year. As an example, according to the statistics of Wind information data, since the beginning of the year, as of July 4, the Shanghai Stock Exchange has approved the 16 single -housing corporate corporate bonds, with a total approval scale of 75.31 billion yuan; the total financing of housing enterprises has reached 124 billion yuan. Especially since March, the company's real estate industry's corporate debt and ABS net financing amount have remained positive, with a total net financing amount of more than 10 billion yuan, providing stable and smooth financing channels for real estate companies. In fact, asset securitization products have become one of the important channels for the financing of housing companies. Wind information data shows that since April, the Shanghai Stock Exchange has a total of 25 housing companies ABS projects, with a financing amount of 29.13 billion yuan, of which Shanghai Jinmao issued 8.708 billion yuan of carbon neutralized CMBS on April 25, setting a national carbon neutralization in China The largest record of the CMBS project has a record of 2.5 times the overall subscription multiple. "Asset securitization products are replaced by asset credit replacement main credit, which is conducive to the effective revitalization of high -quality assets of private real estate issuers and broadening financing channels and methods. For investors, such products can also form a good isolation and slow -release risk. Effect. "Researchers who have been paying attention to the real estate industry for a long time told reporters. The exchanges' debt market helps the industry's credit to restore private real estate enterprises to "ice -breaking" private housing companies is an important part of the real estate industry. If you need to rebuild the confidence in the real estate industry, it is important links to unblock the financing channels of private housing enterprises. Since May, private housing companies Chongqing Longhu, Midea Real Estate, and Xuhui Holdings Group have issued 500 million yuan, 1 billion yuan, and 500 million yuan corporate bonds in the Shanghai Stock Exchange. China Securities Financial Co., Ltd. has passed the private enterprise bond financing support plan. The three -phase bond bonds were successfully issued with the establishment of credit protection tools with the main underwriters CITIC Securities and Cathay -Junan Securities, respectively. "Credit protection tools have a positive effect on issuers and investors. The creation helps to help issuers reduce the cost of issuance of debt issuance, improve issuance efficiency, and introduce the credit endorsement of creation institutions for investors to reduce the impact of the risk of breach of contract, resist the estimation estimation estimation Value fluctuation risk. "Researchers of Huatai Securities said. In May, the Shanghai Stock Exchange led the organization to hold the docking and exchange activities between private housing companies and investors. Longhu, Midea Real Estate, Xuhui Holding Group, Xincheng Holdings, Country Garden's 5 private real estate companies, multiple underwriters and bond institutions participated comminicate. "The main idea of this exchange activity is to encourage relevant enterprises to strengthen the disclosure of active information, reduce information asymmetry, and promote mutual trust and benefit." The relevant person in charge of the Shanghai Stock Exchange said. Participating agencies stated that "Investment and Finance Mutual Trust is the basis for promoting the reasonable financing needs of the real estate industry issuers. Through frank exchanges, it helps to further understand and objectively analyze the actual situation of the issuer, so as to make corresponding investment decisions." At the same time, at the same time The confidence of the issuer's debt issuance of housing enterprise is also gradually reconstruction. A real estate company stated that "is actively preparing a new financing plan." Industry insiders generally predict that the real estate industry is expected to continue to stabilize in the second half of this year. Gradually tend to be healthy and stable and benign cycle. The relevant person in charge of the Shanghai Stock Exchange stated that as one of the important parts of the capital market, under the guidance of the SFC, the SSE of the Shanghai Stock Exchange continued to optimize the real estate financing supervision policy, actively support the reasonable needs of relevant enterprises, and fully maintain the healthy and orderly development of the real estate market.

Recommended reading

There are three industries such as coal, steel, and basic chemical industry! The semi -annual newspaper pre -hospitality section collectively rose collectively

The fifth increase of fuel surcharges up to 200 yuan for some aviation lines, fares, fares inverted

Picture | Site Cool Hero Bao Map Network Production | Liu Zhizhi

- END -

Dongling Township: Let technology help farmers take effect

In order to implement the spirit of the 14th Provincial Party Congress and promote...

Huaye's loss of 417 million yuan in the first quarter of 1202 expanded by 94.00% year -on -year

On June 30, Capital State learned that Huaye 1 (code: 400080.NQ) released the first quarter report performance report in 2022.From January 1, 2022-March 31, 2022, the company realized operating income