The central bank has carried out 3 billion yuan in reverse repurchase operations on the 3rd consecutive day!How long will this situation last?What impact on the market?Expert interpretation comes

Author:Daily Economic News Time:2022.07.06

The central bank website announced on July 6 that in order to maintain the banking system, the liquidity of the banking system was reasonable and abundant. Today, the 7 -day reverse repurchase operation was carried out by interest rate bidding, and the interest rate was 2.1%, which was consistent with the previous.

"Daily Economic News" reporter noticed that this is also the third consecutive day of the central bank to conduct 3 billion yuan of reverse repurchase operations, which will conduct 3 billion yuan reverse repurchase operations on July 4 and 5. Wind data shows that the 7 -day reverse repurchase operation of 3 billion yuan is the lowest value since this year.

Why did the central bank reduce the conventional operating amount of 10 billion yuan to 3 billion yuan? Shao Yu, chief economist of Oriental Securities, told a reporter: "Overall, the market liquidity is still relatively loose, and the market's prediction of financial data is generally better. Relatively, the operation of the entire bank to maintain liquidity is now operating. The order is decreasing. "

The deputy director and chief FICC analyst of CITIC Securities Research Institute also wrote: "The central bank has shown monetary policy from the crisis model to the conventional model. The macro -control policy is expected to enter the revised stage. "

On the 3rd consecutive on the 3rd, 3 billion yuan reverse repurchase operation

Since the central bank has reduced the scale of reverse repurchase operations to 3 billion yuan on July 4, as of now, it has carried out a reverse repurchase of 3 billion yuan on the 3rd consecutive day. From the perspective of funds, the central bank has carried out a number of 100 billion -level reverse repurchase operations at the end of June. Today, there is a 100 billion yuan reverse repurchase expiration. Therefore, the net recovery was 97 billion yuan in a single day. Coupled with the net recovery of 204 billion yuan in the previous two days, a total of 301 billion yuan was returned on the three days.

Although the central bank's reverse repurchase investment has a significant shrinkage, the capital side remains loose. Yesterday, Shibor, Shanghai's inter -bank interbank interest rate (SHIBOR), down overnight 5.1 basis points to 1.367%. 7 days of SHIBOR up to 4.5 basis points to 1.669%. From the perspective of repurchase interest rates, the weighted interest rate of DR007 dropped to 1.5703%, which was lower than the level of policy interest rates.

Obviously, after nearly three months of the maintenance of monetary policy and low capital interest rates, the market's concerns about whether the capital market will usher in a change and whether the monetary policy will be fine -tuned. At the same time, the credit demand indicated by the bill of interest rates, the heating of inflation is expected to rise under the rise of pork prices, and the local epidemic enters the tail -sized stage. The necessity of low capital interest rate operation needs to be evaluated.

"After the end of the capital market, the central bank launched a scattered repurchase operation of 3 billion yuan on July 4th and 5th on July 4th and 5th, which further exacerbated the market's concerns about the fine -tuning of monetary policy and the return of capital interest rates." Obviously.

Every reporter noticed that Wind data shows that in the case of operation, the single minimum size of the previous public market reverse repurchase operation was 1 billion yuan. In addition, the central bank has also carried out inverse repurchase operations of 2 billion yuan, 3 billion yuan, 5 billion yuan, 8 billion yuan, and 9 billion yuan. The latest inverse repurchase operation below 3 billion yuan was in January 2021. At that time, the central bank conducted many 2 billion yuan reverse repurchase operations.

Obviously pointing out: "The central bank carried out scattered reverse repurchase operations in January 2021. The current funding environment is similar to 2021, but the fundamental environment is different. In early 2021 In the process, the economic endogenous growth momentum is strong, and the market discussion policies are 'not rolling. "The current economy is gradually recovering from the epidemic, and endogenous growth momentum is still being repaired."

Expert: It is expected that low -volume reverse repurchase operations will last for a while

Regarding the interest rate trend and monetary policy expectations of the next stage, Shao Yu said that the current liquidity market is relatively rich and the monetary policy is more positive. Essence

Talking about the impact of the low repurchase operation of low -volume reverse repurchase, there are three main aspects: First, if the central bank continues 3 billion yuan per day of reverse repurchase operations, the net return will be 435 billion yuan in early July. Yuan, the scale of liquidity net recovery is lower than in early 2021, higher than May 2020. It is expected that the degree of callback from the interest rate may be between the two.

Secondly, July is the redeem period of fundamental restoration and the transformation stage of the policy model. Refer to the 10 -year national bond yield return rate of 10 years in the process of the return of capital interest rate return in January 2021, which is 17.4bps. 10bps upward space.

Third, after the return of monetary policy to the normal state and near 2021, the stock market encountered a callback after the return policy of the return of funds and interest rates to the return of funds and interest rates in early 2021.

Obviously, although the central bank's operations have been relatively balanced since April, the main reason for the loose funding is that the financial expenditure and credit demand are insufficient, but the low -level operation of the central bank's tolerance rate is that its operating model is a crisis model in the environment of a local epidemic. At present, the domestic and local epidemic situation enters the end of the closing, and the national economy will enter the national post -repair stage, which also means that monetary policy may enter a new stage -to return to the broad -credit goal before the local epidemic. Recently, 3 billion yuan of reverse repurchase operations have been carried out, or subsequent monetary policies have been specified from crisis models to conventional models. Furthermore, in addition to the transformation of monetary policy models, macro -control policies in the second half of the year will enter the re -estimated stage.

Daily Economic News

- END -

The Corps supports the company's independent innovation practice "unique skills"

Our newspaper Urumqi News (All Media Reporter Chen Qiong) The reporter learned from the Corps Industry and Information Technology Bureau that in accordance with the Administrative Measures for the Ad

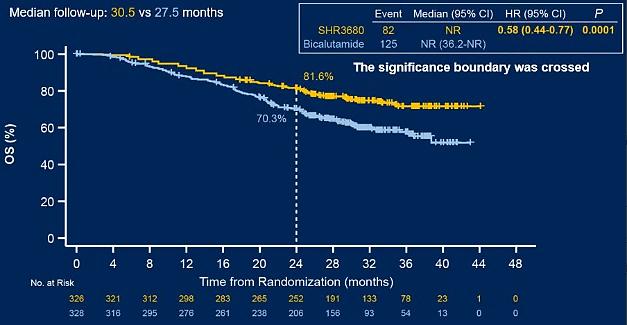

Hengrui Pharmaceutical's new AR inhibitor is approved by patients with prostate cancer to usher in a new choice

Zhongxin Jingwei, July 2nd. On June 29th, Hengrui Pharmaceutical Announcement anno...