COSCO is expected to achieve a net profit of 64.716 billion yuan in the first half of the year. Is there still support for the future shipping costs?

Author:Daily Economic News Time:2022.07.06

On July 6, COSCO Haikong (SH601919, the stock price of 13.92 yuan, and a market value of 222.9 billion yuan) issued an announcement saying that after preliminary calculations, it is expected that the company's net profit to return to the mother in the first half of 2022 was about RMB 64.716 billion, a year -on -year increase of about 74.45% Essence

Image source: Data map

"Daily Economic News" reporter noticed that in the first half of this year, the shipping industry continued to the situation last year. The supply and demand relationship was still one of the reasons for the growth of the performance of the Zhongyuan Maritime Control.

Recently, the cost of shipping has declined. Some research institutions believe that the cost of shipping in the short term will still be affected by factors such as port congestion, but the return of shipping costs will accelerate in a long time.

It is expected that net profit will increase by more than 70 % year -on -year

"After preliminary estimation, it is expected that the net profit attributable to shareholders of listed companies in the first half of 2022 is about RMB 64.716 billion, an increase of about RMB 27.618 billion, an increase of about 74.45%year -on -year." COSCO Maritime Control said.

In response to the reasons for performance growth, COSCO Haikong explained that the supply and demand relationship of international container transportation was relatively tight, and the export freight of the main routes remained high.

"During the reporting period, affected by the new crown pneumonia's epidemic, the global supply chain was seriously lagging, and global customers put forward higher requirements for the stability and toughness of the supply chain." COSCO Maritime Control said.

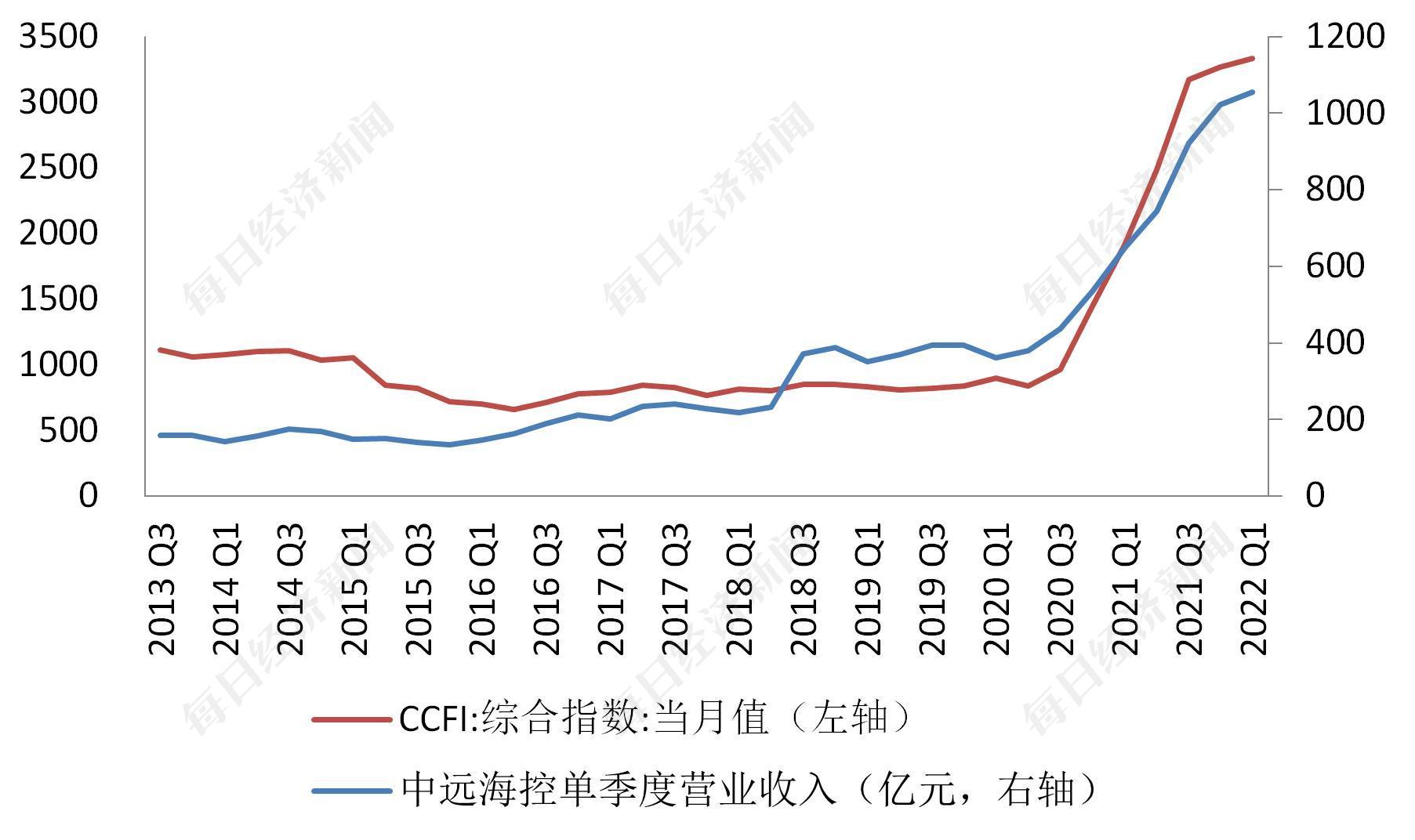

It is worth noting that the single -quarter operating income of COSCO Maritime Control is highly positively correlated with the comprehensive index (CCFI) of China's export container freight (CCFI).

Data source: Flush iFind every reporter drawing

"During the reporting period, the average value of China's export container freight comprehensive index (CCFI) was 3286.03 points, an increase of 59%year -on -year." COSCO Maritime Control said.

In the first half of this year, the comprehensive index of China's export container freight rate maintained a high level of growth. At the same time, although prices have risen, the container throughput in my country's ports still increased. In other words, the container shipping industry has achieved the same volume and price in the first half of this year.

According to data from the Ministry of Transport, in May 2022, the volume of container throughput in my country continued to perform well, and the coastal and inland river port throughput rose. According to statistics, the nationwide port was completed by 25.43 million TEU (international standard box unit), an increase of 4.3%over the same period last year. Among them, the coastal port completion of the container throughput was 22.28 million TEU, an increase of 3.8%year -on -year; the inland port to complete the container throughput of 3.16 million TEU, an increase of 8.2%year -on -year.

In the context of the rising volume and price of the industry, COSCO Marine's customers also face great challenges. COSCO Maritime Control stated that it provides flexible alternatives such as "water transfer" and "water -rail transportation", and gives full play to the important role of scientific and technological innovation and digitalization in the supply chain system, and make every effort to help customers spend a challenging period. To ensure the stability of the global supply chain.

Recent shipping costs have been called back

Since the second quarter of this year, China's export container freight index has been adjusted. In June, the average value of the comprehensive freight index of China's export container released by the Shanghai Shipping Exchange was 3228.37 points, an increase of 3.5%from the previous month; the average value of Shanghai export container index in the current market was 4219.85 points, which was compared with the average of the previous month. Rising 1.4%.

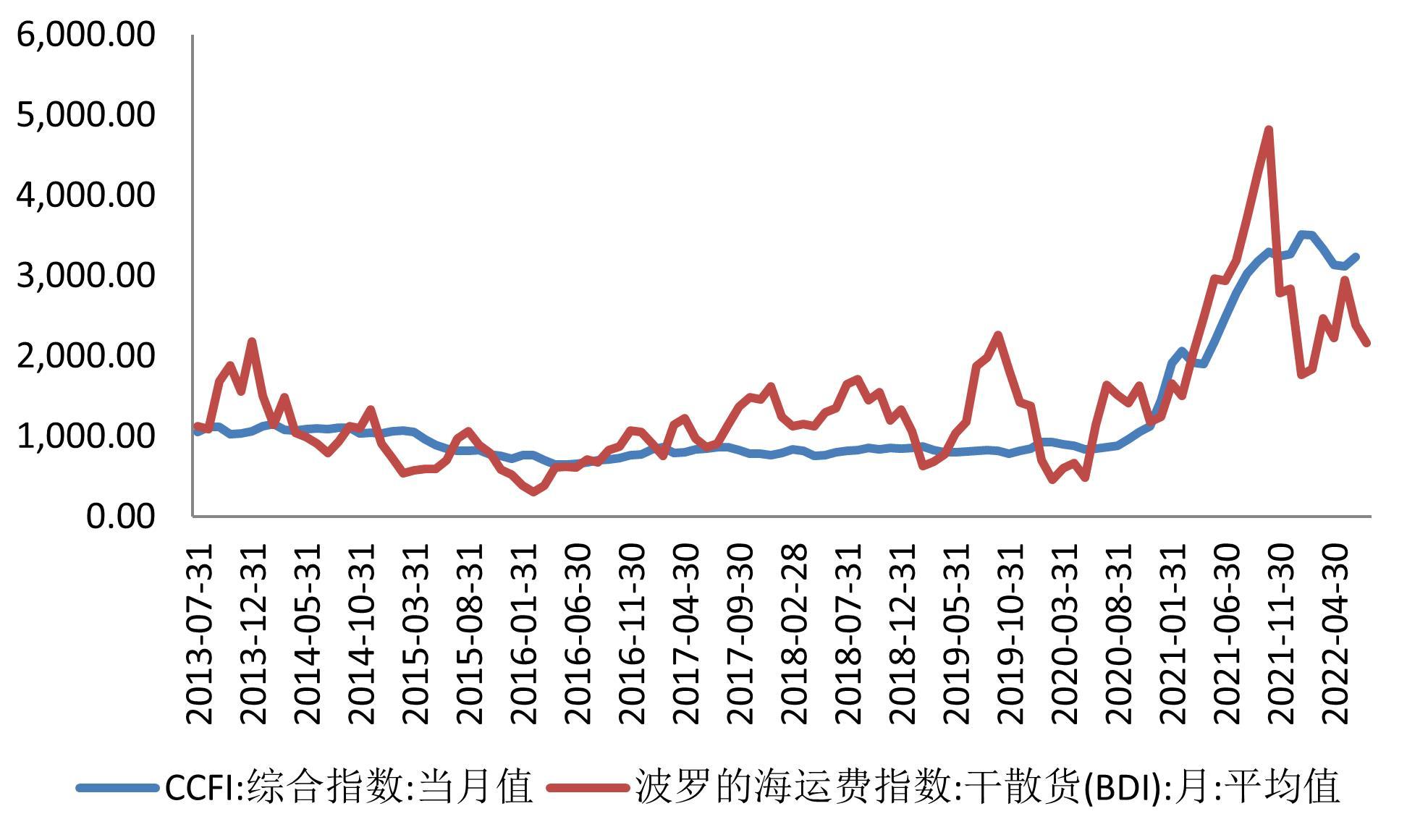

Photo source: every reporter drawing

In response to the shipping price in June, the Shanghai Shipping Exchange analyzed: "After the accumulation of the market market in the early stage of the container rental market has increased, the market rental price has been adjusted this month, and the price of some small and medium -sized ship rental markets has fallen slightly. According to Clarkson statistics In June 2022, the rent of 4400teu, 6800teu, and 9000TEU ships was the same as last month. The rent of 1700teu and 2750TEU ships fell 3.0%and 0.1%from the previous month. "

In contrast, the volatility of the Baltic Swell Slutin Index, which represents the level of international shipping costs, is far greater than the comprehensive index of China's export container freight. Although there was a large decline in the early stage, the Baltic Swell Slutter Index has been showing a growth trend before May this year, and it has gradually recovered from June.

"Daily Economic News" reporter noticed that the weakening of global demand may affect the recovery of the shipping freight index. Clarkson said in a study on June 13 this year: "The global container shipping trade is currently facing downward pressure. In the short term, port congestion and logistics interruption will continue to provide support for the current freight and rent market. With the relief of the congestion of the port, the rapid growth of capacity in the next two years and the downlink pressure of global centralized trade, the process of returning to the normalization of the container ship market may accelerate. "

Clarkson also lowered the forecast of the global shipping container trading growth in the research. "We have now lowered the forecast of global sea transport containers' trade volume to 1.3%(with the TEU calculation), and at the same time, the prediction of the box of the box of the box of the box of the Haili to 0.5%. The possibility of lowering, "Clarkson said.

Unlike Clarkson's short -term freight rate, it is different. CITIC Futures predicts in a research report on July 3 that the freight rate of container ships will continue to fall in the short term.CITIC Futures believes that the idle proportion of ships continues to rise to 4.3%, which is higher than the same period last year.In addition, the demand is generally weakened, and large -scale importers such as Wal -Mart have declined.The congestion of the port has intensified, and the supply chain problem extends to the railway side.The freight forwarding freight is faster, and the shipowner still hopes that the freight price will fall down by adjusting the speed and idle capacity price.Daily Economic News

- END -

Pick up the year | How effective is the reform of the mixed ownership of state -owned enterprises?State Council State -owned Assets Supervision Commission response

Cover news reporter Teng YanA few days ago, the Central Propaganda Department laun...

From January to May, the key projects in the region completed 79.5 billion yuan in investment accounted for nearly 40% of fixed assets investment

Pomegranate cloud/Xinjiang Daily reporter (Reporter Wang Yongfei reported) The reporter learned from the Hetian to Ruoqian Railway and the second major project dispatch meeting of 2022: From January t