The amount of structural deposits in the background of listed companies' purchase of wealth management products decreased by 25.8% year -on -year, the attractive attraction of structural deposits is not diminished

Author:Securities daily Time:2022.07.07

Recently, listed companies' purchase of bank wealth management products has caused continuous market attention.

According to Wind data statistics from Wind data, from January 1 to July 6 this year, listed companies purchase wealth management products (ordinary deposits, structural deposits, bank wealth management, securities firms wealth management, trust, private equity funds, etc.) of 5429.4 100 million yuan, a decrease of 25.8%compared with the same period last year. In addition, in the context of "Go to Gang", structural deposits are still most sought after.

Listed companies prefer structural deposits

Since the beginning of this year, the popularity of listed companies has "cools down" the popularity of wealth management products. According to Wind data, as of July 6th, the press publishing, a total of 913 listed companies purchased wealth management products during the year, with a total purchase scale of about 542.94 billion yuan, a decrease of 188.74 billion yuan from the same period last year, a year -on -year decrease of 25.8%.

The chief economist of CITIC Securities clearly said in an interview with the Securities Daily that the current company's purchase of wealth management products has decreased compared with the same period last year. The epidemic disturbances frequently, the business environment of the enterprise is not good, the cash reserves have been down from last year, and the amount of wealth management products has declined.

Su Xiaorui, a senior analyst of the financial industry, believes that there are two main reasons: First, the external uncertain factors of the financial market in the first half of the year are strong. ;

Judging from the preferences of listed companies to buy wealth management products, the proportion of structural deposits is still the highest. The subscription scale is 358.5 billion yuan during the year, accounting for 66%, a slight drop from the same period last year; bank wealth management products account for 11.6%, and It ranked second, accounting for 6.4 percentage points in the same period last year; the total proportion of ordinary deposits and regular deposits was 9%, an increase of 3.5 percentage points from the same period last year; 1.6 percentage points from the same period last year.

In Su Xiaorui's opinion, listed companies prefer structural deposits because they expect their own funds to achieve a certain degree of value preservation and value -added. In the context of "Go Gang", structural deposits are a kind of To achieve relatively balanced products, it is difficult to find alternatives equivalent to their strength in the market. If the environment that is difficult to seek for alternatives continues, the decline in yields and product scale will be Has little effect.

"The proportion of structural deposits is more than half because its yield may be the same as the regular deposit of 2 to 3 years, but the deadline is generally less than one year, and part of the period is only three months. It is more attractive to the enterprise." Obviously, it said Essence

From the perspective of listed companies, Jiangsu Cathay Pacific, China Telecom, CITIC Securities, Weichai Power, Daa's Co., Ltd., Hangshi Movement, Tsingtao Beer and other companies have higher subscription amounts, and the subscribed products are mostly structural products.

It is worth noting that, due to the consideration of liquidity and safety, the scale of listed companies purchased securities firms, trust products, and funds during the year was 31.47 billion yuan, 8.86 billion yuan, and 570 million yuan. Overall, the financial management of securities firms was quite quite quite quite quite quite quite quite quite quite quite quite quite quite quite. Focus on listed companies.

It is not cost -effective to hold cash too much

Recently, individual listed companies used idle funds to purchase bank wealth management products to attract attention.

On the Shanghai and Shenzhen Exchange Investors Interactive Platform, the reporter used "buying financial management" as a keyword to search and show, and a total of 299 related questions and answers during the year. For example, some investors are more concerned about whether this move will affect the implementation of the implementation of the company's fundraising projects. In this regard, a listed company responded that the company's use of idle fundraising funds for wealth management products is to ensure that the company's daily operations and funds are safe. It will not affect the normal development of the company's main business, product research and development, and the use of fundraising projects. Through banks and securities companies, the short -term financial management of highly safe and liquidity can improve the efficiency of funds and obtain certain investment efficiency.

From the perspective of clearly, the implementation of the company's fundraising project requires rhythm and steadily, and the funds raised cannot be put into all projects immediately. Excessive holding cash is not economically cost -effective. When it does not affect the company's operation, it does not affect the company's operation. Interesting income is conducive to the company's development and improvement of funds, but we must maintain close communication with investors to avoid affecting investor confidence.

Tian Lihui, the dean of the Institute of Financial Development of Nankai University, also holds a similar point of view. He believes that the company's fundraising projects have a phased nature. Therefore, listed companies do not use unused stock cash in cash management and reasonable cash management. In the final analysis, the company's funding efficiency is the problem of governance and management capabilities. Investors need to pay attention to the competitiveness of listed companies.

Dong Dengxin, director of the Institute of Finance and Securities of Wuhan University of Science and Technology, told a reporter from the Securities Daily that there are two cases of listed companies buying wealth management. "Poor money", but I can't find a good investment project or a pessimistic prospect of investment income, and I buy financial management. However, in general, buying a financial management process must be compliant, and the idle funds must be used on the "blade". (Reporter Su Xiangyi Learner Yang Jie)

![]()

[Editor in charge: Li Tong]

- END -

In May, Shanxi residents' consumption prices rose 2.5% year -on -year

On June 21, statistics released by the Shanxi Investigation Corps of the National Bureau of Statistics showed that the consumption prices of Shanxi residents increased by 2.5%year -on -year, which was

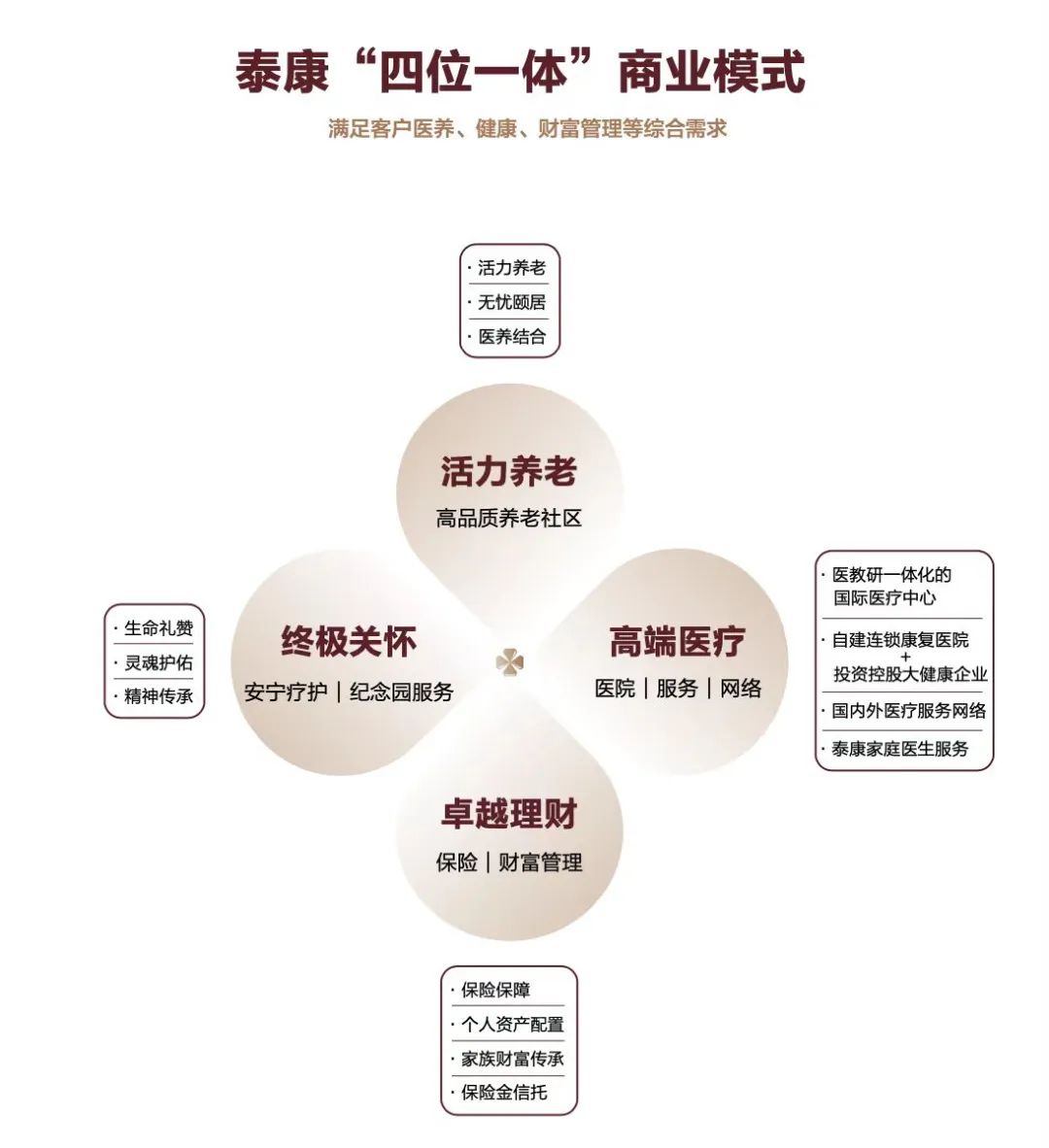

From the perspective of the "New Three Masters", the needs of high net worth groups change

And create and open up the marketTaikang's research predicts consumption trendsRes...