July 7 Auto ETF (516110) post -market review

Author:Capital state Time:2022.07.07

The closing of the Shanghai Stock Exchange Index was reported at 3364.4 points, up 0.27%; the GEM refers to 2849.71 points, up 1.68%; CSI 300 reported at 4443.47 points, up 0.44%; Shanghai Stock Exchange 50 at 2989.21 points, down 0.25%; , Rise 0.68%.

Automobile ETF (516110) rose 5.15%.

Data source: wind

Analysis of the cause of rising: The automobile market resumed exceeding expectations+"Several measures to act on the circulation of automobile circulation and expand the car consumption"

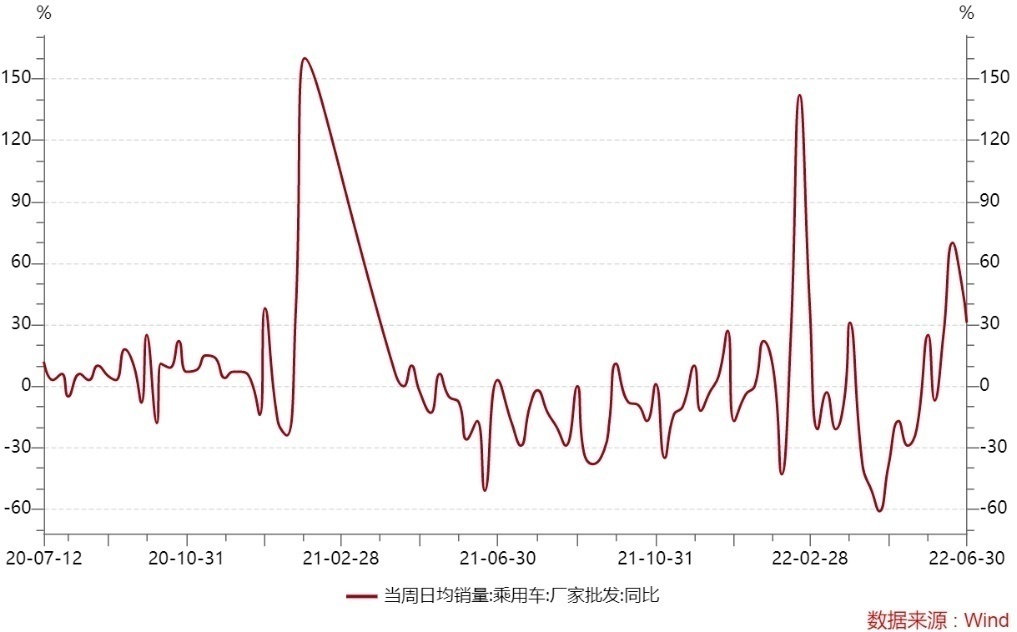

The car market recovery exceeded expectations: Week 4 of June, wholesale sales year -on -year+50%/month -on -month+12%up to 80,000 units per day, 40%/month -on -month in 4 weeks of June 40%/34%reached an average of 58,000 vehicles per day. It is expected that passenger car data is expected to reach a new high in June. According to data calculation of the China Union, the retail sales of domestic narrow passenger car in June are expected to be+15.5%/month -on -month+35.2%to 1.83 million units.

The stimulus policy continues to advance: On July 7th, 17 departments of the Ministry of Commerce issued the "Several Measures on the Circulation of Automobile Circulation and Expand the Consumption of Automobile" to support the purchase and use of new energy vehicles; accelerate the active used car market; promote automobile update consumption; promote the continuous continuity of automobile imports of automobiles Healthy development; optimize the environment of automobiles; enrich automobile financial services. This round of policy stimulus continues to work, and it is optimistic about the continuous improvement of downstream sales and the demand for midstream industrial chain.

Investment logic:

Internal demand-car change cycle+new product cycle. The average period of use of the car and the peak period for scrapped the scrap is 14-15 years. In 2026, China is expected to have about 13.5 million scrap vehicles, which is 2.6 times the waste in 2020. CITIC Securities pointed out that from 2022-2026, the growth center of China's passenger car sales will be maintained at 7%.

Since mid -to -late June, the release of new models and listings of the OEM has been significantly accelerated. This week's ideal L9 explosion (72 hours is scheduled to exceed 30,000 vehicles). The price is 17.98-2.318 million yuan). New models have been accelerated, and explosive models become or catalytic markets. (Individual stocks are for content explanation of non -stock recommendations.)

External force boosted demand-the most dense support for policy support. The automotive industry is experiencing the greatest and most dense stages of the favorable policy support from 2015 to the present; among them, the national level policy covers 2.0L and below displacement fuel vehicles to purchase tax discounts. Or more significant. In terms of traditional cars, autonomous, joint ventures and luxury brands will fully benefit from the purchase tax minus halfway policy. The policy conservative is expected to bring an increase in fuel vehicles of more than 1 million units in 2022. With the relief of the domestic epidemic and the release of car purchase, the fund's fundamentals are expected to usher in a strong recovery.

Outlook on the market:

After the epidemic relief and the purchase tax reduction in June, the policy of halving the purchase tax was effective. The industry's production and sales in the second half of the year are expected to reach high double -digit growth, increase the rate of new car explosion, and the growth rate of industry performance. In the short term, the industry is favorable by policies+post -epidemic volume+vehicle exchange cycle. In the long run, the main line of electrification, intelligence, and the rise of independent brands remains unchanged. Before the entrance of various car consumption stimulus policies, the automobile sector may usher in a better configuration window. However, after the concentration of the early stage is pulled, it is necessary to pay attention to the risk of crowded chips, and pay attention to the increase in short -term fluctuations. From the perspective of investment, long -term holding may reduce the risks caused by short -term fluctuations. Investors can continue to pay attention to car ETF (516110).

- END -

what's going on?The target price of CITIC Securities was lowered by a number of peers, but thes

Original title: What is the situation? The target price of CITIC Securities was lowered by a number of peers, and even lowered rating ... These brokers insisted on buyingAuthor: YunzhonglanThe indus

Pingyuan County: Agricultural technicians walk into the field, support the management of corn flood season

Qilu.com · Lightning News, July 6th. Recently, there was a continuous wind and r...