New rules for credit cards are issued by you and me

Author:Xinhuanet Time:2022.07.07

Xinhua News Agency, Beijing, July 7th.

Xinhua News Agency reporter Li Yanxia

The China Banking Regulatory Commission and the People's Bank of China issued the "Notice on Further Promoting the Standardized Healthy Development of Credit Card Business" on the 7th, rectifying the chaos in the credit card market, and effectively protecting the legitimate rights and interests of financial consumers. This new regulatory regulation will have an important impact on your card and card with you.

Standardize credit card interest charges

There are many credit card business fees, including annual fees, handling fees, interest, liquidated damages, etc. In actual operations, some banks have one -sided publicity low interest rates and low rates, and charging interest in disguise in the name of handling fees, blurring actual use costs.

In this regard, the banking financial institutions are notified to effectively improve the standardization and transparency of credit card interest rate management, and strictly fulfill the obligations of the interest fee explanation in the contract to show the highest annualized interest rate level in a clear way.

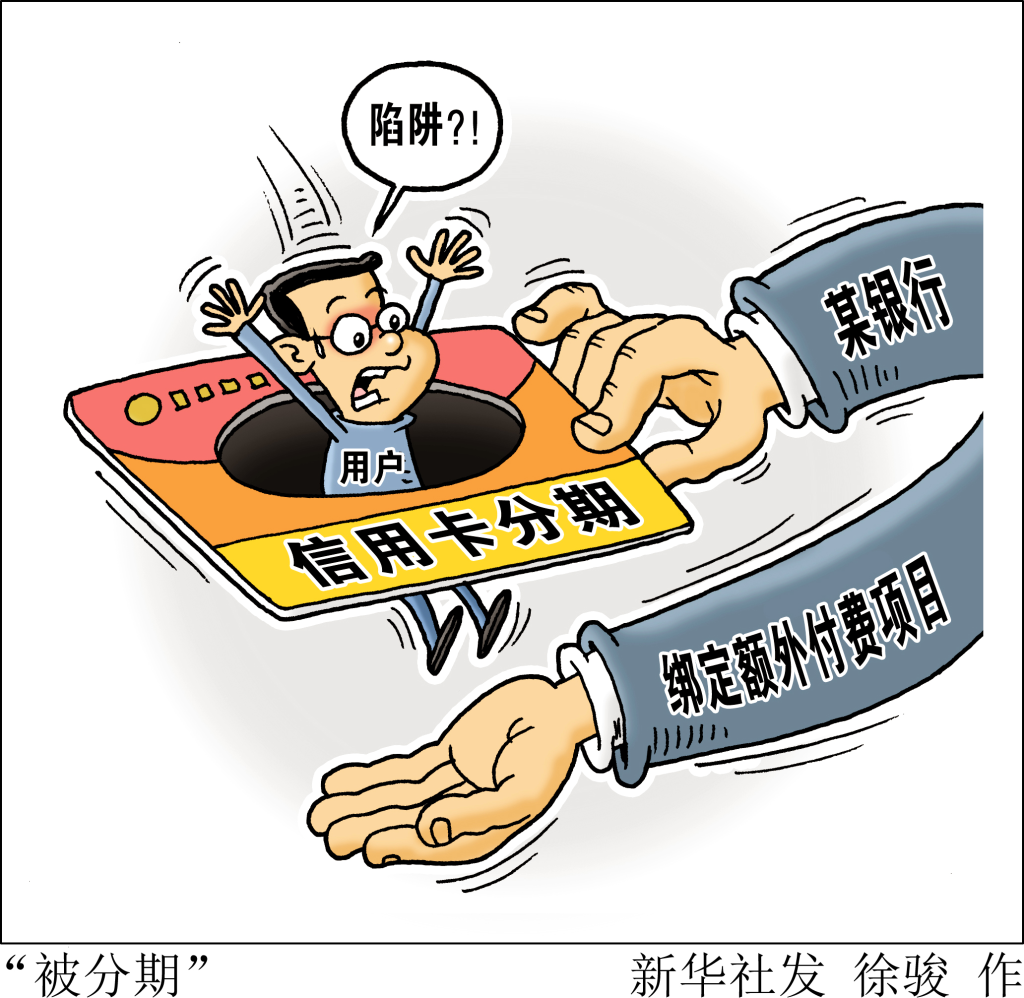

The installment business is a field with more credit card business. Cardholders swipe their cards to consume, and they often receive advice from bank installment repayment. The words "interest -free" and "zero interest rates" make people feel exciting. But in fact, banks usually charge a certain fee for installment repayment business.

The notice requires that banking financial institutions must display all the interest fees, annualized interest rate levels, and interest rate calculation methods of the installment business in the installment business contract (agreement) homepage in a clear manner. When displaying the cost of using the installment business, the form of interest shall be adopted uniformly, and the formal fees shall not be adopted.

The notice also requires that the banking financial institutions should clarify the minimum starting amount and maximum amount of the installment business; the balance of funds that have been handled in installments shall not be handled again; the period of the installment business shall not exceed 5 years.

In addition to strictly standardized interest rates, the notice also clearly requires banks to continue to take effective measures under the premise of compliance and effective coverage risks in accordance with laws and coverage to actively promote the rational settlement of credit card interest fees.

Long -term sleep card ratio must not exceed 20%

In recent years, in the rapid development of credit card business, some banks have blindly pursuing market share, abuse of card issuance, and repeated card issuance, leading to disorderly competition and waste of resources.

The notice shall strictly stipulate the management of the card issuance, requiring that the banking financial institutions shall not directly or indirectly use the number of card issuance, customer quantity, market share, or market ranking as a single or main assessment indicator. Strengthen the dynamic monitoring and management of sleep credit cards. The number of long -term sleep credit cards with no customer active transactions and current overdrawn balances and overpassing balances accounts for more than 18 consecutive months. Banks that exceed this proportion shall not issue new cards.

"In recent years, a number of banks have actively transformed to retail business. Credit cards are generally used as the entry point and focus as an asset business. , Lead to short -term business, "Zeng Gang, director of Shanghai Financial and Development Laboratory.

The person in charge of the relevant departments of the CBRC said that in the future, it will also dynamically reduce the ratio of long -term sleep credit card ratio, and constantly urge the industry to reduce the proportion of sleep cards to a lower level.

Set the upper limit of the total credit limit of a single customer

Excessive credit is also a high issue in the field of credit cards. Faced with fierce market competition, increasing the credit line usually becomes a means to compete for customers.

The banking financial institution is required to set up the total credit card limit of a single customer's credit card with reasonable credit card limit, and incorporates unified management within the customer's credit limit within the institution. When the credit approval and adjustment of the credit line, the customer shall be deducted from the credit card of the credit card of other institutions.

Dong Ximiao, chief researcher at Zhailian Financial, said that some cardholders need to pay attention to the issues of "card raising cards" and illegal cash out. Commercial banks should reduce multiple credit, strictly control over credit, and prevent credit card debt risk.

Pilot online credit card business

At the same time as the chaotic punch is renovated, notify the credit card business innovation. It is clearly proposed that it will explore innovative models such as online credit card business through pilots and other methods in accordance with the principle of controllable risks, stable and orderly principles.

"Carrying out online credit card business will become an important attempt to deepen digital transformation and accelerate the deep integration of finance and technology in commercial banks." The chief information officer of the China Banking Association said that the key link of the online credit card business is remote signing. The screening of target customers, remote video technology support, and online business processes should be done.

It is understood that the regulatory authorities will be guided in accordance with high -quality development, preferential selection of people's service recognition and high trust, consumer rights protection and petition complaints in place, and prudent business philosophy and risk control compliance. The indicator's banking financial institutions participate in the pilot.

![]()

[Editor in charge: Shi Ge]

- END -

Avenue forward, jump to the new highland 丨 Changsha cross -border e -commerce comprehensive test area: non -endless, cargo link globally

Business cardIn July 2018, China (Changsha) cross -border e -commerce comprehensiv...

Go to the "three steps" and go the world with a chicness

As the industrial granary of New China and the manufacturing industry in Hubei Pro...