Yuan Bingyan was fined 978,800 yuan, why is the stars repeatedly banned?

Author:21st Century Economic report Time:2022.07.07

21st Century Business Herald reporter Zheng Zhiwen Intern Reporter Lu Shuang Shanghai report

Recently, the actor Yuan Bingyan was exposed to his connected company Chongqing Liyan Culture Media Co., Ltd. for violation of the tax management law, and was fined about 978,800 yuan by the Seventh Inspection Bureau of the Chongqing Taxation Bureau of the State Administration of Taxation for about 9.78 million yuan, and the penalty date was June 13, 2022. During the investigation and punishment, Yuan Bingyan was the company's legal representative, executive director and manager and shareholder, holding a shareholding of 100%.

On July 4, Yuan Bingyan's Studio issued relevant statements to apologize to the public, saying that "the penalty was caused by the company's failure to perform the withdrawal of the withdrawal and payment volunteer in time. The amount of relevant taxes have been paid; the company has deeply recognized the mistakes, and will be rectified in the subsequent operations, strictly tax taxes in accordance with the law, and timely fulfill the deduction and payment obligations. "As of now, Yuan Bingyan himself has not responded to the matter.

In this regard, some netizens believe that it is also a tax evasion. Yuan Bingyan and Deng Lun and other stars have different results in the industry. question. Wang Huayu, deputy director of the Finance and Taxation Research Center of Shanghai Jiaotong University, said in an interview with the 21st Century Business Herald that there are differences between Yuan Bingyan and other stars. The company of the deduction obligations was punished, and when there was no relevant tax law regulations, it could not be determined that it had subjective faults when it was clearly responsible.

Obligations of failure to be deducted

According to Qixinbao, from 2019-2021, Chongqing Liyan Culture Media Co., Ltd. uses corporate funds to pay for the shareholders' own consumer expenditure that has nothing to do with the production and operation of the enterprise. Regulating the notice of the management of personal investors' personal income tax "(Cai Tax [2003] No. 158), paragraph 1, paragraph 2, the above expenditure should be regarded as the dividend distribution of individual investors, in accordance with the" interest, dividend, dividend income from the income of dividends, dividends, "The project is levied for personal income tax. As a deduction obligation, Chongqing Liyan Culture Media Co., Ltd. shall be deducted and paid for personal income tax 1629994.29 yuan. It is intended to deduct the fines of the above behavior of Chongqing Liyan Culture Media Co., Ltd., which should be deducted from 60%of the unsuccessful taxes, which is 977996.57 yuan, and the penalty date is June 13, 2022.

Cai Chang, a professor at the Central University of Finance and Economics and director of the Tax Planning and Legal Research Center, explained to the 21st Century Economic Herald reporter that "''" Consumer expenditure with the company's funds as the shareholder's own production and operation " Consumption expenditure is calculated in the cost of the company's operation, but strictly speaking, it is also a personal benefit, so this is also an evasion of taxes in itself. " At the same time, Cai Chang pointed out that in accordance with the requirements of the "Enterprise Income Tax Law of the People's Republic of China", this part of the expenditure should not be deducted before tax, so the company should adjust its taxable income, not only the projects of "interest, dividends, and dividends" projects are required Personal income tax also needs to pay corporate income tax.

During the fermentation of public opinion, some netizens found that Yuan Bingyan withdrew from the company's legal representative, executive director and manager position on July 3rd. Zhang Chun was replaced by Zhang Chun, and the major shareholders also changed from Yuan Bingyan to Gu Wei. The change date shows that it is Sunday, so netizens have questioned the existence of dark box operations. According to the business hours of the Industry and Commerce Bureau, we cannot handle the legal person business on the weekend. In some media reports, the change time was July 4th, and the reporter found that Yuan Bingyan's withdrawal of the shares and retreat from Yuan Bingyan on Qixinbao has changed to June 30, 2022.

The adjustment date of the legal person's changes has also attracted attention. In this regard, Cai Chang believes that Yuan Bingyan, as a corporate representative of the company during the incident, is also the main beneficiary. Strictly speaking, he needs to bear all legal responsibilities to the company's illegal acts. Wang Huayu also said that he did not rule out the act of refunding and resigning the position of legal person to reduce the public's doubts about her, but from a legal perspective, afterwards or through the procedure to avoid the legal person's position, it will not affect the legal person or the legal person or The person who is directly responsible, but the specific accountability also needs to be investigated for this responsibility in accordance with the principles of the laws and corrections of the law.

Why is it constantly banned?

On the afternoon of July 4th, Dior just released the relevant developments of Yuan Bingyan, a brand's best friend, and then after being punished for the tax evasion of Yuan Bingyan's affiliated company, Dior immediately deleted the dynamic. At the same time, Yuan Bingyan currently has several works to be broadcast. After Yuan Bingyan falls into tax disputes, it will affect whether it will be informed. However, in the eyes of many netizens, Yuan Bingyan has a lighter consequences compared to Fan Bingbing, Deng Lun and others who also involved in tax evasion cases.

Tan Yujiao, a lawyer of the Shanghai Finance and Tax Law Department of Yingke Law Firm, seems that the person directly responsible for the company's legal representative and actual controller for the company's operations in the company's operations. It is not responsible for the tax evasion of this tax evasion. "The company's tax reporting is responsible for the tax reporting, not Yuan Bingyan said it. Furthermore is Yuan Bingyan's company, not Yuan Bingyan's tax issues. Yuan Bingyan as the company as the company. Shareholders only have a connection relationship, and there is no direct tax evasion, so it is essentially different from the nature of tax evasion of other stars. "Cai Chang also pointed out that Chinese companies and individuals have different tax policies to standardize when taxing. There are certain differences in formal taxation and personal tax policies. "But the taxation involved in the case tax is whether the company is or individual, and the company must bear certain responsibilities." In the past year, there have been traffic stars and head anchors on the bottom line of tax evasion. Why are the phenomenon of tax evasion of the performing arts industry repeatedly banned? Cai Chang believes that there are two cases. One is that the entertainer's awareness of the tax law itself is not enough, and there is no clarification of the illegal and legal boundaries of the tax law. The second is that some entertainers have a weak legal awareness.

Cai Chang suggested that first of all, the relevant practitioners must have a legal awareness of taxation in accordance with the law, stay away from illegal acts, and maintain the dignity of the tax law in my country; secondly, they need to find a relatively competent financial person in charge to check. Third, as a celebrity, the financial and individual finances should be separated. Wang Huayu also said that as a public figure, celebrities should be cleaned up and obey the law. "It should be a role model for taxation in accordance with the law, not tax evasion. This will not only affect their acting career, but also It has a bad impact and wrong demonstration to the public. "

- END -

Survey of employment popularity of foreign companies

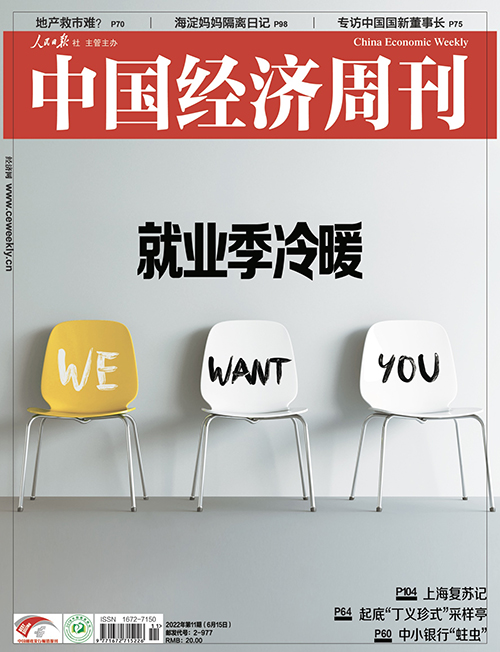

The cover of the 11th issue of China Economic Weekly in 2022China Economic Weekly ...

Two departments: Effectively implement the value -added tax refund policy for coal -fired power generation enterprises to reserve tax refund policies for power guarantee

General Administration of Taxation of the Ministry of FinanceNotice on the impleme...