7 Village and Township Bank's half -year ticket perspective: Anti -money laundering and loan issues are the "penalty area of the penalty"

Author:Economic Observer Time:2022.07.07

Among the 72 tickets, 29 penalties related to "customer identification" account for about 41%. There are 23 penalties related to "loan", accounting for about 31%. There are 6 penalties related to "concealment and false reporting financial statistics", accounting for about 0.8%.

Author: Wan Min, etc.

Figure: Tuwa Creative

Guide

One || From the perspective of the punishment target, most village and towns who have received the ticket have been punished at the same time. Therefore, the number of penalties for the punishment is roughly the same.

金 || For small and medium -sized financial institutions, with the continuous development of the situation of digital economy and digital finance, the difficulty of anti -money laundering financial security is increasing. Anti -money laundering work requires that financial institutions are constantly in terms of technology, personnel, and management awareness. Strengthen training and investment.

In June just in the past, the business issues of village banks have attracted attention.

According to data from the my country Banking Regulatory Commission, there are currently 3,991 small and medium -sized banks in China, including 147 urban commercial banks, 2,196 rural credit cooperatives (including rural commercial banks, rural cooperative banks, and agricultural credit cooperatives), and 1651 village banks, with total assets reaching 920,000 100 million yuan, the total assets of these small and medium -sized banks account for 29%of the total assets of the banking industry.

For a long time, the positioning of small and medium -sized banks, especially village and township banks, is "local operations" and "small agricultural support". Therefore, the operation of village banks is closely related to the local economic environment and more independent local characteristics.

In the "China Financial Stability Report (2021)" released by the central bank in 2021, the test results of the 4023 test banks in the second quarter of that year showed that in terms of subcontraction types, agricultural cooperatives (including rural commercial banks, rural cooperative banks, Rural credit cooperatives) and village banks have the highest risk, and the number of high -risk institutions is 271 and 122, respectively, accounting for 93%of all high -risk institutions. From the perspective of the section, Liaoning, Gansu, Inner Mongolia, Henan, Shanxi, Jilin, Heilongjiang and other provinces have a large number of high -risk institutions. In the central bank rating in the fourth quarter of 2021, the above 7 provinces have reduced the high risk of 4 provinces.

The reporter sorted out the penalty of village banks in the above -mentioned 7 areas in the first half of this year. From it or observing what violations of the daily operations of village and township banks, it is worthy of the attention of other village and township banks to promote compliance operations.

7 Di Village Bank received 72 tickets in the first half of the year

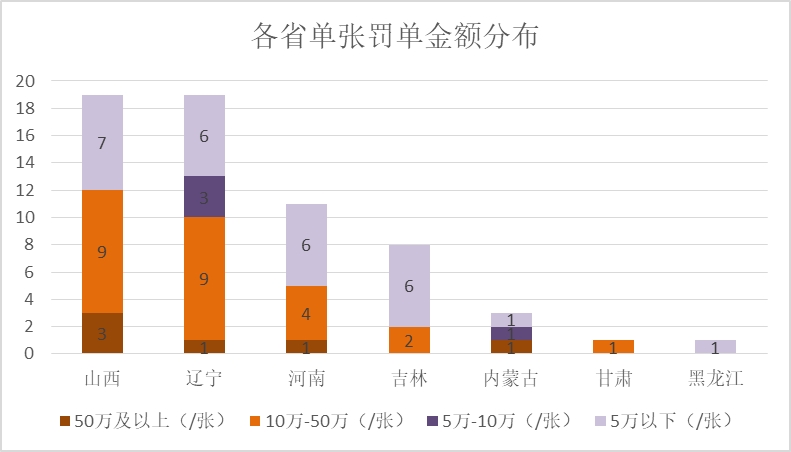

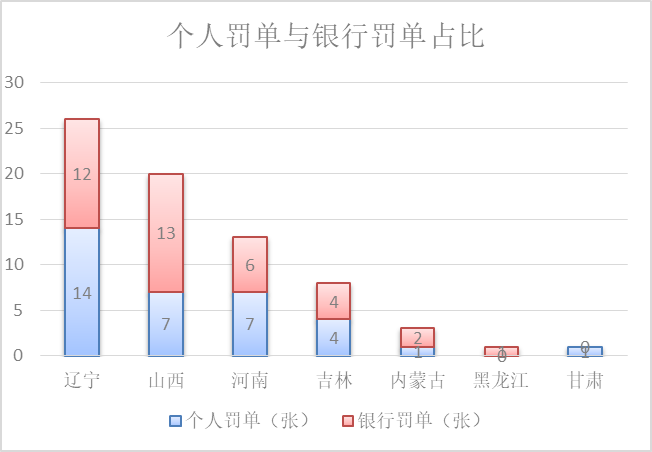

As of June 24 this year, of the 72 financial ticket received by the 72 villages and towns that have been counted, there were 26 tickets from the village banks and related responsible persons in Liaoning, 20 in Shanxi, 13 in Henan, and 8 Jilin. 3 in Inner Mongolia, 1 Heilongjiang, 1 Gansu.

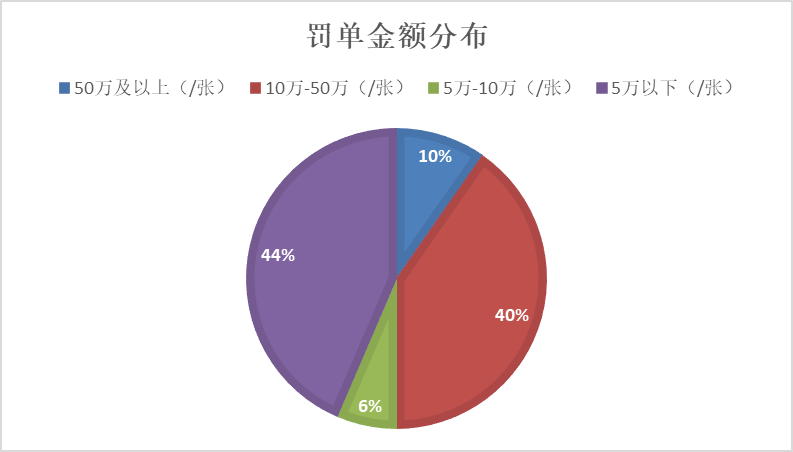

Among these 72 tickets, the maximum penalty amount was 700,000 yuan, followed by 2 single 600,000 penalties and 500,000 3. Judging from the penalty amount of the single ticket, 44%of the fines are below 50,000 yuan, and 40%of the fines are between 100,000 and 500,000 yuan; a total of 62 tickets are given a penalty including fines.

Judging from the amount received by the village banks in seven areas, the village banks in Shanxi received more than 3 single tickets.

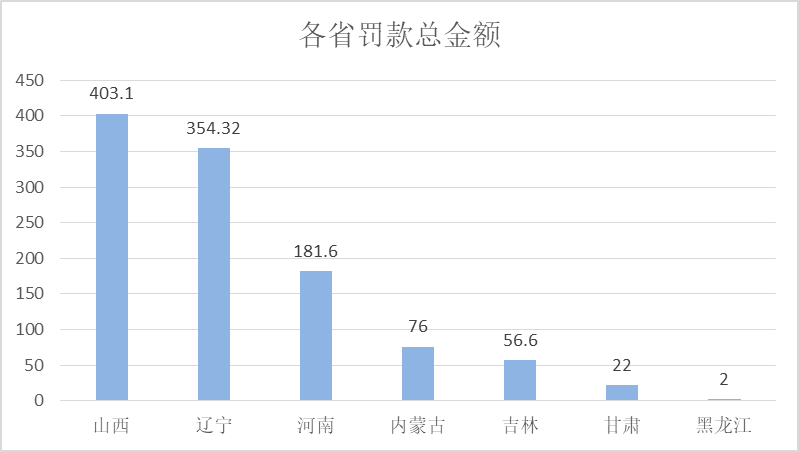

From the perspective of accumulated penalties, Village Banks in Shanxi and Liaoning are 4.031 million yuan and 3.543 million yuan, respectively.

Among the village and town banking tickets in the above seven areas, the maximum penalty of a single penalty appeared in Inner Mongolia. The 700,000 yuan was fined. Single group customer concentration exceeds the proportions; not using credit funds as agreed on the credit contract. " In addition, the "East China" as a direct responsible person was also "warned, fined 50,000 yuan."

One of the fines for a fine of 600,000 yuan was Xiangfen Wandu Village Bank (located in Shanxi), Yang Zhifeng (then legal representative/main person in charge of Xiangfen Wandu Village Bank). Illegally issued a lending loan "and was" ordered to correct Xiangfen Wandu Village Bank for correction, fined 600,000 yuan; supervision was fined 50,000 yuan in Yang Zhifeng, and at the same time ordered Xiangfen Wandu Village Bank to give the rest of the responsible persons. " Another 600,000 yuan penalty is the limited liability company of Fengyu Village Town Bank of Fangcheng, Henan (the legal representative or the main person in charge of Liu Hongjin), because of the problem of "unforgettable diligence of pre -loan investigation and misappropriation of loan funds; Integration of loan, covering the quality of credit assets "was punished.

Tieling Xinxing Village Bank Co., Ltd. (located in Liaoning), which was fined 500,000 yuan, was fined for “illegal issuance of liquidity loans and issuing loans for non -place in operating areas”. He was punished for "loan issuance in violation of regulations", Zezhou Pudong Village Bank (located in Shanxi) was punished for "the request to" over -proportions of funds and a large risk exposure ratio of high risk exposure to real estate enterprises "through affiliated companies and individuals.

The minimum amount of penalties was 05,000 yuan. Ren Yike, then the vice president of Yucheng Tongcong Village Bank Co., Ltd., was punished by the People's Bank of China Shangqiu City Center Sub -branch for overdue overdue due to credit objection.

The punishment of the single penalty received by Shanjia Village and Town Bank reached 8 items. On April 29, the ticket issued by the Xinxiang Central Sub -branch of the People's Bank of China on the Changyuan Minsheng Village Bank Co., Ltd., the bank's financial statistics were reported because of falsely reporting; The damaged renminbi; the fake currency is unzipped in the local People's Bank of China branch in accordance with the regulations; the requirements for security management are violated; the customer's identity information and transaction records are not preserved in accordance with regulations; Complaint data was given warning and fined 335,000 yuan. In addition, 33 tickets contain "warnings".

From the perspective of the punishment object, most village banks who have received the ticket have been punished at the same time. Therefore, the number of penalties for the punishment is roughly the same.

Person Pan Jingtao received by Pan Jingtao, former customer manager of the former business department of Xifeng Village Bank Co., Ltd. (located in Gansu), a personal fine received by village and towns in Gansu area. "The Qingyang Banking Regulatory Bureau is prohibited from working in the banking industry for life.

Among the 72 tickets, a ticket is related to the "executive qualification" and appeared in Xiaoyi Huitong Village Bank (located in Shanxi). Han Shiguang (then the legal representative/principals), Luliang Banking Regulatory Bureau in May 30 this year's fines of "executive personnel are not qualified to approve the actual performance of their duties", and the bank shall be ordered to make corrections, and the fine is 20 10,000 yuan; punishment for Han Shiguang warning.

The problem of anti -money laundering and loan is the "penalty area of the penalty"

Among the 72 tickets, 29 penalties related to "customer identification" account for about 41%. There are 23 penalties related to "loan", accounting for about 31%. There are 6 penalties related to "concealment and false reporting financial statistics", accounting for about 0.8%. There are three reasons related to "financial consumers", accounting for about 0.4%.

In recent years, supervision has continuously strengthened its requirements in the field of anti -money laundering. According to the "Anti -Money Laundering Law of the People's Republic of China", "Customer identity identification and customer identity information and transaction record preservation management measures", financial institutions shall establish a customer identification system in accordance with regulations Essence Customer identification is that when financial institutions establish business relationships with customers or provide financial services to customers, they take corresponding measures based on anti -money laundering regulations to confirm the customer identity, understand and pay attention to the customer's career situation or business background, transaction purpose, transaction nature And the process of funding sources, funds, and actual beneficiaries.

For small and medium -sized financial institutions, with the continuous development of the situation of the digital economy and digital finance, the difficulty of financial security for anti -money laundering is increasing, and anti -money laundering work requires financial institutions Investment.

From the perspective of regions, the punishment is different. Among the villages and town banks in Shanxi, the number of tickets for client identification and loan -related penalties is 8 and 7, respectively. In addition, there are problems involving data and material reporting; Essence

Among the village and township banks in Henan, in addition to customer identification and loan issues, the penalties for falsely reporting financial statistics and missed complaints are higher than several other regions. The number of two fines accounts for 24%.

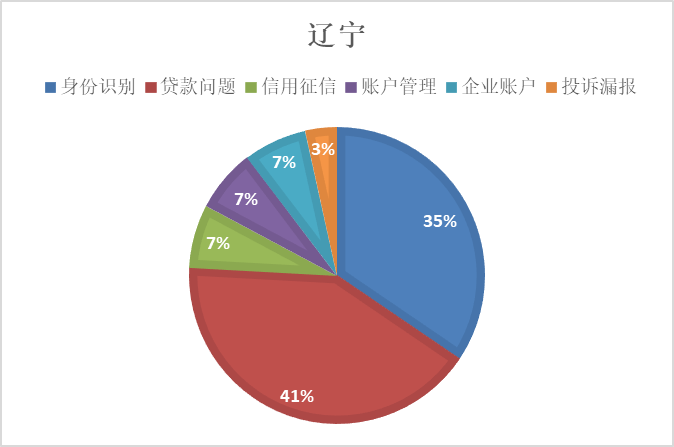

Among the villages and town banks in Liaoning, the proportion of loan issues accounts for 41%, and the number of fines related to account management and corporate accounts accounts for 14%.

Judging from the changes in the number of tickets, the ticket received by the village and towns in Inner Mongolia this year is expected to be significantly lower than last year. In 2021, the village banks and relevant responsible persons in the area received 46 financial regulatory tickets throughout the year, and the amount of fines exceeded one million, and the person in charge of the responsible prohibited from engaging in the banking industry. Whether the village and town banks in Shanxi can be observed last year, it has to be observed last year. Last year, the village and towns banks in Shanxi received a total of 26 financial supervision tickets, with two penalties for 700,000 yuan.

The central bank released the rating of the central bank's financial institution in the fourth quarter of 2021. As of the end of 2021, there were no high risk institutions in 11 provinces (cities, districts) across the country, and 13 provincial (cities, districts) high -risk institutions were individual. High -risk agencies are mainly concentrated in four provinces.

In the central bank rating, there were 1649 village and township banks, and the rating results were 2-10. The central bank's rating level is divided into level 11, with levels 1-10 and D, respectively. The larger the level, the higher the level of institutional risk. The rating results are 8-10 and D-level institutions. According to the results of the central bank's rating, agricultural co -organizations (including rural commercial banks, rural cooperative banks, agricultural credit cooperatives) and village and town banks have the highest risks, and the number of high -risk institutions is 186 and 103, respectively. 7%.

On June 23, Xiao Yuan Enterprise, Vice Chairman of the China Banking Regulatory Commission, attended the press conference of the "China Ten Years" series of themes of the Central Propaganda Department. Response.

"The China Banking Regulatory Commission attaches great importance to the healthy development of small and medium -sized banks, especially small banks ... We have dealt with a total of 5.3 trillion yuan in non -performing loans in small and medium banks in the past five years, which is very strong." Xiao Yuan Enterprise said, "Generally speaking, China, ChinaSmall and medium -sized banks are running smoothly, and development is also healthy. Although there are still some problems, especially the risk of individual institutions is relatively high, and some are suspected of illegal crimes, but in general, the risk is completely controllable. "(The author of this article:Wan Min Tan Huilin Chen Xinyi)

The "adjustment of children" The announcement of the illegal Health and Health Bureau is even more indifferent to the rule of law and life or failed to effectively clean it?The two interpretations of McMull's "problem milk" explain the radical rise of Douyin e -commerce

- END -

The 11th Guangzhou Gold Fair: Focus on green gold, help dual carbon

Text/Demantamu/Interviewee providedUnder the goal of carbon neutral and carbon pea...

the last week!These companies in Luoyang have to hurry up the time report

The last week of countdown! Luoyang has not yet carried out more than 10,000 compa...