Release more financial live water | Zhu Ji and Rural Commercial Bank Yu Jiaping: Putting up the financial responsibility to help the economy steady into quality

Author:Science and Technology Finance Time:2022.07.08

Author: Yu Jiaping, president of Zhuji Rural Commercial Bank

Helping enterprises to relieve it and help stabilize the economic market is a major and urgent task facing the current banking industry. Release more financial water to allow market entities to benefit early and refresh their thirst. This is an inevitable requirement for bank institutions to show their responsibility and achieve high -quality development.

Zhuji Rural Commercial Bank, as the main troops of local financial banks, has effectively followed the Shaoxing Banking Regulatory Bureau's series of decision -making and deployment of financial support to stabilize the economic market. Enterprise burden, strengthening enterprise services, and "combined boxing" to promote economic stability and recovery and improve quality.

Accelerate credit investment and make every effort to stabilize financing. Strengthen industrial financial support, grant 5 million yuan for each letter of enterprises in 1,200 large -scale enterprises, and "one -click credit credit" 6 billion yuan to provide financial support for the real economy; innovatively launched "start -up equipment loans", iterated upgrade "science and innovation loan", "intellectual property rights", "intellectual property rights" "Pure", etc., further enhance the matching of "specialized specialty" and the financing needs of talent technology -based enterprises. This year, it has issued 584 million yuan in intellectual property pledge loans and 1.255 billion yuan in science and technology enterprise loans. Financial benefits account for one -third of the city's science and technology enterprises. Increase special financial innovation, focus on special industries such as Tongshan, nuts and pearls, and launch "wine loan" raw wine mortgage loans. It has accumulated 242 households, small workshops and retail investors, and the amount of loan is 79.5 million yuan; The "Nuts Reading · Shanghui Loan" was distributed to 255 cooking companies; 380 million yuan was integrated into Shaoxing House sites reform, and the first single -house renovation of the "rights ticket" special pledge loan in the country has now been granted 45 million yuan in credit. Expand the needs of consumer finance, strengthen financial supply in the fields of consumption, new consumption and rural consumption, and use interest rate adjustments and issued 20,000 accounts coupons to meet the rigid demand of citizens' houses and decoration, promote the continuous recovery of consumption. 37.2781 million yuan.

The cost of pressure reduction financing is to go all out to reduce the burden. Increasing interest rate discounts, the highest credit rate for large -scale credit -in -scale credit rates will be given, and the maximum rate of 150BP interest rates will be given to the first loan households. Twice the first five years; the amount of funds supporting the funds of inclusive micro loan support tools is increased from 1%to 2%; Corporate financing costs; strengthen cooperation with government financing guarantee institutions, implement preferential loan interest rates on manufacturing, "agriculture, rural" loans, and first loan households, offline personal operating loans give up to 80bp discounts, and lending for lending pledge evaluation fee , Mortgage registration fee, stamp duty, unit settlement account fee, online banking institution service fee, etc. Since the beginning of this year, the comprehensive interest rate per 100 yuan has decreased by 0.14 percentage points. It is expected that the annual market entities will be reduced by 62 million yuan. Strengthen the coordinated coordination and go all out to serve. Implementing the extension of the repayment of the principle of repayment and repayment of the interest payment policy "should be extended", and the management of personal mortgages and consumer loans that encounter difficulties in small and medium -sized enterprises and individual industrial and commercial households, truck loans, and temporarily encounter difficulty in implementing a list system. The extension of the repayment of 36 households and the amount of 58.51 million yuan. Promote the "renewal" of companies that meet the renewal conditions, make good use of non -repayment loans, medium -term mobile funds loans, and loan, and other models to do the demand for funds one month in advance. The amount of lending was 4.02 billion yuan, accounting for 57.6%of the loan ratio of mobile funds. Carry out the cooperation of silver administration in all aspects, and first introduce the "Ten Policies for Steady Growth and Increasing Enterprises" to help the Enterprise ", a single list of 3 billion yuan in credit funds prioritize financing of key areas, and launch a special action of" smooth financing "of 100,000 market entities , Relying on 23 assistants in the assistance of the enterprise to conduct a big visit to the "helping enterprises to relieve the heart -warming heart and warn"; actively participate in the construction of the "Communist Party" party building alliance, focus on the financing needs of local characteristic industries and investment projects, and build "red socks", "Nancheng", "Nancheng", "Nancheng" The red "" Bihu Jiji "and" Pearl Live E -commerce "and other" rich "party building alliances, the credit amount was 1.76 billion yuan.

Scientific management and control risks, go all out to the superior mechanism. Continuously optimize the "dare to loan loan loan and loan" mechanism, explore simple and easy -going, objective and quantitative due diligence exemption standards and processes, and improve mechanisms such as performance assessment, due diligence exemption, and bad tolerance. Improve the handling of non -performing loans for small and micro enterprises, implement the requirements for the supervision of inclusive small and micro loans, and give priority to arrange for small and micro enterprises' non -performing loan nuclear sales plans, focus Loan, strive to make every place. At the same time, we will increase digital empowerment risk prevention and control, and timely grasp the risk points and asset quality conditions through big data analysis, and effectively improve the sustainability of financial support for the real economy.

News+

Zhuji: Developing a new road with rich people and strong villages

Continuing the power of Fumin and Strong Village. This year, Zhuji City has implemented the three -year action plan for the consolidation and improvement of the village -level collective economy, activating the ability of hematopoiesis, sharing rural business results, improving agricultural production efficiency, and promoting the continuous and stable income of farmers.

Most of the four villagers in Shangquan Village, Siya Village, Chen Cai Community, and Diannan Village in Dongbaihu Town are mostly engaged in tea and other industries. These four villages form a "strong village company" and use the deserted fruits and vegetable markets to renovate the joint construction agricultural special product trading service center. The villages are divided into investment ratios, and through charging market booth rental fees, they can collect about 350,000 yuan each year. At the same time, through standardized tea production standards, the quality of agricultural products can be promoted and the increase in farmers' income. The collective economy "living water" is the hope of rural development and an important way to promote common prosperity. In 2021, Zhuji focused on strengthening its own hematopoietic function, strengthened the operation of "strong village companies", paid an eye on project construction, and implemented a new round of village -level collective economy improvement actions. Village accounts for 76.74%. Further regulate the management of village -level migrant workers, take the lead in building village -level migrant storage in Shaoxing City, and achieve full coverage of administrative villages.

"Strong Village" focuses on "rich people" at the same time. The former Xianri Village School and Tea Factory of Bianxian Village in Tongshan Town have changed from the dilapidated dilapidated house to a display base that integrates high -end homestays, sorghum deep processing and wine culture. This project invested by Xiangxian about 21 million yuan. After the production, the annual turnover will reach 5.5 million yuan, the tax revenue is 200,000 yuan, and the village can collect more than 100,000 yuan for the village each year. Not only that, uniformly contracted the surrounding land to plant sorghum, and ask the surplus labor in the village for planting management, but also ask the brewing master to make shochu on the base, providing multiple positions for farmers to increase their income.

In order to lay a good foundation for common prosperity and protect the equal rights and interests of farmers, in addition to supporting the development of various types of projects and increasing various types of income to become rich, Zhuji City also continuously optimizes low -income farmers' help to improve the "one household, one policy, one cadre" The system, invested nearly 2 million yuan to achieve full coverage of low -income farmers' health insurance, effectively reduce poverty due to illness and return to poverty due to illness. Last year, the city's low -income farmers per capita disposable income reached 20920 yuan, an increase of 14.7%.

Source of Information: Zhuji City Agricultural and Rural Bureau

- END -

To build a credit economy ecology for the luxury industry, China China Procuratorate Jiangsu Company shows the responsibility of the central enterprise

With the changes in the consumer market in recent years, the young user group has ...

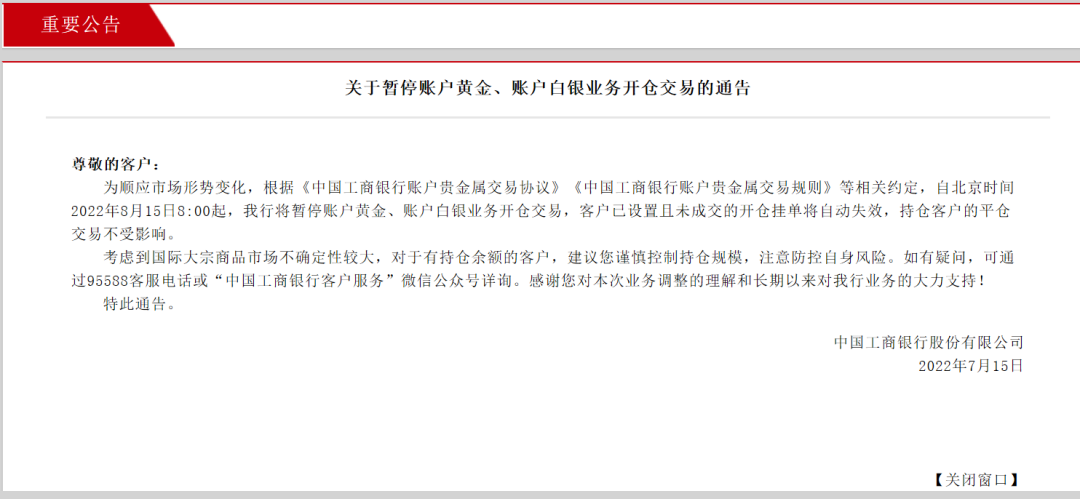

ICBC will suspend the account of the account of gold and silver business!

According to the official website of Industrial and Commercial Bank of China, it w...