Policy dividends will be further released in June.

Author:Securities daily Time:2022.06.14

Financial data in May exceeds market expectations. However, under the data of new credit and social recovery, there is also a slightly sluggish "corner" -the medium- and long -term loans in the resident department in May increased by 104.7 billion yuan. In the same period last year, 337.9 billion yuan was increased.

Why is the medium- and long -term loan data optimizing the credit policy and the LPR (loan market quotation interest rate) of more than 5 years (the loan market quotation interest rate) has been significantly reduced, and is it still relatively mediocre? A number of people interviewed by a reporter from the Securities Daily believe that this is not only related to the low prosperity of the current property market, but also related to the lagging of policy bonuses.

The proportion of residents' medium and long -term loans increases

In May, RMB loans increased by 392 billion yuan year -on -year, but the loan structure was not ideal. In particular, the growth rate of medium- and long -term loans that reflect the ability of residents' houses is not significant. According to data from central banks, in May, RMB deposits increased by 3.04 trillion yuan, an increase of 475 billion yuan year -on -year; in May, the medium- and long -term loans of residents increased by 104.7 billion yuan, which was 337.9 billion yuan less than the same period last year, indicating that the demand for house purchase was still weaker.

"On the one hand, affected by external uncertain factors and epidemic conditions, residents 'income growth is under pressure, and the ability to purchase houses has decreased accordingly; on the other hand, residents' willingness to prevent sexual savings increases, and the power of liabilities to increase liabilities is weak." Caixin Research Institute Deputy Dean Wu Chaoming told the Securities Daily reporter.

Dongfang Jincheng's chief macro analyst Wang Qing told the Securities Daily that the current low prosperity of the property market is still an important reason for the incomplete growth rate of households in May in May.

From the perspective of real estate sales, the reporter According to Wind data statistics, the average daily sales of 30 major and medium cities in May in May were 293,900 square meters, which was improved from the margin last month, but it was still about half of the same period last year.

It is worth noting that although the residents' medium- and long -term loans in May were weak, the period of stretching time, the data provided a different perspective. According to Wind data, from January to May this year, the total number of new and long -term loans of the new resident sector was 114.328 billion yuan, accounting for 85.85%of the total number of new resident loans in the same period. The total amount of medium- and long -term loans was 2914.4 billion yuan, accounting for 78.53%of the total number of resident loans of 3711.5 billion yuan in the same period.

It is not difficult to see that although the number of new and long -term loans of new residents since this year is less than the same period last year, the proportion of new loans in the overall household sector has been raised compared to the same period last year. In this regard, Wang Qing said that this is due to the weak consumption of residents under the influence of the epidemic, and the decline of new residents' short -term loans; on the other hand, it also shows that the financial support of the real estate market is stable and healthy, which is largely eased to a large extent eased, which is largely eased to a large extent to ease it to a large extent. The downlink fluctuations of the property market.

The Northeast Securities Research Report believes that the current purchasing power of residents has not changed significantly. Although the aging population is accelerating, the potential demand for markets has not dropped sharply, and the foundation of the stability of the real estate market is still there. The real estate market needs to boost two confidences. One is the confidence of housing to ensure the legitimate rights and interests of consumers; the other is to boost the stable confidence of housing enterprises and increase the reasonable financing needs of the normal operation of real estate enterprises.

The mortgage interest rate still has room to regulate

From the perspective of policy level, since this year, the decline in housing loan interest rates has risen from the local "self -selected actions" to the nationwide "standard action".

From the perspective of LPR, since the LPR below 5 years in January this year, 5 basis points have been reduced, and the LPR of more than 5 years in May has re -reduced 15 basis points to 4.45%, becoming the largest one since the LPR reform in August 2019. At this point, LPRs have been reduced by 20 basis points for more than 5 years. At the same time, the Central Bank and the CBRC announced on May 15th that the first set of housing commercial personal housing loan interest rates were adjusted to not lower than the corresponding period of loan market quotation interest rates for loans to buy ordinary home household families. Base point.

In other words, no other factors are considered for the time being, the maximum loan interest rate of the first house this year can be reduced to 40 basis points. More vividly, if the buyer's loan loans of 1 million yuan and the loan is 30 years, it takes the equivalent principal and interest repayment method, and its total interest will drop by about 85,000 yuan.

From the local level, according to the data provided by the Shell Research Institute, the interest rate of the 103 key cities in May in May was 4.91%and the two sets of interest rates were 5.32%, which fell 26 and 13 from the previous month. Base point, the new low since 2019.

58 Zhang Bo, president of the Sub -Promotion Institute of Anju House Real Estate Research Institute, said in an interview with the Securities Daily that the reduction in mortgage interest rates can be regarded as a "catalyst" that can be regarded as the real estate market. In other words, reducing mortgage interest rates can accelerate the pace of potential buyers' entry into the market. Especially for cities where some market heat has begun to increase, the catalytic role of low -level mortgage interest rates will be more obvious.

According to the data of Keyerrui Research Center, in May, the transaction area of new houses in 30 key cities monitored was 13.18 million square meters, an increase of 4%month -on -month and a decrease of 59%year -on -year. Among them, the transactions of first -tier cities decreased by 22%month -on -month and fell 50%year -on -year. The signs of "recovery" in 26 second- and third -tier cities showed a first year, an increase of 9%month -on -month and a decrease of 60%year -on -year. According to data from the Shell Research Institute, in May, the transaction volume of second -hand housing monitored in 50 cities increased by about 14%month -on -month, a decrease of about 40%year -on -year, and a narrowing of 8 percentage points from the previous month. "In May, under the influence of the densely introduced property market support policies, the transaction volume of new housing and second -hand housing has risen, but in general, the real estate market has not yet ushered in a real comprehensive recovery." Zhang Bo said that due to residents, due to residents The growth of mortgage loans is closely related to the changes in the transaction scale of new and second -hand housing. Therefore, medium- and long -term loans in residential loans in May also showed a general trend.

Wang Qing also said that for most cities, mortgage interest rates are the most important factor in determining the direction of the local property market and market expectations. Although the mortgage interest rate in May ushered in two major favorable favorable benefits, both were implemented on May 15th and May 20th. The policy effect failed to be fully reflected in the month.

"From the perspective of past experience, especially in the decline of real estate since 2008, if the mortgage interest rate has been reduced to a certain extent, it will become the initiative to drive the property market to recover." Wang Qing said that in addition to the supply and demand factors, the property market also said It will be affected by market expectations. Policy adjustment must first guide the market expectations to further transmit it to the market. This is also an important reason for market performance to lag behind policy adjustments. In addition, whether policy adjustment is enough to change market trends is also an important aspect. Based on this, it is expected that there will be a certain amount of room for low -loan interest rates in the later period.

Credit in June is expected

Since the beginning of this year, my country's economic development has not changed for a long time, but the economic development environment has also faced a complex situation, and steady growth has become the top priority of economic development.

Wang Qing predicts that the next monetary policy will continue to increase implementation in the direction of steady growth. Under the guidance of policy, financial institutions will focus on increasing credit support for the weak links and key areas of national economy such as small and micro enterprises and scientific and technological innovation. Banks will also focus on moderately relaxing credit quotas in infrastructure, real estate and other fields to reduce loan interest rates, etc., and focus on boosting the real economic credit needs. Among them, enterprises are expected to resume a year -on -year increase in medium -term loans in June, and the rare increase of residents' medium- and long -term loans will gradually narrow.

"From this judgment, the year -on -year growth rate of the balance of various loans in June will continue to rise, thereby providing key support for stabilizing the economic market and boosting economic growth momentum in the second half of the year." Wang Qing said.

Wu Chaoming believes that with the improvement of the domestic epidemic situation, economic activities have further recovered, and currency looseness is expected to continue to be appropriate. It is expected that the probability of credit in June will maintain a growth momentum. With the continuous increase in domestic policies to help enterprises, real estate -related policies continue to loosen, it is expected that the credit structure is also expected to be further optimized, and the demand for medium and long -term loans of residents and enterprises may improve significantly.

The institution also gives positive prospects. According to the analysis of CITIC Securities Research Report, considering that in the first half of the year's final month, the bank will focus on the efforts and cooperate with policy support guidance. It is expected that credit data will continue to boost. At the same time, the current pace of issuance of local bond issuance is the top, and it is expected to further drive the social merger growth rate in the first half of the year.

CICC estimates that the credit investment in June is still relatively stable, including the off -season from April to May, and the release season in June is generally increased from the previous month. Restore, etc.

- END -

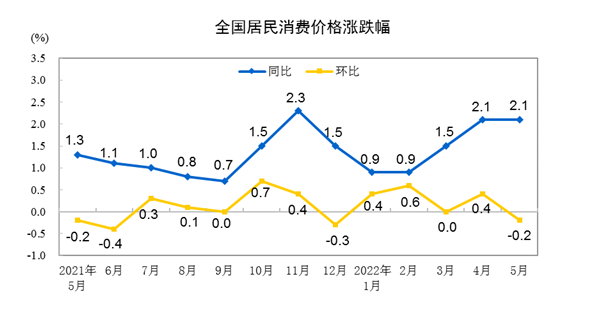

In May, the consumer prices nationwide rose by 2.1% year -on -year decreased by 0.2% month -on -mont

According to the National Bureau of Statistics, in May 2022, consumer prices acro...

Improve the supply chain mechanism of stable industrial chain, strengthen supply and demand docking ... These measures further boost the industry

Xinhua News Agency, Beijing, June 27th: Improve the supply chain mechanism of stab...