CITIC Investment Investment: It is expected to restart the rise under the high increase of the central report of the National Defense

Author:Capital state Time:2022.07.11

At present, the listed enterprises of military industry are issuing a condolences of the interim reporting. As of July 11, 5 of the National Defense Forces ETF (512810) holding component stocks, 5 have released the 2022 interim results preview:

1) Zhenhua's scientific and technological performance of the core supplier of the industrial chain has maintained a high level. It is expected that the net profit of returning to the mother is 128.96%-158.06%year-on-year.

2) The red arrow in the super-hard material faucet is expected to be expected to return to the mother of the first half of 2022, an increase of 103.41%-118.71%year-on-year.

3) The core supporting enterprise of the medium tour of the industrial chain also performs excellent in heavy machinery, and it is expected that the annual growth rate of the net profit of the mother is more than 100%year -on -year.

4) Fushun Special Steel and China Maritime Defense are affected by the rise in the price and raw material prices in the first half of the year, resulting in a decline of about 50%year -on -year net profit. CITIC Construction Investment believes that it is expected to improve with the resumption of the epidemic in the second half of the year.

Data source: Announcement of listed companies, as of 2022.7.11

CITIC Jianzhun pointed out that the current military industry sector is at a key node of the spread of local prosperity to the full prosperity. The acceleration of the performance of middle and downstream companies is expected to come. At present, the valuation level of the sector is equivalent to the lowest point in 2021. The sector is expected to restart the rise under the expected drive of the semi -annual report.

In the early morning of July 11, the national defense military sector was collectively registered, aviation equipment fell, China ’s naval defense fell more than 5%, Zhongtian Rockets, Zhongzhi shares fell more than 4%, and AVIC High -Sciences and Xinyu passed by nearly 4%. The ETF (512810) of the National Defense Forces fell more than 2%, as of 10:40 fell 1.13%, and the turnover exceeded 32 million yuan.

Since the beginning of the year, funds have continued to use the ETF bottom -up layout. As of July 8th, the share of the National Defense Forces ETF (512810) increased over 100 million yuan during the year, and the latest scale was 359 million, which was at a high level in the past 5 years.

Since 2022, the National Defense Army Index has been regulated, with the largest retreat of 40%during the year. There are also industry valuations who have fallen with the index. According to the statistics of CITIC Investment Capital, since the beginning of 2022, the CSI military index has quickly fallen by about 20%. The estimates of the sector have been fully digested, and the cost -effective performance is even more prominent. At present, the overall PE of the military industry sector is 57.52 times, which is at a historical low, lower than the time interval of more than 83%of history.

[3 natural annual excess returns 44.54%, ETF (512810) of the National Defense Forces Workers' Workers]

At present, there are 5 military industry ETFs on the market. From the perspective of actual income, the return of defense military workers (512810) is significantly prominent. From the beginning of 2019 to the end of 2021, the national defense military workers (512810) have increased by 178.69%, significantly exceeding the benchmark index of 134.15% The increase, the cumulative excess return is 44.54%, and the average annual excess return exceeds 14%, which is a significant lead!

In terms of annual perspective, the National Defense Forces (512810) obtained significant excess returns each year. From 2019 to 2021, the annual excess revenue is 3.58%, 9.11%, and 11.07%, respectively.

The premier and excess returns, which are mainly due to the moderate scale of the ETF (512810) of the National Defense Forces, and the new shares are more obvious. According to the Deloitte China report, in 2021, 524 new shares in the A -share market were listed, and the total amount of actual raised funds reached 546.6 billion yuan, and the number and amount reached a new high in recent years. This is the first IPO financing in A -share history exceeding 500 billion yuan. Deloitte China estimates that there are 170 to 200 new shares issued in Shanghai Science and Technology Board in 2022; 210 to 240 new shares are issued on the GEM, and Shanghai and Shenzhen motherboards are expected to be issued 120 to 150 new shares.

Since the beginning of the GEM registration system and the beginning of the science and technology board, the pace of issuance of new shares has accelerated significantly. With the establishment of the Beijing Stock Exchange, the new shares have been steadily advanced to further promote the advent of the era of straight integration. The issuance of new shares will still maintain a high level, and public funds that benefit the policy advantage will continue to benefit from the distribution of new shares!

The above, based on the investment of the national defense military sector, the best repayment varieties are recommended. It is recommended to pay attention to the ETF of the National Defense Forces and Code 512810.

Risk reminder: The target index tracked by the ETF of the National Defense Army is the Sino -Stock Exchange Military Industry Index (399967). The historical performance of the index comes based on the current constituent structure simulation recovery. Its index component stocks may change, and their historical performance does not indicate the future performance of the index. Any information that appears in this article (including but not limited to individual stocks, comments, predictions, charts, indicators, theories, any form of expression, etc.) is only used as a reference. Investors must be responsible for any self -determined investment behavior. In addition, any viewpoint, analysis and prediction in this article do not constitute any form of investment suggestions for readers, and the company does not bear any responsibility for direct or indirect losses caused by the content of this article. Fund investment is risky. Fund's past performance does not represent its future performance, and investment needs to be cautious.

- END -

New Crown Pneumonia Prevention and Control Plan (Ninth Edition)

Source: Healthy China

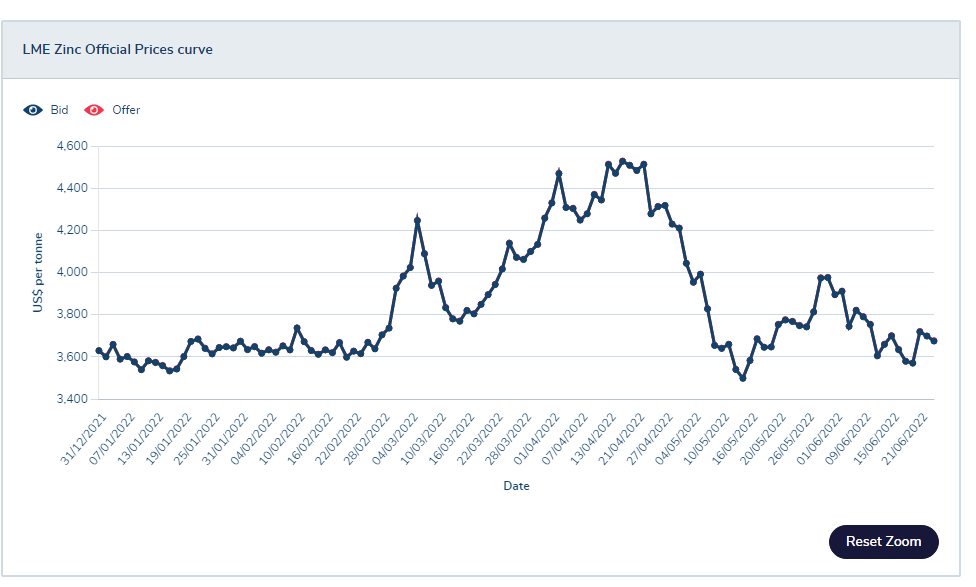

After "demon nickel", zinc is unstable?LME zinc inventory drops greatly, and the spot premium reaches 30 years.

The previous battle about demon nickel was booming. Will zinc repeat the same mist...