Two wheel electric vehicles do not require high -end

Author:Inquiry Xinye News Agency Time:2022.07.11

Author | Wei Qiyang

Source | Insight New Research Society

In 1983, Shanghai Permanent Bicycle Factory went offline to a two-wheeled electric vehicle DX-130 designed and energy-produced in China.

This 150W -pillar motor, which is equipped with a two -wheeled electric vehicle equipped with an ordinary lead -acid battery with a 24V car of less than 30 kilometers, has poor climbing ability, and is easy to wear. There are many shortcomings. 45,000, 805 were sold abroad to earn foreign exchange.

Although the permanent DX-130 does not stir too much waves, the magic box of two rounds of electric changes is opened. With the opening of short-distance travel in Chinese cities, it follows the trend from the 100 billion market. Essence

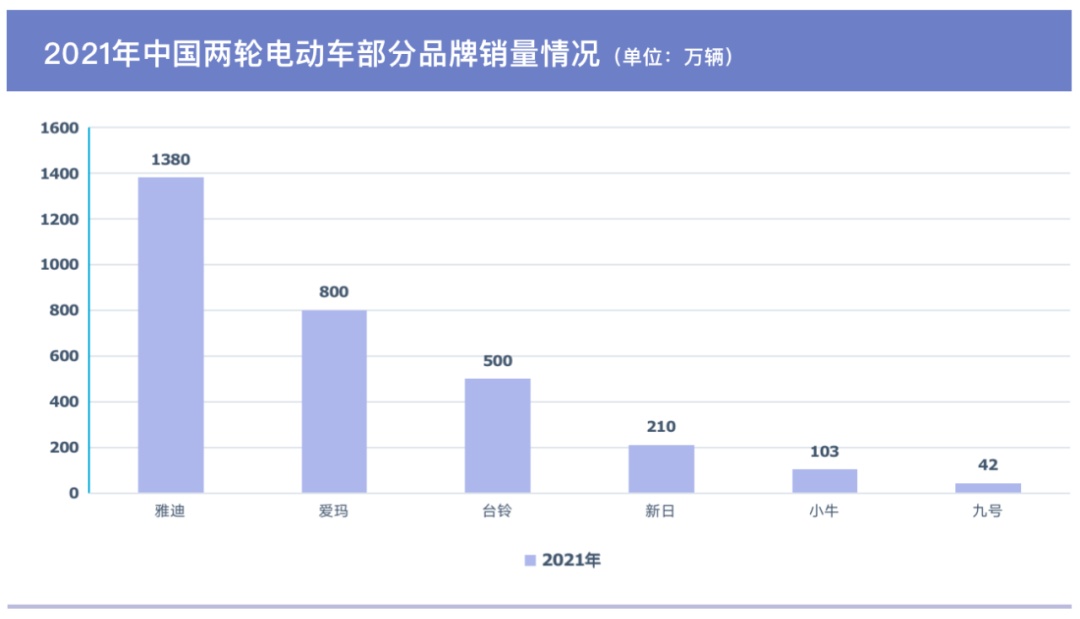

In 2021, in the context of the two -wheeled electric vehicle market decreased by 13.9%year -on -year, 41 million vehicles were still achieved. Compared with it, new energy vehicles were under high -speed growth. Last year, sales were less than 1/. 10.

Data source: Public data sorting drawing: Insight of New Research Society

In the two -wheeled electric vehicles, both the chairman of Emma Zhang Jian and his daughter Zhang Gege, sitting on the 2022 Hurun Global Rich List of the Global Rich List of Henan Shangqiu, also selling 38,000 units per day for 38,000 units. , China ’s pride in the world’ s first global sales for 5 consecutive years.

As a result, some media labels the two -wheeled electric vehicle "China's Fifth Invention".

With the advancement of the historical process, after a series of complicated and fierce competitions such as large -scale warfare, price war, and technological warfare, the two -wheeled electric vehicles have discovered that the "high -end" seems to be a pseudo -concept in the two -wheeled electric vehicle industry. Many brands want to "touch high", but they do not gain anything. The user level does not have a cold for the so -called consumption upgrade.

Under the ultimate inner roll, which direction will the next wind direction of the two -wheeled electric vehicles be blowing in?

01 "The Law of the 28th" is invalidated

Two wheel electric vehicles, 4000 yuan is a hurdle.

According to Master Lu's survey data, users with a price of 2000-3,000 yuan are the most, exceeding 30%; users with 3,000-4000 yuan account for more than 25%; users with less than 2,000 yuan also account for more than 25%.

A rough calculation, the market share of the so -called "high -end" products of more than 4,000 yuan is less than 20 %.

From the price of the price, the market is true. From the perspective of the current price level and the perspective of the development of the national economic development, the two -wheeled electric vehicles of 4,000 yuan want to label the "high -end" label. I believe that many people do Will recognize.

After all, it is not only the price to buy a mainstream mobile phone now. With a comparison reference, it is difficult for the two -wheeled electric vehicle users to recognize the high -end defined by the manufacturers at the price level.

Another dimension, although the two -wheeled electric vehicle manufacturers have been instilling consumption upgrades and high -end transformation of consumption and high -end transformation, their main source of profit still comes from low -end products. obvious.

Let's take a look at the high -end company No. 9 company. The price of its E200P One, E125 and other products is close to or reached 10,000 yuan. Last year, it also won 420,000 sales, revenue of 1.2 billion yuan.

As far as the No. 9 company itself is concerned, this result seems pretty good. You can put the sales data of the No. 9 company in two rounds of electric vehicles 41 million units throughout the year. Yadi's mid-to-high-end product crown series (priced between 5,000-7000 yuan) also sold more than 4 million vehicles last year, and there was a huge gap.

Perhaps the resistance encountered by the high -end, another two -wheeled electric vehicle manufacturer Xiao Niu, which started with high -end products, launched a sub -brand Gova for positioning and sinking market. The product layout has been improved. The NQI, MQI, UQI series, and GOVA brand of Electric Furnaces have more than a dozen new national standard electric models such as G, F, C series, etc., but under the strategy of "replacing the market with price", the average domestic bicycle price has also dropped to 2959 yuan.

Data Source: Guohai Securities Drawing: Insight of Xinye News Agency

In contrast to Mavericks' pushing the sub -sinking market, traditional two -wheeled electric vehicle manufacturers represent the basic market of Yadi and Emma in the low -end market, and they use the sub -brand to impact the high -end.

In 2021, Yadi released the new high -end brand "VFLY". VFly claims to be derived from the Porsche design, including 6 sub -series products, and some models provide intelligent functions such as vehicle center control and real -time navigation. 19800 yuan.

Emma has a sub -brand Xiaopa as a benchmark and launched a light luxury two -wheeled electric vehicle priced at 4999 yuan to 9999 yuan.

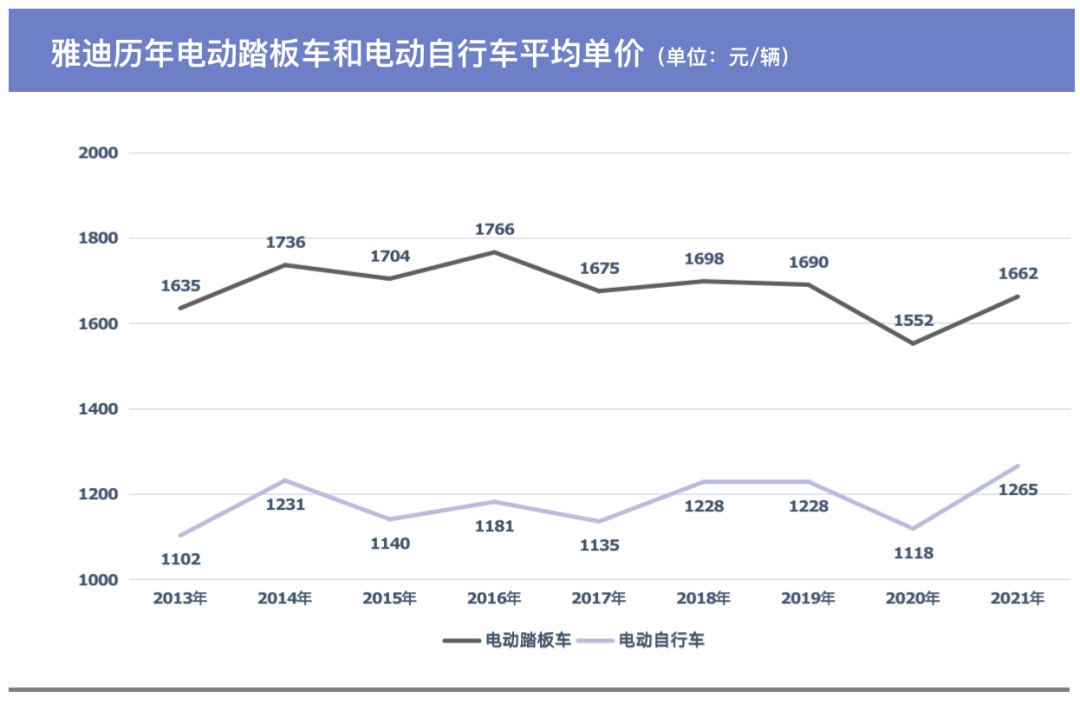

However, from the perspective of market performance, Yady's high -end road is not smooth. It can be seen from the average price of Yadi product line. 1662 yuan; the average price of electric bicycles increased from 1118 yuan to 1265 yuan, but it has not yet exceeded the historical high, which also shows that Yadi cannot complete the high -end upgrade of the brand and products in a short time.

Data Source: Guohai Securities Drawing: Insight of Xinye News Agency

On the one hand, the "new forces" retreated from the high -end market, and on the other hand, the "traditional faction" was wrapped in high -end. When both met in the sinking Red Sea, the laws of the second and eighth seemingly failed to invalidate the two rounds of electric vehicles. 02 "High -end" is a pseudo -proposition

Why is the high -end road of two wheel electric vehicles so difficult?

From the perspective of the demand side, there is no demand; the perspective of the supply side is no motivation.

We might as well think about this question from the principles of firstality: Why do people buy two wheel electric vehicles?

The answer is simple, the need for travel. Compare with the car, cheaper; down to bicycle, comfortable.

The survey report of Ai Media Consultation pointed out that traveling efficiently and effort, no traffic jam and parking trouble, environmental protection is the most important reasons for everyone to buy two wheel electric vehicles; Supplement of transportation.

In the eyes of many users, the two -wheeled electric vehicles are mainly suitable for short -distance mobility. Daily travel is mainly private cars. Only in the scenario of children, buying vegetables, shopping, etc., two wheel electric vehicles will be used under the premise of weather permits. Essence The sun is too large, driving; wind and rain, driving; frozen cold, still driving. Since it is only a supplement to many travel methods, there is no need to spend more money to buy high -end.

When the perspective goes down to third- and fourth -tier cities and towns, users do not need high -end demands to be stronger. They only need to meet the lowest price to meet the lowest mobility needs.

The hot sale of Wuling Hongguang MINI EV can provide the best speculative perspective for two wheel electric vehicles.

The model of the entry version of 2.88 million yuan has no air conditioning and airbags, no reversing images, and does not support fast charging. The interior is only 120km on the most critical battery life. Such a full -scale product can be sold in the sinking market. The most critical point is -cheap.

If so, we can easily summarize the core demands of the two -wheeled electric vehicles. It does not require high -end. What really requires is convenient and practical.

Back to the supply side, the two rounds of electric vehicle manufacturers have suffered a loss in impacting high -end.

Yadi tried to open up a new income curve during the market bottleneck in 2015, and shouted the slogan of "higher -end electric vehicles". 100 million advertising costs to enhance the brand image.

Then, it was upgraded by hundreds of millions of yuan to more than 5,300 specialty stores.

In terms of products, Yadi launched a series of more than 4,000 models, especially Z3 in 2016, with a price of 8588 yuan, setting a brand record.

However, these three axs went down, and the sales volume did not rise, but the revenue of the following year only increased by 3.62%.

As a result, Yadi no longer adheres to the high -end route and returned to the low -end market in 2017. By increasing the proportion of low -cost electric bicycles, in conjunction with repeated discounts and promotion, low -cost replacement, the sales in 2017 exceeded Emma to become the first in the industry; the following year, Yadi sales exceeded 5 million, the income approached 10 billion, and the profit increased by 3 increases. 100 million.

This scene is similar to what the Mavericks are experiencing today.

Grooming the development history of the two -wheeled electric vehicle industry, the high premium space left by manufacturers on high -end products finally became the bargaining chip of the price war. The reason why such history can continue to repeat is that the technical content of the two -wheeled electric vehicles is not high, and the premium cannot be maintained for a long time. In the end, the core is still the competition of traditional channels and costs.

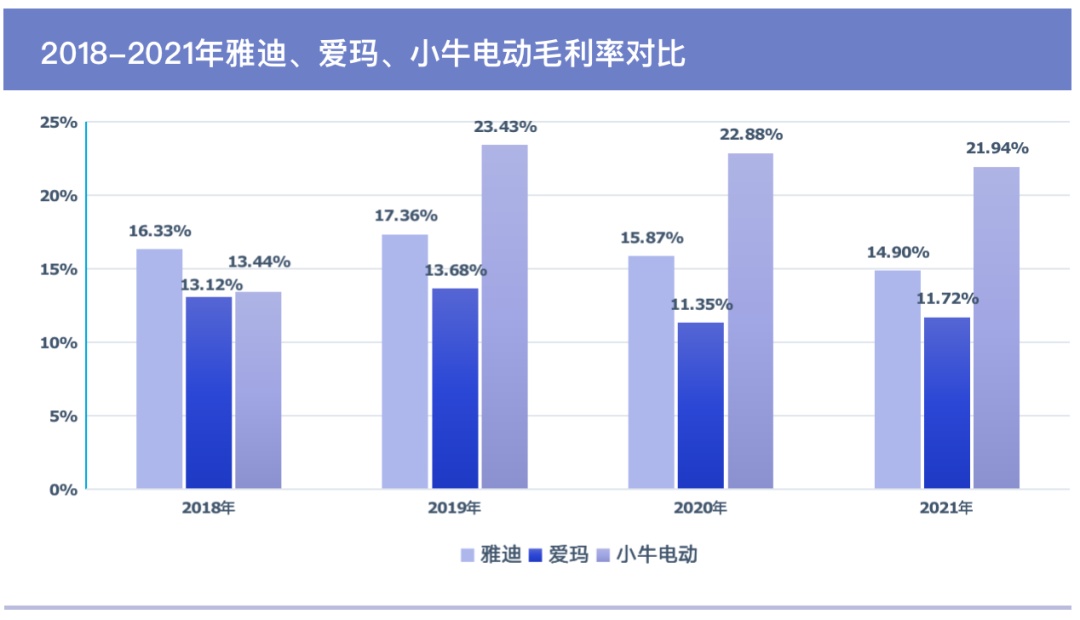

From 2019 to 2021, the gross profit margin of Yadi was 17.4%, 15.9%, and 15.2%, respectively, showing a decline year by year; the same is true of Emma and Mavericks. Gradually decline to 21.94%. This is the inevitable result of the industry's high -end, but the price fight.

Data source: Financial report/network chart: In -see -in -law New Research Society

In layman's speaking, Yady can snatch some users of Emma or Mavericks electric, maybe just because the store is closer to home, and the models in the same price range are 10 yuan cheaper. "High -end" may allow manufacturers to improve the brand image and serve a small number of users, but "low -end" is the large market for manufacturers to make money.

03 How to get out of the inner roll?

If the pure price -performance ratio is maximized by the manufacturer, and the market growing space is locked, the result is that the manufacturer's diluted cost of the sales volume kills the siege. Without holding the market's determination to fight the market, the space that manufacturers can move every step will become narrower and narrower.

Compared with the two most heads in the industry, Jacad won 27 billion yuan in revenue last year. Emma won 15.4 billion yuan, but the gap between the two was only 6.3 billion yuan in 2020. It expanded to 11.6 billion yuan in 2021 to 11.6 billion yuan. about. It is not surprising that the brand concentration is getting higher and higher, but the concentration is so fast that it is expected.

How to jump out of simple low -cost competition in the short term, quickly seek premium space, use new products to seize new main consumer groups, and become a key process for manufacturers to get out of the roll.

Specific for users, I hope to experience more durable, safe or intelligent products under limited prices. For example, intelligence does not mean that multiple display large screens, the Internet of Things, and the intelligentization of cars will have a qualitative leap, but can bring the user a sense of improvement, and the consumer psychology that "is better than no better" consumption psychology Essence

There are already successful examples in the electric micro -car market. As we all know, below 50,000 yuan, Wuling Hongguang MINIEV Pearl Jade has broken the stereotype of the market for the "old man music" of the micro -car; and Chery QQ ice cream as the latecomer, further optimize the space and interior quality, and move to intelligence to intelligence The difference is a big difference. From January to May this year, QQ ice cream was sold for 37,414 units, second only to Hongguang MINIEV in models below 50,000 yuan.

For manufacturers, they are very tested how they make the optimal solution of the product at a limited cost. The management capabilities of the supply chain and channels are the foundation. In low -tech product logic, new stories about technical barriers and core capabilities are also advanced.

Taking Harbin as an example, I have made attempts with intelligent technology. Last year, the A80 model was launched, and for the first time, "installing the electric vehicle into the mobile phone"; and the smart external parts such as VLINK similar to the mobile phone bracket, such as automatic unlocking, real -time cycling instrument panel. In the Tmall flagship store, we can also find that Haru's almost all models support APP intelligent control.

Yadi focuses on the long battery life and durability to the entire model. The Yadi TTFAR graphene battery came to the third generation and became a test field for Yadi to use long battery life. At present, there are many mid -to -low -end electric bicycles that can achieve a maximum of 100km battery life, which is much higher than the "new forces" with a battery life of about 50km. Because the "New National Standard" has requirements for the quality of the battery in the inside, it has become a "technical activity" to break through the bottleneck of the battery life under restrictions.

However, in any case, different manufacturers try different directions, always serve the user experience, and also strive for a greater premium space for themselves. After all, after a few tricks, they will eventually return to price competition.

Seizing this short "beauty" may be the happiest thing in the manufacturer.

Reference

1. Deep sound, two rounds of electric vehicles in the historical process

2. Jianjian Yuan, two rounds of electric vehicles, China's fifth largest invention

3. Yuanchuan Science and Technology Review, Wuling Divine Cars: Looking back now, I can't catch up in the future

4. Yuanchuan Business Review, two rounds of electric vehicles, ten years of dragon and tiger fighting

- END -

"Ice Cream Assassin" encounters a new price regulation for a week, and most supermarket convenience stores are clearly marked

Jimu Journalist Liu DongliVideo editing Liu DongliIntern Li Chenxing Cui Jingtao

Tianjin adjusts some medical services prices!These projects are no longer charged!

Recently, the Municipal Medical Insurance Bureau, the Municipal Health and Health ...