Prospective of the Federal Reserve Conference: Inflation to the economy to cool down!How does Powell

Author:First financial Time:2022.06.14

14.06.2022

Number of this text: 2833, the reading time is about 5 minutes older

Guide: How to achieve soft landing?

Author | First Financial Fan Zhijing

On Tuesday (14th) local time, the Fed's June monetary policy conference kicked off.

While publishing interest rate decisions, the Federal Public Marketing Committee (FOMC) will update economic growth, unemployment and inflation predictions in the quarterly economic outlook (SEP), and at the same time, the dot -matrix chart of the expectations of interest rate hikes will also be announced. Faced with the highest price pressure and turbulent capital market in 40 years, how will the Fed's chairman Powell deal with the question about soft landing and policy paths will become the focus.

Views 1: The interest rate hike is more aggressive

As the US Consumer Price Index (CPI) unexpectedly rose to a new high since 1981, guessing about interest rate hikes has risen. According to the CME Fedwatch tools (CME Fedwatch) tools, the possibility of raising 75 basis points continued to rise, and many institutions such as Barclays and Jeffrey also expressed the judgment of the Federal Reserve that may adopt an expected interest rate hike.

Bob Schwartz, a senior economist at Oxford Economic Research Institute, said in an interview with the First Financial Reporter that 50 basis points are the best choice. He believes that raising the cost of borrowing will curb economic activities and lead to a slowdown in growth, so the rhythm of the Federal Reserve policy must be weighed. In contrast, the interest rate hike at 75 basis points may be too aggressive, and the Fed needs to avoid the occurrence of too fast tightening the economy.

For the capital market, the Federal Reserve ’s future interest rate hike is a greater highlight. On Monday, the highest yield of 2 -year US bonds that were closely related to short -term interest rates reached 3.41%, which was a new high since December 2007, and the anchor of global asset pricing -10 years of US debt yields approached 3.45%, refreshing In the past 11 years.

The 2 -year US debt yield has impacted the 14 -year high, and the market interest rate hike is expected to rise (Source: British Caiqing)

The latest dot -matrix chart will pass the potential interest rate hike path to the outside world. Judging from the minutes of the May meeting and the subsequent officials, the Fed's internal debate gradually shifted to the September and subsequent interest rate hikes.

First Financial reporter's summary found that only Atlanta Federal Reserve Chairman Raphael Bostic was clearly supported by September. He believes that the Fed needs time to evaluate the impact of monetary policy adjustment on economic and inflation. On the other hand, officials in favor of 50 consecutive interest rates have increased. Lael Brainard, vice chairman of the Federal Reserve, said in his speech on the eve of the silence period: "According to the data we have, 50 basis points in June and July seem to be a reasonable path." Next, we can't see the slowdown of inflation data, the hot demand begins to cool, and it is likely to perform at the same speed in September. It is difficult to see the reason for the suspension now. "

It is worth noting that Brened is regarded as one of the most internal members of the Federal Reserve, but when she sworn in a new position of the Fed's vice chairman last month, her remarks can be regarded as conveying the core leadership of the Federal Reserve. View. Her view has also been approved by many officials including Cleveland Federal Reserve Loretta Metter. When talking about high inflation, Mest said: "I don't want to announce the victory prematurely."

Many institutions have raised interest rates at the end of the year. JPMorgan Chase predicts that the dot matrix will reflect the faster policy tightening. The Fed's prediction of the federal fund interest rate will show that the median value at the end of the year will reach 2.625%, which is much higher than the 1.875%of the March forecast. "Powell hopes to do it is to guide expectations." The report mentioned. Wells Fargo estimates that after the dot -matrix chart is "upward", the median interest rate at the end of the year will reach 2.875%, approaching the upper limit of the neutral interest rate range mentioned by the Federal Reserve.

Michael Pearce, a high -level American economist at Kaitou, believes that Powell may have no choice but to adopt a tough attitude. "The only factor that can stop them from becoming the eagle is the economy. But this time, if Powell can give a clear forward -looking guidance on a greater interest rate hike in the future, the market's response will become critical." He said.

Views 2: Inflation expectations or continue to heat up

The latest CPI data breaks the illusion of the outside world. As the Ukrainian war and epidemic factors continue to destroy the supply chain, inflation may continue to rise. San Louis Fed Chairman James Bullard warned last month that the Fed may lose control of inflation expectations.

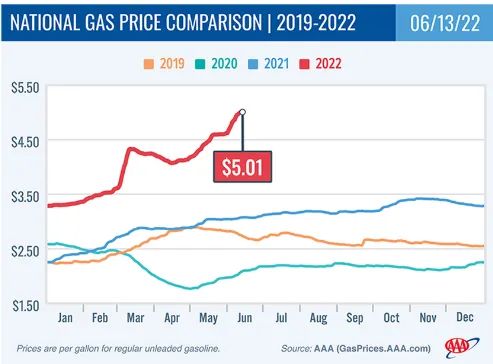

As the main factor to promote rising prices, the high fever of energy prices is making the situation severe. According to data from the American Automobile Association, the average US gasoline price exceeded the $ 5 mark for the first time.

The average price of American gasoline exceeds $ 5, and the pressure of inflation is increasing (Source: American Automobile Association)

Jeremy Weir, the third largest independent oil trading company TRAFIGURA CEO, said last week that as European crude oil is gradually restricted in Europe, the market is facing supply chain pressure. In the next few months, oil prices are likely to be very likely Reach $ 150 or higher per barrel. Goldman Sachs also predicted in a recent report that international oil prices are expected to reach the level of $ 140 in the short term. In addition to rising commodity prices, the market is paying attention to signals of inflation to the service industry. This is because the trend of service prices (hotels, entertainment, air tickets, etc.) is often easy to rise and difficult, which will be a factor that inflation becomes deep in the future.

As a result, the Fed is likely to have short -term inflation expectations. Wells Fargo pointed out in the research report that the worst moment of inflation in the United States has not yet arrived. It is expected that the CPI is expected to rise to nearly 9%next month, and it will remain near this level throughout the fall. This shows that the Federal Public Marketing Committee (FOMC) will counterattack with a tightening policy until the inflation has dropped significantly.

Schwartz told the First Financial reporter that the cooling of inflation may become very slow. On the one hand, as the situation of Ukraine falls into a deadlock, the rise in commodity prices is continuously increasing inflation. Sexual improvement. And even if the Ukrainian issue is resolved, the impact of sanctions on Russian commodity trade may last long. On the other hand, as the economy has returned to the level before the epidemic, American household consumption has shifted from goods to service, which has also increased the pressure of the service industry. Before the inflection point is clear, it is difficult for the Federal Reserve to "loose" on the issue of price.

Highlight 3: Hidden risk of economic cooling

Recently announced many indicators that the US economic momentum has begun to slow, and the market will pay attention to whether the Fed will repair growth expectations.

The decline of inflation and demand suppressed the pace of manufacturing expansion. The US producer price index (PPI) exceeded 10%in the second consecutive month. Chris Williamson, the chief commercial economist in S & P Global, said, "what is worrying is that the growth momentum is rapidly losing."

At the same time, the real estate market has cooled rapidly. Driven by the Federal Reserve ’s interest rate hike, the 30 -year -old US mortgage interest rate has soared to 5.27%, a new high since 2009. The US -raising sales have fallen sharply for three consecutive months. Some potential buyers have been kicked out of the market. This has also suppressed the expected credit growth of the banking industry. At present, the institutional forecasts that the profit growth of the US stock financial industry in the second quarter will fall by more than 15%.

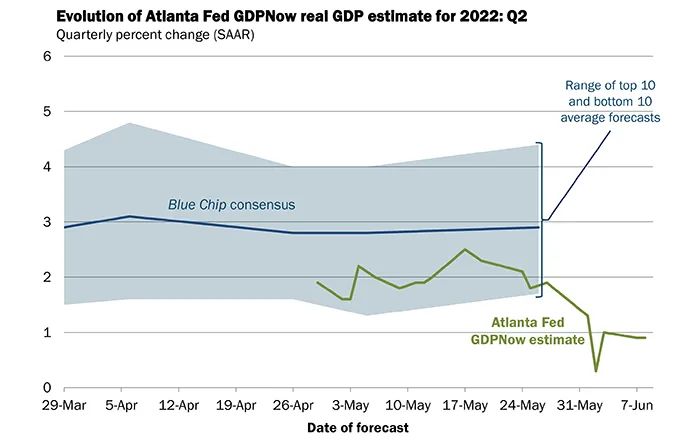

Atlanta Federal Reserve: In the second quarter, US GDP growth fell to 0.9%(Source: Atlanta Federal Reserve website)

The GDPNOW prediction model of the Atlanta Federal Reserve Bank showed that the annualized growth rate in the United States in the second quarter was retained at 2.4%in mid -May to 0.9%. The Federal Reserve's economic situation brown book wrote that many regions have expressed concerns about economic recession.

However, stable consumer expenditures and strong labor markets are important momentum for the US economy. According to data released by Bank of America last week, American consumer spending continued to accelerate steadily. In May, credit cards and debit card expenditures increased by 9%year -on -year, of which credit card expenditure increased by 16%, and debit card expenditure increased by 4%. David Tinsley, a senior economist at the United States, said: "The expenditure of services such as tourism and entertainment is still strong, and the level of family savings is still higher than before the epidemic."

Wells Fargo pointed out that the growth of the US economy -consumer expenditure growth is mainly three main reasons: the reduction in savings rate, the ability to accumulate savings, and the increase in credit use. Although more credit card debt is not a sustainable long -term driving force for consumer expenditures, it does help provide at least some short -term relief in a period of a record high in gasoline prices. But the longer the inflation duration, as the Fed's tightening policy, consumers' dependence on credit will become more challenging.

Schwartz analyzed to reporters that the economy was transitioning to a slower growth environment in the short term, but it was far from recession. Facing the test of inflation pressure and early interest rate hike cycle, the main pillar of the US economy -consumption is still strong, and the healthy labor market also guarantees American household income. He predicts that as the interest rate is close or even exceeds the neutral level, the real test of the US economy will come in 2023.

- END -

Zibo Economic Development Zone and Shanghai Industrial Cooperation Promotion Center reached a cooperation intention

Qilu.com · Lightning News, June 17th. On June 17th, Tang Degen, the Shanghai Indu...

In May, the decline in industrial profits was narrowed, and the benefits of equipment manufacturing were significantly improved

27.06.2022Number of this text: 1492, the reading time is about 2 minutes oldIntrod...