The first 20 years now!The euro fell off the US dollar below the affordable pass and the risk aversion mood burned

Author:Poster news Time:2022.07.12

As the European trading period entered the European market on Tuesday, the euro against the US dollar continued to fall in a decline. As of press time, the currency had a minimum of 0.99999 in the day. Seeing this last time, it was dating back to December 2002.

(Euro/USD daily diagram, source: tradingView)

Simply put, this change also means that the value of the US dollar has even exceeded the euro. As a reference, the exchange rate of the euro against the US dollar at the beginning of this year is still around 1.15.

Ruisui Financial said in the analysis report that the euro/USD step by step is to reflect the market's pricing of the "euro zone decline". Now there is almost no signs of risk preferences. It is only a matter of time.

Jeremy Stretch, director of the G10 foreign exchange strategy of the Empire Commercial Bank of Canada, explained that because the European Central Bank stopped the bond purchase plan and the interest rate hike, the European Central Bank would be "slowed down", and it will be in a very difficult situation. Not substantially suppressed. However, from the perspective of policy signals, the need for the central bank to take action and quickly take action has become extremely obvious.

Burning of risk aversion emotions

Similar to the rise of the US dollar yesterday, the rise of risk aversion has also undergone pressure on the stock market. After the European market opened, it was generally in a decline, and the U.S. stock index that was in the pre -market also weakened.

Although the euro is not weaker alone, a series of incidents around the euro make the currency's fluctuations particularly noticeable.

For Europe now, high inflation caused by the energy crisis is the main problem for the economy. Coincidentally, from this Monday, the "Beixi No. 1" pipeline carrying Russian natural gas has entered an annual maintenance and is expected to suspend gas supply for about 10 days. What worried about Europe in Europe was particularly concerned that if Russia's natural gas did not return as scheduled after 10 days, it was basically equivalent to the decline of announced that the European economy had fallen into darkness.

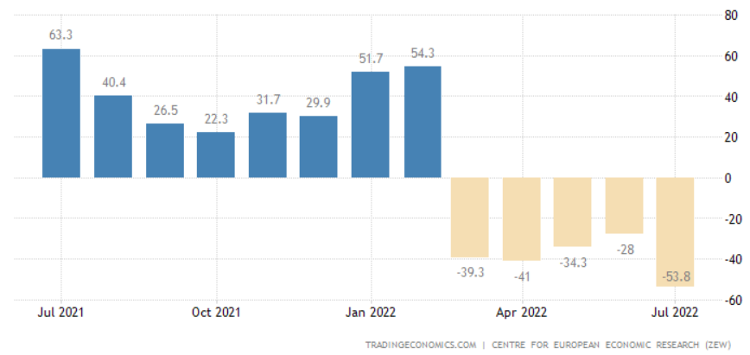

ZEW German investor's confidence index fell to -53.8, which was released earlier today, further fell to -53.8, further fell from-28 in June, and set the worst negative value since 2011.

ZEW Chairman Ashim Vambach specially points out that the market's expectations for energy -intensive and export -oriented economic departments are particularly obvious.

(ZEW Economic Emotional Index, Source: Tradingeconomics)

In addition, the US CPI data in June will also be released tomorrow night. Assuming that the price problem is high, it will force the Fed to raise interest rates more radically, and then promote the US dollar to continue to stir up the international situation.

- END -

This year's A shares are expected to get out of the "√" market, and invest in two directions: "Pan New Energy" and "Social Rong Drive"

In the first half of the year, the A -share market came out of the deep V trend. O...

Gold ETF Fund (159937) turnover exceeds 100 million, Goldman Sachs: Golden in the late period is expected to go up

In the afternoon, COMEX gold rose slightly by 0.05%to $ 1764.8/ounce.As of press t...