The financial "pioneer" of the financial support to help the enterprise relieves

Author:China Agricultural Credit News Time:2022.06.14

The financial "pioneer" of the financial support to help the enterprise relieves

Jiang Wenwen

In order to thoroughly implement a series of policies and measures such as the stability of the country's economy, helping enterprises, and helping rural revitalization, Sichuan Jiange Rural Commercial Bank continuously optimized and improved financial services, implemented strong credit support, stable and sustainable preferential policies, and the people's service measures for the people. Promote financial resources to enterprises and industries that are seriously affected by financial resources to key areas, weak links, and seriously affected by the epidemic, and actively support steady growth, and inject the financial power of farmers and merchants in various market entities in various fields.

The policy "burdens" and relieves the enterprise. "If it wasn't for the financial support of the Rural Commercial Bank, our company would be unable to stabilize!" The person in charge of a car manufacturing company that had just finished the "no repayment of renewal" said with emotion. The company is an investment enterprise of Jiange County Government. It mainly produces a series of warehouse grid transport semi -trailers, dump trucks, bulk cement vehicles and other series. After years of hard work and accumulation, it has developed relatively stable and profitable. Government commendation. In 2020, due to the investment in the second -phase new plant, purchase equipment and purchase of raw materials, it loaned 10 million yuan in Rural Commercial Bank. During the period, interest payment was not owed. However, due to the epidemic, the company's sales in the past three years have declined year by year. The Jiange Rural Commercial Bank has undergone this situation after the management of loan management, and analyzes its operating situation and difficulties in detail. It is believed that the company meets the policy conditions of the "non -repayment loan" and in order to help customers solve difficulties in time. It does not affect customer credit records. Management and protection of customer managers to carry out on -site services. In just 4 days, it has completed loan data collection, report writing, loan review approval, mortgage processing, and system processes. As of now, the bank has set a flexible settlement method for delaying loans and negotiates the installment repayment plan to reasonably extend the loan period. It has accumulated a total of 598 small and micro enterprises. The pressure of the company's repayment helps the enterprise to cross the difficulties.

"Political and Bank of Police" cooperation, Huinong Xing Village. Born due to farmers, accompanied by farmers growing up. Jiange Rural Commercial Bank adheres to the positioning of the three farmers, keeps with the policy orientation, and formulates the "Financial Support Rural Revitalization Work Plan in 2022" in a timely manner, which revolves around large agricultural infrastructure, food and vegetable parks, Xingcun leisure tourism industry and other key areas. Da -agricultural credit investment, strengthening credit supply in key areas, innovation to help rural revitalization characteristic credit products, and continuously deepen the cooperation with municipal agricultural shadow companies, county private associations, county employment bureaus and other units to introduce third -party credit increase, carry out joint rating for joint rating In order to strive for financial discount policies and other measures to create conditions for financing for important areas such as small and micro enterprises and three farmers in the county area, help the agricultural subjects to relieve the difficulties, and comprehensively improve the level of rural rejuvenation financial services. When a village collective stock economy cooperation in Gongxing Town, when the initial processing facility complex of the grain and oil park was constructed, the collective economy could not conduct credit assessment and rating credit. After understanding the situation, the bank issued 200,000 yuan "Hui Nongyu · Xingcun Loan", which successfully cracked the pain points and difficulties of the "first loan" of the "first loan" of the village -level collective economic organization loan. "Hui Nongyu · Xingcun Loan" is a funding demand for the development of village collective economic organizations. The interactive model of the "government and banking" of agricultural capital guarantee and financial investment has injected new financial "living water" into the rural collective economic organization, and realized a virtuous circle of financial support projects and projects to drive development and development. In order to continue to grow the beef cattle and sheep industry, the bank also supports the village community to become rich and leaders to develop production. On the basis of fully investigating, innovatively launched "Hui Nongyu · Rural Rejuvenation Promotion Loan", "Jianmen · Pioneer Loan" and "Jianmen" and "Jianmen Gate" · Beef beef and sheep loan "enriched the bank's diversified inclusive financial system, and effectively met the financing needs of large professional households, professional organizations, family farms, and small and micro enterprises.

Scientific and technological empowerment, to benefit the people. The bank is empowering science and technology to respond to the epidemic. Relying on mobile banking, telephone banking, self -service terminal, and intelligent scenarios online to achieve the full coverage of 29 township financial services in the county, so that customers can "not leave home" to "not leave home". Enjoying the daily services of "all -round" and "non -contact" financial, information, government affairs, logistics and other daily services, which greatly improves the quality and efficiency of financial services. Offline To run the loan procedures, open the "Green Approval Channel", open a self -service inquiry point, the mortgage registration registration, and the industrial and commercial registration extension service window of credit reporting, to achieve one -stop services, and to achieve more data running and less customer running.

In the next step, the bank will continue to implement the decision -making and deployment of the Party Central Committee and the State Council, accelerate the implementation of the policy of promoting the implementation of the financial benefits and the people's rescue policies, with greater efforts and excellent measures to fully do a good job of financial support for the prevention and control of the epidemic and economic and social development. Work provides stronger and strong financial support.

- END -

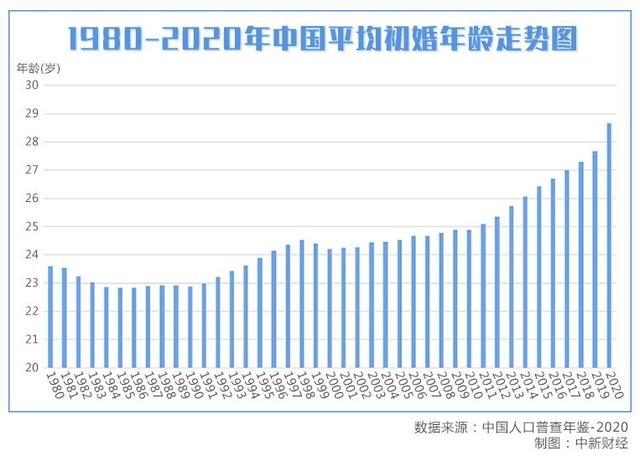

China ’s average first marriage age in 2020 is 28.67 years old

According to the Chinese Population Census Yearbook-20120, in 2020, the average fi...

Li Linlin, Central Plains Securities Research Institute: Investment opportunities in the three major areas of the pharmaceutical industry to pay attention to blood products and medical equipment

[Dahe Daily · Dahecai Cube] (Reporter Chen Yuyao Zhang Keyao) On June 25, Central...