PE/VC joined forces to lead industrial capital, Sagitar Gathering innovative rounds of financing aga

Author:21st Century Economic report Time:2022.06.14

On June 14th, Robosense, a technology company of the intelligent lidar system, announced the new round of strategic financing to complete the latest delivery. Capital follow -up.

The 21st Century Economic Herald reporters learned that the past financing of the financing was mainly based on industrial investors, and this delivery was a PE/VC institution with a partial financial investment. From this point, we can also see some changes in the rhythm of Sutako's financing.

At present, Sagitar Ju Innovation's Innovation Round Strategic Financing Leaders include Huaxing New Economic Fund, Hubei Xiaomi Yangtze River Industrial Fund and Yutong Group, other investors including Yunfeng Fund, Jinglin Investment, Kunzhong Capital, BYD Group, Hong Kong Lixun Co., Ltd. The company, Disaixiwei, Xingshao Venture Capital, Chenling Capital, China -Singapore Sunac, a number of funds under Dongfang Fuhai, and Kang Chengheng.

"As product technology is becoming more mature and the industrial environment continues to improve, the global autonomous driving industry is ushered in a large -scale landing wave." Qiu Chunchao, co -founder and CEO of Sagita, said that the company's new round of strategic financing focuses on the upstream and downstream. All -chain industry capital ecology.

Furthermore, the company will continue to improve the comprehensive strength of lidar in terms of cost, reliability, and mass production delivery, give full play to the strategic effectiveness of the core sensor, and solidly promote the development and change of the automotive and autonomous driving industry.

How to overtake a curve

According to market research and strategic consulting companies Yole Développement's "2021 Laser Radar Application Report" (hereinafter referred to as the "Report"), the R & D manufacturer of laser radar, including more than a dozen head companies around the world) The proportion of the share of automobiles and industrial market applications.

The "Report" shows that Sagitar Juchu accounted for 10%of the car lidar market, ranking first in China and the second in the world. What's more noteworthy is that five Chinese manufacturers have entered the top ten, namely Sagita Juchu, Livox, Huawei, Hesai Technology, and Tutong.

Bao Fan, chairman of Huaxing Capital Group, Fund Founding Partner and Chief Investment Officer, said that the automobile intelligent track is a long -term optimistic field of Huaxing. Historical development opportunities.

Speaking of the development of Sagita Juluchu, he said that Sagita's focused lidar system is the only way for automobile intelligence to move towards high -level. As the earliest research and development of semi -solid lidar and realizing car -level production of car -level production, Sagitar Junchuang has become the world's leading lidar system supplier with its first -class innovative research and development and engineering capabilities.

The reporter learned in the interview that in August 2021, Sagitan Juguang officially announced the second-generation intelligent solid-state lidar RS-LIDAR-M1 in June to complete the car-level mass production SOP in June and deliver the North American luxury new energy vehicle company in batches Essence

This is the first time the second -generation smart solid -state lidar is delivered to the first -loading measurement of front -loading measures worldwide. Sagitar Juchu is the first to start the laser radar "mass production in the first year".

"Sagitar Junchuang's technical route selection 'advanced and practical' has achieved the balance of technology and commercialization." Zhu Yi, a partner of Huaxing New Economic Fund and the head of the advanced industrial investment team, told the 21st Century Business Herald reporter, not only not only In this way, the profound awareness of the industrial chain and cost of Sagitar Juchu has also provided an important guarantee for the company to obtain the industry's leading position.

PE/VC joint industrial capital

The 21st Century Economic Herald reporters sorted out financing information and found that Sagita Gathering Capital's current financing as of the current leadership is PE/VC capital and industrial capital.

In terms of industrial capital, Hubei Xiaomi Yangtze River Industry Fund is an investment fund sponsored by Xiaomi Technology and the Hubei Yangtze River Economic Belt Industry Guidance Fund. Yutong Bus is a listed company in the Chinese bus industry and has a number of investment layouts in the field of smart travel.

In terms of PE/VC capital, Huaxing Capital's Huaxing New Economic Fund is the latest round of delivery leaders. Huaxing Capital is the exclusive financial advisor to the transaction.

In the field of unmanned driving, PE/VC is quite common to invest with industrial capital. In March of this year, Wenyuan Zhixing Weride announced a new round of over 400 million US dollars financing. In addition to the old shareholder GAC Group, investors also entered new shareholders such as Bosch, China -Arab Industry Investment Fund, and Corey Investment Group.

Among the past investors of Wenyuan Zhixing, Yutong Group also appeared. The latter is Wenyuan Zhixing B round financing leader. A few days ago, Sagitar Join and Wenyuan Zhiyi reached a strategic cooperation. Sagitar Juchu will help Wenyuan Zhixing to accelerate the application of car -level intelligent solid -state lidar, and accelerate the production and commercialization of autonomous driving technology.

Regarding the systematic cooperation between different background investors, Zhu Yi told reporters that automobile intelligence is an important focus of Huaxing New Economic Fund in the field of intelligent manufacturing. Including Jingwei Hengrun, Honeycomb Energy, Ideal Automobile, Weilai Automobile, Gateland Microelectronics, etc.

- END -

Logistics companies are preparing to promote the 618th.

Cover Journalist Lei Qiang618 is approaching, and cross -border e -commerce in 202...

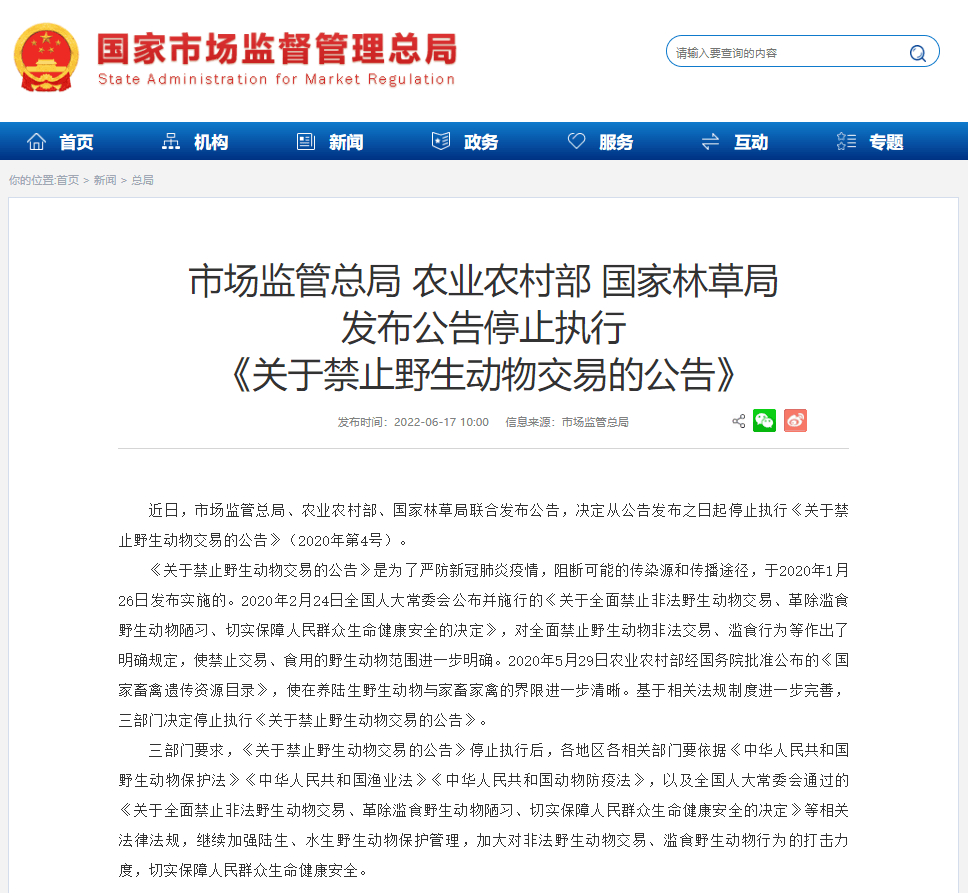

Stopping the "Banning Wildlife Transaction Announcement" to make Zhaoyan's new drug fall?Guojin Securities is expected to rise in the second half of the year

Due to the acquisition of the two experimental animal model companies to complete ...